Japan’s GX Plan: Is the World’s Most Ambitious Energy Transition Being Overlooked?

Nearly two years ago, Japan unveiled its Green Transformation Policy (GX), a $1 trillion plan to dramatically reduce emissions over the next decade. This initiative represents nearly three times the annual GDP investment percentage of the U.S. Inflation Reduction Act — and it aims to catalyze climate tech innovation in the world’s fourth-largest economy.

Surprisingly, GX has largely flown under the radar of institutional investors. Of the 400+ investors Jefferies recently engaged across the U.S. and Europe, only three were familiar with the plan.

Japan’s GX spans all areas of climate finance: carbon levies, emissions trading, transition bonds, and more. Given its scale — and the Japanese stock market’s outperformance over the past three years — Jefferies views it as a defining transition investment theme for the next decade.

In the coming weeks, Jefferies will outline GX’s core policies, investment tailwinds, and strategies for addressing Japan’s highest-emitting sectors. First, here are the eight things every climate investor needs to know about Japan and its approach to decarbonization.

- Japan is the world’s fourth-largest economy — at least. According to the International Monetary Fund, Japan’s $4.07 trillion GDP ranks 4th globally, behind the US, China, and Germany. Some calculations place it in 3rd.

- Japan is one of the world’s leading emitters. The International Energy Agency reports that Japan accounts for 2.9% of global emissions, the 5th highest globally. Since 2000, Japan’s emissions have dropped 15%, and its emissions per capita rank 23rd worldwide — compared to China, which ranks 25th.

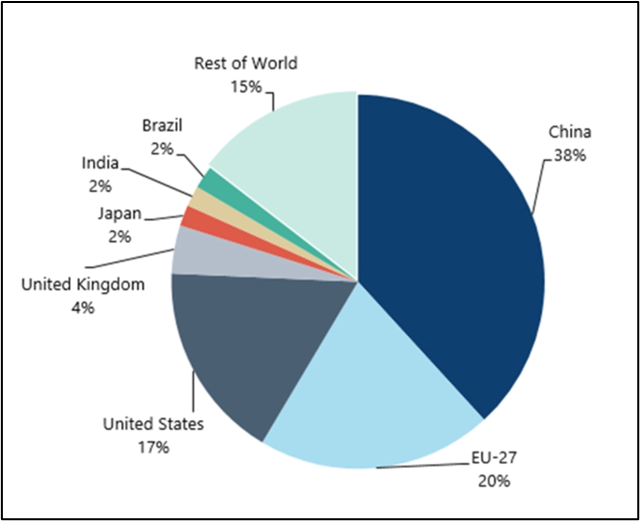

Despite being one of the world’s leading emitters, Japan was just 2% of the total $1.8trn spent on energy transition in 2023.

- Japan’s GX Policy represents a larger percentage of its GDP than the Inflation Reduction Act does for the US. In a recent note, Jefferies encouraged investors to look beyond the US, especially as the IRA may not survive in its current form. It is also arguably more impactful on Japan’s economy than the IRA is on the US. Annual public investment under GX is 0.33% of GDP, compared to the IRA’s 0.13%. Factoring in both public and private investments, GX accounts for 2.47% of GDP, while the IRA is 1.04%.

- Japan has set several new climate targets, including a goal for nuclear power to make up 20% of the country’s energy mix by 2040. To achieve these ambitious goals, Japan is tapping into all areas of climate finance, including bond issuance, R&D investments, subsidies, carbon levies, and an emissions trading scheme.

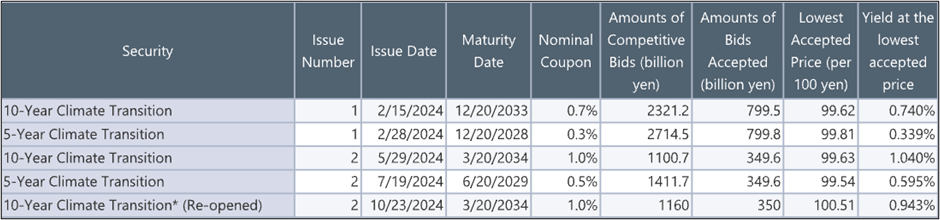

- Japan is issuing transition bonds as part of its GX vision. Japan will issue 20 trillion JPY (~$144B USD) of sovereign climate transition bonds over the next several years. In February 2024, the 10-Year Climate Transition Bond was priced at a 0.74% yield, slightly below regular Japanese 10-year government bonds at 0.755%.

In 2024, Japan issued ¥2.65 trillion (~$17B) across 5 bond auctions. The first bond auction of 2025 is scheduled for January 29.

- Japan plans to impose a carbon levy targeting fossil fuel importers. This levy will gradually increase over time, with the proceeds allocated to repaying the principal and interest of the GX Transition Bonds. Notably, Japan currently accounts for 14% of global coal imports.

- Japan’s GX League is trialing the emissions trading scheme (ETS) for high-emission sectors. Introduced in 2023, it started with voluntary participation from the GX League — a group of 747 companies accounting for >50% of Japan’s emissions. From 2026 onward, the ETS will be mandatory.

- Japan is betting on R&D to drive a carbon-neutral future. Unlike the subsidy-heavy U.S. IRA, Japan’s GX policy focuses on directly supporting R&D through the Green Innovation Fund, which is supporting innovation at the country’s leading companies. In February 2024, 55% of bond auction proceeds were allocated to R&D initiatives.

