Strategics Return to the Table as Tech Deal Sentiment Improves

The Jefferies 2025 Public Tech Conference brought together top bankers, investors, founders, and tech executives to discuss the sector’s key trends and developments. The insights below are drawn from interviews and panels with conference attendees.

When tariff announcements rattled markets in early April, no sector took a bigger hit than technology. Public tech stocks fell sharply — led by mega-caps like Apple, whose global manufacturing footprint left them especially exposed, according to Reuters.1

The turbulence sparked fears that the long-anticipated rebound in dealmaking might stall. With policy uncertainty clouding the outlook and earnings under pressure, many expected M&A activity to pause.

Two months later, tech has proven remarkably resilient, according to EY.2 Through May 2025, tech led all sectors in M&A activity, with 165 deals valued at $100 million or more and a cumulative deal value of $236 billion. In April alone, technology accounted for nearly 60 percent of all billion-dollar-plus deals.

Jefferies spoke with senior tech bankers at its annual Public Tech Conference about what’s driving the market — and where things might go next.

Strong Public Listings Paired with Renewed M&A Momentum

In recent weeks, several large tech companies have completed successful IPOs — including eToro, the Israeli multi-asset trading platform. The company continues to trade more than 20 percent above its May debut price.3 Jefferies served as lead bookrunner on the $713 million offering.

“A month and a half ago, there were positive vibes, but no deals were happening,” said Evan Osheroff, Managing Director in Software Investment Banking at Jefferies. “Fast forward a month later, I want to say we’ve seen ten plus billion dollar deals across TMT. We’re seeing large-cap strategics actively pursue M&A.”

That view was echoed by Stefani Silverstein, Global Head of Technology, Media, and Telecommunications (TMT) M&A at Jefferies, who described just how much sentiment has shifted over the past two months.

“When we last spoke, it was April showers. We’ve reached May flowers,” she shared. “There’s been a real evolution, and folks are risk-on, looking to be acquisitive. Deals that should get done, do get done.”

A recent Jefferies survey of tech IPO investors reflected the same shift in tone. Risk appetite is high, and IPOs are still seen as the preferred route for alpha generation. Investors pointed to growth and unit economics as top priorities and expressed renewed confidence in software, which many expect to lead the next wave of public listings.

Tech Earnings Beat Expectations & Strategics Target AI

Some of the optimism may stem from recent tech earnings, which offered an early read on the impact of tariffs. Many results came in stronger than expected. As Barron’s reported, investors can breathe a sigh of relief: tech companies remain on solid ground. As big tech leans further into AI and software, many are proving less exposed to tariffs than other industries.

“We had the tariff uncertainty hit and the S&P went all the way down below 5000. We’ve come roaring back, which is obviously a great sign. Q1 earnings turned out to be fine,” said Ron Eliasek, Chairman of Global TMT Investment Banking at Jefferies. “This quarter’s going to be really interesting to watch because we have, obviously, all the uncertainty of April kind of factored in.”

Strategic buyers, in particular, are back in the game — many focused on AI infrastructure and enablement. Nearly every company is looking to fill gaps or speed up capabilities in their existing tech stacks, and acquisitions are the fastest way to get there.

“There’s a tremendous amount happening with AI financing,” explained Steve West, Vice Chairman for Technology Investment Banking at Jefferies. “Every large company and established company is looking to complement what they already have, with potential acquisitions of AI companies.”

Attendees at Jefferies’ Public Tech Conference broadly expect a steadier cadence of tech dealmaking in the second half of the year, supported by public market momentum, strong earnings, and the continued push to integrate AI. But they also caution that policy uncertainty and challenging conditions, including high rates, mean the market hasn’t fully stabilized. There’s clear momentum, but also a healthy degree of watchfulness.

Opening IPO Window: Strategy, Storytelling, and Liquidity

At last year’s Private Growth Conference, expectations were high that the IPO market would reopen — and by year’s end, the data looked encouraging.

The Jefferies 2025 Private Growth Conference brought together hundreds of top bankers, investors, founders, and tech executives to discuss the sector’s key trends and developments. The insights below are drawn from interviews and panels with conference attendees.

Activity was still below historical norms, but U.S. proceeds were up more than 50% year-on-year, and IPOs raised nearly four times as much as they had in 2022. Some of the year’s biggest offerings came out of the tech sector, including ServiceTitan and Reddit. Both are now trading above their listing price.

This year, that optimism hasn’t gone away, but it’s tempered by recent volatility in public markets. Uncertainty around trade policy has many companies holding back, even as a strong pipeline of IPO-ready names sits in wait.

At the 2025 Private Growth Conference, Jefferies caught up with leading bankers, founders, and executives across tech to hear what they expect in the second half of the year.

Tariff Jitters Slowed Momentum, but the Rebound May Be Quick

“For three years, we’ve thought the IPO market was ready to open. This year, conditions are different,” said Becky Steinthal, Head of TMT Equity Capital Markets at Jefferies. “There’s never been a higher-quality cohort of private tech companies . . . but we need more market stability. It’s an unusual dynamic.”

