Resetting Tech Market Expectations for 2024

In Ernest Hemingway’s The Sun Also Rises, a character famously describes how he went bankrupt.

“Gradually, then suddenly.”

M&A markets tend to work similarly in the other direction when they are rebounding from a steep dislocation.

In the wake of the 2001 downturn, M&A deal volume recovered incrementally through 2004 until it exploded upward in 2005. Something similar happened in the years after the 2008-2009 great financial crisis, with a few years of moderate recovery followed by significant legs up in 2014 and 2015.

As 2024 begins, tech dealmaking continues to recover gradually – a trend that may endure for months or potentially longer – but be ready for it to shift suddenly.

2023 was a banner year for public equities, with the NASDAQ up over 40% in 2023, but valuations remain well off the stratospheric pre-downturn levels in January 2022. In Software, NTM EBITDA multiples peaked for application software companies at almost 40x in late 2021 vs. ~22x today, while infrastructure software approached 25x and has now settled at around 20x. Internet multiples experienced even more dramatic contractions, with e-commerce NTM revenue multiples 75% below levels observed in early 2021.

But today’s valuations are reasonable relative to history and the headwinds dampening transaction activity in tech markets are dissipating. Inflation is moderating, the Fed is forecasting as many as three rate cuts in 2024, and the bid-ask chasm separating buyers from sellers since 2022 is finally narrowing.

Then there’s the growing enthusiasm for all things AI. If you listened to an S&P 500 earnings call this past quarter, you heard three times as many mentions of “artificial intelligence” as you did the same time a year ago. And while it’s still too early to identify the big winners from AI beyond the chip and processing companies that are providing the picks and shovels for the AI buildout, it’s not too early to identify the key themes and trends that are likely to define tech sector dealmaking in 2024. Investors have an enormous demand for liquidity entering this year and that will inevitably catalyze activity. Here are just a few trends we have our eyes on:

- A Singular Opportunity for Strategics: With interest rates at multi-year highs and tighter leverage limits, strategic buyers have a notable cost of capital advantage over private equity firms. A PE firm getting financing today can expect to pay 2-3 percentage points more than they did in 2020-2022, which will may increasingly price them out of transactions above a certain size.

Strategics also have a chance to take advantage of compelling assets that are either trading at low valuations or prized assets that enable them to press a competitive advantage in the coming market cycle. A great example of the latter is Cisco’s announced acquisition of Splunk in September, an all-cash transaction that values the cybersecurity firm at ~$26B. In hindsight, market participants may look at this deal as one that encouraged other strategic buyers to test the transaction waters, especially given the fact that we know of several other large deals that are also on the verge of an announcement.

- An Altered Playing Field for PE Buyers: Although PE firms face a more challenging credit environment, it’s important to remind ourselves that the last 15 years represented a vacation from interest rate history. Today’s rates are about the same as they were in the two decades leading up to the 2008-2009 great financial crisis and there are signs the market is adjusting to this “old” normal: M&A and LBO activity reached a 17-month high in September. Globally, there is some $3 trillion in capital that’s committed by LPs but undrawn, representing a significant amount of dry powder that will have to be put to work. In addition, there continues to be a huge liquidity disconnect between the money LPs need and what GPs are distributing. When you combine this with fact that GPs have finite investment periods during which they can deploy capital, you have the recipe for a significant burst of investment activity.

In 2024, we expect to see more investments made across the capital structure including a growing proportion that involve co-control or minority investments, as well as more flexibility in a deal’s governance and liquidity provisions. Firms will also need to leverage informational advantages wherever they can as the formal process to sell strong assets is often increasingly over before it starts. This trend was apparent in recent take-privates in the software industry, as the last ten deals commenced with specific inbound interest which led to an auction won in almost every case by the initial bidder.

- Venture Will Be Patient … Up to a Point: The recent IPO drought was even deeper than during and after the 2008 crisis: There were only five total technology IPOs across 2022 and 2023. These droughts don’t last forever, and equity market momentum may start to pry open the IPO window in 2024. However, we expect the overall IPO market to remain muted throughout the year.

Whenever the IPO market does open back up, expect to see most IPO candidates sharing a well-defined profile: significant scale, strong revenue growth, profitability, market leadership and often the presence of an anchor investor that serves as a validator for a company’s prospects.

For those portfolio companies that don’t have the possibility of a near term IPO exit, venture firms are likely to be more willing to engage in M&A at reasonable valuations now that there is less resistance to marking down assets.

- Cross-Border M&A Will Be an Important Part of the Recovery: For most of the last two decades, cross border deals accounted for around 10-15% of total global M&A. But cross border activity has plummeted since 2022, and the accounted for less than 5% of total activity in the most recent quarter. Although the U.S. has historically taken the lead in reviving deal activity in the wake of downturns, we expect cross border activity to return closer to its recent historical averages, providing a meaningful boost for overall global M&A.

These trends all add up to a bifurcated market emerging in 2024, where good companies selling at fairer valuations will have plenty of suitors. However, dealmaking in this dynamic market will require more work, which of course is why Jefferies is here. In this depressed deal environment, we are one of only two global investment banks that is growing our market share and we are continuing to invest significantly in our TMT practice to be well-positioned when activity inevitably increases.

The recovery may be going slower than many would like, but if history is any guide, it can accelerate faster than many may think. When it does, we’ll be ready and looking to serve our clients with the best possible advice and execution resources.

Jason Greenberg is Co-Head of Global Tech, Media and Telecom Investment Banking at Jefferies. Previously, he was Head of Global Tech Advisory at Jefferies. Prior to joining Jefferies in 2014, Jason was at Credit Suisse where he led Software Investment Banking after previously having served as head of Communications M&A. Prior to joining Credit Suisse, Jason was a founding member of the CSFB Technology Group and DMG Technology Groups, where he helped lead their respective efforts in software and communications M&A. Jason has over 30 years of investment banking experience and has advised on hundreds of M&A assignments worth more than $250bn, including acquisitions, divestitures, joint ventures, hostile takeovers, takeover defenses, leveraged buyouts, financings, stock buybacks, spinoffs and leveraged recapitalizations.

