Recent Trends in Global China Business Restructuring

There is a burgeoning trend of multinational corporations (“MNC”) actively restructuring their China businesses through any number of divestitures and / or carve-outs to realign their balance sheets and maximize shareholder value.

It’s a departure from the start of the new millennium through 2018, when one of the fundamental pillars of every good corporate business plan was growing exposure to China. In accordance with predictions that the 21st century belonged to China, this massive, homogenous market of over one billion people was opening up, gentrifying rapidly, and presenting almost limitless potential to global corporates. It seemed that every Fortune 500 CEO was constantly thinking about how to capitalize on and secure their company’s share of the China dream.

Fast forward to 2023, and China now finds itself often at odds with former western trade partners resulting in an entirely different state of play:

- A deflationary economy;

- A bloated real estate market enduring painful deleveraging;

- Shifting global supply chains;

- Decreasing foreign direct investment;

- And record youth unemployment.

The result is that every MNC board of directors is now focused on its “China Plan B” strategy. Board members are asking themselves what the best way is to handle an onshore China business that, for multiple reasons, has failed to live up to expectations and faces severe headwinds for the foreseeable future. It’s led to a wave of restructuring, including:

- Mitsubishi Motors exit from its onshore China JV (sale to a local partner).

- In 2012, a joint venture between Guangzhou Automobile Group Co., Ltd. (“GAC”), Mitsubishi Motors and Mitsubishi Corporation (“Mitsubishi”), was established and started its operations as the company responsible for production and sales of Mitsubishi Motors products in China.

- The ownership breakdown: GAC (50%), Mitsubishi Motors (30%) and Mitsubishi (20%).

- On September 27, 2023, it was reported that Mitsubishi had decided to withdraw from automobile production in China and exit the JV with GAC. GAC will take full control of the joint venture and convert the plant to produce EVs.

- Cargill’s divestment of its China poultry business (sale to a regional PE fund).

- Cargill, one of the top poultry producers in the U.S., has operated in China for more than 50 years in the field of food and agricultural products.

- In 2011, privately-owned Cargill started its China poultry business, including breeding, raising, and processing chickens in Chuzhou in eastern Anhui province. In 2019, Cargill announced the opening of an additional $48.8 million poultry plant in Chuzhou to address the growing demand for poultry in the country.

- Recent factors such as the Ukraine-Russia war and COVID-19 have greatly compressed the margins of livestock farms in China.

- In May 2023, Cargill announced it agreed to sell its China poultry business unit, Cargill Protein China, to the Greater China-focused private equity firm DCP Capital.

Most MNCs still believe in the long-term potential of China’s marketplace and many have chosen to retain a minority stake in the original business, enabling them a “second bite at the apple,” assuming the business thrives under its new owner. Many MNCs also don’t characterize these restructurings as “exits” from China, instead describing them as strategic decisions to structure the business in a way that is more flexible and adaptable to the fast-changing dynamics of the China market. Regardless of which route or structure the MNC decides, the engagement of a financial advisor deeply familiar with the MNC’s business, the local competitors in China and the local Greater China-focused PE network, can provide a company with the insight required to make the most well-informed decision to meet their strategic needs.

Expect a More Active IPO Market in 2024

After two years of limited IPO activity, we are cautiously optimistic about 2024.

- The strong equity market performance in 2023 (S&P 500 +[23]%, Nasdaq [+42%], and Euro Stoxx 50 +[20%]), combined with reduced volatility has companies and financial sponsors reevaluating their IPO plans and timing.

- We have recently seen an acceleration in private companies starting, or in some cases, re-starting their IPO processes.

- With US elections later in 2024, we expect Q2 and Q3 to be the most active windows for IPO execution.

- While the increase in IPO activity will be gradual, we recommend that anyone considering a 2024 IPO should engage in timing discussions now.

Performing Issuers should take advantage of the strong market window

Issuers should take advantage of strong technicals and robust investor demand to pursue a variety of opportunistic transactions including refinancings, repricings, and dividend deals.

- As of December 15th, YTD dividend volume was up 170%+ from the full period the year prior, from $5.9 billion to $16.1 billion, still low compared to historical levels.