One of those companies is Klarna, the buy-now pay-later provider whose highly anticipated IPO was delayed as tariff news rattled markets. Another is Cerebras Systems, an AI chip company that filed to go public in September, but hasn’t yet confirmed the timing or size of its forthcoming public offering.

Fortunately, many investors believe the current holding pattern will last days or weeks, not months. “The lag between markets recovering from tariff volatility and the IPO market coming back is going to be really narrow,” Steinthal shared. “This is the most excited I’ve seen investors about the IPO market in years. They’re going to need fewer data points before jumping into IPOs.”

Gaurav Kittur, Co-Head of Global Internet Investment Banking, echoed this sense of pent-up demand. Public investors and private companies want access to each other, he explained. They just need the conviction to move.

“Next-generation tech leaders have stayed private, so public investors haven’t had real access to those exciting companies,” Kittur said. He believes once a few strong deals go out, momentum will follow: “It’ll probably be a trickle, then a flood.”

In the days since the Jefferies conference, the trickle has begun, marked by a series of successful offerings.

Israeli stock brokerage eToro debuted on NASDAQ with Jefferies as a lead underwriter, raising nearly $310 million as shares closed up nearly 30% on day one. And just this week, stablecoin issuer Circle jumped 168% in its NYSE debut after pricing above the expected range.

Honing Your Pitch While the Market Waits

As many top companies remain cautious, tech leaders are preparing to make the most of the window when it opens.

“We want to go public as the leading travel technology company — not in third or fourth place,” said Dakota Smith, President and Co-Founder of Hopper. The travel data provider and marketplace is eyeing a public listing that could value the business at up to $10 billion.

“That’s what we’re focused on now,” Smith added. “Sharpening the narrative, making sure the client book and revenue growth are strong, and starting to get that story out there.”

Becky Steinthal also underscored the importance of sharp messaging, something many tech leaders are using the current quiet period to refine.

“Companies need to tell a really strong story on unit economics,” she said. “It’s not just about showing profitability; they need to prove they can be a big, bad, self-sustaining business.”

Alternative Paths to Liquidity for Companies in Wait

With IPOs still sluggish, many companies are exploring alternative paths to liquidity. If the big exit isn’t on the table yet, how can they deliver some liquidity to investors and employees in the meantime?

“We see a ton of activity on both the private and the public side,” said Evan Osheroff, Managing Director for Software Investment Banking at Jefferies. “It’s the same old adage: things have been quiet the last couple of years. Companies need to go, private equity needs to go. Everyone wants distributions to paid-in capital (DPIs) and liquidity returned to their shareholders.”

“If you’re a private company eyeing the IPO market, [you’re pursuing] more secondary ways to kick the can down the road,” he added. “We’re doing a lot of these right now: secondary tenders for investors trying to sell, but don’t necessarily want the market to know it’s them selling.”

Osheroff also noted that partial liquidity events can be just as important to employees as to private equity or venture investors. “These alternatives serve early- and late-stage investors—and, I’d argue, most importantly, employees.”

When the Spigot Opens

Despite short-term volatility and the pause it’s created, many insiders remain confident that capital formation is close at hand, with IPOs poised to be part of the broader rebound.

“The world has been waiting for the spigot to open on capital formation broadly,” said Raphael Bejarano, Global Head of Investment Banking and Capital Markets at Jefferies. “That extends beyond IPOs.”

As for the uncertainty coming out of Washington, Bejarano believes clarity is near. “We’re going through a period of recalibration. There’s a new administration and, frankly, some dramatic changes. But it can’t last forever for a whole slew of reasons. When stability returns, the spigot is likely to open.”

For companies with strong fundamentals and a clear story, the message from investors is simple: be ready.

Ravi Mhatre on Venture Capital’s Role in the Age of AI

The Jefferies 2025 Private Growth Conference brought together hundreds of top bankers, investors, founders, and tech executives to discuss the sector’s key trends and developments. The interview below has been edited for length and clarity.

In April, Jefferies hosted Ravi Mhatre, Co-Founder & Managing Director of Lightspeed Venture Partners, at its annual Private Growth Conference. Mhatre runs one of the most active venture capital funds in Silicon Valley, where he’s led investments in Snapchat and other major tech ventures.

Here, Mhatre shares his thoughts on how AI is accelerating growth in enterprise settings, the evolving role of venture capital in funding innovation, and raising capital in a post-tech bubble world.

Explosive Enterprise Growth, Fueled by AI

In just two years, AI technology has gone from a novelty to a broadly adopted system. In enterprise sectors — where adoption cycles are typically much slower — companies are leveraging AI for growth at rates Mhatre describes as “stunning.”

It would be a mistake to assume this growth is confined to specific pockets of industry, Mhatre notes. “We’re in a world where we are supply-constrained on expertise that people want. AI is providing an amplifier effect to let more of that expertise be available.”

From helping doctors see more patients by reducing their administrative burden to enabling developers to write better software, AI is driving significant revenue growth for the companies that use it. Recent estimates suggest that AI could generate over $15 trillion in additional revenue for businesses by 2030.

