Specialty Finance in 2023: Positive Momentum Amid Economic Flux

Specialty finance companies experienced positive momentum during the second quarter and summer of 2023. Sustained demand for credit from both consumers and alternative funding, along with some encouraging macroeconomic trends, drove continued growth.

Inflation and heightened borrowing costs may continue to trouble consumers, a robust labor market and rising wages set the stage for sustained consumer spending through year’s end.

Consumer Credit Dynamics

Credit card demand maintained its strong pace, with balances surpassing $1 trillion in the second quarter of 2023. Personal savings remain low and the cost of everyday expenses high, forcing consumers to lean heavily on credit.

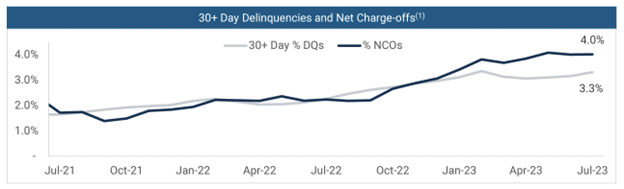

Many Americans amassed savings during the pandemic, but those reserves are running dry. The Federal Reserve of New York reported that delinquency roll rates for credit cards and auto loans now slightly surpass pre-pandemic levels. A robust labor market and rising wages continue to fuel strong consumer spending, but as inflation persists and student loan payments resume, consumers may struggle to meet their obligations in the months to come.

These concerns came to a head in August, when Macy’s announcement caused ripples in consumer finance stocks. The company, a major issuer of credit cards and layaway programs, is often a barometer for consumer credit health. Macy’s highlighted a material decline in credit card income, attributed to elevated delinquencies across its portfolio. The rapid rise in delinquencies surpassed expectations, hinting at increased consumer distress.

New data from the Federal Reserve show credit delinquencies this summer reached rates not seen since 2019. The rate of debt unpaid after 30 days escalated to 7.2% – the highest since 2012.

Alternative Funding Partners: The Rising Stars

Summer 2023 saw a continued shift in the landscape of consumer loan funding. Traditional funding partners like banks and credit unions are stepping back amid liquidity constraints, setting the stage for alternative credit managers. The $700 million joint deal between Castelake and Neuberger Berman with Oportun is testament to this trend.

Other ventures, including Castelake’s agreement to acquire up to $4 billion of consumer installment loans from UPST, reinforce the increasing presence of alternative funding partners. With consumer loan assets offering a tempting return profile, these funders are well-positioned to bridge the gap left by wider banking retreats.

Mixed Macroeconomic Indicators

In the broader economy, unemployment levels hover near historic lows, and inflation shows signs of cooling. Nonetheless, daily household goods still command higher prices, and consumers are feeling the crunch.

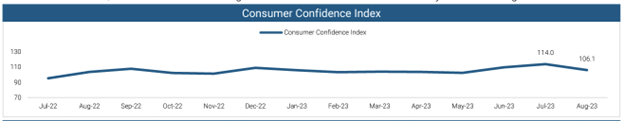

Student loan payments are slated to resume in October, and signs of consumer anxiety have reemerged. The mix of positive job and wage data with negative consumer sentiment place renewed pressure on the Federal Reserve, as it weighs next steps.

The Consumer Confidence Index, after reaching a high of 114.0 in July 2023, dropped to 106.1 in August. Economists had projected the index to rise to 116 this month, making this decline especially notable.

In the banking sector, the impact of 2023’s four major failures continue to be felt. Following the credit downgrades of several banks in August, Fitch announced that the industry was inching toward another downgrade from AA- to A+. Liquidity constraints remain a concern for the US banking sector, and Fitch warned that the operating environment will likely remain challenged in the medium term.

A Sector Set for Growth

The blend of mixed macro signals and a tentative consumer environment might spell uncertainty, but the consistent demand for credit, bolstered by alternative funding partners and fintech, promises to sustain positive momentum in the specialty finance sector. In the intermediate term, issues and investors alike will remain focused on specialty finance companies, particularly as the broader economic climate and state of the consumer continue to evolve.