- For the week ending December 15th, there was $11.2 billion in gross launched loan volume all for opportunistic transactions.

- Following the dovish Fed meeting in December, secondary levels surged to YTD highs, which will allow issuers to pursue further opportunistic transactions in January.

- The broad loan index is at 96, the highest level since May 2022.

- with 54% at 99 or higher, the highest levels since January 2022.

Here are a few examples of transactions Jefferies has recently led that capitalized on these more favorable conditions:

- Jefferies was Sole Arranger on Medallion Midland’s repricing of their $872 million First Lien Term Loan.

- Medallion, backed by Global Infrastructure Partners, is a crude oil gathering/intra-basin transport system in the core of the Midland Basin of the Permian, with 1,240 miles of pipeline.

- The loan was repriced to S+350 from S+CSA+375, allowing the company to lower its weighted average cost of debt.

- Due to strong investor demand the loan was upsized by $50 million in market.

- Jefferies was Left Lead Arranger on CPM Holdings’ $1.215 billion First Lien Term loan, with proceeds from the deal used to refinance existing debt and fund a distribution to shareholders.

- The First Lien Term Loan priced at S+450, 0.50% floor and 98.5 OID.

- As a result of oversubscription from investors, the First Lien Term Loan was upsized by $85 million to $1.215 billion, and pricing was tightened from S+475 to S+450 and OID was tightened from 98.0 to 98.5.

- The Company was able to address its upcoming 2025 maturity while opportunistically funding a dividend to shareholders.

Issuers should also look to raise incremental debt, which enables them to refinance expensive second lien debt and add cash to the balance sheet for future M&A. As of December 18th, YTD incremental / add on volume was up 71.16% from the full period the year prior, from $50.77 billion to $86.90 billion. There are several recent examples of Jefferies facilitating incremental debt transactions including:

- Jefferies was Lead Left Arranger on Summit Behavioral’s $200 million incremental First Lien Term Loan, with proceeds used to refinance the company’s Second Lien Term Loan.

- Summit Behavioral Healthcare is a behavioral health services provider with a focus on substance use disorders and acute psychiatric treatment.

- The incremental First Lien Term Loan priced at S+CSA+475, 0.75% floor and 99.25 OID.

- Due to strong market demand the add-on priced tight of talk.

- Jefferies was Sole Bookrunner on the recently completed $200 million add-on for Icahn Enterprises to the Company’s existing 9.750% Senior Secured Notes.

- Jefferies priced $500 million of 5-year Senior Notes on December 12th and was able to tap the market a few days later for an additional $200 million on December 15th.

- Icahn Enterprises took advantage of the strong market to clean up its capital structure by refinancing its existing notes due in 2024 while adding additional cash to the balance sheet.

- Jefferies was Sole Arranger on Fairbanks Morse Defense’s $210 million non-fungible incremental First Lien Term Loan, with proceeds used to refinance an acquisition bridge loan, pay down the company’s ABL revolver, and add cash to the balance sheet for general corporate purposes.

- Fairbanks Morse Defense, backed by Arcline Investment Management, provides propulsion systems, ancillary power, motors and controllers for the US Navy and US Coast Guard.

- The First Lien Term Loan priced tight of talk at S+CSA+525, 0.75% floor and 98.0 OID.

- The Loan was met with strong lender demand and was upsized by $25 million in market

“Hybrid” Capital as a Solution in an Elevated Interest Environment

In the current elevated interest rate environment, highly levered companies with floating-rate debt are facing increased debt service burdens that can potentially strain the company’s liquidity. In these circumstances, companies that require new capital to refinance upcoming debt maturities, fund ongoing business, and/or fund incremental growth should consider raising “hybrid” capital in the form of structured/preferred equity as an alternative to raising secured debt.

This capital can be structured to meet the idiosyncratic needs of a company as “hybrid” capital providers are typically sophisticated investors with flexible mandates that allow them to design bespoke solutions. This capital can also be provided directly by sponsors. Proceeds from the financing can be used in variety of ways depending on the circumstances, including the repayment of high-cost debt, the funding of cashflow deficits, or fund acquisitions.