The Role of Venture Capital in an AI-Driven World

Realizing this growth will require significant capital. Mhatre believes that venture firms will play a key role in providing it.

“Venture capital has had to be much more of an institutional force in the capital markets ecosystem,” explains Mhatre. The scale of investment needed to support today’s breakthrough technologies is now much larger. The average investment in deep tech, or technologies that aim to solve the world’s most complex problems, has reached $100 million or more per deal.

Traditional sources of capital, like public markets and private equity, often can’t support these investments. Their short-term return focus can be limiting, Mhatre argues. In contrast, venture capital is built to take a long view on innovation and value creation.

Venture also brings a deep understanding of the technology stack, regulatory dynamics, and strategic paths businesses must navigate to scale. “We know what it takes for a company to go from something new and innovative, that didn’t exist, to something that can be a major part of economic activity,” Mhatre explains.

This level of support has positioned venture capital as the go-to source of funding for innovative companies.

Raising Capital in a Post-Tech Bubble World

While there is still plenty of capital available for technology innovation, Mhatre suggests that this is a prime moment for companies to reflect on their product stack.

“Companies need to buy forward,” he says. That means having a clear vision for how products will evolve alongside AI and other emerging technologies. Meanwhile, mature companies must figure out how to compete with AI-native challengers drawing growing shares of budget and attention.

For some, this will mean pivoting to become an AI-forward company in their target markets. For others, it may mean figuring out how to operate successfully as a company that may not be as high-growth in the future.

This Might Be the Tipping Point for AI

As AI systems become more sophisticated, reliable, and capable, demand will only accelerate. Companies will have to keep up. This is one trend that Mhatre believes won’t go away, even amid regulatory uncertainty and a murky macroeconomic outlook.

Mhatre describes the power of the tipping point: core technology trends tend to move forward on their own cadence. If one idea doesn’t work at first, there will always be another trend that drives progress.

“At some point, when these tipping points come together, you get large before and after moments in technology,” he says. “That’s happening on an ongoing basis in AI.”

How Marc Lore is Building the AI-Powered Future of Food

The Jefferies 2025 Private Growth Conference brought together hundreds of top bankers, investors, founders, and tech executives to discuss the sector’s key trends and developments. The interview below has been edited for length and clarity.

In April, Jefferies hosted Marc Lore, Founder & CEO of Wonder, at its annual Private Growth Conference. The serial entrepreneur — best known for founding and selling Diapers.com and Jet.com — shared insights on his latest venture: a food service platform that’s redefining restaurant economics.

Lore’s experience with Wonder offers a window into how entrepreneurs can rethink legacy industries with technology, vertical integration, and a clear long-term vision.

A Restaurant Group that Owns a Delivery Platform

Wonder — part restaurant group, part delivery platform — is aiming to make high-quality meals more accessible, efficient, and consistent. With 30 restaurant concepts under one roof, it delivers everything from burgers to Korean BBQ straight to customers’ doors, all through a single app.

“Think of us as a restaurant group that owns a delivery platform,” said Lore. “Imagine if Chipotle, Sweetgreen, and Five Guys all got together and said, ‘let’s cook all our same stuff in the same kitchen . . . and let’s build our own delivery network so we control the experience end to end.’ That’s how we’re reverse engineering the business.”

Since opening its first location two years ago, Wonder has expanded to 50 locations across the Northeast. Its growth plan includes reaching 200 locations by 2026, with a standalone IPO targeted for 2028.

Owning the Entire Customer Experience

Today, Wonder’s competitive advantage is its vertically-integrated model. As a company, they own all restaurant brands on their platform, which means no royalty payments and unlimited scaling opportunities. It also controls the cooking tech, kitchen operations, and delivery network, enabling faster service and consistent quality.

This control allows Wonder to claim 95 percent on-time delivery. Their model works particularly well in suburban and less densely populated areas, bringing a range of food options to places with more limited restaurant choices.

Billion-Dollar Technology Investment

To achieve restaurant-quality food without a traditional kitchen setup, Wonder invested over $1 billion in software engineering, culinary engineering, and food science.

“We’re able to cook 30 different cuisines and match the quality of best-in-market with only two or three distinct pieces of electric cooking equipment,” Lore explains. Wonder’s proprietary tools can sear steak in six minutes without flames, cook pasta without water, and bake pizza in 90 seconds.

But equipment is just one part of the equation. Wonder also developed sophisticated software, like sequencing algorithms, to ensure food from multiple restaurants finishes cooking at the same time and arrives hot.

M&A as a Strategy Accelerator

Wonder has expanded quickly through strategic acquisitions. Over the past two years, it has acquired meal-kit service Blue Apron, the creative studio Tastemade, and the delivery platform GrubHub. Lore describes his M&A philosophy as “opportunistic” and focused on advancing their core strategy.

“In the case of Blue Apron and Grubhub, those are businesses that we were organically building anyway,” Lore notes. “We’re not looking at acquisitions as some sort of holding company. We have a clear vision and strategy.”