The Road to Recovery: Dealmaking, AI, and New Investment Strategies

In a recent dialogue at Jefferies’ 2023 Private Internet Conference, Cully Davis, Vice Chairman of Equity Capital Markets and Head of West Coast Technology Investment Banking, explored the evolving dealmaking landscape, the cautious re-entry of companies and investors into the market, and the transformative potential of artificial intelligence.

“When Will the Market Recover?”

Davis reflected on how businesses have adjusted their strategies amid uncertain market conditions. Companies have scaled back their ambitions, making tactical moves to reduce cash burn and moderate expansion efforts. While there are positive indicators, the exact timing of a full market recovery remains anyone’s guess.

“We’re getting close,” Davis said. “The fed is close to halting rate hikes, and the economy and consumer have weathered the storm better than expected. But it remains unclear when we’ll wake up and see dealmaking return full throttle.”

Davis characterized current sentiment as a “waiting game,” with firms hesitant to spearhead aggressive moves. Investors are hungry for new ideas, but private companies are reluctant to lead the initial wave back to market.

Public companies, being more transparent, can offer a window into the economy’s health. “Many private companies are looking to public markets as an indicator,” Davis shared. He suggested a resurgence in public market activity might catalyze new activity among private enterprises.

A Coming Wave of IPOs?

Davis emphasized that the sluggish IPO pipeline isn’t born of a dearth of capital. Investment managers, especially in equity funds, are sitting on ample dry powder. The lack of movement stems from diminished business confidence across the market ecosystem.

“The issue isn’t a mismatch between capital availability and ideas,” Davis observed. “It’s a lack of confidence in forecasting performance and transacting at current multiples.”

Investor interest is growing as valuations rise, but a resurgence in dealmaking is a “two-sided equation”. It requires both the willingness of investors to deploy capital and the readiness of companies to embrace opportunities. Davis projects confidence is slowly returning, and the market is ready to absorb a wave of renewed activity.

The summer IPO market, after an unusually quiet period, has shown signs of life. This month, Instacart closed up 12% in its long-awaited Nasdaq debut, and shares of U.K chip designer Arm Holdings rose almost 25% in the largest IPO since late 2021.

Cava Group, a popular Mediterranean-style restaurant chain, roughly doubled its value during its June debut, in an offering co-run by Jefferies. Companies like Savers Value Village, a thrift store operator, and Oddity Tech, the holding company for direct-to-consumer beauty brands, also enjoyed strong public offerings. These successful summer launches may signal a resurgent IPO market this fall, as the frosty dealmaking environment continues to warm up.

AI’s Transformative Future

The dialogue then turned to the exciting frontier of AI. Davis envisions a future where AI isn’t just a technological novelty but integrated into people’s everyday lives.

“AI is massively impactful, and it will be permanently so,” he said. “We’re finally seeing the application of AI, and it’s going to massively change markets and industries.”

Davis also acknowledged the challenges AI might present, stressing that it’s technologists’ responsibility to ensure its application is in service of beneficial change. “The challenge will be ensuring these technologies are harnessed for good,” Davis shared. “But I’m very confident AI will soon be permanently imbued in everything we do as a society.”

—

Cully Davis’ insights shed light on the mix of caution and optimism defining the present investment climate. As companies prepare for a market resurgence on the horizon, his perspective offers a glimpse into a future reshaped by emerging technologies and a fresh approach to dealmaking.

Building and Developing Private Market Portfolios in a Downturn

Speaking at Jefferies’ 2023 Private Internet Conference, Seyonne Kang, Partner at Stepstone Group, shared insight into the private market opportunities awaiting investors and entrepreneurs. She posits that private markets hold great potential, provided companies balance operational efficiency with their desire for future growth.

Trends and Opportunities in the Private Market

As global financial markets continue to ebb and flow, Kang spotlighted a surge of activity in secondaries. “We’ve been very, very busy on the secondary front,” she shared, noting Stepstone’s involvement in direct secondaries and fund interests.

On the fund side, opportunities are diverse. Kang is involved with a range of secondary investments, from GP-led restructurings to LP tenders and strip sales. “These are bottom-up, analysis-driven fund investments – a busy and exciting area.”

In the primary sector, the climate is also promising. Company valuations are favorable, leaving investors optimistic and ready to re-engage. “It’s a great time to put money to work,” Kang stated, citing a shared interest among investors to deploy dry powder.

