To Our Clients

Like many of you reading this note, we are “in the trenches” entrepreneurs working with our employee-partners to build Jefferies, with the goal of enhancing value for all our stakeholders – clients, shareholders, bondholders and employees. While our primary compass is long-term value creation, we all live in a world of daily, weekly, monthly and quarterly pressures. Short-term results affect morale, capital cost, ability to reinvest in your business and the ability to be aggressive when strategic opportunities present themselves, which not coincidentally tends to be when the short term is not very promising and the visibility dim. Further complicating your and our ability to build and lead are the cycles of the economy and the markets, overall volatility and an increasingly globalized world, which brings its own set of opportunities and complications.

Reality is undeniable and unavoidable – our markets once again have become more difficult. The US deficit, the crisis in Euro-Land, state and local budget challenges, stimulus running off, real estate bubbles brewing and busted, lingering unemployment, political logjams…the list feels like it goes on and on. Will the problems persist, be resolved or just be replaced with new ones? We wish we knew, but we don’t. What we do know is that for our collective sanity and in furtherance of our long-term goal of being the best firm serving our clients’ needs, we will power through to the best of our abilities, just like we always do. We will focus on our clients and deliver the best all of Jefferies has to offer.

Let’s not forget the many positives today: The world has ample liquidity. Interest rates will most likely stay low for the foreseeable future. Corporate balance sheets are strong and operating costs have been reduced. For the most part, globalization is making lives better. As our Global Head of Fixed Income Strategy, David Zervos, and his team have suggested, smart risk will be rewarded over the next few years.

Markets have almost always been forced to climb a wall of worries. With globalization comes increased scale of everything, including larger problems. The test will be the world’s ability to mitigate and absorb ever larger challenges on a real time basis. Volatility, risk and some losses are always going to present themselves on the path to long-term gain. In fact, the tougher times are almost always the ones that offer the most long-term opportunity.

Recently we sent out a history of the growth and development of Jefferies over the past 21 years to our entire 3,750 employee-partners. The point we were trying to make is simple. As one goes back over the time at Jefferies from 1990 (when the first of us arrived at this firm), there have been numerous periods (some sustained, some brief) where the world felt more than a little upside down. We most vividly recall

the periods of 1990, 1994, 1998, 2001–02 and, of course, 2008–09. We wanted to remind our employee-partners that a tough operating environment can make the short term somewhat painful, but the true goal is long-term value creation. Our firm not only survived these difficult periods, but in fact we were able to emerge from these periods playing aggressive offense and improving our position each time. We believe this was possible for two reasons:

- In keeping with how we strive to advise our corporate clients, we kept our balance sheet secure and liquid during the intervening periods of exuberance. Capital structure does matter and ultimately is one of the biggest factors in success or failure.

- We tried our best to hold true to a firm-wide culture that would allow us to keep all of our collective eyes on the long term, while fighting through the sometimes painful periods of the short term. That culture demands every employee-partner at Jefferies to strive their best to achieve: clear thinking, transparency, humility, consistency, leadership, communication, investment, teamwork and relentless effort on behalf of our clients.

Our business may be distinct from yours in that our only true asset is our people and there is no room in our industry for a faulty balance sheet. That said, if you really think about it, are we really all that different?

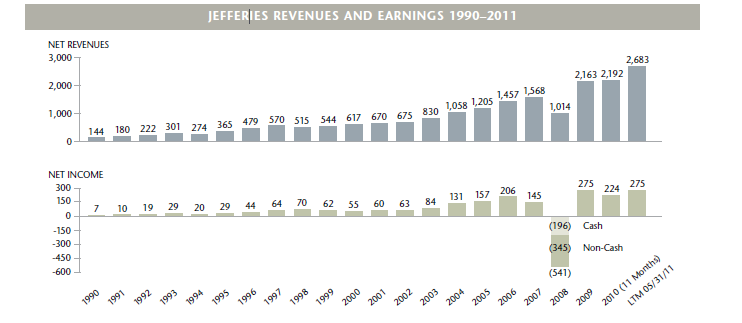

Below is the 21-year chart of the path of evolution of Jefferies that we shared with our employee partners. We share it with you with zero arrogance, as the journey thus far was extremely challenging, filled with mistakes and wrong decisions, and is far from over in terms of all we need to achieve to make our firm the best it can be for our clients. However, it does show the determination and fortitude of a once niche brokerage firm with limited capital that has worked consistently over the past two decades to become a global, full service firm with, as of the writing of this letter, over $45 billion in assets and $8 billion of long-term capital (which we use almost exclusively to help satisfy our clients’ needs). The markets are challenging again, but today we are fortunate that we have the talented and committed professionals, the diversified platform, a strong capital base, and the culture and the fortitude to continue to build Jefferies for the long term for the benefit of all of our stakeholders.

Thank you for your support,

Rich and Brian

RICH HANDLER

CEO, Jefferies Financial Group

1.212.284.2555

[email protected]

@handlerrich Twitter | Instagram

he, him, his

BRIAN FRIEDMAN

President, Jefferies Financial Group

1.212.284.1701

[email protected]

he, him, his