Prime Services C-Suite Newsletter – March 2024

Jack-of-all-Reads: A newsletter for multi-hat-wearing C-suite leaders and their key constituents.

Areas of Focus: Regulatory Environment, Marketing, and ODD

Industry Insights:

Our newsletter, Jack-of-all-Reads, shares the latest and greatest insights in a brief read on a monthly basis. Please let us know of any comments or questions – we welcome and appreciate your continued partnership.

Industry Insights:

- Top of Mind: Regulatory Line Items. Funds continue to try and keep track of the ever-changing regulatory landscape. We are fielding concerns regarding continued updates from the SEC around the new private funds rule, as well as increased cyber security safeguards being put in place in the US and across the pond.

- Private Funds Rule. The rule has different effective dates for funds managing more than $1.5bn AUM (as of Sept 2024) and for those managing less than $1.5bn AUM (as of March 2025). Advice to managers is to start working with counsel to adapt their policies and procedures as soon as possible given there is a long road to compliance. Annual disclosures will have to be made to all investors in the same private fund. Although the SEC has not defined the methods of disclosure, we are seeing an increase in the importance of data room capabilities to centralize important documents.

- Cyber Security. Regarding the SEC’s cyber security rule, managers will have a timeline to file within 48 hours and report any accidents within 72 hours. Although the rule was put into effect for many managers in December of 2023, smaller reporting companies will have until June 2024, at the latest, to comply.

- Cyber In the EU. Managers are working to comply with the EU’s Digital Operational Resilience Act (DORA). DORA entered into force in January 2023 and the terms will apply as of January 2025. March 2024 was the EU’s deadline for public consultation on the policy products aimed to standardize the regulation’s requirements. As it stands, DORA requires AIFMs and ManCo’s to classify or report all IT and cyber security related incidents and contract an external firm to conduct comprehensive resilience testing on their IT and cyber security systems. DORA also requires these financial entities to manage their Information and Communications Technology (ICT) service provider risk, with the provisions placing an emphasis on contractual relationships. AIFMs are encouraged to compile a register of their existing ICT service provider contracts to ensure compliance with DORA.

- Marketing Focus: An Era of Digital Transformation in Marketing & Regulatory Updates. Some groups are starting to explore creative new ways to market and improve workflows. On top of that, the evolution of the regulatory environment has many focused on continued guidance towards the new marketing rule and staying compliant.

- AI & Data Analysis Technologies in Marketing. The team has been fielding questions from managers who are searching for ways to integrate AI tools to enhance, refine, and speed up their marketing efforts. While AI tools cannot replace the human creativity and connection involved in a fund’s marketing process, they can be used in the beginning stages as a starting point for drafting materials, and they can also speed up research processes by succinctly aggregating information. In addition, many marketers are also focused on using other data analysis technologies to gain better insights into their target audience’s needs. A new study published by EXT. Marketing found that almost half of marketer’s plan to focus on implementing new data analysis technology in their processes this year. Video-based marketing is also gaining in popularity, with the EXT. Marketing report finding that people have a preference towards visual aids, including easy to digest scannable content and short videos that can be consumed quickly.

- Additional Guidance: New Marketing Rule Updates. Last month, the SEC released updates to the new marketing rule, which gave managers additional guidance on requirements for calculating net and gross performance. Managers are encouraged to reach out to their legal counsel with any questions to ensure they will be in compliance . Although the law itself has not changed, there was an increase in requests on methodology for performance calculations prior to this FAQ.

- Trends in ODD. Throughout conversations with various ODD teams on their current areas of focus across the industry, many have emphasized challenges around talent retention and acquisition, the increased importance of having efficient IT systems, and the need to more closely scrutinize vendor relationships.

- Talent. As the biggest funds continue to grow in size, the war for talent across both the investment and non-investment teams continues. This has been forcing managers to think differently about how they aim to retain and attract key workers. Many funds are reporting particular difficulty in hiring for junior controller roles and, similarly, many accounting firms are having trouble retaining junior accountants. To cope, some groups are heavily investing in technologies that can help solve for this industry-wide shortage.