If this trajectory continues, she believes the forthcoming years will prove lucrative for both private market investors and entrepreneurs.

Balancing Growth and Efficiency in a New Business Landscape

Kang shifted her focus to the challenges confronting management teams. She stressed the need for companies to balance their growth aspirations with operational efficiency. In recent years, “when capital was easy,” companies could hide inefficiencies and continue to attract dollars. “Today, we’re in an execution-wins environment,” Kang said. Efficiency is the hallmark of success.

In 2023, the era of unchecked spending is in the rearview. Kang juxtaposed companies’ liberal spending habits between 2018 and 2021 with the current climate, where every dollar is scrutinized. “Every project, every sales call, every flight has to be justified,” Kang said. “Companies feel like they need 24 months of cash on hand.”

This financial prudence was echoed in Grant Thornton’s recent CFO survey, in which 58 percent of executives identified cost optimization as their biggest concern in 2023. Across industries, companies are downsizing and restructuring to cut spending.

For startups, these patterns are partially due to longer intervals between funding rounds. The average time lapse between series A and B funding is now 31 months – the longest span in at least 12 years. Founders feel pressure to conserve dollars or consider new fundraising rounds, as their capital begins to run dry.

The Human Element: Leading with Empathy

Kang also highlighted the emotional repercussions of these business challenges. The decisions and pressures facing companies are taxing. “It’s hard to say no, to restructure companies, to kill projects,” she said.

Investors, she suggests, ought to check in on management teams, empathizing with their struggles and reiterating the importance of consistent communication. “It’s important to have those conversations as people first.”

She wrapped up her insights on a forward-looking note, highlighting the positive impact of adversity on private sector innovation. In periods of economic downturn, truly innovative ventures garner more funding than those offering incremental improvements.

Kang anticipated a new innovation wave, spurred by technologies such as low-code and no-code software platforms, cloud computing, and powerful new AI technology. She hailed these tools as transformative, capable of elevating single engineers into a powerhouse of productivity. Kang’s comments on the shifting business climate reflect a balanced and insightful perspective. Despite the evident challenges, there are rich opportunities for growth and investment. Discipline, innovation, and a human touch will pave a successful path forward for investors and management teams alike.

Sonya Brown: Shifting Consumer Trends Spur New Strategies for Founders and Investors

At Jefferies’ 2023 Private Internet Conference, Sonya Brown, General Partner at Norwest, spoke with Cameron Lester about evolving consumer trends, technology’s impact on e-commerce, and more. Brown, who co-leads the firm’s growth equity team, brings decades of investing experience across various sectors, including consumer products, internet and e-commerce, and retail.

The Current Landscape & Advice for Founders

Brown’s reflections on the 1999 dot-com bubble offer cautious optimism for the future, pointing to historical patterns as a guide for the months to come. “Things got very frothy when that bubble burst,” she said. “Then, there was a slow build, and eventually a very long bull market. I think things will continue to play out over a cycle.”

In the face of shifting markets, Brown’s advice to founders and management teams is clear: “Focus on profitability. Be efficient with capital. Find ways to grow with fewer investment dollars.”

Brown emphasized the importance of capital efficiency, encouraging founders to “think outside the box” with new technologies. She cited innovations in artificial intelligence as an opportunity to scale and achieve profitability efficiently, without dramatically increasing headcount.

The Market: Lessons from the Past & Strategies for the Future

Brown expressed excitement about investment opportunities in the current climate. Throughout her career, depressed periods created opportunities to invest in promising business models at low valuations.

“A lot of great companies are formed in environments like today’s,” she stated. “Investors often have more success in depressed periods than at the top of the bubble. We’re exercising cautious but excited and open for business. Taking a longer view in moments like this is vital.”

Consumer Behavior & Emerging Trends

Discussing consumer trends, Brown acknowledged mixed signals: high inflation and interest rates juxtaposed with strong spending and a robust job market. Consumers may still be feeling the pain of a COVID economy, but the more enduring change may be shifts in consumer preferences. U.S. consumers are spending more on experiences than products – a trend fueled by demographic and geographic changes during the pandemic.

New research shows that over 2 million people moved from America’s largest cities to suburbs between 2020 and 2022. Major metro areas like New York, San Francisco, and Chicago have all seen their populations decline.