Hybrid capital can:

- Reduce cash interest burden to extend liquidity runway;

- Help achieve amendments/waivers from existing lenders related to covenants or upcoming maturities;

- Reduce overall leverage to facilitate the refinancing of an upcoming maturity;

- Provide financing for growth investments that otherwise might not be available under the constraints of existing debt; and

- Be structured to limit dilution to existing equity holders.

Pari Plus Transactions: Advancing Beyond Double Dips in Liability Management Transactions

As discussed previously, “Double Dip” financing transactions have gained significant traction in the last year as a new liability management tool that highly levered companies use to raise incremental capital to fund liquidity and/or refinance existing debt. Companies in need of new capital that are evaluating a Double Dip transaction should consider whether structuring the Double Dip as a “Pari Plus” financing is a viable alternative.

Like a Double Dip, a Pari Plus financing is structured to provide a new money loan with additional credit support beyond a pari passu secured claim in the amount outstanding on the loan. The difference is in the nature of the additional credit support provided to the new money loan.

- In a Double Dip transaction, the new loan receives a pari claim against the credit group’s assets via an intercompany loan (1st dip), and duplicate claims in the form of a pari guarantee from the existing credit group (2nd dip).

- In a Pari Plus financing, the new loan receives a pari claim against the credit group’s assets via an intercompany loan (1st dip), PLUS a guarantee from additional guarantors outside the credit group (2nd dip).

In both instances, recovery on the new money loan remains limited to the amount owed on the loan, but the additional claims/guarantees provide significant credit enhancement for lenders, particularly in distressed situations where there is a risk of below par recovery.

A Pari Plus transaction would have different considerations for existing creditors and new money lenders as compared to a Double Dip:

- New money lenders would have a more favorable view of a Pari Plus structure, as the new loan’s recovery benefits from the value of additional assets from outside the credit group in addition to the pari claims.

- Existing lenders would have a less favorable view of a Pari Plus, as the additional guarantees provided in the 2nd dip are structurally senior to existing debt.

A Pari Plus transaction provides many benefits for companies, sponsors and creditors over the traditional liability management tools (uptiers and dropdowns):

- Allows company to raise new capital which might not otherwise be available;

- Lower cost of capital than would be available for pari secured debt;

- Not required to be implemented in a non-pro rata fashion;

- In contrast to an Uptier, the new loan does not prime existing secured creditors on their collateral; instead the new loan has a structurally senior claim on assets outside the credit group; and

- In contrast to a Drop Down, no assets are transferred away from the existing secured creditors’ collateral package.

Similar to a Double Dip, a company’s ability to implement Pari Plus transaction largely depends on a company having sufficient secured debt capacity, flexibility on how pari debt capacity can be used, and asset value outside the credit group.

Sponsor-backed companies that employed the Pari Plus variant of Double Dip transactions in 2023 include Sabre and Trinseo.

The recent wave of Double Dip and Pari Plus transactions have not yet been tested in bankruptcy court. In the meantime, companies, sponsors and creditors should incorporate the Double Dip and Pari Plus structures into their liability management playbooks.

Global Gas & LNG — Rebalancing

The Global Gas and LNG markets will start normalizing after 2024 with loose market conditions likely starting in 2026 and persisting until the end of the decade. During this period, we expect European and LNG gas prices below the current strip ($12/mmbtu TTF cal-26) and historical average ($8/mmbtu TTF). EQNR and TTE will be negatively impacted, US gas producers will benefit from a tightening US market, large backlogs will protect services and shipping names.

One Last Hurrah for global gas. 2024 will be the last year of global LNG market tightness. Based on our demand forecasts (~4% CAGR 2022-30), the market will be balanced in 2025 and shift into a loose market in 2026. We are comfortable with cal-24 European and LNG prices (TTF ~$14/mmbtu), but we believe that cal-25 and 26 will have to reset 26% lower on average. Projects start-ups will reach record levels in 2025-27 (182mt of which US 79mt and Qatar 48mt), causing a sharp drop in FIDs after a strong 2024 (57mt of project sanctions expected).