- Technology. ODD teams are placing emphasis on how their managers are utilizing technology and are seeing more clients engage with software data analysis programs. The days of having all analysis on excel seems to be diminishing.

- Vendor Due Diligence. Ensuring new vendors go through rigorous compliance is a focus, specifically as it pertains to expert networks and alternative data sources. With potential risks arising from managers’ use of AI technologies and the longstanding risks associated with utilizing third-party vendors, it is increasingly important that funds vet their technology systems and put safeguards and policies in place to respond compliantly to any breaches. There is also concern around Expert Networks and heightened diligence on transcripts received from expert networks to ensure there is not MNPI embedded.

Please reach out to your Jefferies contact for more information on any of the topics above.

Client Corner:

Women’s History Month: Numbers in Alternatives: The industry has seen an increased focus around DEI initiatives and many have been reflecting on the pivotal role diversity plays in the alternatives space. Preqin released a report this month on the status of female representation in the industry, finding that only 17% of those in senior roles at hedge funds are women. Although this is 6% higher than the proportion in 2020 and is higher than the rate across the entire alternatives industry, which sits at 15%, there are still discrepancies when compared to the broader workforce. Preqin’s report found that the proportion of female employees across all levels – junior, middle, and senior – appears lower in the alternatives industry overall. As Women’s History Month comes to an end, it is important to continue to create a workplace culture that allows for diversity of thought and ideologies.

Spotlight on Content and Events:

Launch 2025. This series of video, audio, and written content explores critical questions that should be top of mind for alternative fund founders and some answers that can help build a successful launch. It includes six episodes that explore the critical questions that need to be top of mind for every alternative fund founder in the mid-2020s and some answers that can help build a more successful launch such as: “Who do you hire first?” and “What is this going to cost you?”. VIEW HERE

AI FAQ’s: As the industry makes strides in understanding how AI tools may be able to work for them we are fielding questions from managers and investors. This piece answers some of the most frequently asked questions around AI. It also discusses recent trends and themes across the hedge fund industry regarding AI and its use cases. Reach out to the Jefferies consulting team to discuss the below:

- What is AI?

- How are manager using AI?

- How are investors thinking about AI?

- What compliance considerations should AI users keep in mind?

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

EisnerAmper – A Comprehensive Outlook on Hedge Funds in 2024

EXT. Marketing – Top Trends in Financial Marketing in 2024

Schulte Roth & Zabel – Marketing Rule FAQ – Impact of Subscription Lines of Credit on Presentation of Net IRRs

Sidley – Enforcement is on the Rise Against Non-Compete Agreements. Is Your Business Ready?

SS&C – Preparing for Form PF Changes as SEC & CFTC Adopt Amendments

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Ariel Deljanin

Business Consulting Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

Paul Covello

Global Head of Outsourced Trading

[email protected]

Eileen Cooney

Capital Introductions

[email protected]

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2024 Jefferies LLC

Clients First-Always SM Jefferies.com

A View of ESG Performance During the Trump and Biden Presidencies

On November 5, 2024, millions of Americans will head to the ballots, where the presidency, 468 congressional seats (33 in the Senate and all 435 in the House), and 11 governorships will be contested. These outcomes may shape the future of the energy transition, with climate policies front of mind for voters and candidates alike.

Last month, Jefferies’ Sustainability and Transition team explored six key questions around the 2024 elections’ impact on the US energy landscape. This analysis was part of a broader series examining the interplay between politics and the global energy transition.

Continuing this series, the team’s latest report analyzes ESG performance during the presidencies of Donald Trump (R) and Joe Biden (D). Specifically, it explores how ESG heuristics performed against traditional counterparts and broader market benchmarks during each administration.

This analysis covers two distinct periods: (1) from President Donald Trump’s election to President Joe Biden’s election and (2) from President Biden’s election to the present. It’s important to note that these findings do not establish causality, as ESG performance is influenced by a multitude of factors beyond just politics and policy.

Jefferies analyzed seven heuristics focused on ESG and the energy transition:

- Four ESG and energy transition indices outperformed their broad market benchmark during President Trump’s tenure, while three underperformed.