Evolving consumer preferences spurred a corresponding shift in consumer acquisition strategies. Brown remarked on the role of social media – and TikTok, especially – as a consumer acquisition tool.

“43 percent of Gen Z consumers are going first to TikTok to search for a product,” Brown shared, citing research from Jungle Scout. She pointed to her own daughter’s use of the platform – rather than Google, Amazon, or Sephora – to source products like makeup.

Combining Content and Commerce

Brown also recognized a growing convergence of content and commerce, especially in the healthcare space. The rise of health and wellness content post-COVID offers an exciting investment opportunity.

A McKinsey study from 2022 supports Brown’s observation, estimating that spending on wellness products and services now exceeds $450 billion in the US. The market has grown by more than 5 percent annually since COVID.

Diversity, Equity, and Inclusion: Proactivity Matters

Finally, the discussion turned to diversity, equity, and inclusion, one of the key focus areas Norwest has identified to focus on internally and with its portfolio companies. Brown highlighted the firm’s long-standing focus on hiring diverse talent and investing in social missions like sustainability.

“We encourage the same practices in our portfolio companies,” Brown said. “Supporting minorities and underrepresented groups in becoming successful founders, executives, and investors is tremendously important.”

Sonya Brown’s perspective offers a valuable mix of optimism, caution, and strategic insight in a complex and changing market. By focusing on profitability, emerging technology, and shifts in consumer behavior, she sees opportunities for both investors and founders to find success across sectors of the economy.

Jefferies’ Jason Greenberg on Dealmaking in Uncertain Times

At Jefferies’ 2023 Private Internet Conference, Jason Greenberg, Co-Head of Global Technology, Media, and Telecom Investment Banking, shared insight into the current investment landscape and the challenges associated with dealmaking.

Activity may continue to lag in the short term, amid high interest rates and reduced business confidence, but Greenberg foresees a steady recovery in M&A over the next twelve months.

Challenges and Opportunities in Today’s Market

Greenberg acknowledges the complexities of the current dealmaking environment, but also emphasizes the potential rewards for those able to capitalize on opportunities.

“It’s the hardest time to get deals done,” Greenberg stated. “The benefit is that the deals you do now may be the ones that slingshot you into a more successful market.”

He drew parallels to past economic downturns, including the dot-com crash and Global Financial Crisis, where strategic deals led to significant success in subsequent boom markets.

Private Equity Makes A Comeback

Greenberg spoke to new signs of life in private equity, following a very quiet 24 months. Committed capital to private equity funds today is at its highest in years, suggesting a strong interest in acquisitions. Despite significant dry capital, Greenberg expects private equity’s reemergence to be slow, marked by deals that don’t require high leverage.

“We’re seeing private equity back into the market,” he said. “Private deals tend to lag behind public markets by twelve to eighteen months.”

Greenberg also warned that investors are eager to see action, and that could push the M&A market to speed up.

“There’s a point at which you’re being paid to deploy capital,” he shared. “Pretty soon, I think you’ll see the M&A market loosen and begin to accelerate.”

Strategic Buyers and Financial Sponsors: A Shifting Landscape

Greenberg also discussed how the balance between strategic buyers and financial sponsors has changed, as sponsors have become a larger part of the M&A market. Looking ahead, Greenberg predicts a temporary pause in the growth of sponsors, though he thinks their percentage of deals will continue to grow in the long term.

“If you’re a sponsor thinking about the longevity of your fund, you have to recognize that deals done in recent years were completed in an environment with a cost and quantum of debt that isn’t available today,” Greenberg noted. “If the market returns to where it was, and fed funds rate drops considerably, the quantum of debt will expand again.”

Navigating Uncertainty to Come

Greenberg finished by commenting on rising interest rates and their impact on private equity. He stressed the need for funds to set realistic expectations, recognizing that the money they’ve invested might not generate as large a return as in the recent past.

“It feels like rates will be higher for longer than people believe,” Greenberg said. “If that’s the case, private equity funds need to actually recognize investments. They may not see the three-times multiples of recent years, but there will still be good outcomes.”

Greenberg’s comments offer a clear view of a complex market. As interest rates remain high and the market equips for a resurgence of dealmaking, his insight is a valuable resource for private equity funds and investors navigating uncertain times.

