How Can Tech Growth Companies Avoid Missing Their Moment?

Three years after the technology IPO market began declining, the IPO window appeared to be opening in the first few months of 2025. Despite market volatility and policy uncertainty, quality companies were poised to go public amid strong investor demand. However, the White House’s seismic April 2nd “Liberation Day” tariff announcement has, at minimum, delayed the IPO plans of several companies.

As investors sort through the impact of this radically altered trade environment, some of the world’s top technology investors and company leaders gathered for the Jefferies Private Growth Conference on April 22-23 in Santa Monica, CA. Ahead of the conference, we spoke with Evan Osheroff, Jefferies’ Managing Director of Software Investment Banking, to get his take on what’s shaping the technology market and where it’s headed.

Q: The White House tariff announcements caused immense short-term disruption. But do you expect it to fundamentally impact the trajectory of technology industry deal-making this year?

Evan: In addition to causing short-term disruption, it further cemented an environment of volatility, which is even more critical to overlay on the deal environment. As advisors and investors, we can’t control policy. All we can do is react to it. In the first few months of 2025, we already saw a dozen deals featuring venture-backed companies being acquired or going public at billion-dollar-plus valuations. So, the investor interest we expected to have coming into the year was undoubtedly there. I think it will still be there when the smoke clears a bit from the recent market volatility. We have companies in the IPO pipeline that are ready to go imminently and are just taking a week-by-week approach as to when to launch their offering.

In the meantime, investors need to stay focused on company fundamentals and recognize that when it comes to Washington, the only certainty for the next few years is likely to be uncertainty.

Companies, both public and private, venture-backed or in private equity portfolios, will have to accept volatility as the new norm. If people wait for things to calm down and become comfortable, there will be no M&A activity, IPOs, and limited capital returned to LPs. I don’t believe that is how this will play out, and the first few months of 2025 certainly suggest companies and investors are willing to transact despite the volatility.

Q: What is the current state of the IPO market, and what can we expect in the near future?

Evan: We are seeing some positive signs and increased activity, which we expect to continue. Companies are starting to select their underwriters and getting prepared, and interest in IPOs is definitely high. Business health is good, and valuations are more realistic than a few years ago. The problem recently has been a lack of supply. There have been too few IPOs, and people hesitate to be the first mover.

Many good companies are waiting in the background if they have a strong balance sheet. Clearly, some will choose to wait a bit longer as they assess the impact of tariffs and any knock-on effects they have across the market. Nonetheless, you have several notable fintech names ready to go. There are also several large software companies valued in the tens of billions that could go public any time they want, and we expect at least some to start sooner rather than later. Although there has been less activity in enterprise, a broad array of companies across various tech sectors are getting prepared for a potential IPO.

If these companies have a large cash pile and don’t have to do anything, they will not rush out. In the meantime, many companies are doing secondaries to provide liquidity to their employees and investors.

Our advice to companies considering an IPO is to worry less about a macro market window and more about your own window when you are growing fast, making the transition to profitability, and leaving plenty of runway for public investors to accrete value in their portfolios.

Q: Can delaying their IPOs create problems for these growth companies?

Evan: I don’t think enough people are talking about this. There are plenty of good reasons for private companies to do secondaries, but at a certain point, you are kicking the can down the road. Over time, these companies will have increasingly impatient employees eager to monetize their equity. They also run the risk that there won’t be enough value for public investors to capture by the time they do an IPO. If you do secondaries for too long, you may miss your IPO window and the great valuations – and payouts – that were once possible.

Q: What are your thoughts on AI as a near-term source of revenue and profitability?

Evan: AI presents a huge opportunity for growing revenue and scale. However, profitability may be years away.

I believe companies that deploy AI will create the greatest value. We are already seeing companies crossing $100 million in revenue in a matter of months, not years. Is that sustainable? We’ll see. Eventually, though, AI will generate substantial revenue and enormous value, uplifting pricing, capabilities, and competitiveness. Next up is the 10-person, $1 billion revenue company. That is not very far away from where we are today.

Q: Do you think people overestimate the magnitude or near-term payoff of the AI revolution?

Evan: AI, however you define it, will be infused into everything, including AI agents, foundational models, better analytics, and enhanced search capabilities. I have a firm conviction that it will change and transform everything.

One of these AI companies hoping to do an IPO will be the next Netscape, and another will be the next Google. But no one knows which one it will be.

Q: The arrival of DeepSeek in the public mind was a big moment. It wiped out a significant portion of the market capitalization of major companies that day. Is it having a lasting impact on software companies?

Evan: It’s less about DeepSeek specifically having an impact on software companies and more about showing what is possible in a world of open source and how critical that is to innovation. DeepSeek effectively showed that models can be copied, and innovation can be applied to achieve spectacular results. That is why companies are moving so fast and raising so much money. We are still at the beginning of the innovation curve, and that is exciting.

Jefferies Business Consulting and Strategic Content Newsletter – Q1 Recap

Jack-of-all-Reads: Jefferies Business Consulting and Strategic Content Newsletter

Q1 Recap

Spotlight on Jefferies Content and Events:

Welcome to Jefferies. Margaret Davidge-Pitts, Brad Lutzer, and Fabio Mariani Join to Enhance Our Prime Brokerage Offering for Clients: Please welcome Margaret Davidge-Pitts, who joins as our Head of Asia Capital Introduction, based in Hong Kong, Brad Lutzer, who joins our Prime Services Sales and Origination Team, based in New York, and Fabio Mariani who joins our Securities Finance team as Head of Americas Prime Distribution, based in New York. The addition of Brad, Fabio, and Margaret will broaden our reach with key equity financing clients and bolster our overall client strategy across the globe.

- Margaret joins us from Goldman Sachs, bringing nearly 20 years of experience and expertise in helping hedge funds launch, scale and raise capital in Asia, including in markets such as South Korea, Taiwan, Thailand, Australia and New Zealand.

- Brad also brings nearly 20 years of industry experience and relationships across a broad range of hedge funds and asset managers; he joins from UBS.

- Fabio brings nearly 30 years of experience and expertise in the Prime Brokerage Industry specializing in Hedge Fund Distribution for Securities Finance. He joins from TD Securities and has spent over 25 years at Goldman Sachs.

- Recent Movers: Recently, our Prime Services Sales team has relocated two of our key members to expand our global presence: Ed Barnes has moved from NYC to London and Grace Qiu has transitioned from NYC to Hong Kong. These strategic moves aim to enhance our business and strengthen our offerings.