The AI-Powered Future of Food

Lore’s vision is for Wonder to become a comprehensive “super app” for food. The company aims to integrate all of the ways to eat in one platform, from first-party restaurants and third-party local delivery to meal kits and reservations.

“Our ultimate goal is to autonomously feed families breakfast, lunch, and dinner according to their budget, health goals, and the foods they love,” says Lore. The next step, he says, is to use AI to support better ways of feeding families.

“Imagine making efficient use of all your groceries, not wasting any food, solving for your health goals while taking the burden off of having a meal plan completely off the table.”

There’s No Substitute for Great People

While Wonder’s tech and operations are core to its growth, Lore credits his team above all.

“I think the common theme is just surrounding myself with great people,” he reflects. “Creating a culture that not only identifies and attracts the best talent, but also gets the best out of them.”

With plans to reach $5 billion in revenue by 2028, Wonder is positioned to transform how Americans access and consume quality food, making it healthier, more convenient, and more enjoyable in the process.

Tariffs, Valuations, and Cautious Optimism: The Outlook for Tech M&A

The Jefferies 2025 Private Growth Conference brought together hundreds of top bankers, investors, founders, and tech executives to discuss the sector’s key trends and developments. The insights below are drawn from interviews and panels with conference attendees.

Global M&A value rose steadily in 2024, driven by a surge in billion-dollar-plus deals. Tech megadeals led the way, with 16 transactions topping $5 billion — more than any other sector.

Last year’s growth was supported by healthy private sector balance sheets, expansive fiscal policy, and renewed appetite from strategic buyers. Still, slower-than-expected rate cuts and rising antitrust scrutiny created some friction.

At this year’s Private Growth Conference, dealmakers struck a tone of cautious optimism. Both sponsors and strategics are eager to transact, and with the right conditions, many expect activity to pick up. The question is whether recent volatility will get in the way.

Cautious Optimism, Even as Tariff Uncertainty Lingers

“I think everybody, as they entered 2025, was hopeful the environment would be strong, both on the equity side for IPOs and on the M&A side,” said Stefani Silverstein, Co-Head of Global TMT M&A at Jefferies. “On the M&A side, we’ve seen that play out. There’s been strong momentum. Deal volume has kept pace with last year, but the number of deals has increased.”

Tech M&A deal volume rose 4.8% in Q1 from Q4 2024, reaching 1,145 deals. That’s a 22.2% increase from the same quarter last year. However, much of that activity came before the tariff announcements in March, which roiled public markets and private sector confidence.

“There still isn’t a lot of data [on tariffs’ impact]. . . but there are a number of processes that were close to signing where it’s still very much on track,” Silverstein said. “I think, in the cases that have gone cold or been cut short, financing has become a bit more challenging.”

The tariff outlook remains uncertain, with potential exemptions by product or trade partner still on the table. But the lack of clarity has many business leaders in a wait-and-see posture, raising the risk of slower deal activity ahead.

Jon Gegenheimer, Managing Director in Technology M&A at Jefferies, shared a similar view.

“There’s no doubt that the recent tariff news has been disruptive to the point of an arrest of the market,” he said. “Decision makers have shifted right back into a wait-and-see mode, with a lot of people thinking about late summer, Labor Day, that sort of time frame for potentially a restoration of M&A activity in tech.”

Both Gegenheimer and Silverstein noted that more steadiness in the news cycle would help dealmakers better forecast demand and move forward with confidence.

Dealmakers Watch as Antitrust Tone Starts to Shift

Beyond tariffs, antitrust headwinds remain top of mind. Under President Biden, federal agencies pursued dozens of cases against major tech firms, leading several companies to abandon planned mergers.

“For years, the major tech companies moved into strategic segments via acquisition, but that window is essentially shut for the time being because of the regulatory scrutiny,” said Gaurav Kittur, Co-Head of Global Internet Investment Banking at Jefferies, at the time.

Entering 2025, it wasn’t yet clear how President Trump would handle antitrust enforcement. While many expected a lighter touch, members of his administration have also expressed concerns about big tech’s impact on competition.

“You also have individuals who’ve publicly called for more freedom in M&A,” said Jon Gegenheimer, “but at the same time, endorsed novel antitrust theories. Those statements are at odds.”

Still, after Capital One’s $35 billion acquisition of Discover received the green light, dealmakers are hopeful the regulatory chill is beginning to lift.

“There’s a view that we may now be in a more open environment,” Kittur said. “And as a result, we’ll probably see more of the large tech players actively pursue the areas of growth they want to acquire into.”

Strong Fundamentals and Narrowing Spreads

Many of the ingredients for strong dealmaking are in place: private equity has dry powder and a renewed risk appetite; a strong cohort of private companies is waiting in the wings; and more strategic buyers are at the table than we’ve seen in years.

So what needs to happen for deal activity to pick up in the coming months?

First, dealmakers need to regain confidence in the markets.