Longer term growth prospects unchanged. While the recent high-price environment has damaged medium-term demand growth prospects, we continue to view gas as important to the energy transition and a substitute for coal as prices come down. Our long-term forecasts, consistent with 2-2.7°C global warming scenario, show gas demand continuing to grow through 2040 and staying flat between 2040 and 2050. This will result in a LNG demand growing at a 4% CAGR during 2022-30, 3% CAGR during 2030-40 and 2% during 2040-50.

Winter weather risk abating. While an average European winter could still bring 2024 trough gas inventories sub-40bcm (23bcm or 37% below 2023) and provide incremental support to 2024 prices, this is becoming a low probability scenario. We forecast Europe exiting winter with 55bcm in storage (49% filled), 7bcm below 2023, keeping prices close to the fwd curve.

Areas of potential upside (and downside). Despite a cautious view on 2025-26 prices, we see areas of upside risk: 1) Further Russian supply cuts: up to 56bcm of Russian gas exports at risk in 2024; 2) Unplanned maintenance seems to be normalizing but its has been a source of surprise for the last 3 years; 3) We assume that some demand loss in Europe will be permanent, but lower gas prices could trigger a higher than expected demand response; 4) repricing and growth of LatAm gas supplies. What about downside risk? We see a low probability / high impact risk that potential peace negotiations between Ukraine and Russia could result in a return of Russian piped volumes to Europe.

Stock positioning. We identify several ways to gain stock exposure to these market dynamics:

- Oil Majors. We see EQNR and TTE as particularly vulnerable to lower spot gas prices in Europe / LNG. SHEL should be more protected, and we see low spot exposure for XOM / CVX.

- US E&Ps. The LNG build-out will create a sustained demand-pull that will support HH prices. We like AR, EQT, SWN, and CHK.

- US LNG Developers. We continue to see Cheniere (LNG) as the premier US LNG developer with largely de-risked medium-term growth and long-term option value.

- Energy Services. BKR, TE and SPM should continue to benefit from high level of contracts awards expected in 2024/2025.

- LNG Shipping. FLNG and CPLP are generally insulated from potential freight rate weakness given their backlogs are stretched 5-6 years on average.

- LatAm: We see PAM and CSAN (via its Compass Gas subsidiary) as key beneficiaries from Latin American gas growth opportunities.

Link to full research:

India’s Energy Transition: 15 Insights from Jefferies’ Visit

Jefferies ESG Strategy Team has taken a close interest in India since our founding.

Most of the world’s future energy demand will come from emerging economies. The way these countries manage their resources will be key to achieving global net-zero goals – and India’s trajectory is particularly significant.

For years, India’s energy demands have been driven by coal growth, but today, the country is quickly diversifying. As the Indian equity market nudged past the $4 trillion mark, almost tripling in value since 2020, India’s position as a rising hub for low-carbon investment and innovation cannot be overlooked.

In November, the Jefferies ESG team visited India for a first-hand look at the country’s energy and social transition. We visited four cities and states: Mumbai (in Bombay), Delhi, Ahmedabad (in Gujarat), and Hazaribagh (in Jharkhand).

The trip yielded several important insights for the global investment community about this important economy and its emerging role in sustainable investment. Below are fifteen observations from our trip.

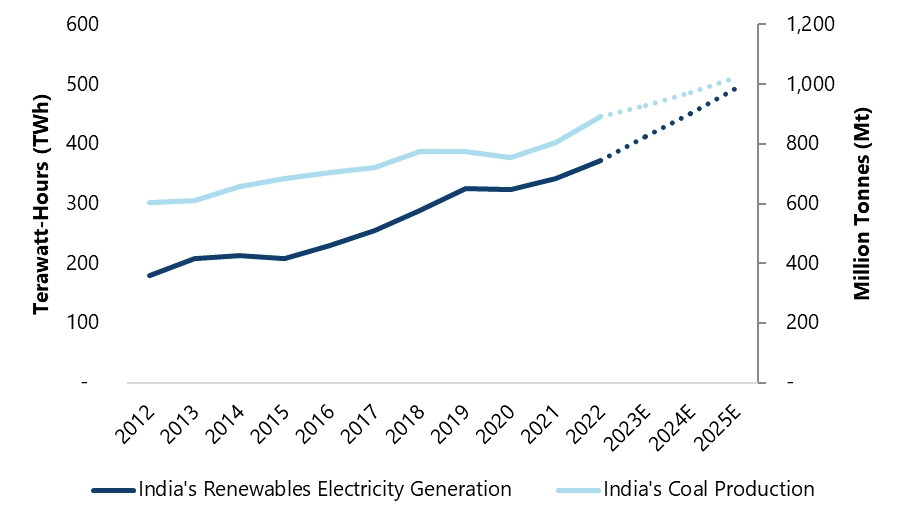

Two Competing Narratives: Both Thermal Coal & Renewable Power Generation Set to Rise