Digital Footprint of Multi Manager Funds: This piece dives into the online presence of multi-manager funds, examining how they strategically brand themselves in the digital landscape. It explores how multi-manager funds leverage digital tools to enhance their brand and communication with investors. Please reach out to your coverage for a copy.

Initiation Report: Israel Economic and Strategic Outlook 2025: Israel has been embroiled in prolonged warfare on multiple fronts since the October 7th 2023 tragedy. There are optimistic signs that Israel’s geopolitical reality could greatly improve. Click here for full PDF.

AI Agents—The Key Human Capital Question in 2025: Insights from our 3.5 years of studying human capital investing have led us to focus on the central investment human capital theme of 2025: AI agents. This note outlines what AI agents are, recent updates from MSFT and CRM, and practical steps for investors to analyze how companies integrate AI into the workforce. Click here for full report.

Industry Insights

Access Funds & Why They Have Proliferated: Access firms might have had a stigma to them, like SMA’s once did, however, the success of private wealth channels highlighted their potential for fundraising and many groups are now working with or in dialogue with these firms. These platforms leveraged fintech to streamline operational processes, reducing headaches associated with feeder funds, such as redemption docs and annual audits. This model now provides financial advisors and their HNW and RIA clients access to high-quality alternative managers across hedge funds, private equity, REITs, and evergreen vehicles, albeit at a higher cost due to streamlined operations.Main concerns for managers include:

- Failure to Raise Capital: Success often depends on brand recognition. Less-known managers may struggle to raise capital as access funds are not placement agents. If unsuccessful, managers face penalties, typically paying one year of management fees.

- New Players: Managers must ensure access fund providers can handle client reporting for QPs and AIs. Engaging a knowledgeable lawyer is crucial to protect the manager and ensure compliance.

- Liquidity Mismatch: Hedge funds may have annual liquidity, lockups, and gates, while access funds might be more liquid. This mismatch can create challenges, especially with illiquid investments. A good lawyer can negotiate liquidity arrangements and create processes for mass redemptions.

SMAs and Due Diligence: With the rise of separately managed accounts (SMAs), understanding investor perspectives on transparency and due diligence is crucial. A study by Investment Advisor Association reveals that SMAs collectively manage over $1.5 trillion in assets, with an annual growth rate of 8% over the past five years.5 Key points to consider include:

- Multi-ODD: Multi-Manager funds are increasingly investing via SMAs. Investors may focus diligence on multi-strategy managers if SMA managers rely on their services. However, some conduct ODD on both the SMA and commingled fund, reviewing track records, performance, AUM, staffing, and fund specifics.

- Transparency: SMAs offer increased transparency, but managers should address potential risks in SMA agreements. A study by Squarepoint encourages managers to ask about internal trading strategies, shadow alpha declarations, reasons for Pre-EOD transparency, willingness to adopt confidential information language, and gather references from other PMs to mitigate risks arising from this transparency. 6

- Ring-Fenced SMAs: Ring-fencing is typically non-negotiable and built into the platform by asset owners. While it provides a form of separation, sleeves can still be affected by other managers’ portfolios. Some SMA platforms incorporate ring-fencing, often structured as segregated portfolio companies or series LP/LLCs, preferred for asset separation. Combining sleeves can offer better margining, and managers are compensated for their performance regardless of others’ outcomes.

Midtown Office Reports: Multiple brokers reported that 2024 saw the highest yearly leasing volume in NYC since pre-pandemic levels, marking a significant increase from 2023. Despite this, rents have not seen much increase as vacancy rates remain higher than pre-pandemic levels. This trend signals a substantial return to office spaces, with new businesses also seeking short-term options during their launch phase.

- Coworking Space and Short Term Rentals: Sublease terms range from 1 to 2 years, with even 1-year leases being rare. Landlords typically avoid leases shorter than a year due to transaction costs, and the length of the signing process. For coworking spaces in Midtown, many managers will consider options like Studio or Industrious, or go directly through major landlords like Tishman or SL Green.

Service Provider Trends: Emerging trends in the service provider community are shaping various verticals.

- AI and Compliance: There are growing offerings around AI and expert network calls, along with the implementation of AI policies. Cyber compliance is also seeing more attention, with many CCOs updating policies to include AI and data usage clauses.

- Middle Office Services: Outsourcing services for data, operations, treasury, settlements, and collateral has been gaining popularity, especially among new launches with an in-house CFO. This trend helps address the ongoing struggle to find junior talent to support senior staff.

- Trends around Technology: There’s a rise in “lite” offerings as many more managers are increasingly focusing on technological developments showing interest in software earlier in their life cycles with limited access to capital.

Regulatory Corner

Korea Update: As you may be aware, The Korean market will lift its short sale ban on March 31, 2025. In advance of this, the Financial Services Commission in South Korea and related organizations have announced guidelines and control measures designed to eradicate naked short selling of stocks traded on the Korean Stock Exchange. Jefferies’ offering of Equity Swaps product in Korea will continue uninterrupted, and our upgraded position management system will fully abide by the new rules.

- Global Offering: As part of Jefferies’s expanded global offering, we are pleased to share that we will be able to offer our equity swaps product in South Korea to facilitate short sales. Jefferies SWAP clients can synthetically short Korea equities again from this date.

- Pre-Borrow: Korea is a pre-borrow market, meaning borrow needs to be secured with Jefferies Financing desk before any short is executed. While the previous short sale universe was restricted to the KOSPI 150 and KOSDAQ 200 names, this is not the case now. All Korea equites are in scope (subject to certain exclusion names designated by the exchange (Offshore ETF / Synthetic ETF / ‘Overheated’ short sell names).

Proposed Increase in Endowment Tax: Policymakers close to President Trump are considering raising the tax rate on university endowments to combat the U.S.’s fiscal deficit. The 2017 TCJA introduced a 1.4% tax on endowments for universities with at least 500 students and assets exceeding $500,000 per student.1 Rep. Troy Nehls proposed the Endowment Tax Fairness Act to increase this tax to 21%, matching the federal corporate tax rate, while Rep. Mike V. Lawler suggested a 10% hike.2

- Impacts: Colleges argue higher taxes would reduce their ability to support financial aid, research, and faculty, impacting spend targets and asset allocation. Universities may be expected to adjust their portfolios, potentially increasing risk or exploring more tax-efficient strategies.

Enhanced Scrutiny on FCA’s ‘Name and Shame’ Proposal: The FCA’s “name and shame” plan requires early disclosure of investigations to increase transparency and deter misconduct.