“Ultimately, investor and CEO confidence is what drives M&A activity,” said Ron Eliasek, Chairman of TMT, Head of Software at Jefferies. “We think this volatility is short term, and we’re still expecting a busy back half of the year. But when you see that volatility on your screen every day, it chips away at confidence.”

Second, the gap between buyer and seller expectations needs to keep narrowing. Valuation dislocation remains one of the biggest hurdles — especially for venture-backed companies.

“The bid-ask spreads have narrowed year after year. They’ve narrowed again,” said Evan Osheroff, Managing Director in Software Investment Banking at Jefferies. “Business health is actually strong. But if you thought your valuation was X two weeks ago — or two months ago — you’re not suddenly going to accept five times revenue today.”

For now, optimism is cautious but palpable. Deal pacing may be uneven today, but most expect steady transaction activity in the back half of the year.

“Investors are still looking for good opportunities, and what surprised me at this event over the past couple of days is how pervasive that sentiment is,” said Raphael Bejarano, Global Head of Investment Banking and Capital Markets at Jefferies. “Despite all the background noise, investors are here. They’re focused on finding the best companies, understanding them, and identifying angles through which to invest.”

Secondaries Get a Second Wind

In April, several measures of economic and policy uncertainty exceeded levels last seen at the start of the COVID pandemic.

Although this volatility may have delayed the long-awaited resurgence of M&A and IPO activity, it also reinforced the appeal of secondary transactions as a tool for GPs and LPs to rebalance portfolios, free up or raise cash, and buy time to position for more favorable exits. No matter what the rest of 2025 holds, GPs and LPs should be surveying options in a secondary market that is broader, deeper, and more diverse than ever before.

As reported by Jefferies, global secondary volume hit a record of $162 billion last year, a 45% increase over 2023. This exceeded the previous record of $132 billion in 2021. LP transactions accounted for $87 billion of last year’s volume, and GP-led transactions contributed $75 billion, fueled by:

- An expanding buyer universe: Last year, global dedicated available capital reached a record of $288 billion, which is coming in from more sources than ever before. In addition to ever-increasing fund sizes from established and new traditional secondary investors, we expect nearly one-quarter of all secondary capital raised in the next 12 months to come from evergreen retail vehicle capital (e.g., ’40-Act funds).

- More creative liquidity solutions: While 84% of GP-led secondary transactions were via continuation vehicles (and half of which were single asset), the LP transaction landscape has expanded well beyond direct portfolio sales to include preferred equity, managed funds, and SPV-affiliate transactions.

- Competitive pricing: The average pricing of LP-portfolios reached 89% of net asset value (NAV) last year, a 400-basis point increase over 2023, spurred by rising public markets, ample supply of quality and newer vintage portfolios, and lower interest rates. Although many Q1 2025 transactions came in at a slightly lower percentage of NAVs due to market uncertainty and volatility, buyers and sellers are still generally more aligned on price than in 2022 and 2023.

Something else has shifted in the secondary market as well. Several years ago, many LPs and GPs we spoke to saw the secondary market as a place to dip into to solve unforeseen problems in their portfolios or deal with unwelcome macroeconomic developments. Today, they are utilizing secondary markets more programmatically, managing portfolios serially via annual or bi-annual secondary sales.

For GPs, secondary transactions offer a reliable path to generate DPI in an otherwise uncertain environment and raise substantial fee and carry paying capital. For many GPs, conducting a single-asset transaction for a high-performing trophy asset can raise as much new fee-paying capital as their latest flagship fundraise. At the same time, continuation vehicles enable them to hold onto and reinvest in their existing assets while waiting for a better IPO or M&A window. LPs increasingly rely on these transactions to manage liquidity, rebalance portfolios, comply with regulations, or optimize exposure to specific asset classes. This helps explain how the Jefferies Secondary Advisory team was able to execute on 18 deals in Q1 2025 – 7 GP-led and 11 LP-led – totaling $9 billion in transaction volume.

As the year progresses, we expect strong interest in secondary strategies, be they buyouts, real estate, or venture, regardless of the market environment. Suppose public market volatility persists, and IPO and M&A activity remain muted. In that case, secondaries will continue to be a viable alternative for GPs and LPs for the same reasons they were over the last few years. However, if IPO and M&A activity picks up, that will also likely deliver better pricing for LP portfolios in the secondary market and drive even stronger benchmarking valuations for GP-led transactions. That’s precisely what happened in 2021, when IPO and M&A activity were record-breaking, and so too was the volume of secondary transactions, which was the second highest year on record ever.

Amid immense uncertainty, secondaries have a second wind that will likely keep blowing no matter what the market throws at investors in 2025 and beyond.

What We Learned from the Year Generative AI Went Mainstream

The Jefferies 2025 Private Growth Conference brought together hundreds of top bankers, investors, founders, and tech executives to discuss the sector’s key trends and developments. The insights below are drawn from interviews and panels with conference attendees.

In 2023, generative AI was already reshaping the business landscape, but some important questions remained. Chief among them: how would these technologies meaningfully impact businesses, given their unclear enterprise applications?

Today, that question is largely answered. If 2023 was the year of AI hype, 2024 was the year AI went mainstream.

