Pass the Guac, Do You Mind If We Double Dip This Chip?

It is common for highly levered sponsor-backed companies with liquidity needs and/or upcoming maturities to engage in liability management exercises, which often includes creating a new priming tranche of secured debt (an “Uptier”) or transferring assets out of the secured collateral package (a “Drop Down”).

In recent months, a new liability management transaction structure, (the “Double Dip”), has emerged and quickly gained traction as a more “creditor friendly” alternative to the traditional tools in the liability management playbook.

A Double Dip transaction is structured to use available secured debt capacity to provide a single new money loan with two separate secured claims against the credit group’s assets. The Double Dip loan receives claims from both a guarantee (the 1st dip) and an inter-company loan (the 2nd dip). As an example, lenders who provide a $100 million new money loan in a Double Dip transaction could have $200 million in total secured claims in a potential future restructuring. While lender recovery will be limited to the amount owed on the loan, the additional claims provide significant credit enhancement for lenders, particularly in distressed situations where there is a risk of below par recovery.

A Double Dip provides many benefits for companies, sponsors and creditors over the traditional liability management tools:

- Allows company to raise new capital which might not otherwise be available.

- Lower cost of capital than would be available for pari secured debt.

- Not required to be implemented in a non-pro rata fashion.

- In contrast to an Uptier, the new loan does not prime existing secured creditors; instead secured liens are diluted equally by the pari secured claims from the new loan.

- In contrast to a Drop Down, no assets are transferred away from the existing secured creditors’ collateral package.

A company’s ability to implement a Double Dip largely depends on a company having sufficient secured debt capacity and flexibility on how pari debt capacity can be used. Sponsor-backed companies that have employed Double Dips as part of liability management transactions since May ’23 include At Home Group, Sabre, Trinseo, and Wheel Pros. While there is precedent for Double Dip claims being asserted in bankruptcy court (including in General Motors, Lehman, LatAm Airlines, Delta and others) per CreditSights, the recent wave of intentionally structured Double Dips has not yet been tested in bankruptcy court. In the meantime, companies, sponsors and creditors should incorporate the Double Dip structure into their liability management playbooks.

Actionable Ideas: Roll Up Strategies in a Subdued M&A Environment

With a mix of economic and market headwinds prevailing against M&A activity in 2022 and 2023, financial sponsors’ exits have been expectedly muted. As such, many sponsors have resorted to fundamental buy and build strategies to create value over a longer time period. While the roll-up strategy is a time-tested approach for many sponsors, the low interest rate environment that prevailed from 2008 until early 2022 was an accelerant for it.

Sponsors are active across a range of sectors where they can find an acquisition platform to make attractive strategic add-on investments, ranging from broadly defined physician/dentist/veterinarian practices, and ancillary support services, to HVAC service providers and insurance brokerage and wealth management companies. Despite the increasing interest rate environment, sponsors can still create significant value by leveraging a platform’s infrastructure, coupled with entry/exit multiple arbitrage for add-on acquisitions. Platforms that have seen differentiated success on exit include those that enjoy organic growth coupled with a robust inorganic expansion strategy. While rising interest rates have had some negative impact on the economics of add-on acquisitions, the strategy is still appealing thanks to the potential of economies of scale to enhance margins and the ability to create regional powerhouses in fragmented, but large industry sectors. In addition, we have observed an increase in financial sponsors bringing in partners for substantial strategic minority stakes to both help fuel continued growth through acquisition and to set a valuation benchmark. Recent examples of successful and ongoing strategic roll ups include:

- Goldman Sachs Asset Management’s investment of over $1.0 billion (through both equity and subordinated debt) in World Insurance Associates (“World”), an insurance brokerage firm, previously owned by Charlesbank Capital Partners. Charlesbank first invested in World in 2020 and since then is rumored to have completed over 100 add-on acquisitions. Goldman and Charlesbank will partner as co-lead equity investors in World with Goldman’s investment slated to support a continued acquisition strategy as well as organic growth expansion.

- In April 2019, LGP acquired The Wrench Group, a leading provider of essential home maintenance and repair services, specializing in HVAC, plumbing, electrical, and water quality services. Under LGP’s ownership, Wrench completed 14 acquisitions, which led to substantial multiple expansion and an over 3.5x increase in EBITDA. In late 2022, TSG Consumer Partners and Oak Hill Capital made a significant minority investment in Wrench with the intention of continuing the external expansion strategy.

- In 2019, Ares Management and OMERS Private Equity sold National Veterinary Associates (“NAV”) to JAB Investors. At the time, NAV was one of the largest veterinarian and pet care services globally with over 670 companion animal veterinarian hospitals and 70 pet resorts across 43 states. Under JAB’s ownership, NAV has executed three material acquisitions and over 100 bolt-on acquisitions resulting in a nearly 3x increase in EBITDA.

Convertible Debt: Low-Cost Debt Capital in a High Interest Rate Environment

The convertible debt new issue market in 2023 has been frequented by companies seeking a lower cash interest alternative to what is being offered in the high yield and investment grade debt markets. Historically, convertible debt has been a common financing tool for high-growth businesses because it offers an attractive cost of capital relative to debt or equity, no financial covenants and an investor base supportive of general corporate purpose use of proceeds. About two-thirds of convertible transactions annually from 2020 to 2022 used proceeds for general corporate purposes or for M&A financing.

This trend has shifted in 2023 due to the high interest rate environment, with over two-thirds of issuers accessing the convertible market to refinance an upcoming debt maturity. To put the interest savings into perspective, the average coupon across the 40 refinancing transactions this year was 3%, which is significantly lower than the yield on Treasuries. This refinancing trend is being driven by a wider breadth of sectors and has also led to a significant increase in investment grade issuance. This year, the industrial, energy and real estate sectors account for 45% of issuance and investment grade has comprised 40% of total, whereas in 2021, the technology sector represented 52% of issuance volume and investment grade issuance comprised 6% of total. The upshot is that companies evaluating a refinancing or raising capital for general corporate purposes should consider convertible debt, given the expectations that interest rates will remain elevated, combined with a stable equity market backdrop and a broad community of convertible-dedicated investors looking for new investment opportunities.

Performing Issuers Should Take Advantage of the Current Market Window with Opportunistic Transactions

- Due to strong market fundamentals and lack of historical new issue supply, companies should take advantage of the market window through refinancing, repricing, and dividend transactions.

- As of September 14th, YTD dividend volume was up 126% from the same period the year prior, from $5.5 billion to $12.3 billion, but this is still low compared to historical levels.

- 52.5% of loans were bid at 99 or higher, which further supports additional opportunistic transactions getting done on a fungible basis.

- Through September 15th, 15 of the 19 deals that have priced in the month to date period cleared tight of talk, with four of those transactions being opportunistic repricings.

- Jefferies was Left Lead Arranger on CPM Holdings’ $1.215 billion First Lien Term loan, with proceeds from the deal used to refinancing existing debt due in 2025 and to fund a distribution to shareholders.