- Outcomes: Hedge funds fear reputational damage and unnecessary investor withdrawals, noting that 2/3 of past FCA investigations ended without enforcement.3 Revised rules still concern hedge fund professionals, who worry it could deter business in the UK.4 AIMA recommends limiting disclosures to cases of immediate mass market harm or public knowledge. Investors should be aware of potential impacts on fund performance and market perception due to these disclosures.

Please reach out to your Jefferies contact for more information on any of the topics above.

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

ACA – SEC Marketing Rule FAQs for Gross and Net Performance of Extracted Performance

AIMA – Hedge Fund Confidence Index

Akin Gump – SEC Staff Says It’s OK to Just Be Gross

Carne – 2025 Change Research Report

Citco – Citco 2024 Middle Office Solutions Report – A Year in Review

FiSolve – Weekly News Digest: March 21, 2025

IQEQ – Roundup: SEC’s off-channel communication enforcement continues

SRZ – EDGAR Next: Preparing for the SEC’s Filing System Transition

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

1Tax Foundation, New Efforts on Taxing Endowments Raise Questions on Neutrality and Revenue Collection

2Congressman Lawler Reintroduces the Endowment Accountability Act to Ensure Wealthy Universities Invest in Students

3Financial Times, FCA backtracks on plan to ‘name and shame’ probed companies

4Alternative Fund Insight

5Investment Advisor, Industry Snapshot 2024

6Squarepoint, Position Paper: Handling SMA Transparency with Responsibility

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2025 Jefferies LLC

Clients First-Always SM Jefferies.com

After a Record Run, Can India’s IPO Market Regain Momentum?

In 2024, 338 companies went public on the National Stock Exchange of India (NSE) and BSE, raising a record $21 billion. By year’s end, India was one of the world’s hottest IPO markets, with its volume matching the combined total of China and Hong Kong.

More recently, though, Indian public markets have lost steam. The Nifty 50 index, which tracks the country’s top-50 public companies, initially dipped on concerns over the Trump administration’s anticipated tariffs and continued to slide as more details emerged.

What does this mean for public offerings? It may be too soon to tell, but some investors view current IPO aftermarket performance as a warning sign. More new listings have struggled than succeeded in recent months.

Jibi Jacob, Head of Equity Capital Markets at Jefferies India, believes that broader market conditions—not IPO pricing or quality—are to blame.

“India’s market cap. has decreased from $5.5T to $3.7T, and IPOs feed on what is happening in secondary markets,” he said at a recent conference. “But if you look at the top 20 IPOs, mean returns are 25-28%. If pricing were wrong, returns would be more negative.”

Jefferies Insights caught up with Aashish Agarwal, the firm’s India Country Head, to discuss the country’s IPO pipeline. This follows his Q&A last fall, where he spoke about India’s growth story and the backlog of large companies eyeing public offerings.

Jefferies was recently recognized as India’s ‘Best Investment Bank’ by Global Finance.

India’s IPO Pipeline: Crowded but Stalled

Before analyzing the current market, it’s helpful to look back at recent trends in Indian public issuances, which, until November 2024, had ranked among the world’s most active.

In 2023 and 2024, Indian IPOs grew in number but even more in scale. Public issuances rose 22.6% from 2023, while fundraising volumes jumped 139%.

In 2023, small- and medium-sized enterprises led the IPO surge, nearly tripling new issuances from the year before. By 2024, larger companies entered the mix, and going into 2025, several of India’s unicorns were expected to go public.

Now, the outlook for large-cap IPOs is uncertain. No “mainboard IPOs”—listings from large, established companies—have launched for four consecutive weeks. New issuances have primarily come from the small and mid-cap segment.

“Though we have not seen sizable IPOs in the last few weeks, year to date nine companies got listed and cumulatively raised $1.8B. In the last two months or so, when the market has seen corrections, there are eight or nine issuers who have mandated banks for their potential listing with issue size greater than $1Bin the next 12 months,” Agarwal explained. “Since IPOs take 6-9 months for listing, being in the state of readiness is the key right now.”

A growing backlog of high-profile businesses has been cleared for public issuance but remains on the sidelines for now. So far, 34 companies have received approval to raise $4.8 billion this year, while another 55 are awaiting clearance for up to $11.4 billion, according to a leading Indian brokerage and asset management group cited by the Financial Times.

Has IPO Pricing Run Too Hot?

For two years, companies have capitalized on strong valuations in India’s public markets, which have become some of the most expensive globally by price-to-earnings multiples. The 2024 hot streak of IPOs added to the appeal. A study of 162 IPOs last year found that more than 82% traded higher after listing.

This stood in contrast to IPO markets in the U.S. and Europe, where new listings have struggled for years.

Some investors are asking if valuations have overheated. Reuters recently highlighted India’s largest IPO of 2024—a subsidiary of Korea’s Hyundai Motors. While the parent company trades at a 3.7x forward price-to-earnings multiple, its Indian subsidiary trades at 22x. Indian units of Japanese and European companies have seen similar valuation premiums.

Are 2025’s IPOs struggling in aftermarket trading due to inflated valuations, or is their performance simply mirroring broader market declines driven by tariff threats and other pressures?

“The two sizable IPOs of this year, Dr. Agarwal’s Health Care ($350 M) and Hexaware Technologies ($1B), have stood the test of recent market volatility. Both are above their issue prices currently,” Agarwal said. “We believe the aftermarket performance of 2024’s IPOs is currently driven by broad market performance and outlook.”

A Necessary Reset for Indian Markets

Some financial leaders see reason for optimism in India’s market performance, including Jefferies India’s Head of Research, Mahesh Nandurkar. In a recent appearance on CNBC India, he points to signs of stabilization in Indian benchmark indices and describes the recent downturn as a necessary reset.

“This much-needed market correction is now, I think, behind us,” he said. “Valuations are now down closer to long-term averages, and fundamentals are showing signs of improvement.”

His remarks come at a time of heightened volatility for U.S. public equities. Historically, turbulence in the U.S. has rippled into emerging markets—but this time could be different.

Nandurkar thinks the extended bull run in U.S. equities may have dampened investor appetite for emerging economies. Now, with uncertainty around tariffs and trade policy weighing on the U.S. economy, American investors may start looking elsewhere for returns. India could stand to benefit.