Many of the key elements of Japan’s GX Policy are still taking shape, but there’s no question this plan merits investors’ attention. Jefferies’ team will continue to monitor the decarbonization of one of the world’s leading economies — and the economic growth and innovation this strategy aims to ignite.

Follow along for more insights from Jefferies’ Sustainability and Transition Team on the Japan GX Plan and other important climate investing themes in the weeks ahead.

Ten Questions for the Energy Transition in 2025

It’s too soon to predict what 2025 will mean for the energy transition. Much depends on the incoming administration’s policies, the resolution of global conflicts, and the direction of emerging technologies. As S&P Global Commodity Insights wrote in their 2025 outlook, “there is more uncertainty in energy markets heading into a new year than any year since the pandemic.”

Jefferies’ Sustainability & Transition Team is entering 2025 with ten key questions, covering the challenges and opportunities shaping the global transition. While the team brings perspectives on these issues today, developments in policy, technology, and markets could lead to a range of outcomes in the year ahead.

- Is the energy transition a viable investment theme for equity investors?

Yes, despite the underperformance of clean energy equities (ICLN) relative to oil and gas (IEO). The energy transition is much bigger than the performance of solar and wind producers compared to traditional energy companies.

Jefferies compiled a list of approximately 1,000 public equities across 27 subsectors related to the energy transition, representing a combined market cap of $18 trillion. A detailed analysis of the broader universe tells a different story about the transition’s investability and performance. Expect further insights on this subject in 2025.

- Will Climate Tech 2.0 repeat Climate Tech 1.0?

The team remains cautious about the scaling challenges facing climate tech companies, often referred to as the “missing middle.” These companies, struggling to transition from pilots to larger-scale projects, face significant hurdles, particularly in securing capital.

Jefferies has identified over 1,000 promising climate tech firms—across energy storage, sustainable aviation fuels, green hydrogen, nuclear, and more—that need significant scaling-up capital. In a high-interest-rate environment with uncertain government funding, this could be a challenge.

On January 13, 2025, Jefferies will host a seminar featuring leaders in climate tech, including Decarbonization Partners, Spring Lane Capital, Sila Nanotechnologies, and Commonwealth Fusion Systems, to explore these issues and investment opportunities further.

- Will investors look outside the U.S. for opportunities in the transition?

Jefferies anticipates a more global approach to energy transition investments in 2025. While U.S. investors have largely focused on the Inflation Reduction Act since its passage, significant decarbonization initiatives in countries like Japan, China, India, UAE, Saudi Arabia, and Brazil have been overlooked.

The firm expects global programs such as Japan’s GX Plan to gain investor attention as U.S. enthusiasm slows during a political transition. Jefferies sees these international markets as rich with opportunities in specific transition sectors.

- Is 2025 finally the year of climate adaptation?

Climate adaptation is a multi-trillion-dollar investment opportunity as economies worldwide contend with increasingly extreme weather. Data from the EU’s Copernicus Climate Change Service indicates that 2024 will be the hottest year on record, marking the first time global temperatures exceed 1.5°C above pre-industrial levels.

This year, Jefferies has highlighted investable themes like heat resilience, urban climate adaptation, and water management, offering stock ideas to address these challenges. The firm hopes to see more investment vehicles developed in public markets to support these critical areas.

- How will the carbon removal industry evolve?

Jefferies maintains long-term confidence in the carbon removal industry due to its necessity in reducing atmospheric CO₂ levels and its support from major governments and tech companies like Microsoft. However, the industry is going through transition, and Jefferies anticipates industry consolidation among the 800+ carbon removal companies currently operating.

Jefferies is producing a 15-part series, “How to Build a Carbon Removal Company,” featuring leaders from Direct Air Capture, Biochar, and Marine CDR, offering insights into where the sector is headed in 2025.

- How will companies commercialize sustainability?

Outside of the energy transition, companies across sectors are seeking to commercialize the sustainability megatrend.

Jefferies has developed a 10-part framework for how businesses can commercialize sustainability through capital raising, M&A, joint ventures, carbon markets, regulatory incentives, and more. Data from 1H24 showed sustainable debt surpassing $5 trillion since 2006, while green M&A activity continues to grow by both value and volume.

As companies move from “awareness-building” to executing sustainable strategies, Jefferies will use its framework to track developments and identify best practices across industries.

- Will AI agents change the labor market?

Jefferies has focused on human capital issues for nearly four years, and in 2025, artificial intelligence will be the firm’s singular focus.

Jefferies expects AI agents to be a transformative force in the labor market in 2025. These software programs, capable of independently performing tasks to achieve human-set goals, are being developed by companies like Salesforce, OpenAI, and Microsoft.

AI agents are already enhancing workflows, such as Salesforce’s Agentforce tools for sales and customer service. McKinsey estimates that generative AI could create over $2.6 trillion in annual value, with AI agents driving much of this impact.

- Which Republican Party becomes dominant: free market or populist?

Jefferies sees growing tension within the Republican Party between its traditional free-market faction and an increasingly influential populist wing. While the free-market camp champions deregulation and lower taxes, the populist side emphasizes trade protections, anti-Big Tech sentiment, and pro-worker policies.

How these factions influence the party’s economic agenda—particularly under the incoming administration—will shape policy debates around tariffs, unionization, and taxes in 2025.

- Will deregulation succeed and could it accelerate the energy transition in the US?