- Term Loan priced at S+450, 0.50% floor and 98.5 OID.

- Due to oversubscription of the order book, the First Lien Term Loan was upsized by $85 million to $1.215 billion, the margin was tightened from S+475 to S+450 and OID was tightened from 98.0 to 98.5.

- Jefferies was Left Lead Arranger on Lakeshore Learning’s $150 million First Lien Term Loan to fund a dividend to the sponsor.

- Lakeshore is a leading developer, distributor and retailer of educational products and classroom furniture, primarily serving the Early Childhood Education and K-5 markets.

- The dividend was met with robust lender demand and was upsized by $50 million in market.

- Pricing on the Fungible First Lien Term Loan is S+CSA+350 with a 0.50% floor.

- Jefferies was Left Lead Arranger on Nomad Foods’ repricing of their $700 million First Lien Term Loan.

- Nomad Foods operates across 22 countries in Europe and is the leading Western European player in savory frozen food, and the third largest branded savory frozen food company in the world.

- The loan repriced at S+300 from S+370, allowing the company to take advantage of the strong market window and lower their weighted average cost of debt.

- Jefferies acted as Left Lead Bookrunner on the recently completed $165 million add-on for Heartland Dental to its existing 10.5% Senior Secured Notes.

- The company was able to upsize the tack-on quantum from $100 million due to heavy oversubscription.

- Heartland Dental took advantage of the strong market and cleaned up their capital structure by repaying the amount outstanding under their stub term loan due in 2025, with the remainder of the proceeds allocated as cash to the balance sheet for general corporate purposes.

Jefferies Is Open for New LBO Underwrites

- Amid an uptick in new-issue activity, Jefferies has been the most active investment bank in underwriting new LBOs. We are an arranger on 6 of the 7 LBOs expected to come in September / October, and are Left Lead on 3 of these transactions.

- Market conditions for broadly syndicated loans began improving over the summer, creating an incredibly receptive environment for new LBO financings.

- As of September 20, the loan index was at 95.91 bid, the highest level since May 2022, indicating the strength of the new market and demand for new volume.

- New LBO and M&A launches for the first half of September totaled $10.1 billion, which was the most for any month since June 2022 ($13.1 billion).

- Private equity firms should look to the syndicated market to finance new LBOs.

- The strength of the syndicated loan market will allow issuers to achieve improved pricing and a more flexible covenant package compared to offerings in the private credit market.

- According to KBRA data, the broadly syndicated market also offers pricing ~200 bps tighter than the private credit market, offering significant cash interest savings for companies.

- Jefferies is Left Lead Arranger on Simon & Schuster’s $1.62 billion LBO by KKR.

- Pricing on the $1.1 billion First Lien Term Loan is S+400, with a 0.00% floor issued at 99.0 OID.

- The Margin was tightened from S+425 to S+400 and OID was tightened from 98.5 to 99.0.

- Jefferies was Joint Lead Arranger on Syneos Health’s LBO by Elliot, Patient Square, and Veritas.

- Syneos Health is a leading global contract research organization providing clinical development and commercial services to biopharmaceutical and medical device companies across the product development lifecycle.

- Pricing on the $2.7 billion First Lien Term Loan is S+400 with a 0.00% floor issued at 98.5, while the $1.0 billion Senior Secured Notes priced at 9.000%.

- The syndication was a blowout with the term loan pricing tightening 50 bps from the S+450 price talk and the OID tightening from 97.0 to 98.5.

- Due to strong demand and oversubscription, $700 million was shifted from the Bond to the Term Loan.

Weigh to Go: Assessing the Wider Implications of a Slimmer Society

The public enthusiasm for GLP-1 use as a weight loss treatment has yet to lose steam. Our healthcare teams forecast this could be a >$100B global market, with uptake rapidly rising through the end of the decade. Jefferies’ Global Research teams detail the possible implications for a slimmer consumer, with sticky behavioral changes, across 7 sectors. They identify ~80 companies that could benefit and ~80 that may find this a structural headwind.

A Revolution 20 Years in the Making. Glucagon-like peptide-1 receptor agonists (or GLP-1s) were originally approved for use in 2005 as a treatment for Type 2 diabetes. By increasing the amount of insulin secreted by the pancreas (which lowers blood sugar) and suppressing the release of glucagon (which causes the liver to produce sugars), these drugs have proven to help manage Type 2 diabetes and functionally reduce appetites. The potential weight loss implications were not lost on the medical community. However, it wasn’t until semaglutide was approved in 2017, with an indication for weight loss specifically approved in 2021, and subsequent study showing CV risk improvement, that it properly captured the attention of the masses. Meanwhile, despite initial stock reactions suggesting these drugs will wipe out obesity and Type 2 diabetes, our teams would point out a few items. First, GLP-1s remain under-penetrated despite being available for ~20Y. Second, bringing patients down to healthy weights could actually increase eligibility for other procedures. We summarize the thoughts of our respective healthcare teams herein.

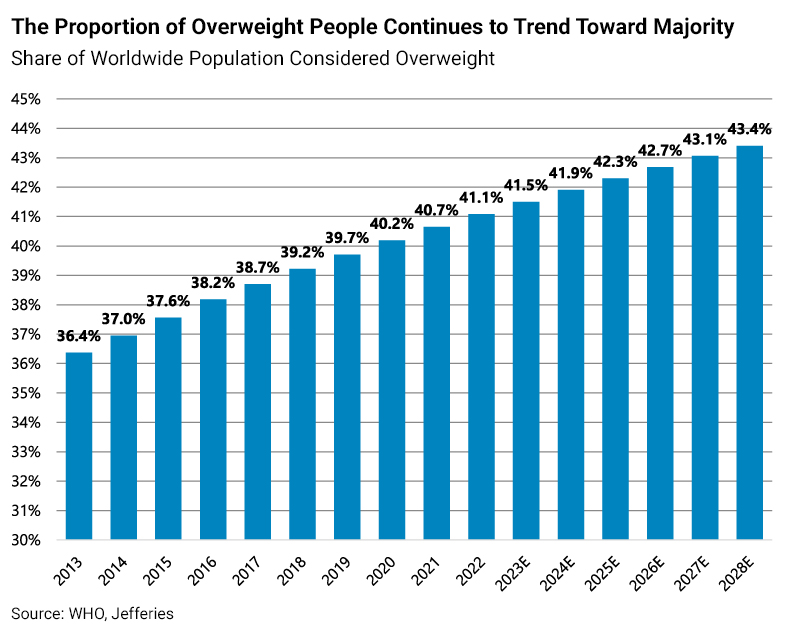

A Designer (Clothes) Drug. The advent of semaglutide brought the first FDA-approved weight management drug to market. Looking further out, the prospect of oral drugs (instead of injectables) and payor coverage suggest a large potential market and significant uptake. Given the WHO estimates that >40% of global adults are overweight, widespread adoption could cause substantial changes in consumption patterns. As our food & restaurant teams showed via their survey work, consumers taking these GLP-1s indicate they are filling their grocery basket with healthier items. We suspect the implications don’t just stop at the calorie level.