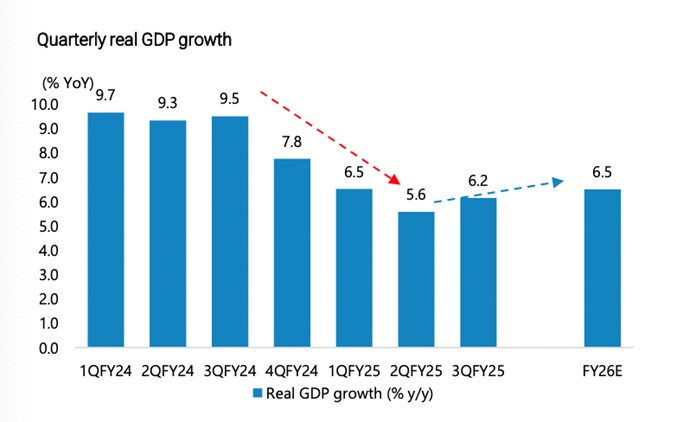

Source: MOSPI, CEA, Jefferies

Growth projections for the Indian economy reflect this. After the shallow slowdown of recent quarters, GDP growth is expected to rebound to 6.5% CAGR.

The panel cautioned that it’s too soon to call the trajectory of Indian public markets. But if the correction is truly in the rearview, it could set the stage for a stronger IPO pipeline.

Searching for Growth in Emerging Markets

As IPO activity lags in developed markets, investors are turning to emerging economies for opportunities. Indian public equities may be expensive, but they’ve delivered strong returns for years.

The question now is whether the recent IPO slowdown signals a deeper shift or just a temporary setback. With several high-profile companies still waiting to go public—and fresh positive signs for India’s economy—many eyes will be on India’s markets in the weeks ahead.

For more insights from Aashish Agarwal and Jefferies’ award-winning India team, read his Q&A on Jefferies Insights: What Will Drive India’s Growth for the Next 20 Years?

What the Global Political Shift Means for Energy

Just two months into the new U.S. presidential administration, the conversation—and regulatory framework—around energy is shifting dramatically. Yet global energy trends unfold along much different trajectories and timelines than those governing politics. According to Pete Bowden, Jefferies’ Global Head of Industrial, Energy & Infrastructure Investment Banking, this is why most energy investors and leaders with whom he speaks are moving with patience and deliberation.

This week, Pete and his team are host to several hundred senior leaders from the U.S. and globally at the Jefferies Energy and Power Summit in Houston. There, they are to discuss the most consequential trends shaping global energy markets. In advance of the gathering, we sat down with Pete to get his take on a few key questions likely to be on the minds of meeting attendees.

Q: What will the near-term impact of the energy regulatory changes from the Trump Administration be?

A: The changes may not be as seismic as some think.

The perception that everything would change the day Trump entered the Oval Office in January ignores the realities of this industry’s lead time and decision-making process. When you think about major oil companies, you think about aircraft carriers, not PT boats. Once they have their 2025 drilling plan set, which is halfway through 2024, they don’t change it based on the outcome of an election.

Let’s say the Keystone XL pipeline is approved tomorrow. It will still take years to build and will not be in service until after Donald Trump leaves the White House.

Daniel Yergin likes to remind people that the president of the United States does not determine supply or demand or set the oil price. Donald Trump can, and likely will, ease up on permitting, allowing the industry to initiate activity on federal onshore lands or offshore blocks that it could not effectuate under President Biden. Even if that happens, though, oil companies will still move deliberately. For example, if President Trump were to open drilling in the Arctic, companies would still have to assess the liability and reputational risks of exploring there.

Ultimately, leaders in this sector want sensible public policy that recognizes fossil fuels as global commodities, and that the domestic availability of hydrocarbons solidifies American companies’ leadership role in the world.

Q: What will change at the Federal Trade Commission mean for the energy industry?

A: The Trump administration initially announced that it was retaining some core components of the Biden administration antitrust framework, suggesting there could be more continuity at the Federal Trade Commission than some expected. However, more recently, President Trump announced the firing of two Democratic members of the Commission. I do think the general attitude toward energy sector mergers will change. During the Biden administration, it seemed like almost every energy combination was reviewed, even if it had zero or negligible anti-competitive characteristics. Still, the FTC would ask select questions or issue a full second request, causing delay or risking a blocked deal.

Now, under President Trump, industry participants with wish lists that include deals they did not think could get through the FTC or DOJ will try to make those deals happen over the next few years.

Q: We’ve entered a higher-risk world with tariffs, potential trade wars, and shifting alliances. What will the impact of that be on the energy industry?

A: It has highlighted the importance of U.S.-produced hydrocarbons for the U.S. market. No matter the trade regime, we are the most significant end market.

Everyone is lining up trying to buy U.S. inventory because the production is proximate to the best end market. You know, at least directionally, what the regulatory regime will be.

Outside the U.S., one must worry about tariffs and shifting winds across different regimes worldwide. The U.S. has long been the most important end market and may now be the most important producer, so it is attractive in both ways.

Q: What is the state of the global energy transition?

A: In places like Europe, governments and voters are realizing that oil and gas will still be necessary for a long time to come because the energy transition has proven harder, more costly, and slower than some anticipated.

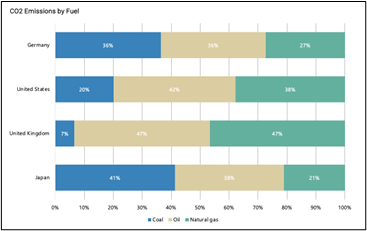

People are also learning that moving too quickly away from existing reliable energy sources can have serious, unexpected ecological consequences. For instance, Germany decommissioned nuclear power plants and assumed they could add enough offshore wind and solar energy to compensate. They could not. Consequently, Germany burns lignite coal in power plants to get through the winter. That is 1930s technology with a high carbon output per unit of electricity produced.

Q: How do you think the established players in the global energy industry can help fast-developing countries meet their demand?

A: The developing world needs the expertise and support of the developed world to meet its energy requirements correctly. If we do not provide them with that expertise and support and they do it the wrong way, it does not make a difference what we do in the lower forty-eight states on carbon capture or anything else. That is a drop in the ocean if we return to coal as the world’s flex fuel.

Focusing on the U.S. alone is like declaring a no-peeing section in the swimming pool. It just doesn’t work. Greenhouse gas emissions are a global challenge that requires solutions deployed globally.

Q: How do the significant investments the U.S. has made in renewable energy figure into the global picture?

Remember that the United States only accounts for about 14% of global carbon emissions, and our share is declining. Solar and wind deployment is growing rapidly here and worldwide and will likely continue. However, fossil fuels still account for over 80% of global energy demand.

To understand why, remember that over a billion people live in energy poverty worldwide, and fossil fuels are often the most available, affordable, and reliable option for countries to meet their energy needs.

Take India. India is electrifying and trying to do so with LNG, the right bridge fuel. However, President Biden’s previous export ban on LNG caused the country to pivot back to coal. This is a global problem that needs to be addressed globally.