Cameron Lester is Global Co-Head of Technology, Media and Telecom Investment Banking at Jefferies. He was most recently Head of Global Internet Investment Banking at Credit Suisse. Prior to returning to investment banking, Cameron was Co-Founder and General Partner at Azure Capital Partners for fifteen years, specialized in Internet, software and related infrastructure technologies. Prior to Azure, he served as a Managing Director and the Group Head of the Software Investment Banking Group at Credit Suisse First Boston Technology Group. Prior to CSFB, Cameron served as the Group Head of the Software Investment Banking Group at Deutsche Bank. He received an MBA in Finance from the University of Pennsylvania’s Wharton School and a BA in Economics from the University of Virginia.

Prime Services C-Suite Newsletter – January 2024

Jack-of-all-Reads: A newsletter for multi-hat-wearing C-suite leaders and their key constituents.

Increased Focus on Compliance and Technology

Industry Insights:

Our newsletter, Jack-of-all-Reads, shares the latest and greatest insights in a brief read on a monthly basis. Please let us know of any comments or questions – we welcome and appreciate your continued partnership.

Industry Insights:

- Cayman Regulatory Update. SinceCayman’s removal from the FATF’s Grey List, they have remained active. Please see below for two notable developments.

- Grey List Removal. The country officially is removed from the EU’s Grey list in December 2023 after complying with various guidelines. The removals from these lists marks a step forward for the country although due diligence and maintaining a strong regulatory regime remain top of mind.

- Beneficial Ownership Transparency Act. This bill was approved in late 2023 and is expected to go into effect in the first half of this year. The ruling will increase transparency and create a public register for the country. The largest changes include updating the definition of beneficial owner from 10% to 25% and eliminating reporting exemptions from limited partners and limited liability partners.

- Proactive Compliance: Increased Costs and Focus. As the heightened regulatory environment persists, managers are expecting to remain focused on compliance heading into the new year.

- Staying Ahead. The majority of firms are taking steps to be prepared for potential new rules and regulations expected to take effect this year, including the Private Funds Rule. Overall, there is a significant focus on managers starting to formulate and begin executing on a plan for becoming compliant. There is still time, but given the broad scope of the rule, it is imperative for managers to begin working with their legal counsel and compliance consultants to get the process started.

- “Culture of Compliance” is now “Proactive Compliance.” Holding annual compliance trainings and offering ongoing education has become an industry best practice and a critical part of a successful compliance programs. Now, managers are tasked with raising the bar even further to create a culture of proactive compliance, where employees are encouraged and empowered to self report mistakes, issues, and raise flags when necessary.

- AI Trends. The industry is still in relatively early stages of identifying and implementing all of the potential use cases for AI across the investment and non-investment sides of the business. While leveraging AI is becoming a powerful differentiator and source of investment for some, others are hesitant to leverage it without further education. While there is no overnight pressure to start formally using AI tools, many would argue that over time, not figuring out how it might benefit your organization could become a competitive disadvantage.

- ODD Views. ODD teams are increasingly incorporating questions about if and how manager are utilizing AI into their processes. If yes, the next layer of questions focuses on what guardrails are in place to ensure quality and accuracy of output.

- Ways to Utilize. In conversations with our clients and industry experts, some of the key use cases within hedge fund organizations to date include: research, IR support, creation of marketing materials, and payroll.

Please reach out to your Jefferies contact for more information on any of the topics above.

Client Corner:

“Practical and Tactical”: Service Provider Landscapes. Decision-makers are spending Q1 exploring ways to increase efficiencies and strengthen partnerships across their businesses. The Business Consulting team has put together a series of pieces that outline the landscape of service providers across verticals, what has changed, and how to evaluate which providers may be a good fit for your business. Please let us know if you’d like us to walk you through the latest, which include fund administration, trading software, RMS systems, CRMs systems, and HR firms.

Spotlight on Content and Events:

iConnections Global Alts 2024. We look forward to seeing many of our clients and industry partners in Miami this week.Please see details below for an opportunity to see our Global Head of Sales, Barsam Lakani, moderate a session on Multi-Strategy platforms.

- Multi-Strategy Platforms and the Power of Diversification. Tuesday January 30th, 11am – Moderated by Barsam Lakani, Head of Jefferies Prime Services Sales with Jain Global, MS AIP, Davidson Kempner, and J Goldman

The Voice of Asset Owners: How Allocators Aim to Invest in the Transition 2025. With the global energy transition upon us, Asset Owners, the entities that hold and allocate capital on behalf of participants, beneficiaries, or the organization itself (including pension funds, endowments, foundations, insurance companies and sovereign wealth funds) play an important role in understanding the shape and pace of the energy transition. Understanding of how allocators view the transition is crucial in elevating the perspectives of asset managers and the broader investor community. Read Here

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

CBRE – Why Flex Workspace is Thriving Despite the Headlines

Citco – 2023 Q4 Hedge Fund Report – Quarterly Review

Diligence Vault – Quantifying the Value of Operational Due Diligence (ODD)

KPMG – Asset Management Industry Insights for 2024

Maples – EU Removes the Cayman Islands from EU AML List: Considerations for Clients

RQC – Q4 2023 Quarterly Regulatory Newsletter

SS&C – SS&C GlobeOp Hedge Fund Performance Index and Capital Movement Index

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Erin Shea

Head of Business Consulting

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

Shannon Murphy

Head of Strategic Content

[email protected]

Paul Covello

Global Head of Outsourced Trading

[email protected]

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2023 Jefferies LLC

Clients First-Always SM Jefferies.com

The Energy Transition in 2024: Eight Key Moments to Watch

2023 was a paradoxical year for the energy transition, marked by unparalleled progress and notable new challenges. Renewable energy installations grew at a record pace, as solar capacity, EV sales, and battery storage surged to new highs in the United States and China.

However, amid global progress, new roadblocks emerged: over 1,500 GW of solar and wind power are delayed in grid interconnection queues, and the transition contends with increasing capital costs and inflation. Low-carbon stocks also performed poorly, even as the broader market recovered.

As we begin 2024, a pivotal year for the global transition, this mix of promising developments and persistent challenges raises three key questions:

- What do voters want? In 2024, the largest election year in history, up to 4 billion people in 76 countries will vote. The outcomes of these elections will shape the global energy transition over the next half decade.