Healthier Choices Leading to Healthier Fundamentals. Starting with the consumer sector, our teams call out potential tailwinds for apparel retailers — to revamp closets — but particularly those with athletic offerings. Similarly, health & wellness products could see a boost. In addition, beauty cos could see a tailwind as more consumers look to combat facial changes. Within financials, although better health could lead to lower premiums for insurance cos, delayed mortality should more than offset that through greater investment returns. Meanwhile, lighter load factors could lead to better fuel efficiency for airlines, and increased focus on wellbeing could mean more sales of fitness related devices and the chips that go into them.

Belt-tightening from Tighter Belts. Restaurants and certain food products appear to be some of the most at-risk industries as we look longer term. The teams’ survey work suggests this will impact certain beverage cos as well, particularly on the alcohol side. Downstream from them, we anticipate this could have negative implications for the packaging space & food retailers, as volume trends for certain products flatten or decline. Agriculture-levered firms, such as farm equipment, may also contend with mix headwinds. And while many consumers are currently able to at least partially offset the cost of the drugs, they remain quite expensive, which could put a damper on bigger ticket purchases. Our teams specifically call out items like furniture and travel spend.

Links to Relevant Research:

Prime Services C-Suite Newsletter – September 2023

Back to School on Regulations and Research Software

Our monthly newsletter for multi-hat-wearing C-suite leaders covers the latest and greatest insights across the hedge fund industry.

An Expanding Overton Window: Ten Predictions for the Future of Climate Investing

Investors focusing on climate change face a central paradox.

On the one hand, excitement around the energy transition is skyrocketing. Over $70 trillion in global capital is aligned with the transition to net-zero by 2050, a sevenfold increase since the 2015 Paris Accords.

Despite this, the world’s dependence on fossil fuels hasn’t waned. Demand for coal, gas, and oil hit record highs in 2022. From 2000 to 2022, the world only achieved a 4% reduction in carbon dependency, with fossil fuels supplying 82% of primary energy.

Our sluggish energy transition raises a pivotal question: how must global capital allocation toward climate change evolve?

We believe the ‘Investor Overton Window’ on climate change must expand significantly in the near future, as the need for more immediate climate action grows.

Here, we outline ten predictions for investors as short- to medium-term decarbonization expectations shift.

- Climate Adaptation Takes Center Stage

- Carbon Removal Becomes a Multibillion Dollar Industry

- Geoengineering Becomes Mainstream

- Carbon Prices Rapidly Expand

- The US Energy Transition Receives Bipartisan Support

- Solar & Wind Continue Along S-Curve Growth

- Greater Importance Is Given to Breakthrough Tech

- There Is a Global ‘Marshall Plan’ for Grids

- China & India Go from Laggards to Leaders

- GDP Ceases to Be a Universal Measure of National Progress

(1) Climate Adaptation Takes Center Stage

Mitigation efforts have attracted investment for more than a decade. Now, attention is shifting towards climate adaptation, with growing bipartisan support in the US.

The Biden Administration released climate adaptation and resilience plans across 23 agencies of the federal government. Meanwhile, House Republicans are strategizing to “protect American lives and livelihoods by deploying smart resilience and mitigation investments in conservation and adaptation solutions.”

What characterizes our new focus on climate adaptation?

Emerging Research

The Global Commission on Adaptation Report highlights eight key areas for climate adaptation investment: (1) Early Warning Systems, (2) Climate Resilient Infrastructure, (3) Dryland Agricultural Crop Production, (4) Mangrove Protection, (5) Water Infrastructure, Destination, and More, (6) Insurance and Reinsurance, (7) Heat Stress, (8) Urban Planning and Adaptation.

Infrastructure Investments

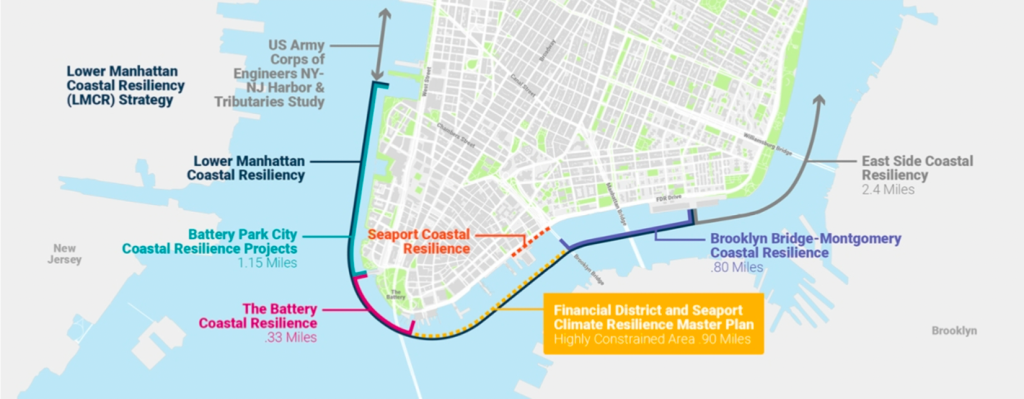

A $53 billion proposal from the US Army Corps of Engineers aims to bolster coastal ecosystem resilience by building breakwaters, seawalls, and levees. This infrastructure overhaul could significantly reduce future flood risks and economic costs related to storm events.

Insurance Concerns

The US has sustained 363 weather and climate disasters since 1980, totaling over $2.59 trillion in damages. These events are leading some private insurers to retreat from high-risk areas. State Farm and Allstate confirmed they would stop issuing new home insurance policies in California, and Farmers and AAA have ended many homeowner insurance policies in Florida. This retreat by private insurers places even more pressure on the federal government to provide relief.

Exhibit 1 – Major metropolitan areas, including NYC, are developing adaptation strategies.