Q: What should leaders in the energy industry think about that may not be at the top of their minds right now?

A: The industry should consider where it will be in 30 years. And that is hard for public companies to do. They need to make their numbers every quarter and have annual planning and deployment of capital cycles.

The industry needs to explain that even if fossil fuels are reduced in the power and transportation sectors, oil and natural gas liquids are still used in just about every household good. The idea that we will completely wean ourselves off oil is unrealistic.

If you believe that carbon capture and sequestration will be part of our carbon emissions control, oil and gas companies’ downhole expertise will be necessary. Carbon goes into depleted reservoirs, and the people who know how to put it there are the same people who took it out. These are big, multi-year projects with high capital intensity and a rigorous engineering overlay.

If you are a large oil company or energy producer, you should offer the public and policymakers a clear vision for how you can write the next chapter of this industry and ensure that energy is cleaner and more abundant.

European Mid-Cap Outlook: Q&A with Dominic Lester, Edward Keen, and Lorna Shearin

Now in its fifth year, the Jefferies Pan-European Mid-Cap Conference has quickly established itself as a marquee event for investors and corporates focused on Europe’s mid-cap universe. Launched during the pandemic as a virtual gathering, the conference has evolved into one of the largest and most impactful events of its kind. This year, it returns to London with 190 participating companies (up from 167 in 2024) and 525 investors confirmed, representing 286 institutions worldwide.

The 2025 conference reflects Jefferies’ strategic commitment to supporting mid-cap companies across Europe. Investor attendance is up 47% year-on-year, with 36% of participants now coming from outside the UK, reflecting the rising global appetite for European mid-cap opportunities.

Ahead of this year’s conference, we sat down with Dominic Lester, EMEA Head of Investment Banking; Edward Keen, Head of Equities EMEA; and Lorna Shearin, Deputy Head of EMEA Investment Banking, to discuss the themes shaping the European mid-cap landscape and what to expect from the event.

European Mid-Cap Outlook

What are you most excited about as we head into this year’s conference?

Dominic Lester: From a macro perspective, Europe’s momentum is building. Ironically, recent US political shifts have pushed Europe towards greater economic coordination. The UK is moving closer to Europe, Germany has reawakened following Merz’s electoral victory, and we’re seeing renewed energy in Southern Europe, particularly Greece and Italy. Funding is available, debt financing remains resilient, and equity markets are competitive. All of this creates a fertile backdrop for mid-cap companies. It feels like the start of a European economic renaissance.

Lorna Shearin: The Jefferies Mid-Cap Conference is a unique event, and we always look forward to connecting with so many of our UK and European investment banking clients. This year, we have 65 UK corporates participating, and the conference provides an excellent opportunity to showcase them—particularly our UK broking clients—to a broad pool of global institutional investors. It promises to be an interesting three days as we hear how these companies are navigating shifts in technology and macroeconomic conditions, and how these factors are shaping their M&A and growth strategies.

2025 marks the conference’s fifth year—what makes this year’s conference stand out?

Dominic: It’s truly international, bringing together participants from across Europe and beyond. This reflects Jefferies’ long-term strategy to support the mid-cap universe. We’re seeing a diverse range of growth-oriented leaders—70% of companies are represented by C-suite management, with many new and returning names.

Edward Keen: I’m excited by the scale of participation—it’s becoming a bit of a marquee event! We now have 190 corporate attendees, with a third from the UK. The 125 European corporates represent a full range of sectors and include some of the most dynamic and exciting mid-cap companies in Continental Europe. On the investor side, we’re seeing large teams attending, some with up to 10 investment professionals. That shows deep institutional commitment and highlights Jefferies’ differentiation across trading, research, and banking.

How do you see the European mid-cap landscape evolving over the next 12–24 months?

Ed: We’ve expanded from a UK-centric model to pan-European coverage over the last few years. Mid-caps have always been a core focus for Jefferies, and there’s a strong case for European mid-caps right now. Valuations are compelling—most would argue they are cheaper than their US peers—and there’s real potential to find alpha. Our advisory expertise makes us a valuable partner to institutional investors.

Are there sectors or geographies where you expect significant deal activity or consolidation?

Dominic: Consolidation is accelerating in financial services, particularly in Italy, and we expect it to continue across Europe. Pharma remains active, and aerospace and defence are obvious areas given increased local defence spending. The IPO market is slowly reopening—we’ve seen corporate carveouts and private equity funds tap the public market to exit some assets that might be too large to sell, like Galderma. The constraint on European IPOs has been on the supply side, but I think we’ll see more high-quality companies coming to market, like Visma, Verisure, and other high-profile names such as Revolut. I don’t foresee a blockbuster IPO year, but it’s warming up and setting the stage for 2026. There’s also ongoing restructuring among over-leveraged companies, which will drive more M&A.

Lorna: Overall, deal activity remains healthy, particularly in technology, healthcare, energy and energy transition, and infrastructure, where we are seeing significant deal flow, including sponsor exits and public-to-private transactions. That said, the current geopolitical backdrop is making deal completion less certain and timelines to close are often longer. Geographically, Germany and the UK will likely remain focal points for many of our clients. It is the drive for innovation, sustainability, and digital transformation that continues to be the principal force behind M&A activity in the near and medium term.

Are institutional investors becoming more open to European mid-caps versus US opportunities?

Dominic: Yes. There’s a clear valuation arbitrage. Investors are still selective, but they’re looking for higher-growth opportunities—companies showing double-digit topline growth are in demand. In the UK, pension funds are under regulatory pressure to allocate more to public equities, which should help domestic demand as well.

Ed: Globally, we’re seeing US and AsiaPac long-only funds increasing their European exposure. We don’t really foresee people taking an overweight position—more of a rebalancing toward neutral. It’s important to remember that the liquidity profile of Europe is nowhere near as rich as the US. We have to tread carefully, but this could mark the beginning of a long-term shift. If there’s a resolution to the Russia-Ukraine crisis, there will be a resounding appetite for Europe, but things can change in an instant. Europe has its challenges—no one is totally immune to the effects of tariffs—but relative stability, predictability, and cheaper valuations are attracting capital.

Investor attendance is up 47%, with 36% ROW participation well above historical norms. What’s driving that international interest?

Ed: In my opinion, it reflects the diversification of global asset flows. Investors are moving away from being overweight in the US, and Europe is a key beneficiary. It also highlights the growing depth and breadth of Jefferies Corporate and Institutional investor clients. We are listening to what they want, and delivering!