India has enough coal reserves for the next 200 years. The increasing demand for power, established technical expertise, strong state-owned enterprises (SOEs), indicate that coal consumption will continue to rise over the next two decades.

Simultaneously, the renewable energy sector will see tremendous growth in its share of the power mix. This growth will be supported by favorable policies and the country’s pursuit of energy security.

Though coal and renewables may appear to be contradictory forces, both are poised for robust growth through 2030 and beyond.

A Desire for Energy Independence

India’s aspiration for energy independence was a recurring theme during our visit. Internal coal reserves provide independence in the short term. In the medium to long term, renewables offer a path to greater energy independence, especially for sectors beyond power, such as transportation and industry.

Unwavering Policy Support for Energy Transition

Our meetings with government agencies and corporate leaders affirmed India’s unwavering policy support for the energy transition. There was no sense that current pro-renewable policies or subsidies would be scaled back, regardless of the outcome of the 2024 federal elections. This contrasts with many Western governments, where energy policy is currently dependent on the outcome of upcoming elections.

The Uniqueness of India’s Interconnected Grid

India’s Grid is one of the few in the world where new assets can be connected for transmission in 7-12 months. A singular grid, and policies which mandate the creation of high-speed networks where none exist, provide significant advantages. India’s Electricity Act should be studied by investors and policymakers around the world.

India’s Storage Options (e.g. Sodium Ion Batteries & Pumped Hydro)

Over the course of the trip, sodium ion batteries and pumped hydro were frequently highlighted as the two main alternatives to Li-Ion batteries, which remain expensive. Pumped hydro, in particular, exhibits favorable characteristics.

The Financial Health of India’s Power Distribution Companies

Entering the trip, the financial health of power distribution companies (DISCOMS) was cited as a major hurdle to renewable adoption. Their inability to competitively purchase RE power has weighed on India’s transition. We learned that policy interventions and reforms supporting DISCOMS have alleviated these concerns for generators and developers.

Self Sufficiency

Several of the companies we met are planning to expand their manufacturing capabilities down the supply chain (e.g., wafers, cells, ingots for solar panels). Driven by geopolitical concerns and external market unpredictability, both SOEs and private entities are seeking self-reliance. India aims to compete with China in green tech manufacturing – though most acknowledge it will be a decade-long journey.

National Green Hydrogen Mission

India believes that relative to China, the country was left behind on solar, batteries, and other forms of green manufacturing. India is keen to lead in green hydrogen. The National Green Hydrogen Mission, focusing on replacing significant amounts of grey hydrogen and building capacity, is central to this ambition.

The Creation of Carbon Markets

While the development of carbon markets is on the horizon for companies, it remains a medium-to-long-term consideration. The national scheme is still in early stages and is not yet significantly influencing corporate decisions. However, it is viewed as a future catalyst for making green hydrogen economically viable.

Business Strategy & India’s NDCs

Sovereign-level targets and Nationally Determined Contributions (NDCs) for India are clearly spurring action from both private companies and SOEs. As a reminder, India is planning for 500GW of installed low carbon capacity by 2030, and 50% of power gen to be from renewable sources by the same date. Those we engaged with reported strong financial positions and cash generating assets, with capital availability not an issue in allocating towards the transition. Many have and will continue to seek strategic M&A with European and US counterparts (see here and here).

Both the Private & Public Sector Are Actively Involved in Energy Transition

We met with Adani Green, Adani New Industries, and Adani Energy Solutions (all part of the Adani Enterprise Family), Reliance Industries, ReNew Power and HDFC Bank to name a few. All of these privately owned companies are actively investing in the transition.