Source: Lower Manhattan Climate Resilience Study, NYC Economic Development Corporation

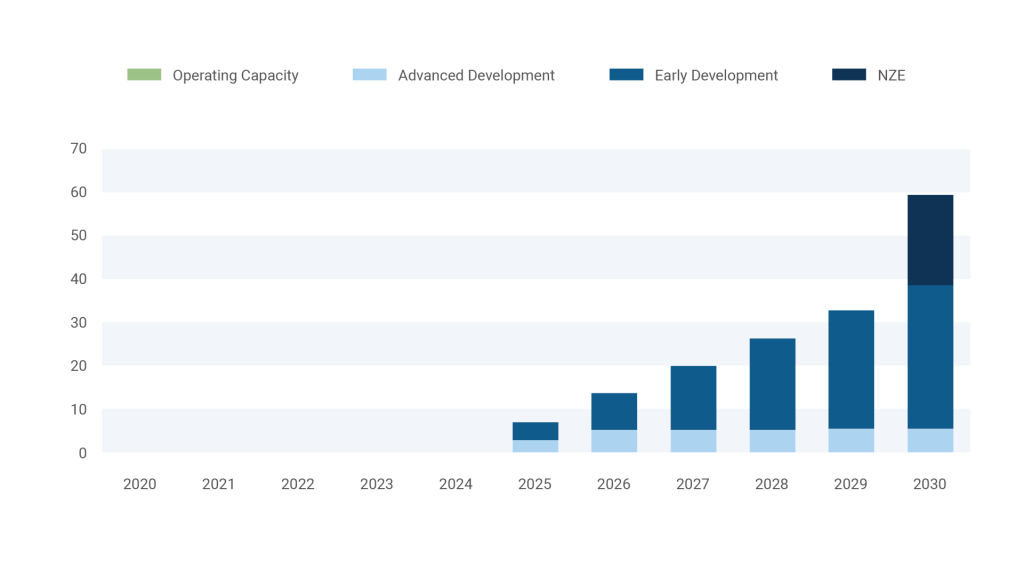

(2) Carbon Removal Becomes a Multibillion Dollar Industry

The carbon removal industry is quickly growing. The International Panel on Climate Change (IPCC) says carbon dioxide removal (CDR) is required to achieve global net-zero carbon and greenhouse gas emission goals.

Here’s how the industry is gaining momentum:

Government Support

The US Bipartisan Infrastructure Law earmarked $3.5 billion for the establishment of four direct air capture hubs. The Department of Energy allocated an additional $1.2 billion for projects like Battelle, Climeworks, and others, set to create thousands of jobs while removing 2 million metric tons of CO2 from the atmosphere annually.

These investments reflect a robust and growing governmental commitment to advancing carbon removal initiatives.

Global Competition

Elon Musk’s foundation funded a $100 million competition, XPRIZE Carbon Removal, that invites companies around the world to create and demonstrate CDR solutions.

Teams must demonstrate a working solution at a scale of at least 1,000 tons removed per year, model their costs at a scale of 1 million tons per year, and show a pathway to achieving a scale of gigatons per year in the future.

Corporate Commitment

Frontier Climate’s ambitious initiative, backed by tech industry giants including Stripe and Alphabet, pledges to purchase over $1 billion in permanent carbon removal between 2022 and 2030. Across the market, there is a growing acceptance of CDR technologies’ impact, and private enterprises are working hard to overcome roadblocks to scalability.

Exhibit 2 – Net zero scenarios in modeling, by both the IEA and IPCC, rely significantly on carbon removal.

Source: Jefferies, IEA

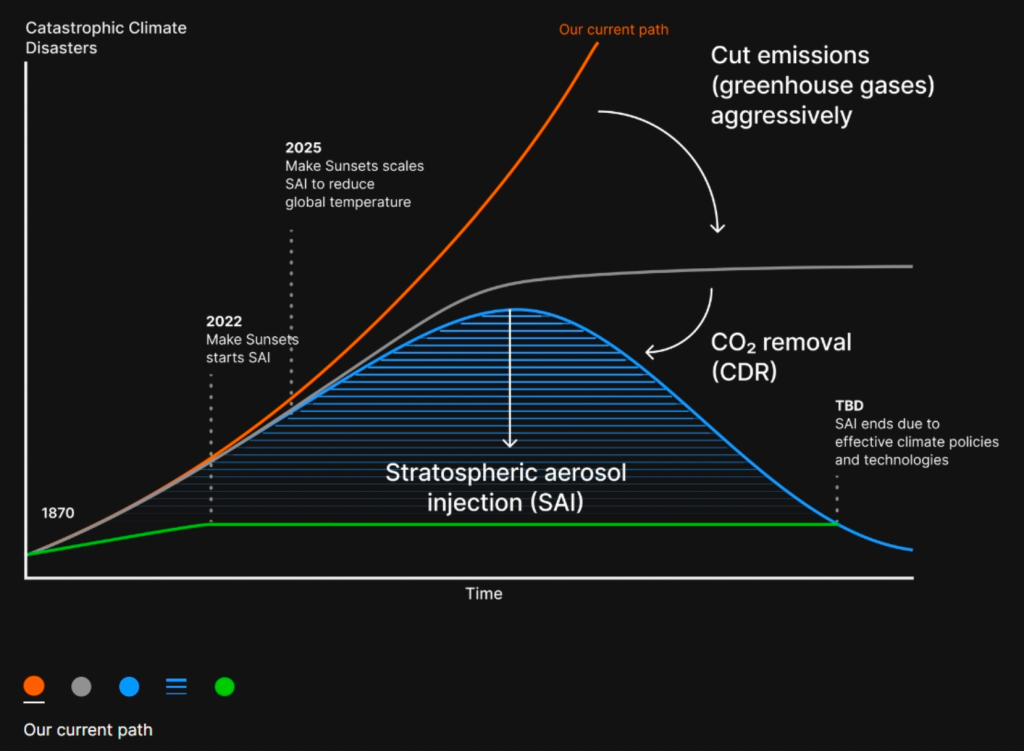

(3) Geoengineering Becomes Mainstream

Geoengineering, once a scientific taboo, is now gaining traction globally. Both governments and private companies are exploring it as a viable route for climate intervention.

US Government Initiatives

The 2022 federal Appropriations Act, signed by President Biden, directs his Office of Science and Technology Policy to develop a cross-agency group to coordinate research on solar geoengineering. This group will coordinate with NASA, the National Oceanic and Atmospheric Administration (NOAA), and the Department of Energy.

European Commission’s Stand

The European Commission is calling for international talks on the potential dangers and governance of geoengineering, saying such interventions pose ‘unacceptable’ risks. The EU maintains a stance against developing or testing solar radiation modification, but it will fund two projects to assess such techniques.

China’s Program

In 2020, China announced plans to significantly expand an experimental weather modification program. The ambitious project aims to cover an area of over 5.5 million square kilometers.

Private Sector Involvement

Companies are also showing interest in geoengineering. Make Sunsets, backed by venture capitalist Tim Draper, is one such example. The company aims to send balloons filled with sulfuric dioxide into the atmosphere, in order to cool the planet and combat climate change.

Exhibit 3 – Stratospheric Aerosol Injection: an effective solution to buy time for other efforts to take hold.

Source: Make Sunsets

(4) Carbon Prices Rapidly Expand

The IPCC has expressed high confidence that the price of carbon increases significantly if a higher level of stringency is pursued. There’s a substantial variation in carbon prices across different models and scenarios.