- Will roadblocks hinder progress? Costly capital and ongoing supply chain challenges threaten the transition’s momentum.

- Will we see continued breakthroughs in climate tech? Major innovations, like another nuclear fusion moment, could significantly change the pace and potential of decarbonization.

Here are the eight moments Jefferies is monitoring in 2024 – each poised to shape the trajectory of global progress in the year ahead and beyond.

- ESG and the Energy Transition Are on the Ballot

- China: Could Emissions Peak in 2024?

- Japanese Transition Bonds

- India: Coal Expansion and Renewable Energy Go Head-to-Head

- Will Grid Bottlenecks Persist?

- Rising Capital Costs Pose New Challenges

- Does Carbon Capture and Storage (CCS) Deliver on its Promise?

- The EU Innovation Fund

ESG and the Energy Transition Are on the Ballot

As 76 countries and up to 4 billion people head to the ballots, two elections particularly stand out: the United States and the European Parliament.

The United States presidential election, likely featuring a rematch between President Biden and former President Trump, could critically influence U.S. energy policy and support for decarbonization. Former President Trump has indicated intentions to repeal parts of the Inflation Reduction Act.

Elections for the European Parliament will also prove critical. The current leading party, the European People’s Party, has supported legislation within the European Green Deal. The outcome of 2024 elections could see Europe reaffirm its support for the energy transition – or shake up the status quo.

China: Could Emissions Peak in 2024?

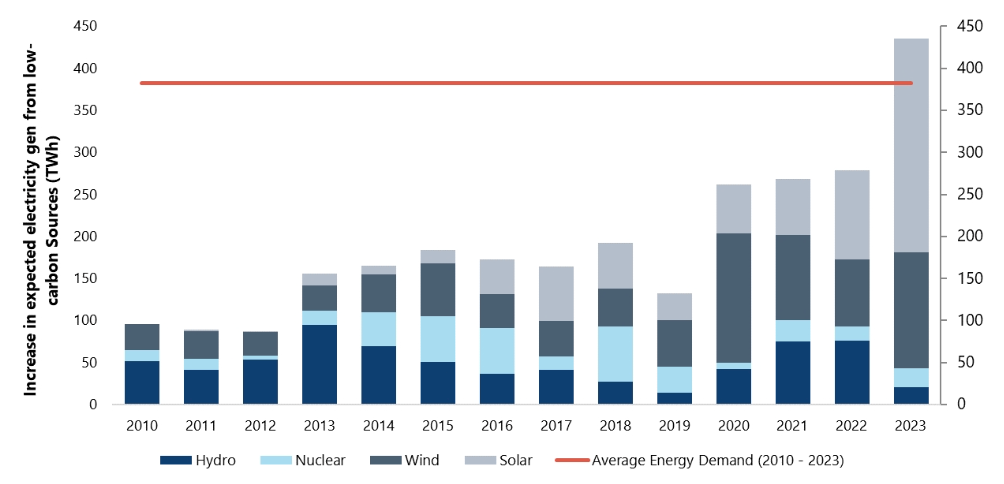

China saw a year-over-year emissions increase in 2023, but its post-COVID return to economic activity also drove significant progress in low-carbon infrastructure and technology. An impressive 230 GW of renewable capacity was added last year, and hydropower is posed for strong growth in 2024.

If low-carbon sources continue replacing fossil fuels in power generation, and incremental power demands continue to be met by renewable additions, China could enter an emissions decline for the first time in 2024.

China energy growth in China (FY ’21) will be greater than average demand.

Source: China Electricity Council (CEC), IRENA, Jefferies Research

Japanese Transition Bonds

In December 2022, the Japanese government unveiled its 10-year, 150-trillion JPY (~$1 trillion) Green Transformation Policy. Central to these initiatives is the use of transition bonds to support industry decarbonization.

Upfront investment of $20 trillion JPY of Climate Transition Bonds is intended to catalyze a public-private investment of $150 trillion JPY. Investment destinations of these bonds include non-fossil energy, industrial restructuring, energy conservation, and resource recycling and carbon reduction technologies. The first auction of these bonds, scheduled for February 14, 2024, marks a key step in Japan’s journey towards a greener economy.

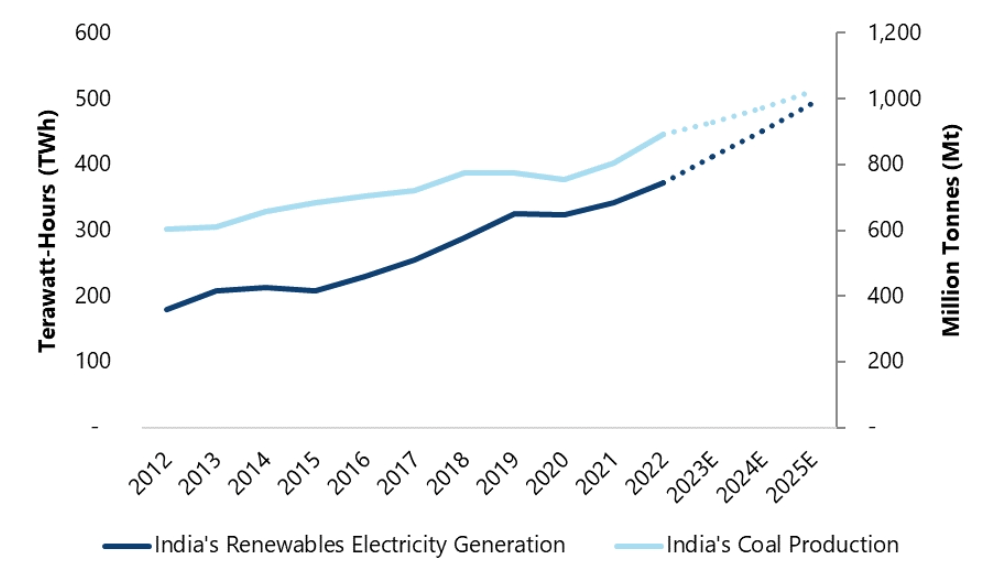

India: Coal Expansion and Renewable Energy Go Head-to-Head

As the world pursues net-zero goals, India is in a unique position. The country can demonstrate that rapid economic growth is compatible with an ambitious decarbonization agenda.