Dominic: In addition, significant capital is flowing into Europe from the Middle East. Sovereign wealth funds and private equity investors there have both the capital and expertise, particularly in energy and industrial sectors. We’ve already seen large energy acquisitions in Germany and expect more to follow in industrials, petrochemicals, and beyond.

Any parting thoughts?

Dominic: This feels a bit like the 2020 reset. Historically, it’s been in the US’ interest to create military and economic dependence on the US. But as America turns inward, leaders in France, Germany, and the UK are taking the bull by the horns, and Europe is moving towards greater self-reliance in defence and energy security. I don’t think investors will sit on the sidelines in fear. People are shaken by geopolitical risks, but it’s prompting decisive action. This is a pivotal moment for Europe’s economy—and a huge opportunity for mid-cap investors.

Lorna: This is one of Jefferies’ flagship conferences, and it continues to grow year on year. In the same way that the Jefferies London Healthcare Conference has become a “must-attend” event in the annual calendar, we see our Mid-Cap Conference evolving in the same way. We’re delighted to host the event and to support both our corporate and institutional clients as they connect, grow, and flourish.

Ed: Make sure you sign up early if you want to come next year!

Data Moats, Infrastructure, and Agents: Where Investors See AI’s Next Big Opportunities

A Jefferies Insights Podcast

Evan Osheroff, Managing Director of Software Investment Banking at Jefferies, sat down with Don Stalter, North American Partner at Global Founders Capital, to discuss the trajectory of artificial intelligence (AI) and the opportunities growth investors are eyeing in the sector.

Their discussion covers the evolution of AI in business, the significance of data and operational expertise, the challenges and opportunities of investing in AI, the energy and infrastructure implications of AI’s growth, and emerging AI applications like autonomous logistics.

As a long-time investor and entrepreneur in technology, Don brings a unique perspective on what it takes for young companies to succeed in this fast-growing space — from building the right team to using open-source models to create application-layer businesses and AI agents. Mapping the AI market, where thousands of new companies launch each year, is no small task. Don and Evan’s conversation digs into the key questions investors should be asking and where the next big opportunities might lie.

Don Stalter is the North American Partner at Global Capital, where he has been an early backer of ten $1B+ unicorns. His most notable investment was in Deel, where he wrote the largest seed check and helped recruit key executives. Previously, Don co-founded CityDeal, a B2B marketing technology company acquired by Groupon in its early days. He also built out Groupon’s international offices and led global business development at Airbnb. Earlier in his career, Don worked in Credit Suisse’s tech M&A group and as a private equity investor at Savant Growth.

Evan Osheroff is a Managing Director of Software Investment Banking at Jefferies, with over 15 years of experience and more than $100B in completed transactions. He specializes in application and infrastructure software and has extensive expertise in M&A, IPOs, convertible offerings, debt financings, leveraged buyouts, and more.

How Japan’s GX Plan Aims to Decarbonize the Country’s Toughest Sectors

Jefferies recently wrote about Japan’s Green Transformation Policy (GX), a $1 trillion plan to dramatically reduce emissions over the next decade. This initiative represents nearly three times the annual GDP investment percentage of the U.S. Inflation Reduction Act — yet it has largely flown under investors’ radar.

Decarbonizing Japan’s economy comes with unique challenges and opportunities. Japan relies more on coal (the most carbon-intensive fossil fuel) than its high-income peers, and a large share of its energy is imported. At the same time, Japan can draw lessons from other countries’ transition policies and emissions trading schemes, giving it a significant second-mover advantage.

Historically, Japan has lagged in energy transition investment. Last year, it made up just 2 percent of global energy transition spending, despite being the world’s fourth-largest economy. Smaller economies, including India, the U.K., and Brazil, matched or outspent Japan in 2023.

The GX plan is specifically designed to address these challenges. It targets high-emission companies with an aggressive decarbonization strategy — aimed at maintaining their economic performance and the country’s energy supply.

Here’s how it works in five key steps.

- Target Setting: Japan’s slow start in the energy transition isn’t stopping it from setting ambitious, fast-moving goals. The GX Plan aims to reshape the country’s power mix by 2040, with 40-50 percent from renewables and 20 percent from nuclear. These targets set the stage for bold policymaking and investment — detailed in the steps that follow.

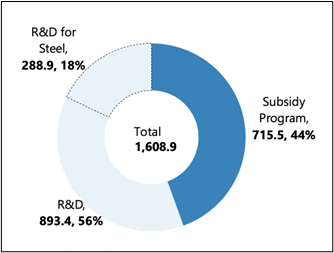

- Transition Sovereign Bonds: Between 2023 and mid-2029, Japan will issue ¥20 trillion in transition sovereign bonds. Unlike the “green bonds” of the IRA, which fund climate projects across the economy, transition bonds specifically help high-emitting companies lower emissions — moving from “brown” to “less brown” or “greener.” Proceeds will fund R&D through the Green Innovation Fund and support decarbonization efforts via the Subsidy Program, with a focus on Japan’s hardest-to-decarbonize sectors.

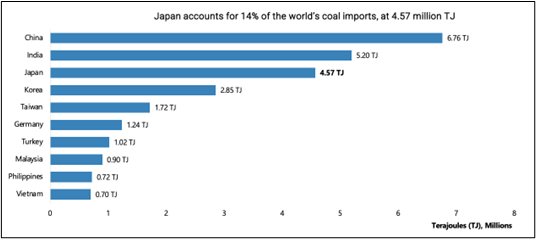

- Carbon Levy on Fossil Fuel Imports: Japan accounts for 14 percent of the world’s coal imports, trailing only China and India. Starting in 2028, it will introduce a carbon levy on fossil fuel importers, with rates increasing over time. Revenue from the levy will be used to repay the principal and interest on GX Transition Bonds. By linking fossil fuel imports to decarbonization funding, Japan is creating a built-in financial mechanism to curb coal dependence while sustaining long-term support for its transition strategy.

- A National Emissions Trading System (ETS): Japan launched its national ETS in FY2023, beginning with voluntary participation through the “GX League” — a group of 747 companies responsible for over 50 percent of the country’s GHG emissions. Notably, 18 of the 20 highest-emitting Japanese stocks (Scope 1 + 2) have joined. This voluntary phase runs through FY2025 before transitioning to a mandatory ETS in 2026. Japan has the opportunity to learn from the successes of ETS efforts in Europe, China, and beyond. More details on its plan will be released this year.