Lightspeed’s Faraz Fatemi: Navigating the Shift in Consumer Social Post-Pandemic

At Jefferies’ 2023 Private Internet Conference, Faraz Fatemi, Partner at Lightspeed Venture Partners, shed light on the profound post-pandemic shifts in social media and e-commerce. Fatemi brings robust experience across the startup ecosystem, as both a member of founding teams and an investor in consumer social platforms.

The Evolution of Social Media

Fatemi reflected on the post-COVID trajectory of social media, tracing its evolution from the traditional social use case – powering communication between small groups of people, like friends and family – to the ‘recommendation media’ that dominates platforms today. Today, these platforms leverage algorithmic recommendation systems, feeding users content tailored to their interests.

Fatemi pointed to TikTok’s meteoric rise, observing, “platforms like TikTok proved that recommendation media, based around user interest, scales faster and delivers more content than traditional social media.”

Fatemi also identified trends on the horizon. He pointed to multiplayer media platforms as an opportunity to bridge social interaction and digital content, powering shared consumption experiences across networks of family and friends.

Monetization Models and the New Face of E-Commerce

As e-commerce and social media become increasingly intertwined, Fatemi notices significant experimentation with diverse monetization models. As ad dollars continue to gravitate toward legacy giants like Facebook and Google, early-stage businesses are venturing into uncharted territory.

“There’s quite a bit of innovation in traditional subscription, in-app purchasing, affiliate, and marketplace take-rate models. These new approaches are fueling the next phase of digital monetization,” Fatemi shared. “Much of this is rooted in AI, which impacts the product roadmap for early-stage social and content-led platforms.”

Fatemi pointed to AI-powered product placement and brand matching as one example. Algorithms are connecting brands with content and creators whose audiences align directly with their offering. These mechanisms, coupled with advancements in content recommendation, are driving huge advancements in e-commerce.

Preparing for the Public Market

On the IPO front, Fatemi’s outlook was cautiously optimistic. He believes many companies focused on improving margins and scaling during the downturn. Now, they are poised for a favorable reception in public markets.

“Of course, there’s some fear that if companies go public now, they may be subject to depressed multiples or suffer from limited IPO demand,” Fatemi acknowledged. “But just like the best companies in venture markets always get funded, the best companies going to IPO will attract strong interest.”

Fatemi believes businesses primed for IPOs 12 to 18 months ago are better prepared for public markets today. The sluggish IPO pipeline of 2022 and 2023 may fuel a series of successful public offerings in the months to come.

Fatemi’s insight into the rapidly transforming domains of social media and e-commerce reveal an industry that is not merely adapting to market shifts but actively shaping them. From the next phase of monetization to new applications of AI, the future of consumer social will reflect rampant innovation, with much yet to explore.

Secondaries Provide an Answer for the Primary Questions Facing GPs and LPs in 2023

GPs and LPs lately find themselves facing a similar conundrum.

GPs want to raise new funds while maintaining the long-term upside of attractive assets they already own. But they also need liquidity – to return capital to LPs, support current portfolio companies or invest in new assets that suddenly have more compelling valuations.

They are increasingly finding a solution to this challenge in the secondary market, which surpassed $100 billion in global volume for the second straight year despite challenging economic conditions in 2022.

Nearly half of LPs that sold into the secondary market in 2022 did so for the first time, with goals such as rebalancing portfolios and generating liquidity for new opportunities, which suggests growth in this market is just beginning.

As broader macro sentiment improves, Jefferies sees continued momentum for GP-led secondaries and the most compelling window for LP-led secondaries transactions since the beginning of 2022.

Globally, the secondaries market is deep and well-established, and there are several overriding trends creating opportunities in the market in 2023 and beyond.

For GPs

Amid a tepid M&A and public exit environment, single-asset continuation funds have become the most popular way for sponsors to utilize the secondary market to manage both fund liquidity and duration – representing approximately 50% of overall GP-led market activity.

In 2022, the GP-led secondary market saw an estimated $52 billion in transaction volume, which was 24% less than 2021, but still 49% more than 2020.

Throughout 2023, we expect investor appetite to remain robust for single-asset and multi-asset continuation funds, especially as secondary funds raise larger pools of dedicated capital and new entrants in the space continue to deploy capital.