Three-quarters of businesses now use AI in at least one function, and generative AI is projected to drive $1.1 trillion in revenue by 2028. Big Tech is expected to invest a record $300 billion in AI this year.

At Jefferies’ Private Growth Conference, sector leaders discussed the trajectory of AI adoption and how it’s shaping dealmaking in 2025.

Embedding AI Into Everyday Decision-Making

“The AI ecosystem is maturing exponentially,” said Raphael Bejarano, Co-Head of Global Investment Banking at Jefferies. “Every year is a period of exponential change. I think we’ve seen that with the companies at the Private Growth Conference — their monetization, their actual utility. We’re beginning to see the green shoots where adoption is really going to happen”.

One of the companies making AI easier to adopt is Sigma Computing, a cloud-native analytics platform that helps non-technical users work with complex data. By layering AI on top of traditional business intelligence workflows, Sigma is making data more accessible to everyday decision-makers.

“If you reduce it a little bit, what AI means for us is an access method,” said Mike Palmer, CEO of Sigma. “We talk a lot about making access to data simple. There are a billion and a half people with spreadsheets in the world, and we thought that was the lingua franca of business. But actually, the lingua franca of business is just language. So for us, AI is just another way to allow an average person to easily get an answer to a question [from data].”

The latest McKinsey survey on generative AI adoption found that companies that successfully integrate AI into their workflows are already seeing meaningful EBIT gains. While adoption varies by industry, most companies are at least using AI in marketing and sales, with plans to expand into other business functions.

That perspective was echoed by Mark Crane, a Partner at General Catalyst who has led several investments in applied AI. He described how AI is reaching every part of the business landscape: “Generative AI is everywhere. Every vertical has been touched by this and will be touched by this,” he said. “Public safety, shipping, healthcare — pick your favorite vertical.”

AI Is Already Moving the Top Line

One major topic at this year’s conference was how AI could reshape performance and growth expectations in the years ahead. With adoption now mainstream, when should investors expect to see impacts on company financials?

Gaurav Kittur, Global Co-Head of Internet Investment Banking at Jefferies, suggested that impact may come sooner than expected.

“I was just talking to a CFO . . . his business grew more in the last five days than it had in the past year, driven by an AI algorithm that just started to work,” Kittur said. “AI is transformative. We’re starting to see the impact on top lines, on revenue, on profitability.”

Ravi Mhatre, Founding Partner at Lightspeed Venture Partners, has observed similar trends. “We’re seeing it happen,” he said. “It’s more than just pockets. The thing that’s most attention-getting for us is the speed with which revenues in these enterprise sectors is starting to happen… Usually in enterprise it takes longer, but these technologies are solving real business problems, so adoption is happening very rapidly.”

The Private Growth Conference also featured several entrepreneurs who spoke directly to how AI is driving financial impact for their business.

Dakota Smith, President and Co-Founder of Hopper, noted the effect on operating costs: “[AI] lowered our cost of customer service by 70 percent,” he said. “And it actually increased customer satisfaction… because they get instant assistance.”

For Sellers, an AI Narrative Is No Longer Optional

AI is also having a growing impact on transaction activity. Much of this is being driven by strategic buyers, as two-thirds of business leaders plan to use M&A to strengthen their AI capabilities over the next year. Private equity is also active in AI-driven deals, as sponsors look for ways to apply AI to drive efficiency across their portfolio companies.

“Every seller right now — frankly, whether or not you’re a tech company — has to have an AI story,” said Jon Gegenheimer, Managing Director in Technology Investment Banking at Jefferies. Many buyers, he explained, are already evaluating targets based on their AI exposure: “What they want to understand is, net-net, is the target I’m looking at a beneficiary of AI, or is AI an antagonist?”

That perspective was echoed by Stefani Silverstein, Co-Head of Global TMT Investment Banking at Jefferies. “It is very much not just a buzzword anymore; it is the reality,” she said. “Whether [a company] has a solution for AI, is the solution for AI, or is at risk of disintermediation from AI — they need to have an answer”

She emphasized that buyers are pressing for clarity. “It’s relevant for almost every single deal,” she said. “Having a solution, a story around [AI] that can be articulated to investors, to the board, to the investment committee is critical. It’s really driving a lot of the activity, at the very least, the dialog”

Continuing Up the AI Adoption Curve

AI is already reshaping operations, performance, and deal activity, but many still believe we’re in the early innings.

“Most of us are not really using the full capacity [of AI],” said Cameron Lester, Co-Head of Global TMT Investment Banking at Jefferies. “We all can see there’s a Ferrari engine out there, but most of us are still driving much more modest cars.”

For companies and investors, the real work now lies in building the systems, talent, and discipline needed to put that power to use in a measurable way. And as this year’s conference showed, that effort is already in motion.

How AI is Transforming Cybersecurity

The cybersecurity sector is rapidly transforming, spurred by the transition from cloud-based to AI-native technologies and the urgency for governments to shore up national security vulnerabilities.