- An Innovation-First Approach to Climate Policy: Japan’s GX Plan prioritizes research and development in addition to subsidies — a strategy aimed at positioning the country as a global hub for climate tech and clean energy innovation. More than half of the transition bond proceeds will fund R&D through the Green Innovation Fund. The plan also dedicates JPY 200 billion over five years to deep tech startups and JPY 700 billion to support small and medium-sized enterprises driving the energy transition.

This chart illustrates the use of proceeds for the February Bond Auction (representing 1.6T JPY of the total 20T JPY to be issued).

Japan’s decarbonization path comes with unique challenges—but it’s being tackled with an equally unique strategy.

The scale and structure of the GX Plan—its incentives, R&D focus, and diverse climate finance tools—set Japan up for one of the most ambitious energy transitions in the developed world. Jefferies, and investors everywhere, should keep a close watch.

Follow along for more insights from Jefferies’ Sustainability and Transition Team on the Japan GX Plan and other important climate investing themes in the weeks ahead.

Grid Upgrades Are Lagging—Can Drones Change That?

Last February, Jefferies wrote that upgrading and expanding grid infrastructure was widely viewed as the biggest obstacle to a net-zero future.

Clean energy investment was surging, but grid development lagged badly. Existing infrastructure was severely unprepared for the projected load growth of the next decade.

A year later, new innovations aimed at modernizing the grid are gaining traction—and one, in particular, is turning heads. Infravision’s drone-enabled power line stringing uses unmanned aerial vehicles to install power lines faster and more cost-effectively than traditional methods.

Could this be the breakthrough that speeds up grid deployment while cutting costs and improving safety? Jefferies’ Sustainability & Transition Team sat down with Infravision’s founders to explore where drone-enabled power line stringing stands today—and what it could mean for the global transition.

This article recaps Jefferies’ interview with Cameron Van Der Berg, Co-founder and CEO of Infravision, and Brian Leveille, the company’s CFO. For a deeper dive into their insights, read the full report from Jefferies’ Sustainability & Transition Team.

A New Approach to Transmission Replacement

The United States needs to more than double existing regional transmission capacity by 2035, according to the Department of Energy’s 2023 Needs Study. A key piece of this effort is replacing aging power lines with new and advanced materials—an effort that’s expensive and, in some cases, risky.

Infravision’s drone-enabled approach is tackling the challenges of transmission replacement head-on. Its proprietary TX System pairs a heavy-lift drone with an electric smart puller tensioner, enabling automated, high-precision power line stringing across long distances.

According to Van Der Berg and Leveille, this system offers three key advantages:

- Safety: The drones take on high-risk tasks—like working at elevated heights or in difficult terrain—reducing the need for direct human intervention. This lowers the risk of accidents while allowing crews to stay focused on other critical tasks.

- Efficiency: Drones can reach remote areas that ground crews and helicopters can’t, helping to speed up project timelines.

- Savings: The system offers lower cost per phase mile than traditional methods while also reducing overhead expenses.

The founders believe these benefits position Infravision to significantly disrupt traditional power line installation.

Infravision’s Market Opportunity & Growth Strategy

Infravision’s drones aren’t just an R&D experiment—they’re already in operation, with real projects and growing scale. Their primary customers are utility companies and engineering, procurement, and construction (EPC) contractors, including a 50-kilometer, 250-megawatt high-voltage line with Powerlink Queensland.

Infravision has also partnered with PG&E to deploy its drones on power lines and is now working with Sterlite Power in India. As global power demand and electrification efforts accelerate, the company expects to expand its presence across international markets.

The company’s total addressable market is significant, backed by $200 billion in planned transmission capital expenditure and $870 billion in distribution capex and opex globally in the coming years. Following a $23 million Series A funding round led by Energy Impact Partners, Equinor Ventures, and Edison International, Infravision plans to double its workforce over the next year.

New Opportunities in the Energy Transition

Drone-enabled solutions create a wide range of opportunities for the energy transition.

They don’t just improve cost and safety efficiencies in transmission installation—they also shorten project timelines, freeing up skilled workers for other transition projects. Additionally, companies like Infravision make large-scale T&D construction more feasible in non-Western countries, where high costs have historically been a barrier.

For more on Infravision’s solutions, check out Jefferies’ full recap of the team’s recent conversation. For deeper insight into the energy transition, climate tech, and related opportunities, explore the Jefferies Sustainability & Transition Team’s work on Jefferies Insights.

Prime Services C-Suite Newsletter – December 2024

Jack-of-all-Reads: A newsletter for multi-hat-wearing C-suite leaders and their key constituents.

Regulatory Initiatives, Liquidity Trends, and AI in Relationships

Wishing you all a wonderful Holiday Season and success in the New Year! We welcome and appreciate your continued partnership.

Industry Insights:

2024 was a year marked by macro and geopolitical uncertainty, but despite this unpredictability, the U.S. equity markets massively outperformed. The S&P 500 and Nasdaq have risen 26% and 28% respectively as of end of November1. What do we think this current backdrop means and what are a few keys to success in 2025?

- Lower Quantity but Higher Quality in the New Launch Landscape: While the number of managers launching new funds is lower than in years past, the quality is higher. Hedge fund consultant & technology provider, PivotalPath, has tracked 145 “quality new launches,” defined as managers spinning out of shops with >$1bn in assets. A major backer of these high-quality launches are large Multi-Manager platforms. This is giving much needed “oxygen” to the new launch space, allowing pedigreed groups to get off the ground and cover their startup costs much quicker.

- Top Performance: Despite the notable decline in both headline launches and liquidations, reversing 2023’s trend when net new launches turned positive, hedge fund industry assets continue to surge, topping the $4 trillion mark, which is likely due to performance-based growth.

- After experiencing outflows in 2022 and 2023, hedge funds reversed this trend, attracting nearly $23.04 billion of net inflows through Q3 2024, but a majority of the growth in assets, approximately $324.8 billion, has come from hedge fund performance.2

- Top Performance: Despite the notable decline in both headline launches and liquidations, reversing 2023’s trend when net new launches turned positive, hedge fund industry assets continue to surge, topping the $4 trillion mark, which is likely due to performance-based growth.

- Hedge Fund Concentration: The number of hedge funds in the industry is sitting at 8,213, up slightly from the 8,145 that existed in 2023, but below 2015 peaks. As the number of hedge funds remains steady and assets continue to swell higher, the trend of further industry concentration prevails, which is evidenced by the fact that firms with greater than $1bn in AUM account for 85.50% of assets in the industry.2

- Increased Consolidation: Flows have been bifurcated to the largest ($5bn+) and smallest (<$100mm) managers,2 this year pointing, perhaps paradoxically, to this trend of industry consolidation amidst a healthy new launch backdrop.