While secondary market activity was more subdued on the venture and growth side of the market last year due to widespread valuation uncertainty and an expansive bid-ask spread, there are strong indications of improving demand for those opportunities. Globally, more sponsors and VCs are using the secondary GP-led market to enhance the distribution pace to LPs, while raising additional capital to help support strong performing assets or invest in new ones at today’s reduced valuations.

For LPs

There were $56 billion in LP-led secondaries last year, down 13% from the year prior, as buyers accounted for increased market volatility, inflated private company valuations, expected delays in exits and higher underwriting hurdles. But we expect activity to accelerate in 2023 because:

- Many LPs continue to seek ways to reduce their exposure to illiquid assets and redeploy into new private equity deals or other growing strategies such as private credit or infrastructure.

- The market for LP portfolios has rebounded considerably, thanks to stabilizing NAVs and improved public markets, continued strong operating performance in many PE portfolios, and successful secondary market fundraising campaigns by many of the leading funds.

Looking Ahead

In early 2023, there were several indicators suggesting the IPO and M&A markets were ready to rebound after a difficult 2022. But then a regional banking crisis in the U.S. and the collapse of a major bank in Europe once again put many investors on edge. It was a stark reminder of the uncertainty in global markets and the necessity of investors having diverse toolkits available to navigate them.

Looking through the end of 2023, we see strong tailwinds that will nudge more LPs and GPs to use secondary transactions as an essential tool to both preserve liquidity and access to upside. Numerous LPs currently have negative net cash flows in their private equity programs, as capital calls outpace distribution activity, which spurs an enhanced need for liquidity. Meanwhile, many GPs are searching for creative ways to hold onto prized assets for longer while keeping their LPs happy. Buyers will continue to be selective, especially with year-end valuations approaching that could reset some private company valuations.

We’re seeing these trends unfold across most global markets amid plenty of pent up demand and dry powder. Together, they suggest secondary market activity is primed to accelerate in the months and years ahead.

Jefferies’s Private Capital Advisory team features 60 dedicated professions working alongside our sector bankers and regional coverage teams. In 2022, we advised institutional investors and general partners on over $20 billion of private equity secondary transaction value.

Overtime’s Zach Weiner on The Changing Space of Sports Media for Gen Z

Speaking at Jefferies’ 2023 Private Internet Conference, Zach Weiner, Co-founder and President of Overtime, emphasized the need for entertainment companies to be agile, responsive, and in tune with the evolving habits of modern consumers.

For decades, large incumbents dominated the sports and media landscape, commanding consumer attention with traditional content and outreach strategies. As Millennial and Generation Z audiences came of age, legacy media struggled to keep pace. Their tried-and-true tactics failed to engage younger audiences, whose tastes were short-form and colloquial.

“When we started Overtime, this new 13- to 35-year-old demographic was our focus,” Weiner said. “By adopting the right voice and leveraging the right platforms, we could create content that really resonates with this next-generation audience.”

Weiner stressed that prosperity lies in understanding the digital space, adapting to audiences’ evolving interests, and constantly innovating to engage viewers. This audience-first strategy was instrumental to Overtime’s early success, and it continues to power the company’s growth today, with more than 80 million fans across platforms.

When it comes to engaging target audiences, Weiner cautioned against trying to cater to everyone. Success means finding consumers whose specific needs and interests you can meet. It is challenging to deliver compelling content and compete with major incumbents as a generalist.

“Do I want the 55-year-old sports fan to watch our basketball league? Sure – I’m not against it,” Weiner said. “But at the end of the day, by focusing more narrowly on Gen Z and Millennials, we can deliver content that really interests them.”

Weiner also spoke about the challenging environment for consumer internet businesses, and how those challenges informed his approach to monetization and business development as a young entrepreneur.

“Among founders, I’ve noticed two extremes: those focused on running the business their way, and those focused solely on revenue,” Weiner shared. “Like most things in life, you want to land somewhere in between. Do what you think is right for the business but remember the importance of revenue generation and cost conservation, too.”