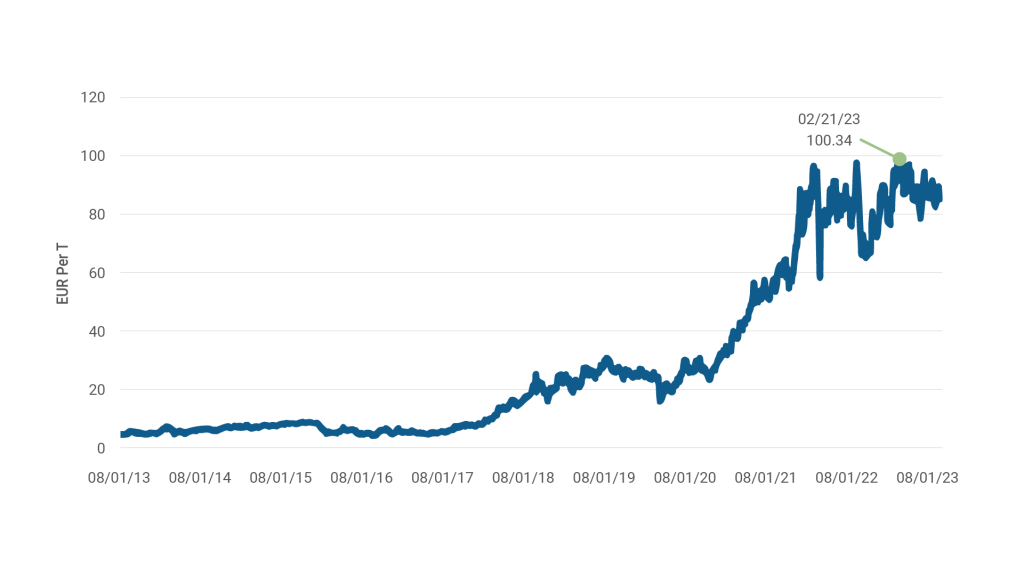

The carbon market price in the EU’s ETS was 4.33 EUR/t in 2013. By August 29, 2023, it soared to 85.68 EUR/t. Within this period, the peak was 100.34 EUR/t on February 21, 2023.

Comparatively, the UK’s ETS was trading at 48.03 GBP/t on August 29, 2023.

we could point to needing a c.2.5x increase in carbon prices to achieve many goals they

It’s crucial to note that even these elevated prices, among the world’s highest, are still insufficient for meeting the 2030 and 2050 climate goals. Nonetheless, they demonstrate that economies can withstand high carbon prices.

These price movements are a positive indicator, pointing toward a growing global commitment to more stringent climate mitigation measures.

Exhibit 4 – EU ETS Carbon Market Price (8/1/13 – 8/9/23)

Source: FactSet, Jefferies

(5) The US Energy Transition Receives Bipartisan Support

Despite the political noise around ESG, the US energy debate is evolving. A bipartisan consensus is emerging around the energy transition, driving policies that lay the groundwork for a net-zero America.

Recent legislation includes:

Inflation Reduction Act (IRA)

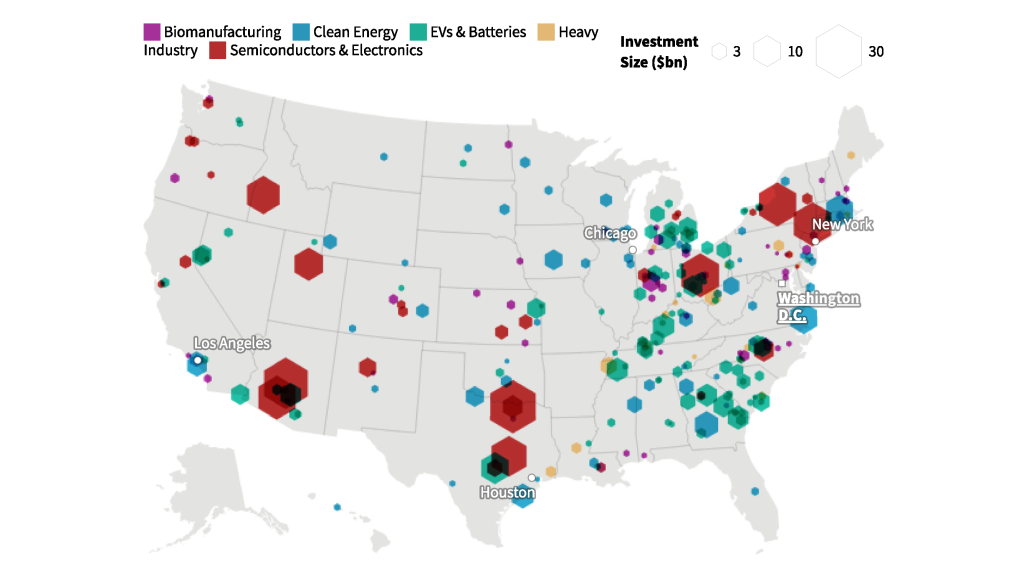

The most significant bill to date. One year into the IRA, $278 billion has been announced for clean energy investment, resulting in 272 new projects and the potential creation of 170,000 new jobs as reported by the Rocky Mountain Institute.

Farm Bill

A forthcoming $1.5 trillion Farm Bill could also significantly impact agriculture and food systems, further showcasing bipartisan support for a cleaner and more sustainable future.

Bipartisan Infrastructure Bill and CHIPS Act

Both pieces of legislation include investments in decarbonization.

The Bipartisan Infrastructure Bill allocates $7.5 billion towards a national network of 500,000 electric vehicle chargers; $50 billion to project against droughts, floods, and wildfires; $65 billion for clean energy and grid-related investments; $55 billion to expand access to clean drinking water; and $21 billion to clean up Superfund and brownfield sites and cap orphaned oil and gas wells.

The CHIPS Act is estimated to direct $67 billion toward the growth of zero-carbon industries.

Additional Efforts from the Biden Administration

An additional $12 billion has been made available to automakers and suppliers for expanding plants to produce electric and other advanced vehicles. The initiative has not faced Republican opposition.

Exhibit 5 – Clean energy investments post policy announcements since 2021.

Source: RMI, White House

(6) Solar & Wind Continue Along S-Curve Growth

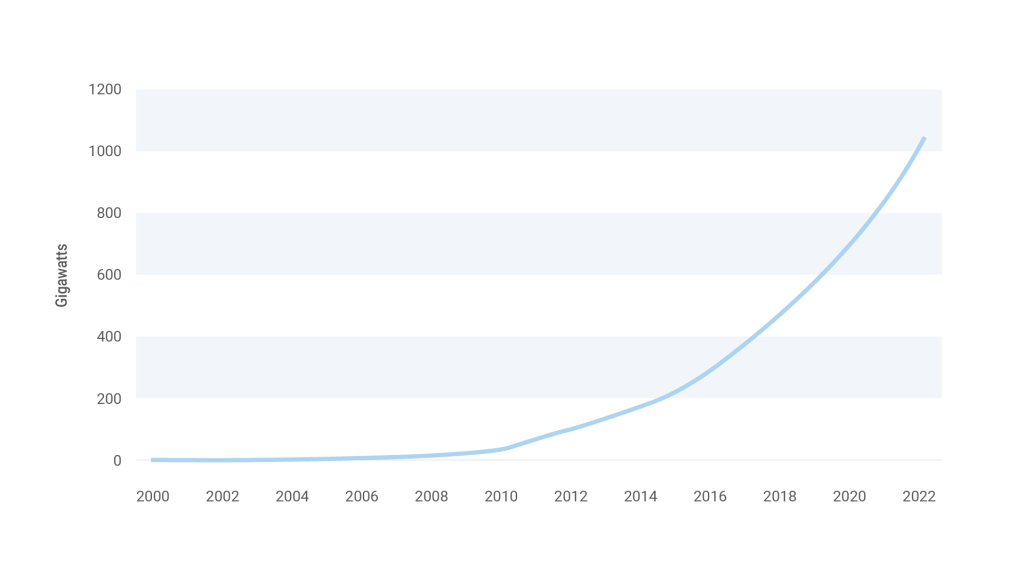

Over the last decade, advancements in solar, wind, and electric vehicle battery technologies have vastly outperformed prior assumptions around market penetration.