Jefferies Managing Director Tim Roepke believes some cybersecurity companies are so valuable – and critical to the technology ecosystem – that they are fundamentally shifting the deal landscape and “challenging traditional ideas of when to buy versus when to build.”

On the heels of Jefferies’ April Private Growth Conference – which featured several leading cybersecurity companies and hundreds of other investors and company leaders – we spoke with Tim Roepke to get his take on the current state of the cybersecurity sector.

Q: What will AI’s impact be on the cybersecurity sector?

Tim: AI could be the most significant technological paradigm shift we’ve seen, including the iPhone, Google search, social media, and the public cloud. It could outdo them all because it touches every person and every business.

Q: How do you secure these AI applications? Is it very different from software security in the past?

Tim: AI apps were not a part of IT stacks in the past, so new muscle memory is being created. Company leaders are asking themselves, “How will we use AI individually? How will we use it as a business? And ultimately, how do we secure it, so it doesn’t do bad things?”

They are also looking for tool consolidation. If a CTO has five cybersecurity problems, they don’t want five cybersecurity vendors. They want one that can handle most problems.

Businesses also want to prevent catastrophic scenarios that can snowball. Imagine a company creating an AI agent that knows customers’ bank accounts, blood types, and financial histories and can distribute that information to millions. They must ensure it is checked appropriately, secured inside a firewall, and monitored and managed.

Q: How are the upstart cybersecurity companies trying to define themselves, and how are incumbent cybersecurity companies trying to stay ahead?

Tim: Twenty years ago, there was a shift to cloud-native technology. That was moving our data from servers in our closets and basements to AWS or Microsoft Azure. Now, the data revolution associated with AI use-cases has created a shift in infrastructure requirements. There is a small group of businesses in terms of dollars of revenue, but they have immense value and go-to-market ability.

It will take a long time for a business of any scale to move from a cloud-native to an AI-native infrastructure. However, breakthrough startup cyber companies can now approach potential customers with a holistic offering. They can say, “We have a solution that prevents your AI from getting out of control, can protect you from traditional hackers, and can prevent North Korea from getting into your cloud.”

Q: How is cybersecurity technology with AI different from what has existed in the past?

Tim: AI-native cybersecurity companies tend to be very prescriptive and on offense. They find and neutralize the attackers or discover things that could happen to organizations months in advance, and act. They are out to find problems before they ever start.

Q: When transformational technology changes the landscape, what does that mean for deal-making?

Tim: It will lead to a lot of deal-making.These companiesare so critical and valuable that they challenge traditional ideas of when to buy versus when to build. Google purchased Wiz for $32 billion. Google could have tried to build something like it, but buying Wiz made sense even at that price.

The Future of Carbon Removal, According to the People Building It

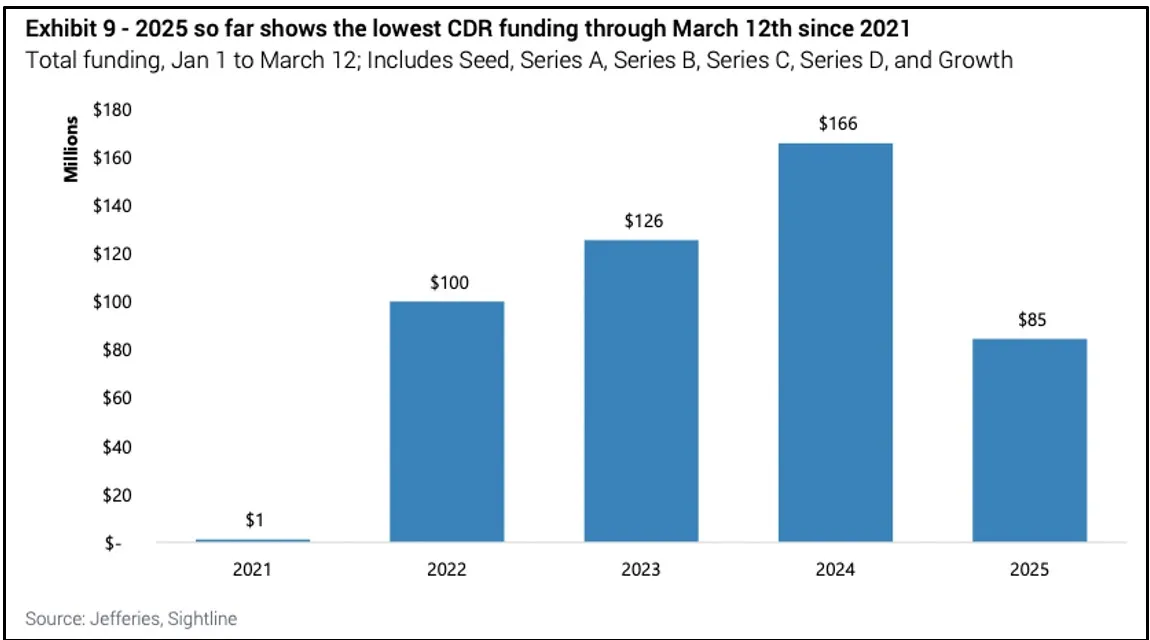

In January, Jefferies’ Sustainability and Transition Team posedten key questions for the energy transition in 2025 — a year many investors expect to be more uncertain than any since the pandemic. Among those questions: How will the carbon removal industry evolve?