We also engaged with NTPC, Power Grid Corp of India, Solar Energy Corp of India — Ministry of Renewable Energy. These organizations are either within the government apparatus or majority owned by the state. SOEs and state banks are clearly key drivers of India’s decarbonization efforts.

National Investment & Infrastructure Fund Limited (NIIFL)

The NIIFL is an innovative collaborative platform for pooling institutional capital in infrastructure. Its structure enables private capital to navigate local bureaucracy effectively and could serve as a model for both emerging and developed countries in funding transitions. Engaging with NIIFL presents attractive investment opportunities and a mechanism for de-risking investments.

And some signposts to track going forward . . .

New Coal Projects

Existing coal mines and power plants are unlikely to be retired early. Instead, investors should monitor when new coal projects stop being commissioned, as this will be a sign of accelerated progress towards net zero.”

Storage Costs

The price of Li-ion batteries has dropped 14% this year (c.$139/kWh). This is still not cost-effective enough for the country to capitalize on its mass solar potential. Monitoring the price of various storage options will be harbingers of further decarbonization in India.

Follow Experimentation in India

Panasonic and AES have recently announced an agreement to construct a 10MW energy storage facility in India. Many companies are also exploring sodium ion batteries. Developments in wind, pumped hydro, and hydrogen are all worth tracking. The country is at the epicenter of the growth versus carbonization challenge, and we expect innovative developments and solutions to continue emerging.

Prime Services C-Suite Newsletter – December 2023

Jack-of-all-Reads: A newsletter for multi-hat-wearing C-suite leaders and their key constituents.

Views from Capital Intelligence… Looking Ahead

Industry Insights:

Our newsletter, Jack-of-all-Reads, shares the latest and greatest insights in a brief read on a monthly basis. Please let us know of any comments or questions – we welcome and appreciate your continued partnership. Happy Holidays to all and we look forward to continuing our partnership in the new year.

Industry Insights:

- This month we collected insights from across our team on the industry outlook for next year. We look forward to discussing further with you in January.

- Outlook for hedge fund launches in 2024. The team is optimistic that we will see both established managers launching new products as well as an increase in specialist strategies which offer unique return streams, different factor exposures, or a combination of the two.

- Fundraising Environment. While multi-strategy and multimanager funds have been the primary group in the spotlight this year, questions remain around if demand will continue as LPs are more cognizant of fees. We expect to see:

- A continued interest and demand for uncorrelated, low beta, low net market neutral strategies with a focus on alpha generation.

- Increased appetite for healthcare and TMT strategies as rates start to decrease and indices hit rock bottom.

- More interest in tech as LPs have rotated out of the sector and are now underexposed.

- Interest for event driven strategies may increase as M&A activity rises.

- While we do see managers launching new products or a 2nd or 3rd vintage of an existing strategy, we are hearing feedback that some investors, particularly endowments and foundations, don’t have the liquidity to invest in the next iteration of a product given existing commitments to other drawdown/capital call types of investments they have made.

- As we are continue to see managers launching new products, managers need to be mindful around continuing to spend enough time on the flagship funds.

- Terms and Fees Outlook. Founders share classes have been becoming more illiquid. Nearly all groups have a lock and gate. See below for findings from a recent analysis our team conducted on the evolution of terms for newer managers; we always find it interesting to study the new launch environment as many of these managers set the stage for the innovation of terms for established managers launching new products.

- Management Fees. In 2023, the average founders share class management fee rose to 1.35%, up from 1.25% in 2022, which marks a return to 2021 levels when the average founders class management fee charged was 1.35%. Interestingly, in 2023, main share class management fees increased 40 bps from their 2021 levels (charging 1.60%), continuing their trend upward.

- Incentive Fees. The average inventive fees for founders share classes declined over 15% in 2023, down 230 bps from their 2021 levels. Conversely, the average incentive fee for main share classes rose to nearly 19.50%, up from 2022 when the average fee was 18.80% and in line with 2021 when the average fee was 19.50%

- Liquidity and Lock Ups. 87% of new launches imposed a lock-up in the founders share class, 2/3 of which were soft lock ups. The most common liquidity offered continues to be quarterly with a redemption notice of 60 days.