The costs for these renewable technologies have followed a consistent downward trajectory, allowing them to become more accessible and efficient over time. The solutions have followed a promising S-curve of growth and adoption.

This cost reduction, paired with significant technological enhancements, paved the way for record deployments of solutions once considered niche and uncommercial by investors. Contrary to the expectations of many, these solutions have transcended the barriers that often lead to linear adoption and slow growth.

Looking ahead to 2030, we expect continued exponential growth for these established renewable energy solutions. Continued policy support, various industrial policies, and ongoing technological breakthroughs will all contribute to additional growth, with numerous opportunities for investors.

Exhibit 6 – Global solar PV capacity is set to almost 3x between 2022-2027, showing clear s-curve characteristics.

Source: IRENA, Jefferies

(7) Greater Importance Is Given to Breakthrough Tech

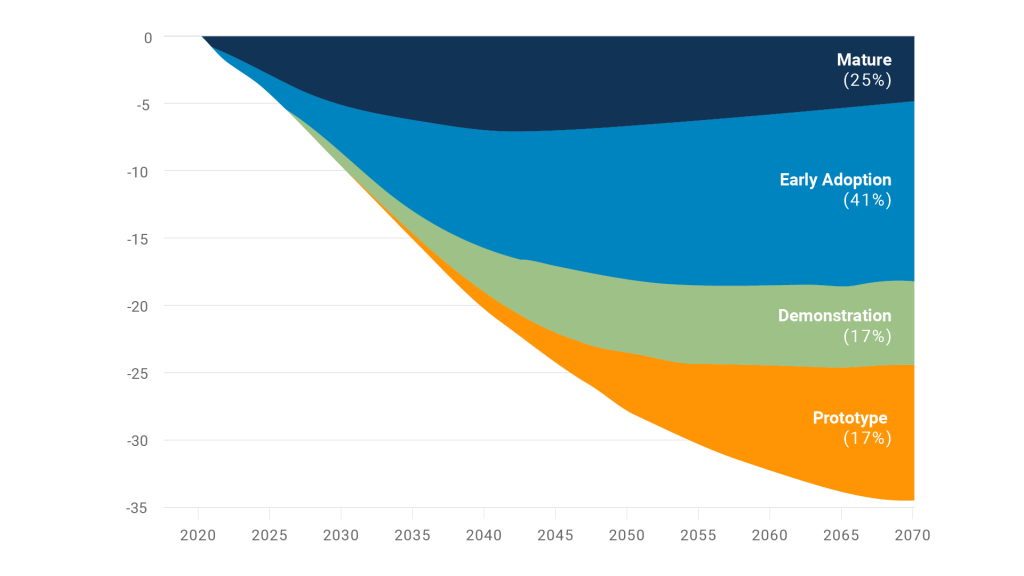

The International Energy Agency (IEA) reports that over 75% of the cumulative emissions reductions needed for its 2050 net-zero scenario are not yet commercially available. In fact, 35% are still in the prototype or demonstration phase.

Advancements in renewables, enhanced battery range, and energy efficiency have successfully reduced emissions in sectors like road generation and power generation – but significant emission reductions are still needed in more difficult sectors. These include shipping, trucks, cement, and steel, which require the use of technologies not currently available at scale.

It is clear that without a major acceleration in breakthrough solutions, decarbonization targets will not be achieved.

We believe investors should direct capital towards seemingly unrealistic solutions today, such as nuclear fusion and small modular reactors. Some of these have the potential to be part of the range of options available through 2050.

This proactive approach will allow investors to make informed predictions about which technologies are likely to become commercial and within what timeframe, thus supporting the push toward global decarbonization targets. A focus on these areas would also improve underlying technologies, reduce costs, and accelerate deployment.

Exhibit 7 – 75% of the emissions reductions required in a net-zero scneario are from technologies that are not commercial today.

Source: IEA, Jefferies

(8) There Is A Global ‘Marshall Plan’ for Grids

The importance of power grids in the decarbonization of the energy system is becoming increasingly apparent. Electricity accounts for approximately 20% of final energy consumption globally. As more end-users, such as electric vehicles and buildings, opt for electrification, the demand for power is predicted to more than double in the US and Europe. This surge will significantly burden the existing grid infrastructure.

Challenges to overcome include:

Lead Times for New Transmission Lines

In the US, over 10,000 projects (around 1,400 GW) of generation capacity and 680 GW of storage await interconnection. In the UK, over 600 transmission projects are waiting for grid connection, with some delayed for up to 13 years.

Reasons for delays include complex permitting processes, involvement from multiple stakeholders, and technical challenges.

Grid Capacity

Grid capacity constraints are a major obstacle to enhancing power grids. Issues like limitations in authorized transmission capacity, transmission outages, and load variations are pressing concerns.

Flexibility

Modern grids must offer solid flexible generation as clean energy sources integrate. Today’s fossil sources, such as gas peaker plants, provide this flexibility. Grids of tomorrow will need to combine storage and smart demand response systems to maintain flexibility.

Regional Interconnections

Improving cross-border electricity interconnections is crucial for decarbonizing power systems.

The UK currently depends on about 8GW of interconnected power from mainland Europe. This interconnection needs to improve in both the UK and Europe. In the US, the lack of a unified power grid or federal authority for infrastructure approval is a significant hurdle.

Addressing these challenges head-on is vital for upgrading the grid infrastructure in the developed world to meet growing demand and support the global decarbonization effort.