Jefferies recently hosted investors across four states in India. The trip revealed the two competing narratives that will define the country’s trajectory:

- Growth in coal volumes will continue. Increasing power demand, established technical expertise, powerful SOEs, high utilization rates, and plants with decades of useful life remaining all mean coal consumption will increase over the next two decades.

- Simultaneously, renewables will see robust growth, given policy support and a need for energy security.

The year 2024 will be a critical indicator of how these competing forces will shape India’s energy landscape and its role in the global energy transition.

Coal production and renewable capacity additions will continue to grow in 2024 in India.

Source: IEA, Jefferies Data

Will Grid Bottlenecks Persist?

2023 marked a pivotal realization for investors, policymakers, and developers: grid bottlenecks are a critical barrier to the decarbonization of the power sector. Last summer, the Federal Energy Regulatory Commission’s (FERC) issued a new rule aimed at reforming the integration procedures for new generators into the existing transmission system.

These changes could mark an important moment for the expansion of and improvements in grid infrastructure. Faster rates of deployment could allow over 1,500 GW of wind and solar to enter capacity. The impact on the pace of the transition would be marked.

Rising Capital Costs Pose New Challenges

The energy transition faced a challenging macro landscape in 2023 The era of low-interest rates and minimal inflation, which previously bolstered the transition, gave way to a high-rate, high-inflation post-COVID world. This shift has introduced substantial challenges for low-carbon developers, impacting both renewable energy stocks and project financing.

The world will be watching interest rates and inflation closely in 2024. Continued economic tightening and elevated capital costs don’t represent a long-term impediment, but they could decelerate the shift towards cleaner energy sources in the short and medium term.

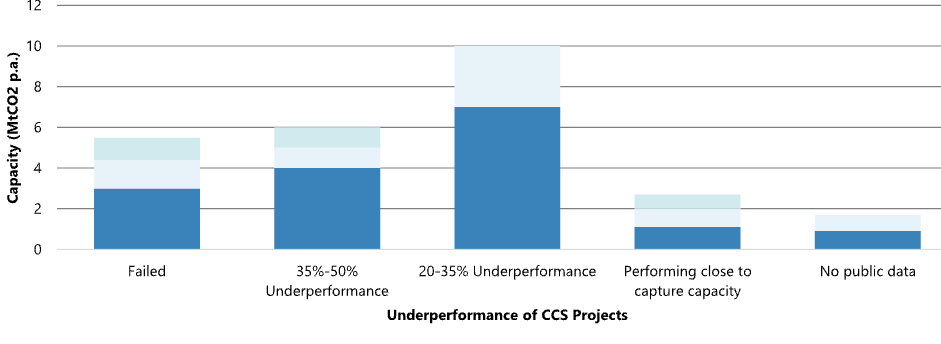

Does Carbon Capture and Storage (CCS) Deliver on its Promise?

Carbon Capture and Storage (CCS) remains a topic of intense interest and debate in the energy sector. Despite high expectations and substantial investments, the performance of CCS projects has thus far been underwhelming.

Chevron’s Gorgon CCS project in Australia serves as a cautionary tale. As the world’s largest CCS facility, its performance has fallen drastically short of expectations, capturing only about half of its projected capacity. In 2022-23, Gorgon injected merely 1.71 million tons of CO2, far below its annual target of 4 million tons. This shortfall has raised serious doubts about the viability and effectiveness of CCS technology, with Chevron resorting to purchasing carbon credits to offset its deficiencies.

Santos’s Moomba CCS project in South Australia is a project to watch in 2024. With aims to store up to 1.7 million tons of CO2 annually, its success or failure will be a crucial indicator of the potential of CCS technology. A successful implementation by Santos could reignite confidence in CCS, while any shortcomings might further fuel skepticism.

Carbon Capture and Storage projects’ poor report card.

Source: Jefferies, IEEFA, The Carbon Capture Crus: Lessons Learned: September 2022

The EU Innovation Fund

The EU Innovation Fund stands as one of the world’s most significant financial initiatives to foster innovative low-carbon technologies. With a substantial budget of 4.8 billion EUR, the Fund is a cornerstone in the European Union’s strategy for a low-carbon future. Running from 2020 to 2030, it is primarily financed by revenues from the EU Emissions Trading System, potentially accumulating up to 20 billion EUR depending on carbon pricing.

The current focus of the Innovation Fund is on two key calls for proposals: the IF23 Auction for renewable hydrogen and the IF23 Call for net-zero technologies. These calls, launched in late 2023, are set to close in the first and second quarters of 2024, respectively. These initiatives represent crucial steps in the EU’s commitment to advancing the next generation of low-carbon technologies, potentially setting a global precedent for innovation in the transition to a sustainable energy future.

++

As we move through 2024, the highlighted eight key moments will critically influence the pace and potential of the global energy transition. As stakeholders and observers alike watch these events unfold, the collective actions and decisions made in 2024 will chart the course of our global energy landscape in the years to come. Follow along with Jefferies Sustainability & Transition Team for continued insights on these eight developments and more.

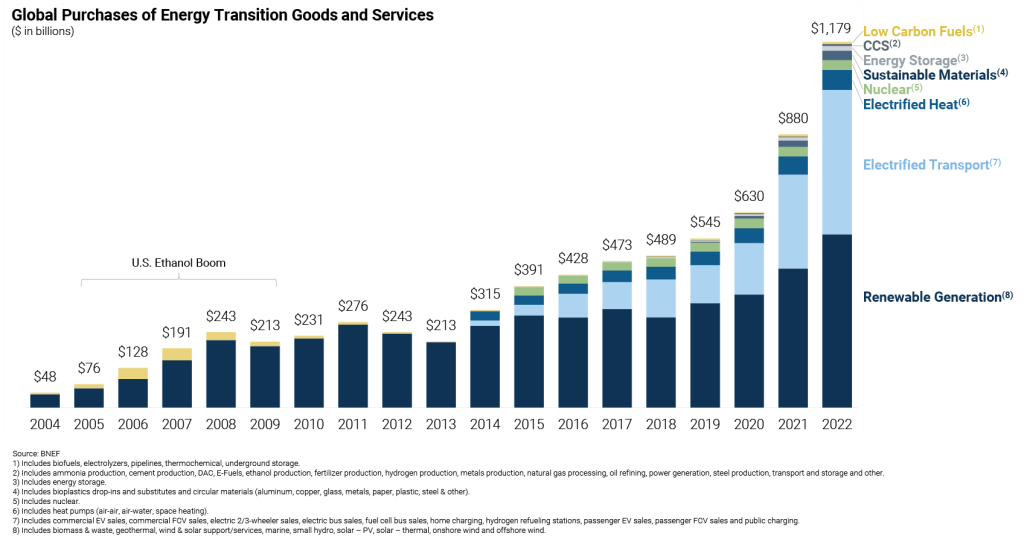

The Energy Transition is Opening Up Immense Opportunity in the U.S. for PE Firms

The energy transition has been picking up steam for a while. But a confluence of new factors has the potential to further accelerate growth and create unusually promising investment opportunities for private equity.