- A Spotlight on Performance YTD: On a year-to-date basis, 89% of all hedge funds are reporting positive performance, according to PivotalPath, producing an average return of ~15%. When evaluating fund performance based on AUM, smaller managers in the $100mm to $250mm range have been the best performing cohort year to date, while managers in the $2.5bn to $5bn range are lagging behind by more than 600bps.

- Alpha Production: Most hedge funds are posting positive returns this year, however, the major hedge fund indices, as tracked by HFR, are lagging behind equity market indices. Through November, the S&P 500 is up about 26%, while the MSCI World has surged about 20%.1 Contrarily, the HFRI FWC is only up about 10%, and the HFRI Equity Hedge is up approximately 13%.4 Despite this, hedge funds are still conserving capital and producing alpha – PivotalPath’s composite hedge fund index demonstrates that through November hedge funds are producing an average 5.8% of alpha over the S&P.

- Sector Focus: When focusing specifically on healthcare performance, the HFRI Healthcare index is performing above both the XBI and IBB. Growth in both healthcare and technology sector assets have been on a steady incline over the past three years. The growth seen from the healthcare and TMT groups is slightly ahead of that in all equity hedge assets. Interestingly, there are still net outflows which is a contrast from net inflows of the overall hedge fund industry.

- Fundraising as a Top Challenge in 2024….But Optimism for 2025: Capital raising for hedge fund managers proved challenging in 2024, especially as equity markets surged, interest rates remained high, and economic uncertainty prevailed.

- Creating Liquidity: Moreover, many institutional allocators still reported being hamstrung by their privates allocations, looking to their hedge fund books as a form of liquidity. In Dynamo Software’s 2024 Hedge Fund Report, hedge fund managers ranked fundraising as their top business challenge, followed by delivering alpha, managing key client relationships, and recruiting talented employees.

- “Hit the Ground Running”: The majority of hedge funds are determined to increase marketing efforts in 2025, with more than 55% of the groups surveyed in the study anticipating ramping up their capital raising efforts in the New Year.

- The War for Talent Wages On: As many job seekers are now placing an increased emphasis on firm culture, they may also have expectations of career development opportunities across levels, creating alignment of autonomy, flexibility, and purpose.

- Trends in Hiring: Unsurprisingly, multi-manager & multi-strategy funds, as well as equity long short managers, have been some of the most active groups hiring new talent, according to data compiled by With Intelligence. Multi-Manager platforms specifically were responsible for nearly 40% of hiring in the industry in Q2 2024. Across all firms, 63% of new hires were on the investment side, while the other 37% were on the noninvestment side, across various legal, operations, and technology focused roles.

- Role Type: Overall, industry headcount in non-investment roles has increased from 40% to 54% since 2015,5 pointing to the increased focus on non-investment functions such as technology and infrastructure, treasury, and portfolio financing.

Regulatory Corner:

SEC’s Regulatory Enforcement Priorities – What’s in focus for 2025?: Coming off a very active year on the regulatory front in 2024, the SEC has released their enforcement priorities for 2025. Some exams have led to full sweeps of all aspects of a firm’s procedures. As a result, compliance teams are focused on making sure their policies and procedures are reflective of the firm’s practices and that their team is well versed on what should be included. Although many of these rules have been discussed at length, below are some current industry insights and areas of focus for our clients:

- Regulation SHO: This rule has a compliance date of January 2nd, 2025 with the first report due in mid-February (2 weeks post month-end). Managers should begin to track which securities meet the threshold.

- Regulation S-P: The SEC adopted amendments to Regulation SP in May of 2024, and firms with over $1bn AUM have until November 2025 to comply with the ruling.

- AI Enforcement: The term of “AI Washing” has been gaining popularity, especially as regulators want to ensure that managers are not overselling their use of the technology. Because part of the SEC’s focus is on emerging financial technologies, they are expected to release a Predictive Data Analytics rule in 2025, which should encompass managers’ use of AI.

- Marketing Rule: The first sweep of sanctions when the New Marketing Rule was released in 2022 were mostly focused on hypothetical performance and returns. However, now the most common deficiencies are related to testimonials or endorsements from 3rd party ratings, as well as fees and expense calculations.

- Cyber Security: The SEC is aiming to evaluate if a fund has a comprehensive business continuity plan in place and that this plan has been tested. Any plans should outline appropriate vendor due diligence processes, as well procedures to ensure investor information is protected. Third party controls and governance practices will also be reviewed

Spotlight on Content and Events:

Terms Analysis: The Jefferies Capital Intelligence team has compiled the most recent trends and fee studies with focuses on Long Only, Healthcare, Emerging Managers, and TMT hedge fund managers. As discussed in the most recent edition of the newsletter, throughout 2024, the team has observed firms being more creative with their terms and fees, oftentimes even creating unique share classes to cater individual investors’ needs. Some key findings from each vertical include:

- Long Only: Since 2022, equity long only mandates have accounted for about 33% of all equity mandates, up from the 30% they accounted for in the 2021-2023 timeframe.

- Healthcare: Historically, healthcare funds have charged higher fees than traditional long short fund; however, after reviewing the fund terms of healthcare funds that launched between 2022-2024, the team found that healthcare terms have become more aligned with traditional long short funds.

- Emerging Managers: Since 2022, the team has consistently observed over 80% of emerging managers choosing to outsource their trading functions, and while less common than choosing to outsource trading, the team has seen more than 30% of emerging managers choosing to outsource their CFO/CCO/COO function.

- TMT: In terms of redemptions, most directional managers required 60 days’ notice, while the most popular notice for low net funds was 45 days. This difference in liquidity may partially be attributed to the variations in directional and low net funds’ holding periods for long positions.

Please reach out to your Jefferies contact for more information on any of the topics above.

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

ACA/NSCP – 2024 AI Benchmarking Survey Results

Akin Gump – Nasdaq Diversity Rule Deemed Unenforceable By 5th Circuit

Dynamo – Dynamo Software’s 2024 Hedge Fund Report

SRZ –REMINDER: SEC Short Position (Form SHO) Filing Deadline Fast Approaching

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Ariel Deljanin

Business Consulting Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

Eileen Cooney

Capital Introductions

[email protected]

1FactSet, performance data is through November 2024.

2HFR Q3 2024 Hedge Fund Report

3SOFR refers to the Secured Overnight Financing Rate, which is a broad measure of the cost of borrowing cash overnight collateralized by Treasury Securities.

4HFRI, performance data is through November 2024.

5Arcadian

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2024 Jefferies LLC