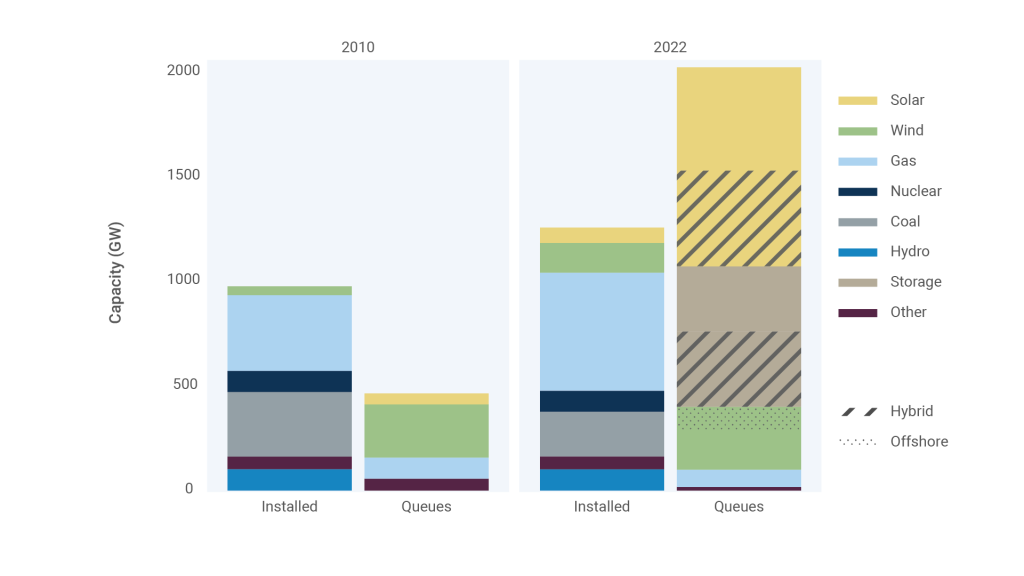

Exhibit 8 – The total generation and storage capacity in active queues in the US has grown 4x in the last decade.

Source: Lawrence Berkeley National Lab, Jefferies

(9) China & India Go From Laggards to Leaders

There is a growing global consensus that the key to a net zero world resides in decisions made by emerging economies. All projected growth in energy demand over the next 25 years is concentrated in these countries. Among them, China and India play especially critical roles.

China’s Role

China is facing a unique energy duality. It is both the leader in carbon emissions and renewable energy development.

Despite accounting for a third of global CO2 emissions, China is the world’s leading producer of wind and solar power, ranking first in intellectual property and competitiveness in offshore wind power and advanced solar technology for the past decade.

Since 2015, China’s spending on low-carbon research and development has surged by 70%, per the IEA. The nation recently pledged to peak its CO2 emissions before 2030 and achieve carbon neutrality by 2060. No national pledge is as significant as China’s. Early indicators suggest the country is on track to achieve its first goal before 2030.

While China deserves recognition for these efforts, its coal expenditure continues to run rampant. The country’s pace of approval for new coal plants doubled to its highest levels in 2016 according to BloombergNEF data, countering its clean energy strides.

India’s Role

In contrast, India’s per capita energy use and emissions are below half the global average. The country’s renewable energy expansion is propelled by solar energy, with a fivefold increase in installed solar power over the past decade. India’s share of the global solar market is anticipated to jump from under 10% to around 30% by 2040.

India’s coal consumption remains high, comprising 55% of its energy needs, but the nation’s clean energy efforts go beyond solar. As the 4th largest listed equity market globally, India’s emerging status as a hub for low carbon investment cannot be overlooked.

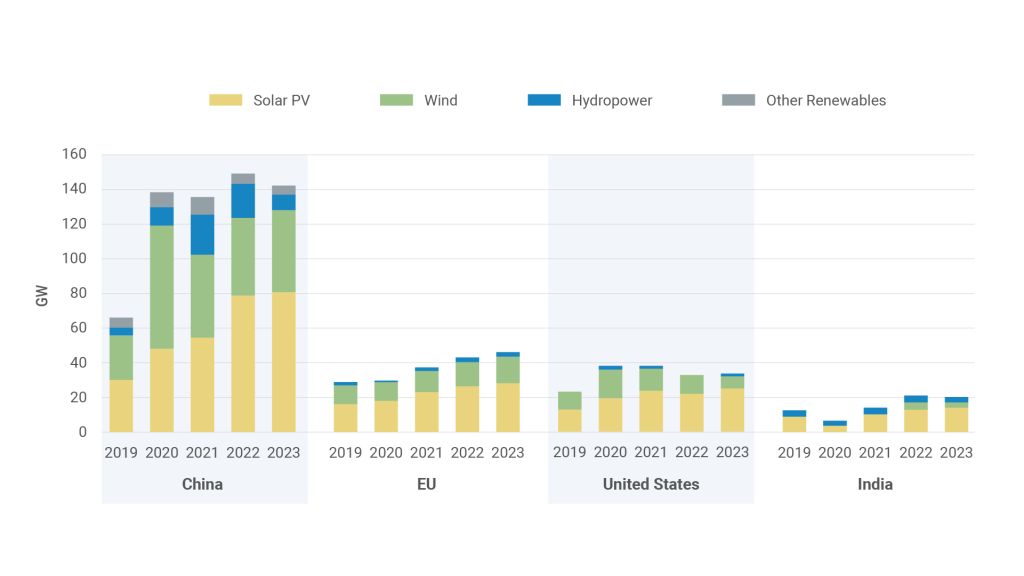

Exhibit 9 – Renewable capacity additions in China, the EU, the US, and India (2019 – 2023).

Source: IEA

(10) GDP Ceases to Be A Universal Measure of Wealth

The notion of a ‘post-growth’ economic mindset is beginning to enter mainstream discourse. Degrowth can be defined as an ‘equitable downscaling of production and consumption that increases human wellbeing and enhances environmental conditions’.

Degrowth in Business

In a business context, degrowth involves a systemic restructuring. It means turning away from excess production and consumption and concentrating on meeting universal basic needs within local bio-capacities. Surpluses would be invested in common goods and services.

In a degrowth scenario, the global economy would not experience universal degrowth but aggregate degrowth, acknowledging varied needs across different regions.

Beyond GDP

The movement also advocates for metrics beyond GDP, as it is poorly equipped to assess a nation’s well-being and sustainable development effectively. Governments worldwide are working on new metrics to report alongside GDP, focusing on a balance between economic growth, well-being, and sustainable development.

Support from IPCC

The IPCC’s Working Group III report for the first time discussed the need for degrowth-related steps given increased awareness and discussion around resource constraints related to the energy transition.

The authors write, “Demand-side measures and new ways of end-use service provision can reduce global GHG emissions in end-use sectors by 40–70% by 2050 compared to baseline scenarios, while some regions and socioeconomic groups require additional energy and resources. Demand-side mitigation response options are consistent with improving basic well-being for all (high confidence).”