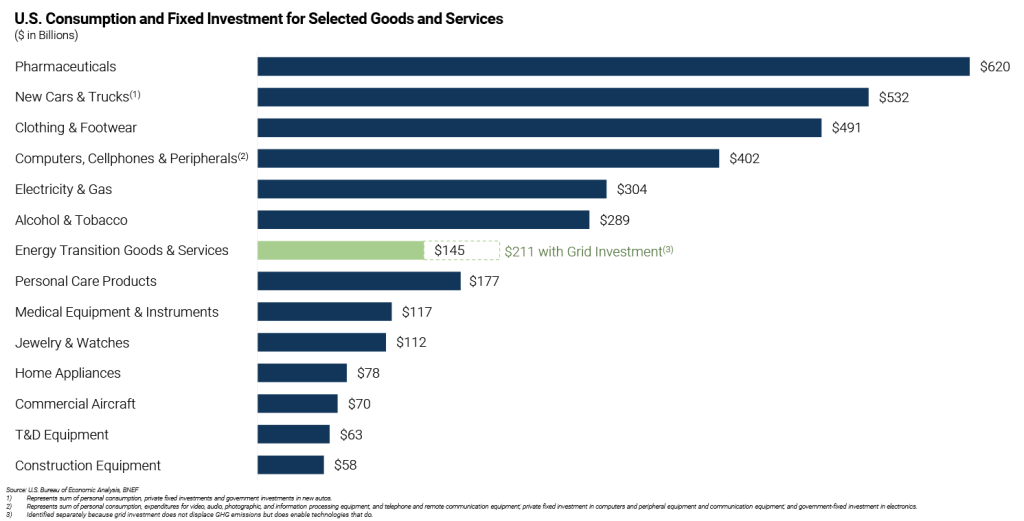

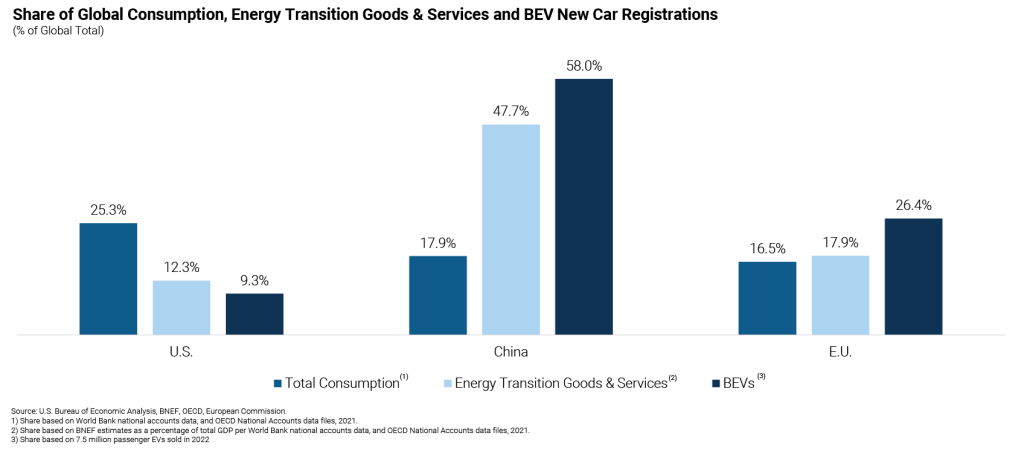

Last year, global spending on energy transition goods and services was nearly $1.2 trillion, representing a five-fold increase from a decade earlier. The U.S. market was $211 billion (including investment in the power grid) making it a little more than half the size of the electronics market (smart phones, computers and peripherals); nearly twice as large as the market for medical equipment; and three times larger than the market for commercial aircraft.

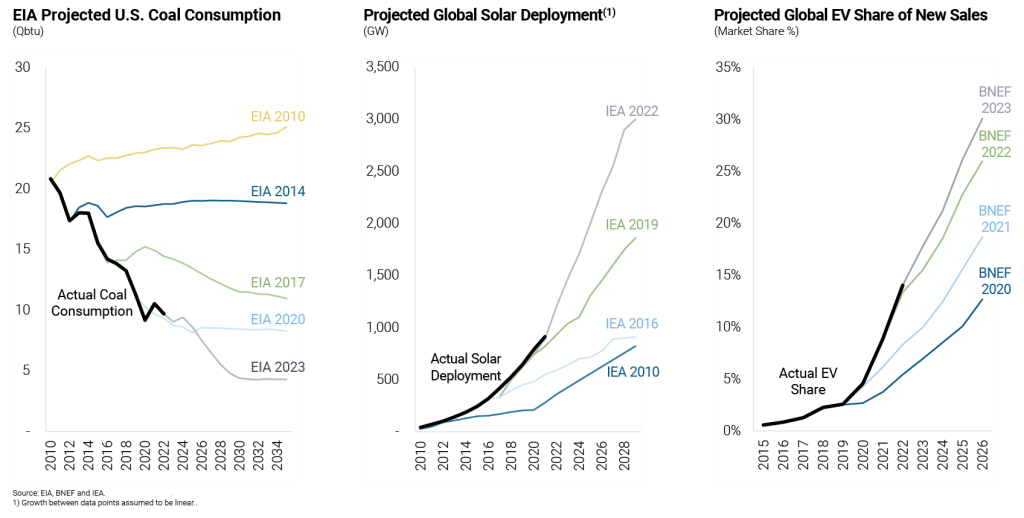

Since 2010, experts’ projections have dramatically underestimated the speed of the energy transition and the size of the markets for related goods and services that it would create. Forecasts for everything from coal consumption to global solar deployment to electric vehicle sales were way off.