Jefferies is optimistic about the success of a deregulation agenda, including the Department of Government Efficiency (DOGE). In particular, the firm is monitoring deregulation’s potential to advance U.S. infrastructure projects critical to the energy transition. Proposed reforms to the National Environmental Protection Act (NEPA) could streamline permitting for grid infrastructure, nuclear projects, and utility-scale solar.

The firm will closely monitor developments under the incoming administration’s deregulation and government restructuring initiatives, which could provide bipartisan momentum.

- Will there be a global peace dividend in 2025?

2024 was a violent year. The ACLED’s Conflict Index shows global conflicts doubling over the past five years, spanning 50 countries.

Although most analysts expect extended global conflict, Jefferies believes the new administration could accelerate resolutions in Ukraine, the Middle East, and possibly China. A “peace dividend”—economic benefits from reduced defense spending—could follow, mirroring similar trends from the 1990s.

Jefferies plans to study the investment implications of such a shift, exploring opportunities that could emerge if global conflicts de-escalate in 2025.

What Energy Transition Investors See in Trump’s Policy Agenda

It’s been two weeks since the 2024 election, where the presidency and 468 congressional seats were contested. As of last Wednesday, the results are official: the GOP will hold a trifecta under President-elect Trump.

While the party’s agenda is still taking shape, one thing is clear—its policies will diverge from the Biden White House and its Democratic allies.

Jefferies’ Sustainability & Transition Team spent the past two weeks engaging over two thousand investors and companies on the implications of the election for global investment, the energy transition, and sustainability. Here are eight takeaways from those discussions.

- Which Republican Party Will Prevail?

Populism has taken root in the Republican Party. President Trump made grains across nearly every major demographic, and he performed exceptionally well in working-class communities.

Within the party, the team sees a growing divide between two camps:

- Traditional Republican Orthodoxy: Focused on deregulation and tax cuts.

- Populist Economics: Focused on protecting workers via tariffs; supportive of antitrust measures and skeptical of big tech; and supportive of government investment in key sectors.

The world is closely monitoring President Trump’s appointments to gauge the party’s trajectory, as the investment implications could vary significantly depending on which philosophy takes precedence.

- The Return of Industrial Policy & Tariffs

For years, industrial policy fell out of favor as a tool for promoting domestic industries and driving growth in developed markets. Recently, there’s been a shift. In 2023, more than 2,500 new industrial policy measures were implemented globally, ranging from tariffs to subsidies and state-directed financing.

The Trump administration is expected to lean heavily on industrial policy to boost U.S. competitiveness. Tariffs will likely take center stage, alongside continued support for key sectors like defense and energy. The campaign has also floated ideas such as creating a sovereign wealth fund to support U.S. industries.

Investors will need to integrate these policies into their strategies.

- Brace for Deregulation

Jefferies has tracked deregulation closely for months (see here, here, and here), anticipating a significant shift in the event of a Trump victory.

Now, there are plans for a new Department of Government Efficiency (DOGE), with Elon Musk and Vivek Ramaswamy at the help. Musk hopes to cut $2 trillion from the federal budget. Throughout the campaign, Trump regularly called for reducing the administrative state and pursuing widespread deregulation.

The specifics of this agenda—and its feasibility—remain uncertain. However, the potential impact on investors extends far beyond ESG and climate. Companies and investors should take a hard look at existing regulations, particularly those affecting competition, as many could be targeted for overhaul.

- Tax Cuts & Tariffs: Will Trump’s Policies Be Inflationary?

2025 will be a year of tax reform, with the Tax Cuts and Jobs Act (TCJA) expiring at the end of the year. Proposals for deficit-funded tax cuts and a high debt-to-GDP ratio have sparked bond market concerns over long-term (10-year) rates.

Since both the federal government and many companies often borrow at 10-year+ rates, changes in these rates over the next four years will heavily influence the federal deficit and corporate investment plans.

- The IRA Will Not Survive in Its Current Form

Heading into the election, conventional wisdom held that the Inflation Reduction Act (IRA) wouldn’t be repealed, given that 80% of its funds were directed to Republican districts. In September, Jefferies flagged potential downside risks to this assumption, and in October 2023, noted that the IRA could fall short of its goals unless key structural issues—like permitting—were addressed.

It’s now clear that significant efforts will be made to amend the IRA. Even without a full repeal, the incoming administration could pursue administrative actions that would effectively achieve the same outcomes as repealing the bill.

- The U.S. Energy Transition: Not All Is Lost

Several areas of the energy transition are poised for growth under a Trump presidency, whether due to federal indifference, alignment with favored industries, or state-level initiatives. Despite policy uncertainty and a potential shift in direction, the U.S. remains a highly attractive region for energy transition investments.

Investors see the most opportunity in the following sectors over the next four years:

- Natural Gas

- Carbon Capture & Sequestration

- Critical Minerals

- Transmission Reform (State & Federal)

- Grid-Enhancing Technologies (e.g., Dynamic Line Rating, Advanced Distribution Management Systems)

- Nuclear

- Geothermal

- Biofuels

Executives consistently highlight favorable capital and regulatory environments, a skilled labor force, and access to low-cost feedstocks (e.g., natural gas) as reasons the U.S. stands out, regardless of federal policy. Jefferies anticipates that specific areas of the transition will gain traction based on strong unit economics, rather than relying heavily on public subsidies.