Jefferies has long been confident in carbon removal, given its fundamental role in reducing atmospheric CO₂ and strong backing from major governments and tech companies. But the industry is entering a period of transition, driven by concentrated demand, high costs, and wavering government support in a shifting political climate.

To better understand today’s challenges and opportunities, Jefferies hosted CEOs from fourteen leading carbon removal companies. Their perspectives offer a candid look at the sector’s key risks — and how winners could emerge from this moment of uncertainty.

This article previews CEOs in Carbon Removal: A Playbook Amidst Grave Uncertainty, a new report from Jefferies. For full insights from the Carbon Removal Event, consult the complete report.

How Do Executives Address the Key Uncertainties in Carbon Removal?

Jefferies sees three main sources of uncertainty in the carbon removal industry: (1) Concentrated Demand, (2) High Costs, and (3) Volatile Government Support.

The team raised these topics with carbon removal executives. Here’s how they responded:

- Concentration of Demand: Microsoft Now Accounts for 77 Percent of Total Carbon Removal Tons Purchased

The companies argue that demand remains strong, not just from tech, but also from sectors like financials, consumer goods, industrials, and airlines. They note that Chinese tech companies are beginning to show interest in carbon dioxide removal as well. Executives expect demand to grow further as both voluntary carbon and compliance markets open up. They also point out that companies purchasing carbon removal credits early will be “first in line” when costs drop and supply tightens. Finally, they report that since Trump’s victory, they have not seen any slowdown in demand for carbon removal credits.

Still, sector leaders are mindful that Microsoft now accounts for 77 percent of total durable carbon removal purchased to date, with 93 percent of their portfolio focused on BECCS (bioenergy with carbon capture and storage). This concentration raises concerns about the industry’s early dependence on a single corporate buyer.

- High Costs: Carbon Removal Credits Are Exorbitantly Expensive

Most carbon removal companies face specific cost bottlenecks. For direct air capture (DAC), energy costs are a major hurdle. For soil carbon, enhanced rock weathering (ERW), and other approaches, the bigger challenge often lies in MRV — measurement, reporting, and verification. MRV accounts for more than half the costs for ERW companies. At Charm Industrial, which uses bio-oil injection, lab testing for MRV costs about $200 per ton, but because their data is stable, the CEO expects they can cut 90% of those costs by moving to less frequent testing.

Alternative revenue streams can also help offset costs. Equatic’s green hydrogen sales, priced around $3 per kilogram, help bring their net carbon removal cost to well below $100 per ton. Capture6 creates multiple revenue streams by managing brine, producing fresh water, and capturing carbon through their DAC solution — all of which use the same units of energy.

- Volatile Government Support: Will the Trump Administration Kill the Industry?

Government support has been critical for carbon removal companies, with U.S. leadership playing an especially important role. Mote Hydrogen, for example, received a substantial grant from a U.S. Hydrogen Hub, and Climeworks was selected for up to $625 million in funding from the Department of Energy. Climeworks cited the U.S. as a leader in carbon removal but also pointed to Canada’s investment tax credit, a memorandum of understanding with Saudi Arabia, and early moves by several Asian governments. Equatic has received ARPA-E funding and a Department of Energy award, along with a partnership from the Singapore government.

Recently, the Trump Administration has paused federal funding and laid off federal employees who worked on carbon removal. The CEO of Charm Industrial noted that permitting remains a bigger obstacle than economics for carbon removal companies, and suggested that if permitting reform advances under Trump, a pullback in incentives may not be as significant a headwind as some expect. CEOs also noted that venture capital investors are taking a “wait and see” approach, a trend that has continued since the event.

Jefferies continues to view carbon removal as a bipartisan priority, with ongoing support through programs like the 45Q tax credit and DAC hubs.

A Shakeout That Could Strengthen the Industry

Jefferies’ Sustainability & Transition Team wrapped up the event with a definitive message: don’t give up on carbon dioxide removal.

The team projects that a slower energy transition could drive even greater demand for carbon dioxide removal — and that Trump’s presidency may not be as negative for the industry as many expect.

There are also now more than ten proven carbon removal technologies, each with different characteristics, costs, and co-benefits; it’s not just about direct air capture. And there are practical ways to reduce costs, including through economies of scale, alternative revenue streams, and streamlining MRV processes.

Many industry executives believe a shakeout among carbon removal companies will ultimately sharpen the industry’s focus on quality, credibility, and scalability at a reasonable cost. Buyers are taking a portfolio approach and avoiding heavy bets on any single technology. Investors in carbon removal are doing the same — diversifying across technologies, scale, geography, and registries to manage risk.

For deeper insights, consult the full Carbon Removal Event report and Jefferies’ 10-part expert series on the science behind leading carbon removal technologies, published in 2022.