Forecasts may again be too conservative for four reasons:

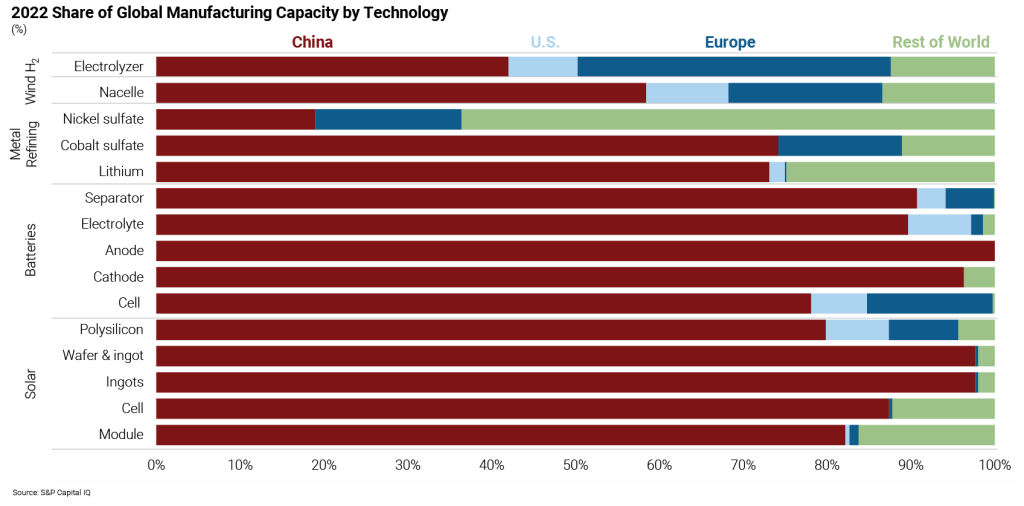

New Wave of Cost Reduction Driven by Onshoring: The cost of solar modules, wind turbines, and batteries as well as many other energy transition technologies has been falling for decades. This has made them increasingly competitive – if not less costly than – conventional solutions. But most of the reduction over the past ten years has come from economies of scale rather than breakthroughs in technology or manufacturing methods. That has in part been due to most energy transition products being manufactured in China, which has a long track record of reducing costs through production efficiencies rather than technological innovation. With the U.S. government recently passing the Inflation Reduction Act, CHIPS Act and Infrastructure Investment and Jobs Act, there are tremendous incentives to bring manufacturing, particularly of energy transition related products, back to the U.S. While most experts see more goods being produced in the U.S. as a result, they haven’t factored in the innovation that will likely come from large-scale manufacturing of energy transition products in the U.S. and its potential to accelerate cost reduction and adoption.

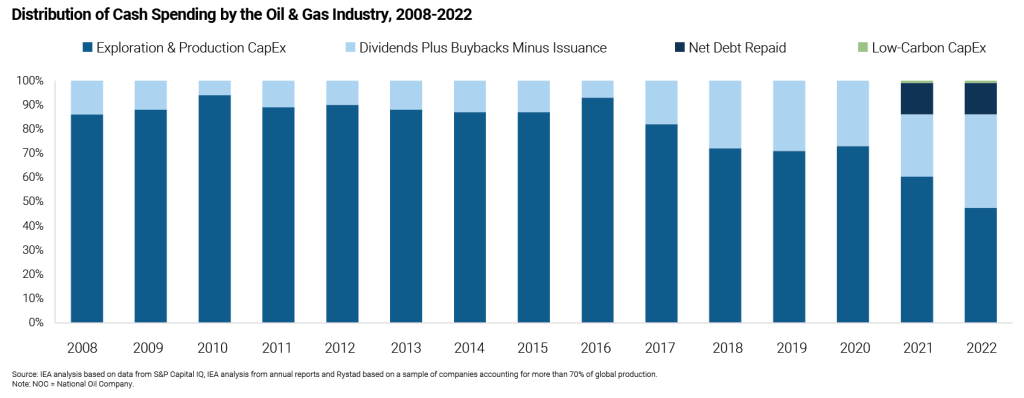

Higher Prices for Fossil Fuels: Energy companies are paring back investments in production despite record cash flows. Less than half of the record free cash flow that oil and gas companies are generating is being invested in new supply. Instead, they are plowing that money into stock buybacks, dividends and debt repayment. The underinvestment in exploration could mean much higher prices for fossil fuels in the future. That, in turn, should make energy transition technologies that are being worked on now more competitive on a relative basis even without further cost reduction.

National Security Imperatives: In the past, the primary driver of policy support for the energy transition was fighting climate change. But the war in Ukraine added a new one for many governments – national energy security. Every country has renewables (the sun shines and wind blows everywhere) but only 20% of people live in countries with sufficient fossil fuel supplies to meet their energy needs. The attractiveness of renewables from a national security perspective is that every country has them and no one can take them away. The E.U. has redoubled its support for renewable energy in the wake of Russia’s invasion of Ukraine, which underscores how powerful the national security imperative can be in driving incremental policy support for the energy transition.

Outsized Growth Potential in the U.S.: The U.S., with just 4% of the world’s population, consumes a disproportionate share (25%) of just about everything in the world – except energy transition goods and services. The U.S. is a significantly smaller market for energy transition goods and services than the E.U. or China, consuming only about 12% of energy transition products produced globally and just 9% of all electric vehicles. In fact, China and the E.U. consume energy transition goods and services at 2.7x and 1.1x the rate that they do all goods and services, respectively. If the U.S. were to consume energy transition related goods and services at the same rate that it does all good and services, the U.S. market would more than double in size. There is a good chance this will happen, as there is no reason why the U.S. should be so far behind China and the EU in its consumption.