- Look Beyond the U.S. on Energy Transition

Although the U.S. may pull back from global climate initiatives, the rest of the world will press ahead. China and the EU27 lead the world in real-economy capital formation for low-carbon technologies. 80% of the global population lives in net importers of fossil fuels, so the incentive to decarbonize will persist.

One unintended consequence of the Inflation Reduction Act (IRA) is that it has diverted investor attention away from decarbonization opportunities outside the U.S. For instance, Japan’s Green Transformation (GX) Plan—a ¥150 trillion initiative to decarbonize its economy—offers significant investment opportunities but has largely been overlooked.

Investors should broaden their focus to include other major policy programs that are shaping global decarbonization efforts.

- Will the U.S. Try to Compete with China on Decarbonization?

The U.S. must decide whether competing with China and other nations on climate and the energy transition fits into its broader Great Power Competition strategy.

The Inflation Reduction Act (IRA), CHIPS Act, and Bipartisan Infrastructure Law (BIL) were designed to position the U.S. as a leader in key areas like AI, semiconductors, biotech, and future energy systems. Significant changes or rollbacks to these initiatives could risk ceding ground in one or more of these strategic sectors.

++

Policy expectations for the next four years will evolve as President-elect Trump’s statements and appointments unfold in the coming months. For now, investors are preparing for a regulatory and investment landscape that contrasts sharply with the one shaped by the Biden administration.

For ongoing insights on the energy transition, climate investment, and related policy, stay connected with Jefferies’ Sustainability & Transition Team.

How Quickly Is Climate Change Accelerating? It Depends How You Look At It

For years, the pace and scale of the global energy transition have been uncertain. Significant progress has been made in areas like solar capacity, electric vehicles, and battery storage, but new challenges continue to surface: aging grid infrastructure, high inflation, and surging power demand.

More recently, another layer of uncertainty has emerged—the pace of climate change itself. The acceleration of global warming is often used as a metric for assessing climate risks, but scientists are increasingly debating its implications. These debates raise questions about how quickly the climate is changing amid an uneven global transition.

Jefferies’ Sustainability & Transition Team recently sat down with Pierre Friedlingstein, Professor and Chair in Mathematical Modeling of the Climate System at the University of Exeter. Together, they explored what the latest data reveals about the trajectory of climate change—and whether net-zero efforts are up to the challenge.

Here are eight key takeaways from their discussion.

- Global fossil fuel emissions have quadrupled over the last 60 years, contributing to increased warming. Global emissions are around 37 billion tons of CO2 annually. Emissions have risen sharply since the 1970s, climbing from an average of 22 billion tons per year back then to nearly 40 billion tons per year in the last decade. China is the largest contributor, accounting for 31% of global emissions, followed by the U.S. at 14%, India at 8%, and the EU at 7%.

- Carbon sinks are still working to absorb CO2, but their efficiency is declining. Over the past 60 years, the ocean and land have more than doubled their capacity to absorb carbon, removing about 55% of global emissions. However, there are signs that these natural carbon absorbers may be becoming less efficient and slowing down.

- The amount of CO2 the world can emit while keeping global warming within specific limits—like 1.5°C or 2°C above pre-industrial levels—is finite. There’s a clear, direct link between total CO2 emissions and temperature rise, supported by all major climate models. At the current rate of emissions, we have roughly 7 years left to stay within 1.5°C, 15 years for 1.7°C, and 28 years for 2°C.

- Warming may be accelerating, but the rate of acceleration varies depending on the baseline and time period analyzed. Research shows a steady rise in warming from the 1970s to 2010, with a faster increase after 2010. However, the strength of this argument varies. The acceleration is more noticeable when comparing recent years to the late 19th and 20th centuries but less convincing over shorter time frames.

- The reduction in sulfate aerosol emissions may also be contributing to faster warming, as these particles have a cooling effect. Regulations to limit aerosol emissions, driven by their harmful health impacts, have led to fewer aerosols in the atmosphere. With less cooling from aerosols, warming could be accelerating.

- Climate scientists debate whether warming acceleration is a meaningful metric. The perceived rate and direction of acceleration depend on the timescales and natural variability considered. It’s important to focus on metrics like the remaining carbon budget, current emission rates, and the efficiency of natural carbon sinks in absorbing CO2.

- There is an increasing need for carbon removals given the limited carbon budget available. To limit future warming, CO2 must be removed faster than natural sinks can manage. Approaches like Direct Air Capture (DAC) and Bioenergy with Carbon Capture and Storage (BECCS) show potential for effectively removing carbon from the atmosphere.

- Whether the rate of warming continues to rise or not will depend on our ability to mitigate emissions. As long as emissions continue to rise, climate change will continue with increasing impacts and need for adaptation.

Jefferies’ conversation with Professor Friedlingstein underscores the central challenge of the global transition: despite advances in understanding and addressing climate change, the window for effective action is narrowing. Without faster, more ambitious efforts, critical warming thresholds could be exceeded within decades.

At the same time, the professor’s insights reveal the complexity of the climate conversation. Metrics like warming acceleration are context-dependent, and different indicators can yield varying conclusions. Understanding progress and setbacks in the global transition requires openness to evolving data and a broad range of climate metrics.

For more insights on climate and the energy transition, follow along with Jefferies’ Sustainability & Transition Team.

How Workforce Dynamics in Japan Will Shape the Country’s Economic Future

Japan is now positioned as one of the world’s most promising equity markets through 2030. While foreign investment has historically played a small role in the country’s economy, this opportunity has sparked a surge of Western capital. Berkshire Hathaway, for example, increased its stake in five Japanese trading houses by 70%.