With Overtime, Weiner is always exploring avenues for revenue diversification. The company’s path to profitability began with advertising and e-commerce through their media business. Once Overtime’s audience was well established, Weiner pursued new and larger opportunities for profit: live rights. Capitalizing on the media company’s intellectual property, Weiner launched Overtime Elite and OT7, two new professional sports leagues for the next generation of athletes.

“We realized that if we can make young people care about something, let’s make them care about leagues,” Weiner said. “The media company provides this base to launch the IP, which in turn creates much more economic value.”

Overtime Elite (OTE) achieved a significant breakthrough in the 2023 NBA Draft. Two Overtime Elite stars, twins Ausar and Amen Thompson, were considered among the draft’s best prospects, both taken in the top five picks. Two other OTE prospects received two-way contracts, with the New York Knicks and Milwaukee Bucks, respectively.

The launch of these spin-off leagues expanded opportunities for monetization, including a media rights deal with Amazon Prime, enhanced brand partnerships with companies such as State Farm and Gatorade, and an increase in merchandising opportunities. This balanced strategy — prioritizing the audience and core competencies while pursuing profitability — became the catalyst for Overtime’s growth.

Pacaso’s Spencer Rascoff on the Revitalized Experience Economy and More Pandemic Shifts

At Jefferies’ 2023 Private Internet Conference, serial entrepreneur Spencer Rascoff joined Cameron Lester, Global Co-Head of Technology, Media, and Telecom Investment Banking at Jefferies, to discuss shifts in the consumer landscape.

Rascoff – co-founder of Zillow, Hotwire, and most recently, Pacaso – shared insight into the booming Los Angeles startup scene, post-COVID transformations in consumer behavior, and the thriving market for second homes.

Rascoff expressed enthusiasm for LA’s surging startup ecosystem, where his latest digital real estate venture, Pacaso, is based. He highlighted the city’s unique convergence of media, entertainment, technology, and digital creators – all fueling a swell of local entrepreneurship.

“Post-COVID, we have a lot more latitude in where we live,” Rascoff said. “People are untethered from their homes in San Francisco, Seattle, or New York – places they had to live before the pandemic. Now, many of them are choosing LA, and the city is booming.”

Testra, in its second annual ‘Tech’s Great Migration’ report, found that Los Angeles now hosts more than 3,800 venture-backed companies, surpassed only by the Bay Area and New York. Since the pandemic, LA’s startup scene has emerged as one of the nation’s fastest growing.

The pandemic’s impact extends beyond lifestyle choices. COVID also triggered profound shifts in consumer behavior. Rascoff cited the revitalization of the ‘experience economy’ as among the most impactful and enduring changes. Drawing analogies to other global incidents of historic scale, he noted how such events tend to cultivate a ‘live for the moment’ mentality among consumers.

“Online travel companies were left for dead during COVID,” Rascoff observed. “Now, they’re just booming. Travel is going nuts for exactly this reason: people want to live again.”

Tourist arrivals worldwide in 2023 are projected to reach up to 95% of pre-pandemic levels, a significant increase from the 63% in 2022, according to data from the UN’s World Tourism Organization. This resurgence is mirrored in the rallying share prices of travel companies, which struggled during the pandemic.

Rascoff cited his own company, Pacaso, as another example of this shift. The platform facilitates fractional ownership of second homes, allowing buyers to invest in a share ranging from 1/8 to 1/2. In just their third year of operation, Pacaso crossed $1 billion in total revenue, as more people realized their long-held dream of owning a second home.

Turning to the broader housing market, Rascoff acknowledged that the sharp rise in mortgage rates from 2% to 7% has affected real estate transactions, with fewer this year than the last couple of years. However, he expects the second home market, where Pacaso operates, to see less impact.

“Second home markets tend to be more expensive, and buyers use more cash and fewer mortgages. They’re less susceptible to rising interest rates because the rest of their balance sheet is much stronger than your average consumer,” Rascoff explained. He added, “Second home markets appreciate faster than primary markets and are better insulated during downturns due to the low number of distressed sellers.”

Rascoff’s perspectives underscore the boundless potential of the ‘experience economy’ and the opportunities it offers to innovative ventures like Pacaso. As the pandemic continues to reshape lifestyle and consumption choices, businesses and regions that can tap into the consumers’ desire to ‘live in the moment’ are poised for substantial growth.