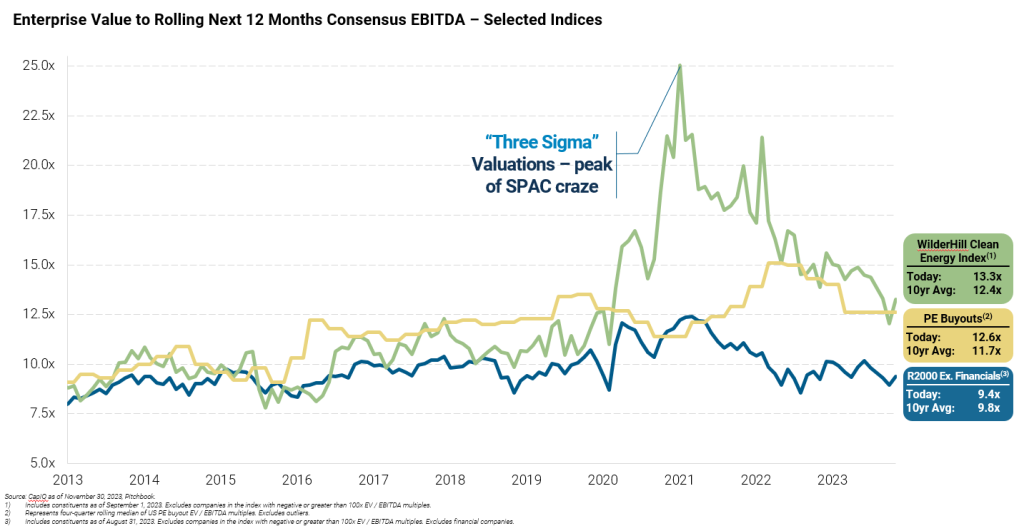

An Emerging Opportunity for Private Equity: At the same time as these new drivers are emerging that could accelerate growth, public market valuations for energy transition companies have compressed dramatically. The median company in the Wilder Hill Clean Energy index, one of the most widely followed indices of energy transition companies, currently trades at a multiple of just 13.3x next 12 months consensus EBITDA which compares to 25.1x at the index’s peak in Q1 2021 and 9.4x for the median company in the Russell 2000 today – which has lower growth prospects and is more sensitive to GDP growth.

The potential for faster growth in energy transition markets coupled with historically attractive valuations creates a very attractive risk/reward opportunity. It’s rare for growth prospects to be improving at the same time as valuations are compressing. Private equity should take note.

David Dolezal is Jefferies’ Global Head of Energy Transition Investment Banking where he is responsible for leading the firm’s coverage of companies in the solar, wind, electric vehicle, energy efficiency, energy storage, biofuels, advanced nuclear, fuel cell and sustainability consulting and software subsectors. David has more than 25 years of experience advising companies and investors on financing and M&A. He has completed more than 100 transactions for both Fortune 500 and middle-market companies, including leading three of the five largest cleantech IPOs in history (Array, Shoals and GT Solar), two of the three largest PIPEs into energy transition companies in history (IEA/Ares and Array/Blackstone), the largest sale of a renewable power company to an oil & gas major in history (Savion/Shell) and the largest sale of an energy-as-a-service company in history (Budderfly/Partners).

Kyle Baker is Jefferies’ Head of Energy Transition Investment Banking, Americas and directs the overall coverage effort alongside David Dolezal. She delivers sector expertise to financial sponsors with energy transition investment mandates and brings nearly two decades of investment banking experience covering sectors related to sustainability and energy services in both the U.S. and Europe.

The Impact of the Universal Proxy Card on the 2023 Proxy Season and Beyond

The new universal proxy card (“UPC”) rules took effect in 2022, making the 2023 proxy season the first in which both company and dissident nominees were listed on the same ballot, allowing shareholders to choose among the different candidates in a contested election. Despite widespread speculation that the new rules could lead to a boom in activism campaigns, the actual impact has been mixed. Overall, activism levels remained elevated, despite the challenging macro-environment of the past year. However, fewer activist campaigns went all the way to a shareholder vote and more settlements were reached.

One reason for the decrease in proxy fights and the increase in formal settlements between corporates and activists was the uncertainty on both sides about how voting dynamics would play out under the new rules. More public companies may have capitulated earlier because they believed activists could win at least one seat in a proxy fight.

This theory is supported by a review of proxy fights that occurred in the 2023 season. According to FactSet data, since the UPC was adopted, shareholders have elected at least one activist nominee in 67% of proxy fights that went all the way to a vote, up from 40% in the 2022 season. This year, there were also more cases of activists winning exactly one seat at the vote, despite fewer campaigns going to a vote.

While the sample size is small, these trends suggest that the UPC is making it easier for activists to win at least one board seat at target companies, a trend we expect to continue in the 2024 season as the rules become more familiar to activists. To prepare for the potential increase in UPC activism, public company boards and management teams should continue to “be their own activist” by regularly and proactively refreshing the composition of their boards of directors to ensure an optimal mix of skillsets, experience and diversity, and by reviewing strategic and financial alternatives to preempt the most likely activist demands for change.

Lessons from eToro: How Digital Adaptation is the Key to Growth

In September 2023, Jefferies hosted its seventh annual Tech Trek, Israel’s largest institutional investor conference. The three-day event connects leading global investors with the Israeli tech ecosystem through a series of panels, presentations, and meetings.

During the conference, Jefferies spoke with Yoni Assia, Co-Founder and CEO of eToro, the world’s leading social investment network. Headquartered in Tel Aviv, eToro offers smart investing tools, multiple asset classes, and a social networking community to over 30 million users worldwide.

Assia discussed the genesis of eToro and its journey to success, highlighting his early inspiration, commitment to digital adaptation, and Israel’s growing role in the global financial and technology sectors. His insights offer a powerful roadmap to young entrepreneurs, detailing the strategies that drove eToro’s steady growth through shifting markets and continuous waves of innovation.

Note: Assia’s comments on Israel were made before the events of Oct. 7. The ongoing conflict may influence the region’s tech ecosystem and investment landscape.

The Founder’s Journey: Complementary Skills Support Innovation

Assia’s passion for finance and technology started in his early teens, as he learned to trade and develop software. While pursuing his master’s degree, he recognized the financial industry’s need for innovation.

“I was conducting research for Bloomberg on ways to simplify their terminal interface,” Assia shared. “I quickly realized the limitations of these platforms’ user experience. There was a huge opportunity to introduce internet innovation to the world of trading and investing.”