Last fall, Jefferies’ Equity Research Team published From Lost Decade to Golden Age: A New Paradigm for Japan Inc., highlighting investment opportunities emerging from Japan’s ambitious economic reforms.

For new entrants, understanding Japan’s unique economic and professional landscape is essential. Jefferies’ latest Human Capital Survey, which compares attitudes in the Japanese labor force to those in the U.S. and U.K., provides valuable insights.

Here’s what the survey revealed about Japan’s labor force in 2024—and what it means for investors.

- Quitting: Just 22% of Japanese respondents are considering quitting in the next six months, compared to 42% in the UK and 45% in the U.S. This aligns with research showing that Japan’s HR policies—steep seniority-earning profiles, extensive fringe benefits, participatory management, and reluctance to hire experienced workers from other firms—result in low turnover rates..

- Remote Work: 28% of Japanese respondents prefer to work five days in the office, compared to 22% in the U.S. and 14% in the UK. Additionally, 56% of full-time employees in Japan are required to work in the office five days a week, a higher percentage than in both the U.S. and UK.

- Four-Day Workweek: Only 69% of Japanese employees support a four-day workweek, compared to 87% in the U.S. and UK. Among the 63,000 Panasonic Holdings employees eligible for a four-day workweek pilot, only 150 opted in.

- Burnout: Just 31% of Japanese employees report experiencing burnout, compared to over 70% in the U.S. and UK.

- Employee Recommendation: When asked how likely they would recommend their company as a workplace (on a 1-10 scale), 70% of Japanese workers rated it 0-6, and only 10% gave it a 9-10. In comparison, 31% of U.S. workers and 38% of UK workers gave a 0-6 rating. Japan’s employee Net Promoter Score remains deeply negative.

- ChatGPT Use: Just 52% of office workers in Japan have used ChatGPT, compared to 79% in the U.S. and 80% in the UK. Concerns about automation are also lower in Japan than in the other countries.

- Upskill & Reskill: Only 67% of Japanese workers would explore skill development due to concerns about automation, compared to 84% in the U.S. and 86% in the UK. Notably, 35% of U.S. respondents would consider higher education for reskilling, versus just 14% in Japan.

For years, Jefferies has analyzed the human capital strategies of American and European companies, finding a significant link to corporate performance (see Human Capital Stocks and Europe’s Human Capital Stocks). As investment opportunities in Japan expand, insights from this latest survey may reveal where opportunities and risks lie.

Overall, the survey reveals that Japanese employees are less likely to quit than their American and British counterparts, for a range of reasons. As a result, employee engagement—and its impact on productivity—is the most material issue for Japanese companies today.

While the U.S. SEC has been slow to require human capital disclosures, Japan is moving forward with mandatory reporting on key areas, including: (1) succession plans for critical roles, (2) management remuneration ratios, (3) director skills matrices, and (4) initiatives to promote women, foreign nationals, and mid-career hires into middle-management positions.

These measures signal a shift in corporate transparency, offering both new and seasoned investors insights into the workforce dynamics that will shape Japan’s economic future.

For continued insights on human capital management and more, stay connected to Jefferies’ Sustainability & Transition Team.

The OCFO Is Having a Moment–Where Does It Go From Here?

The Chief Financial Officer’s role once focused on core accounting operations like AR/AP and FP&A. Today, the Office of the CFO (OCFO) is the strategic hub of modern enterprises. It influences everything from HR and risk management to the deal desk.

This expanded role has sparked a wave of products aimed at optimizing the often-painful workflows that fall to CFOs. The new category is catching investors’ attention, with some viewing it as the next big disruption in enterprise software.

“Today, OCFO is as core as it gets. All our investments touch OCFO in some way,” said Jonathan Wulkan of HG Capital.

At Jefferies’ fourth annual Office of the CFO Summit, leaders from 75 companies and nearly 175 investors gathered to discuss key trends, opportunities, and challenges in this growing space.

This recap covers a panel of four private equity investors in the OCFO space:

- Peter Christodoulo, Francisco Partners

- Jonathan Wulkan, HG Capital

- Matthew Dorr, General Atlantic

- Andrew Ren, Permira

How Did OCFO Become a Focus for Investors?

The OCFO category is still new—just a few years ago, it wasn’t on the radar of entrepreneurs or investors. Mr. Christodoulo explained the category’s emergence, charting CFOs’ evolution from accounting to a broader, product-centric role.

“I first heard the term ‘OCFO’ five years ago,” he shared. “The CFO’s role used to be mostly focused on things like accounting, AR/AP, FP&A, and Treasury. But gradually, a CFO’s role has grown as areas like payroll have led into HR and areas like billing have led into subscription and consumption billing. Now, CFO roles are heavily intermingled with products. It’s almost similar to fintech 15 years ago.”

For investors, this shift signals opportunity. Because CFOs’ focus was historically narrower, centered on core accounting operations, much of the innovation in other areas of the enterprise is only now starting to influence their job functions. Manual processes and legacy solutions still dominate CFO workflows.

“The biggest tailwind for OCFO is that this category has traditionally been seen as being in the background. Now, the OCFO is one of the loudest voices in the room, and that brings bigger budgets and a need for better technologies,” Mr. Ren shared. “The category is really exciting.”

Software Investing Is Down–Is OCFO The Exception?