- Biggest Challenges to Launching in 2024. Heading into 2024, many firms are navigating the costs of keeping up with legal and compliance requirements given increased SEC activity, as well as grappling with how to attract and retain top talent.

- Multi-Manager Platforms. Will continue to actively hire and create competition for talent amongst emerging and established managers.

- Importance of Backing and Seed Capital. The barrier of entry to launching a fund is much higher now – from it being more expensive to run/operate a fund in this inflationary environment to there being less day one capital providers who are able to invest. Additionally, many provide deeper support and partnership that enable managers to scale.

- Thoughts from ODD. This year has been increasingly important from the operational due diligence perspective. The geopolitical environment and banking crises have prompted many to reevaluate how they view risks.

- The Latest on the ODD Landscapes. Questions from some ODD groups are becoming more complicated. Previously, managers seemed to have less of a grasp on what they needed to do, that information is now more readily available.

- AI in ODD: The Wave Of The Future. As managers are exploring different ways that they can leverage AI, ODD professionals are getting quickly educated on how to better understand and diligence it.

- Counterparty Risk. Diversification and vendor due diligence has been top of mind throughout our conversations with the community. The banking crises this year prompted a resurgence of putting processes in place to combat these risks however, most funds still only have one management company bank account in place.

- ODD Exam Format: Remains Hybrid. In a post-COVID world, the industry has been able to strike a balance of creating efficiencies through completing some components of ODD virtually and leveraging tools such as data rooms. The important exercise of visiting managers and participating in face to face meetings continues.

- Regulatory Changes. The SEC recently came out with their 2024 exam priorities which includes focus the new marketing rule, fiduciary duty rule,, and off channel communications. The SEC is currently aggressive in rule making and enforcement actions. There are new, existing, and upcoming disclosures, which groups will quickly need to adopt.

- Top of Mind in 2024: Private Fund Rule. This rule has been highly scrutinized as the advisor may no longer able to provide side letters or negotiations. It has brought on more comment letters than any period of time.

- Spotlight on Preferential Treatment. This will grant information and redemption rights as well as prohibit advisors from offering preferential redemption terms unless offered to all current or future investors. Potential solutions include creating customized reports sent via email or portal, or hosting regularly scheduled calls open to investors.

- The Latest on the ODD Landscapes. Questions from some ODD groups are becoming more complicated. Previously, managers seemed to have less of a grasp on what they needed to do, that information is now more readily available.

Please reach out to your Jefferies contact for more information on any of the topics above.

Spotlight on Content and Events:

Jefferies Launch 2025: Many of the trends we highlighted in last year’s Annual State of Our Union remained top of mind through 2023. Decision makers were revisiting their assumptions, and redefining their organizations in efforts to sustain themselves through challenging periods, or fuel growth amidst dislocation. Stay tuned for the Jefferies Launch 2025 series which will be released with both written and video components. In this series, we leverage expert views on what potential founders need to know now before launch including costs, the challenges, and potential upsides.

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

Lowenstein Sandler – The SEC’s Private Fund Adviser Rules Explained — Part 4: The Quarterly Statement Rule

Vigilant Compliance – 8 Important Considerations for Dual-Hatted CCOs

Waystone Compliance – SEC 2024 Exam Priorities for Private Fund Advisers

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Erin Shea

Head of Business Consulting

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

Shannon Murphy

Head of Strategic Content

[email protected]

Paul Covello

Global Head of Outsourced Trading

[email protected]

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2023 Jefferies LLC

Clients First-Always SM Jefferies.com

Jefferies Head of UK Banking on the Road Ahead for Investors

Jefferies recently sat down with Philip Noblet, Head of UK and Ireland Investment Banking at Jefferies. They discussed new inflation data and its potential impact on dealmaking. They also touched on next steps for private equity firms sitting on dry powder, and how investment banks can support corporate and sponsor partners through challenging times.

Their conversation came on the heels of October inflation data, where UK headline inflation fell sharply from 6.7% to 4.6%, the lowest in two years. This follows the Bank of England leaving its benchmark interest rate unchanged at 5.25% in early November. The central bank ended a run of 14 straight hikes in September, as policymakers keep their eye on a 2% target.