Assia brought a background in finance and computer science, and his brother, Ronen, was studying design. Their complementary skill sets laid the foundation for eToro: a user-friendly, visually engaging digital trading platform.

eToro’s Ethos: Embrace Digital Change

Founded on a bedrock of innovation, eToro’s 15-year journey has been marked by continual evolution and growth. The company’s success underlines the necessity of digital adaptation for long-term market leadership.

In 2010, tapping into the burgeoning world of social networking, eToro launched OpenBook, the world’s first social investment platform. The company continued to adapt in 2012, launching mobile apps to align with the rise of Apple and Android smartphones. Since then, eToro has consistently adapted its offerings, adding a diverse range of asset classes and enhancing its platform capabilities.

“Running a global company in a competitive sector isn’t easy,” Assia said. “Our vision has always been innovation, and that guides the design of our user experience; the new technologies we introduced; our integration of cryptocurrencies and machine learning; and more.”

The Market’s Future: AI Empowers Retail Investors

Looking ahead, Assia is particularly excited about artificial intelligence (AI) and its potential to support retail investors. With the growth of platforms like ChatGPT, everyday customers gain access to the sophisticated analytical tools once only available to large investment funds.

The democratization of technology and information is integral to eToro’s mission – and adopting new AI capabilities is the next big step.

“Suddenly, we have technologies that enable users to harness the wisdom of the crowd and leverage amazing analytical insights,” said Assia. “At eToro, we’re integrating these technologies quickly, rolling out platforms designed to empower better investment decisions.”

Israel’s Entrepreneurial Ecosystem

When Assia launched eToro, he faced skepticism about the possibility of creating a global financial and tech institution out of Israel. He drew inspiration from his father, who faced similar challenges with his own Israel-based tech startup, Magic Software, in the 1990s. Both companies helped prove Israel’s potential as a tech hub, with Tel Aviv now a global center for innovation and entrepreneurship.

“Over the past 30 years, Israel has developed a robust entrepreneurial ecosystem,” Assia shared. “Today, people are building businesses, being inspired by their peers, and finding mentors to guide them. There are investors and talented entrepreneurs everywhere in Israel.”

Yoni Assia’s journey with eToro reflects the remarkable evolution of both his company and Israel’s tech landscape. His experience – blending finance, technology, and a relentless pursuit of innovation – offers invaluable lessons for entrepreneurs everywhere.

The Voice of Asset Owners

How Allocators Aim to Invest in the Transition

The Industrial Revolution, the Information Revolution and now the Energy Transition. Despite challenges and skepticism from many corners, it is inarguable that the global energy transition is upon us. We spoke with global Asset Owners overseeing more than $10 trillion to understand how they are navigating one of the critical secular trends of our time.

The Delicate Pact Between Consumers and Corporates & Victory Cuts

As he looks to 2024, US Economist Tom Simons believes that the extremely resilient post-COVID expansion is unlikely to continue for much longer. While the US consumer has defied nearly all expectations to this point, their sustained spending has largely been driven by under saving and consumers’ confidence in their ability to remain employed, leading them to spend a large portion of income. Although the business sector is currently confident enough in the consumer to avoid significant layoffs, Tom expects this confidence could begin to wobble as we enter 2024. While Tom expects some components of inflation will remain firm due to a lack of labor and a continually shrinking prime age workforce, he believes the overall reading should approach the Fed’s 2% target in 2H24. This, combined with increases in unemployment, should enable the Fed to make significant cuts to the Fed funds rate, which he sees bottoming at 3.0-3.25% in September. As a result of these cuts, Tom anticipates that the 1H24 growth slowdown will be short-lived, aided by both lower rates and a US consumer that is well-positioned for the long-term.

Chief Market Strategist David Zervos says the most recent FOMC meeting, and resulting Fed commentary, suggests that the risk of overtightening is in balance with the risk of being too accommodative. This was underlined by the additional 50bp drop in the updated Fed funds rate forecast for YE24, despite just a 20bp trim to the core PCE projection, which brought it down to 2.4%. David says this change implies that the Fed’s focus on inflation-fighting credibility no longer needs to take precedence over employment goals going forward. As a result of their policy-making successes, he expects the Fed to make a set of modest “Victory Cuts” beginning next year.

Global Head of Equity Strategy Christopher Wood says the key explanation for the resilience of the American economy in 2023 remains the extraordinary base effect from the historic expansion in M2 supply in 2020. That’s why the recent contraction in US M2, which was the third largest in 103 years, is notable. The markets remain fixated on the Fed’s recent pivot, which Christopher views as bearish for the US dollar and therefore positive for emerging market equities. From a US and developed stock market standpoint, it should also be more bullish for cyclical equities relative to growth equities. However, he continues to believe that US Treasuries are in a structural bear market, especially with both political parties in the US unlikely to embrace meaningful fiscal discipline.

The Demise of ESG-Focused Activism

Earlier this month, prominent activist investor Jeff Ubben announced he was shutting down his environmental and social investing fund, Inclusive Capital, marking a blow to the ESG activism paradigm. Considered a leader in the then-burgeoning ESG activism sphere when it launched under Ubben in 2020, Inclusive shut down because its mission unfortunately has not been rewarded by public markets, according to various media reports.

The decision reflects the view that ESG focused funds can be risky as they seek to achieve investment returns while seeking longer-term ESG objectives. Fewer activist hedge funds have recently used ESG themes as a wedge to extract concessions from target companies given the challenge of aligning a fund’s investment horizon with what could be a much longer timeline for ESG focused themes.

Further evidence is seen in the shift of Engine No. 1’s investment strategy. In 2021, it won three board seats in a landmark proxy fight at Exxon, predicated on critiques of the Company’s environmental and social corporate performance. Recently, Engine announced that it will no longer deploy an activism strategy and voted its shares against a shareholder climate resolution at Exxon last year. The fund now invests in private companies, including mining assets with poor ESG profiles.

Hedge fund activists have for many years targeted public companies’ financial, operational and governance performance as a basis for demanding corporate finance changes. Though we believe the pure ESG activist is waning, we believe ESG critiques will still appear if directly impacting a target company’s performance. It is still imperative companies take a rigorous and proactive approach to investor engagement well before the arrival of an activist.