Private equity and venture capital investment in software declined 51% year-over-year in 2023, as high interest rates and declining public-market valuations buffeted investors. With a new rate cutting underway, Jefferies asked the panel about their outlook for OCFO investing in the second half of 2024.

The response was clear: they’re open for business.

In discussing the future of OCFO investing, panelists highlighted a trend familiar to enterprise software investors: the shift from point solutions to platforms. As the OCFO role expands to cover more diverse functions, investors are seeking products that support the full stack, rather than individual functions.

“(OCFO products) should track the movement of data and money from the customer journey through internal systems. We think that there are great partnership opportunities between front and back-office software tools and payments platforms. From the OCFO perspective, it’s one continuous journey.”

Does the Sector Face Headwinds?

From an investor perspective, the panelists pointed out a few headwinds facing OCFO.

- Mr. Wulkan noted the influx of new entrants into the market. What was once a nascent category is becoming increasingly crowded, with more competitive bidding.

- Mr. Christodoulo mentioned that, like most sectors, OCFO hasn’t been immune to the high-rate environment of recent years. Businesses have had to adjust their cost structures, and in some cases, growth has slowed.

Despite these challenges, the overall sentiment was that OCFO remains a fast-growing and exciting sector—one that’s really just getting started. For more insights on OCFO and its trajectory, check out Jefferies’ interview with Evan Osheroff, Managing Director for Software Investment Banking.

Is AI Ready to Transform Healthcare? Leaders in Biotech and Provider Services Weigh In.

At last year’s Global Healthcare Conference, interest in AI was beginning to surge. This year, it’s reached a fever pitch.

A record one in four healthcare investment dollars is now going to companies leveraging AI. And AI is beginning to drive transaction activity in the sector, from IPOs like Tempus, an AI-enabled precision medicine leader, to M&A in medical devices, biotech, and beyond.

Still, separating the hype from near-term commercial opportunities remains a challenge for sponsors and corporates, especially in such a fast-moving space.

Jefferies Insights sat down with banking leaders in provider services and biotech to get their take on how AI is being integrated into healthcare—and where it’s still mostly noise.

Can AI Ease the Strain on Provider Services?

The provider services sector faces several challenges. Demand for healthcare is surging, but a growing labor shortage makes it harder for providers to keep up. At the same time, profit pools are shrinking amid ongoing inflation and rising labor costs.

Providers are under pressure to deliver care more efficiently—and many are turning to AI for support. A recent survey found that 75 percent of providers increased IT investments over the past year, focusing on technologies that can optimize operations and reduce clinical burden.

The question is, are AI-powered technologies ready to make an immediate impact?

Jefferies Insights posed this to Ashwin Pai, Managing Director in Healthcare Investment Banking. With nearly two decades of experience in provider services, Pai regularly supports transactions and fundraising for emerging technology leaders in the sector.

“There’s a lot of interest and activity in the provider services sector around AI,” Pai shared. “The opportunity set is broad, and many technologies are still in the early stages of testing and development. But in some areas, we’re already seeing AI tools applied to great effect.”

Providers are already piloting AI tools in clinical applications like documentation, where they’ve shown promise in easing administrative burdens on clinicians. There’s also hope that AI can support more electronic health record (EHR) functions, such as responding to patient inquiries and assisting with medical coding.

“Beyond admin, there’s incredible potential for AI in clinical decision-making,” Pai explained. “We’re already seeing AI-powered wearables introduced, giving providers much deeper insight into patients’ conditions and progress, even in remote settings. And that’s just the start—AI will soon be a key tool in medical imaging, predictive analytics, and a true clinical support partner for physicians.”

Pai also pointed to the potential of AI in areas like radiology, supporting physicians in analyzing medical imaging and making diagnoses. There is ongoing innovation around predictive AI to detect diseases like cancer and neurodegenerative disorders earlier than human diagnosis typically allows.

Transaction and fundraising activity around the integration of AI in provider services is gaining momentum, as more sponsors and strategic buyers hone in on opportunities. Pai highlighted Microsoft’s $1.5 billion investment in G42, a UAE-based AI company leading advancements in AI-powered diagnostics and digital health, as a key example.

What AI Can (and Can’t) Do for Biotech

Few sectors have sparked as much excitement around AI as biotech. The potential for AI to revolutionize drug discovery—streamlining a notoriously long and costly process—carries significant clinical and financial promise.

However, in these discussions, hype is often mistaken for near-term potential. That’s why Jefferies Insights spoke with Dr. Gil Bar-Nahum, EMEA Head of Biotechnology, who brings two decades of experience in biotechnology and holds a PhD in biochemistry from New York University.

“There’s no doubt that AI’s potential in biotech is exciting. Machine learning can help us better understand drug efficacy and optimize clinical trials—and that’s just the beginning,” Bar-Nahum shared. “But if you’re asking whether AI can make an impact on my five-year, $200 million clinical trial today? We haven’t seen it yet. So the hype has tempered a bit.”

The biggest hurdle for early-stage biotech companies is fundraising. Drug discovery costs hundreds of millions of dollars—and the field is inherently high risk. Clinical trials for new drugs have a historical success rate of just 7.9 percent. The time horizon for biotech investments is also uniquely long, with regulatory approval and commercialization taking years, even for successful breakthroughs.

This created a tough market in recent years, as biotech grappled with high interest rates. Earlier this year, equity capital markets began to reopen, fueled by pent-up demand and expectations of an easing cycle. Financing is beginning to trickle through again for development-stage biotech ventures.