We just saw positive news on inflation in the UK. What do you think this means for interest rates and deal flow in 2024?

Whether you are a corporation or a private equity sponsor, you crave stability. And we’ve been through a period without stability, especially due to interest rate hikes. It’s made everyone very data dependent, and it’s hard to deal under these circumstances.

When stability returns – even at rates no one likes – everything level sets. Folks can make a plan.

On the private equity side, we have seen a quantum of funds raised over the last five years, and that capital hasn’t yet been deployed. All these players are coming back to the market, looking for opportunities. Many of these opportunities, albeit on the smaller side, have been in the UK public market.

On the corporate side, it’s all about CEO confidence. Whether you’re in the US or the UK, you need to feel confident in your own business, share price, and prospects.

We’re trying to provide folks with that confidence, supporting them with insightful ideas, bringing them thoughts from our equity division. We’re helping them understand what investors are thinking, and how investors will support public companies’ growth journeys, be it through acquisitions, disposals, or private equity sponsors.

I think we’re seeing stability return, albeit at higher rates, and that’s bringing signs of life to our pipeline for 2024.

When stability returns, but rates remain high, is private equity open to dealmaking?

I believe private equity will still do deals.

A partner said to me the other day, “if I’m borrowing money at 10 or 11 percent, what’s my rate of return?” The answer is 25 percent. Everything just goes up. It just makes the job more difficult. You have to incent management teams. You have to spend more time with the businesses. Private equity firms are really digging in, and they’re looking to acquire companies that can do the same.

Also, there is increased pressure to deploy capital. Investors aren’t paid to sit and twiddle their thumbs; they need to deploy their powder. There are a lot of bright folks in private equity, looking for opportunities, and we’re starting to see the industry gain momentum.

Do you think the return of deals will be driven by any sectors, in particular?

I think healthcare and tech is where it starts. These sectors have really held up through a really difficult 2022 and ‘23. I think deals in these sectors will continue to accelerate and become bigger – but we also need to question what ‘big’ means.

We were doing deals in 2021 for $10 billion. That’s a difficult deal to pull together today. But can we get to single-digit billion-dollar deals? Yes, and I think that primarily takes place through mergers.

Folks will use their shares, which they feel are undervalued, to buy other shares that appear undervalued. Taken together, these new valuations will be worth more than the sum of their parts. I think these single-digit billion-dollar deals will come back in the private equity world, as financing returns.

Our leveraged finance team is very confident about where the market’s going. We’ve seen some real positivity in the American and European leveraged finance markets, the private credit markets, and when you pair that with growing stability and confidence, it should inevitably lead to better deal flow and deals of larger size.

Investors are struggling to deploy capital. They’re struggling with liquidity events. How can investment banks like Jefferies be more creative? What are the strategies for helping sponsors unlock capital in the current environment?

One of the things we do well as a firm is put ourselves in the client’s shoes. We think, ‘what do the clients really want here?’

Sometimes, that means pushing them to explore. Sometimes they need to be brave, and that’s a lot easier when you have a thoughtful, insightful partner. Someone sitting across the table that has done it dozens of times before.

Jefferies made a wise decision in hiring one of the best continuation vehicle teams. You see many sponsors with high-quality portfolio companies that aren’t just willing to sell at a good price but put them into continuation vehicles. We’re at the forefront of that movement.

Fundamentally, though, it’s all about how you provide ideas to clients. In the end, a senior team bringing thoughtful ideas instills confidence in the client. And when the client knows advice is in their best interest, they’ll respond to it and take action.

Finally, IPOs have faced challenges in the US, even as activity returns. What do you see for the IPO market in the UK?

The reticence to invest in existing public companies is very high in the UK. To bring a public company to the UK, especially one in their growth stage, is challenging. We’ve seen share prices collapse, through no fault of the company. There just hasn’t been support and confidence from investors in public markets.

So, I suspect very little IPO activity in the UK. But that doesn’t mean we won’t go after them, when the opportunity is right.

When we connect with potential IPO candidates, we look at everything. How has private capital helped them? When is the right time to come to the public market? We give them real-time feedback, encouraging them to look at all their options, and ensuring they are in the best position.