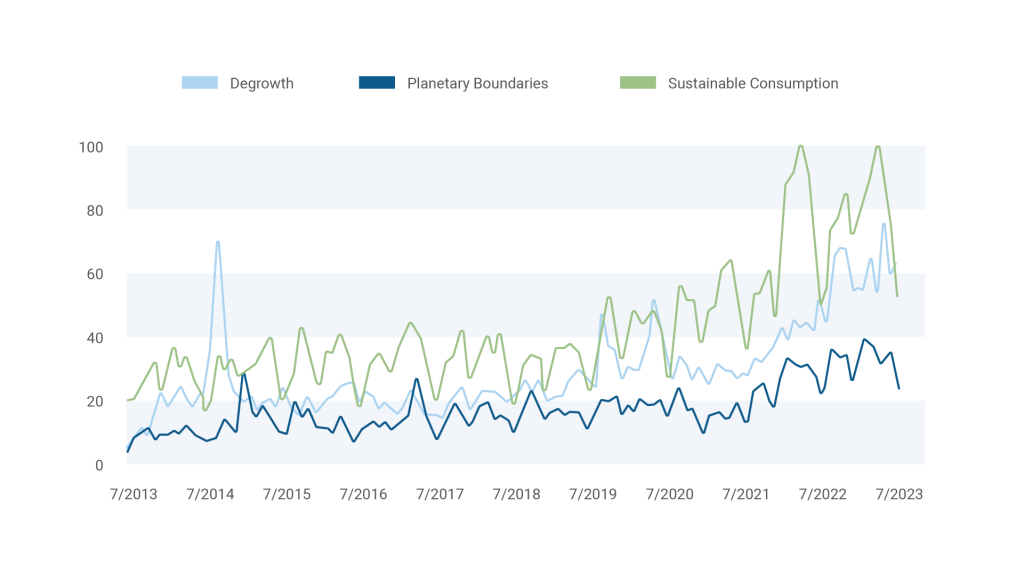

Broader society is becoming attuned to these themes, with Google searches having increased over the past decade.

Increasing Acceptance and Regulation:

While there are no explicit ‘degrowth’ funds, the rise in circular economy fund launches post-COVID, from three to eleven, indicates growing interest.

European regulations further support this trend, with the circular economy being a key objective in the EU Taxonomy. The European Parliament’s “Beyond Growth” conference earlier this year emphasized the implementation of a post-growth, future-fit EU, highlighting the increasing acceptance of degrowth-related ideas.

The shift toward a post-growth economy underscores the world’s concerted move towards sustainable development. In coming years, we anticipate a rise in demand for solutions addressing these themes, met by an increase in products catering to this new economic approach.

Exhibit 10 – Global Google search trends (7/1/13 – 7/31/23).

Source: Google Trends, Jefferies

How Financial Firms Can Extract Value From AI

When ChatGPT launched last November, it revealed that artificial intelligence had gotten smarter and faster than most people had previously imagined. It became clear that AI may soon transform so much of our lives, including every facet of knowledge-based industries.

Change is coming especially fast to the financial sector, where companies had already spent years deploying increasingly sophisticated algorithms to parse ever bigger data sets. Suddenly, a wave of innovative new AI products and applications are coming onto the market that are designed to make companies and investors more efficient and profitable.

Applications of technology in finance have been advancing for centuries, from the abacus to the electronic spreadsheet to the Bloomberg Terminal. AI applications will transform the financial services industry too, but the technology is still nascent. As such, this is the ideal moment for experimentation, especially with boards and management teams already pressing their teams to figure out how firms should implement the latest AI technologies and deal with new AI-related risks.

What makes this latest burst of AI innovation so different from what came before?

The release of large language models like GPT-4 essentially allows every writer to become a coder, and vice versa. You no longer need a technical expert to turn your questions and most data queries into algorithms and translate the outputs from the algorithm back into English.

So long as you can ask concise questions, you can get most of the answers you need. In effect, English has become the new coding language.

How can we start deploying AI across our business?

Think of your AI investments as a barbell.

On one end of the barbell are visionary applications for AI – where you think to yourself,

“It would be a game changer for our business if we could do X.”

Don’t worry about whether you currently have the tools or in-house expertise to do X. Make your blue sky AI aspirations known throughout the organization and especially on your tech and data teams. You don’t want today’s technical limits to stifle the development of your most lofty ideas. Given the rate of advancement in AI, those ideas may be possible to implement in the not-so-distant future. In essence, you want to ask for magic, because magic could be available sooner than you think.

On the other end of your AI investment barbell are the immediate use cases for it in the here and now.

You should implement as many off-the-shelf solutions as you can across your business so everyone gets a more intuitive understanding of the strengths and weaknesses of AI. Most of the applications we’re all already using have AI tools or plugins, like Microsoft Office’s Copilot feature and Salesforce’s Einstein. Zoom has several AI features, including one that creates a transcript of your meeting and a bulleted summary of what was just said.

One of the most compelling new tools for the financial industry is an extension of ChatGPT called Code Interpreter, which takes input from virtually any data source including Excel documents. Code Interpreter can then clean the data, chart it, and draw different inferences.

For example, an institutional investor might take global weather data and put it into Excel along with same store sales data for individual retailers. Code Interpreter could test to see where there are correlations between the weather and sales at the retailers. Then it could present its conclusions to you in a written report that includes charts and verbal explanations.

Introducing off-the-shelf AI solutions throughout your organization is a low-cost, low-risk way to experiment with AI that will help everyone understand AI’s capabilities.

What are the most pressing risks of AI adoption?

Three stand out. The first is vendor dependence. New AI tools, technologies, and companies are being developed so quickly that today’s preferred solution could be obsolete by tomorrow. So this is a moment to maintain maximum flexibility and to avoid any AI implementation or partnership that you can’t walk away from quickly if developments require it.

Second, you have probably heard about large language models generating “hallucinations.” These are false statements that read like true things you have read before.

Hallucinations seem so credible that you believe them. And they are already getting professionals into trouble. Recently, lawyers submitted a filing in Manhattan federal court that featured fictional cases that ChatGPT had made up. The lawyers had even specifically asked ChatGPT to verify that the cases were real, and it falsely told them they were. The offending lawyers were fortunate to emerge with only a minor $5,000 fine, but it isn’t hard to imagine how a ChatGPT hallucination could lead to more catastrophic consequences for a financial firm.

Finally, and perhaps most importantly, is data governance and security. AI technology and large language models will eventually become commoditized. When that happens, your firm’s differentiator will be the proprietary information that you put into these models.

The proprietary information that you are putting in – say the corpus of research on your data for the past 20 years – is incredibly valuable. It can be used to train a large language model to write cogent insights. If someone gains access to the information that differentiates your company and uses it to compete with you, that could spell big trouble. So you will want to ensure that all your vendors perform data security audits and have effective verification provisions.

Artificial intelligence is such a powerful tool that businesses will find it imperative to introduce it to most of their teams and their workflows. If you put the right guardrails in place and think carefully about what AI can potentially do for your firm, the rewards of AI will far outweigh the risks, now and in the future.

Spenser Marshall is the Chief Data Officer of Sundial Data, a direct data sales subsidiary of M Science, a portfolio company of Leucadia Investments, a division of Jefferies Financial Group.

This is the first in a series of articles on the implications of AI for financial firms. Next up: How AI is Democratizing Access to Alternative Data.