“The biggest near-term opportunity for AI is making clinical trials more efficient,” Bar-Nahum explained. “Preclinical biotech companies burn through cash, and in a risk-off environment, that makes things tough. Where AI can cut costs and streamline operations, it can make a big impact in R&D—like streamlining clinical data and analyzing patient populations.”

Some of these opportunities are already being realized, such as a collaboration between Keio University, Mitsubishi Tanabe Pharma Corporation, and Boston-based Neuro Discovery Lab. Researchers are using machine learning in a knowledge graph approach, analyzing potential relationships between disease and biological function in large quantities of patient data. The team reports significant gains in efficiency.

++

Opportunities to apply AI in healthcare are exciting and diverse, varying widely by sector. In some cases, there are near-term opportunities for AI-powered technologies to make healthcare more predictive, efficient, and impactful. In others, meaningful applications are still a long way off.

Still, one thing is clear: no matter their role, everyone in healthcare is thinking about it.

For more insights on AI’s near- and long-term potential in healthcare, follow Jefferies’ 2024 Global Healthcare Conference in London.

Healthcare’s Path Forward: The Key Trends Shaping 2025

Tommy Erdei is Joint Global Head and European Head of Healthcare Investment Banking at Jefferies. He joined the firm in 2009 as a Managing Director for Jefferies Healthcare Team and is based in London. Erdei spearheaded the organization of Jefferies’ annual Global Healthcare Conference and hosts the annual Healthcare Temperature Check.

Last year’s London Healthcare Conference came amid significant market and geopolitical uncertainty. Inflation was well above the Fed’s two percent target, and rate cuts were still ten months off.

Still, participants spoke of the sector’s resilience. Supply chain pressures were easing, capital markets reopening, and sponsors and corporates were positioning for a rebound in dealmaking.

Now, as third-quarter data shows growth in transactions, the quiet confidence of last year’s conference appears to be paying off. A fresh rate-cut cycle and record dry powder are paving the way for more dealmaking, while innovations in AI and GLP-1s continue to excite investors.

Ahead of this year’s conference, Jefferies Insights caught up with Tommy Erdei, Joint Global of Healthcare Investment Banking, for his outlook on the healthcare sector and the months ahead.

Healthcare’s Momentum Builds

Even in a tough macro environment, healthcare proved uniquely resilient. Private equity activity has remained steady, relative to other sectors. There are robust pipelines of innovation. And industry leaders are sitting on large cash reserves, supporting strategic M&A.

“Healthcare is a defensive sector,” Erdei shared. “The ups and downs are much narrower than you see in other sectors such as technology or consumer sectors, for example. In broad strokes, things are typically good or great in healthcare.”

Now, the outlook for the sector is moving from resilient to strong, Erdei explained, as some of its key challenges begin to abate.

First, bid-ask spreads are narrowing. For two years, buyers dealt with significantly higher capital costs, while sellers clung to old valuation expectations. Now, as rate cuts begin, sellers adapt to the new normal, and their companies continue to grow into the valuation expectations from a year or two ago, both parties are increasingly aligned. This will spur growth in transaction activity, especially of PE-owned companies.

Second, equity capital markets (ECM) are gradually opening up—particularly in sectors like biotech—allowing more companies to raise capital.

“Healthcare is a broad sector, but in key areas, equity markets have been really active in 2024. There’s been a lot of buzz around M&A by large-cap pharmaceuticals of biotech/pipeline focused companies, particularly earlier in the year. This is always good to supporting funding of earlier-stage Biotech companies, as those investors look forward to a large payday from such takeovers as their product pipeline matures. And so we’ve seen the equity capital market for biotech open back up nicely, after a challenging couple years for fundraising,” Erdei said.

The biotech IPO market slowed significantly in 2022 and 2023 but has seen a gradual reopening in 2024: 7 Biotech IPOs have priced over the past two months, the most active two-month stretch since 2021. In total, there have been 17 IPOs in 2024 compared to 11 and 10 in 2022 and 2023 respectively.

Meanwhile, the follow-on market has seen near record activity in 2024 buoyed by an active M&A backdrop and strong data readouts igniting investor interest and returns. The 2024 market is the 2nd most active year ever for biotech follow-on issuance by proceeds raised.

“In healthcare, all these forces are connected,” Erdei explained. “With more M&A deals, financing will find their way to to new and exciting biotech pipeline opportunities, via IPOs, follow on offerings or from VC private investments. And with more capital, trying to find opportunities in the biotech sector, we will see further strength for biotech companies raising capital.”

GLP-1 and AI: Key Themes in Healthcare Innovation

Last year’s conference was dominated by talk about GLP-1 drugs as semaglutide treatments showed remarkable effectiveness in also addressing obesity in addition to its traditional market of diabetes. As the two major commercialized innovators, Novo and Eli Lilly, drove very strong growth , companies across the supply chain positioned themselves to capitalize on the growth opportunities.

Analysts project that early leaders Novo Nordisk and Eli Lilly will maintain a two-thirds share of the semaglutide market through 2031, thanks to their first-mover advantage. However, up to $70 billion of the GLP-1 market is still up for grabs, according to a recent report by Morningstar and PitchBook.

“GLP-1s were new at last year’s conference, but excitement remains high as results continue to exceed expectations,” Erdei shared. “The market isn’t limited to the peptide space—it impacts companies across the supply chain. There’s a race in several subsectors to seize this opportunity.”

This year, excitement also extended to artificial intelligence. A record $11.4 billion in venture capital is expected to flow into healthcare AI in 2024, as companies and investors explore potential applications of these technologies.

“Healthcare is such a broad sector, and AI opportunities vary across categories,” Erdei added. “AI in drug discovery and pharmaceutical supply chains is a big focus this year. There’s also growing interest in AI’s potential to optimize provider services workflows—logistics, electronic health records, diagnostics.”

++

As the effects of a rate-cutting cycle and more stable equity markets begin to ripple through healthcare, the sector is poised for stronger deal activity, innovation, and investment. However, this isn’t a rebound from a downturn—healthcare showed resilience throughout the recent storm.

For deeper insights into the market, and more from Tommy Erdei and the Jefferies team, check out the 2024 Healthcare Temperature Check and follow coverage of this year’s Global Healthcare Conference.

Where’s The PE Action in Healthcare?

By the Jefferies Editorial Team

Michael Dodds is a Managing Director and Global Head of Healthcare Sponsor Coverage at Jefferies. He joined the firm in 2005 and has nearly two decades of investment and merchant banking experience in the sector.

Healthcare has been a hotbed of private equity activity for the past decade, accounting for over 20 percent of global buyouts in 2021. However, like many sectors, dealmaking slowed in recent years amid rising interest rates and inflation. Sponsor-led healthcare transactions dipped in 2022 and 2023.

Now, with a new easing cycle underway, there’s uncertainty around what’s next for healthcare PE. At last year’s Global Healthcare Conference, participants predicted an uptick in the sector’s M&A—but driven more by strategic buyers than sponsors.

Fresh third-quarter data point to a healthy market. Healthcare transaction value rose year over year, with deals from TowerBrook, CD&R, and The Carlyle Group headlining the quarter.

Jefferies Insights sat down with Michael Dodds, Managing Director in Healthcare Investment Banking, to discuss private equity activity in healthcare this year—and where it could be headed next.

Healthcare Transactions in ‘24: A Slow but Steady Path Forward

September’s 50-basis-point cut was welcome news to investors—but compared to the near-zero rates of recent years, borrowing costs are still high. The target range for the federal funds rate remains between 4.75 and 5 percent.

The macro environment is improving, and there’s a growing appetite for capital deployment and dealmaking, but the floodgates won’t open all at once.

“There is more stability in the market today, but rates are still high, and leverage multiples have shifted from a few years ago. Most sponsors expect the current deal environment to hold steady through year’s end,” Dodds shared.

Third-quarter activity reflects this prediction. Healthcare M&A rose in Q3, but just 6 percent—a positive but modest sign of recovery. Dodds explained that it will take time for valuations to align and leverage multiples to catch up with new rate cuts.

“Bid-ask spreads are narrowing, but there are still some challenges around dealmaking. Over the next six months, we’ll see buyers gain confidence and sellers adjust their expectations as everyone continues to get comfortable with the new environment,” Dodds said.

Dodds also emphasized the importance of a well-run process in times of uncertainty. Strong multiples will depend heavily on bankers’ ability to drive competition and optimize deal structures. For the Jefferies team, this has been a key focus, Dodds said, as deals no longer come as easily as they once did. Having experienced M&A bankers and expertise in the sector are vital.

How Sector Dynamics Are Shaping Healthcare M&A

Healthcare’s rebound won’t unfold evenly, as challenges and opportunities vary across subsectors. Dodds pointed to medical technology, life sciences, and pharmaceutical services as areas where he expects sponsor-led transaction volume to remain strong. Plus, PE is also looking into specific pockets within healthcare services, like infusion, home health, hospice and pharmacy, where activity is high and a strategic or IPO exit is likely.

Notable deals from the quarter include TowerBrook and CD&R’s acquisition of R1 RCM, a technology-driven revenue cycle management company, for $8.3 billion. The Carlyle Group also led a $3.6 billion acquisition of Vantive Kidney Care, bringing the firm’s total investments in medtech and diagnostics to $40 billion in enterprise value.

Biopharma remains the most active healthcare subsector year to date, with 42 transactions. However, many of these are strategic-led deals, such as Eli Lilly’s Q3 acquisition of Morphic for $3.2 billion.

What’s Holding Back IPOs in Healthcare?

The IPO market divided opinions at last year’s Global Healthcare Conference. About half of participants anticipated a rebound in 2024, while the other half expected it to stay sluggish. Healthcare go-public activity has slowed in recent years, reflecting a tough capital markets environment for new listings.

Dodds expects private equity to stay cautious about IPOs—except for the largest funds, where taking companies public may be the only feasible path to liquidity.

“Generally, sponsors have a bias against IPOs. They take a long time to monetize, so they’re a big drag on funds’ IRR,” he explained. “However, we expect the IPO market to become a more popular exit path for healthcare private equity firms, especially as the companies they own become larger and public markets continue to improve. We’re seeing evidence of this already.”

Dodds expresses cautious optimism about the near-term outlook for the healthcare sector. As the economic climate stabilizes and the Fed continues lowering rates, sponsor-led deal activity is expected to pick up.

For the Jefferies team, a focus on a strong advisory and transaction process has been crucial in managing the downturn—and will continue to be as markets recover. With over 130 healthcare bankers worldwide, the firm remains one of the leading advisors in global healthcare M&A, equity transactions, and financing.