- All seven ESG and energy transition indices underperformed vs their broad market index during the current Biden era.

—

Invesco WilderHill Clean Energy ETF (PBW) vs. Invesco S&P 500 Equal Weight Energy ETF (RSPG) vs. S&P 500 (SP50)

- PBW tracks a modified equal-weighted index of US-listed companies involved in clean energy sources or energy conservation.

- RSPG tracks an equal-weighted index of US energy companies listed in the S&P 500.

- SP50 includes 500 leading companies in leading industries of the US economy.

Findings: During the Trump Administration, PBW saw the strongest performance and RSPG saw the weakest, with a delta in total return of 350.5 percent. During the Biden Administration, performance flipped: RSPG performed strongest and PBW weakest in a reversal of 309.8 percent.

iShares STOXX Europe 600 Oil & Gas UCITS ETF (SXEPEX) vs. SPDR S&P Oil & Gas Exploration & Production ETF (XOP) vs. STOXX Europe 600 (183660)

- SXEPEX tracks the performance of companies from the European oil and gas sector.

- XOP tracks an equal-weighted index of companies in the US oil and gas exploration and production space.

- 183660 includes 600 European companies representing all market caps.

Findings: During the Trump Administration, STOXX Europe 600 saw the strongest performance and XOP the weakest, with a delta in total return of 81.7 percent. Again, during the Biden Administration, performance flipped: XOP performed strongest and STOXX Europe 600 weakest in a reversal of 208.9 percent.

iShares MSCI ACWI Low Carbon Target ETF (CRBN) vs. iShares MSCI World ETF (URTH) vs. MSCI AC World (892400)

- CRBN tracks an index of stocks from global firms selected for a bias toward lower carbon emissions.

- URTH tracks a market-cap-weighted index of stocks that cover 85 percent of the developed world’s market cap.

- 892400 captures large- and mid-cap companies across developed markets.

Findings: During the Trump Administration, performance was essentially the same across all indices. Under the Biden Administration, URTH has seen the strongest performance and CRBN the weakest, with a delta of 8.3 percent.

MSCI Global Alternative Energy (MS700750) vs. iShares Global Energy ETF (IXC) vs. MSCI AC World (892400)

- MS700750 includes developed and emerging market companies that derive 50 percent or more of their revenues from alternative energy products and services.

- IXC tracks a market cap-weighted index of global energy companies.

- 892400 captures large- and mid-cap companies across developed markets.

Findings: During the Trump Administration, alternative energy saw the strongest performance and IXC the weakest, with a delta in total return of 146.2 percent. Under the Biden Administration, performance flipped: IXC saw the strongest performance and alternative energy the weakest, with a delta of 202.6 percent.

Invesco Solar ETF (TAN) vs. iShares Global Energy ETF (IXC) vs. MSCI AC World (892400)

- TAN tracks an index of global solar energy companies selected based on the revenue generated from solar-related businesses.

- IXC tracks a market cap-weighted index of global energy companies.

- 892400 captures large- and mid-cap companies across developed markets.

Findings: During the Trump Administration, TAN saw the strongest performance and IXC the weakest, with a delta of 337.5 percent. During the Biden Administration, IXC saw the strongest performance and TAN the weakest, with a delta of 207.2 percent.

SPDR MSCI USA Gender Diversity ETF (SHE) vs. S&P 500 (SP50) vs. MSCI USA (984000)

- SHE tracks a market cap-weighted index of US companies promoting gender diversity while exhibiting a high proportion of women across all levels of their organization.

- SP50 includes 500 leading companies in leading industries of the US economy.

- 984000 measures the performance of the large- and mid-cap segments of the US market.

Findings: MSCI USA saw the strongest performance under the Trump Administration and SHE the weakest, with a delta of 21.3 percent. During the Biden Administration, the S&P 500 saw the strongest performance and SHE the weakest by 19.7 percent.

iShares MSCI USA ESG Select ETF (SUSA) vs. S&P 500 (SP50) vs. MSCI USA (984000)

- SUSA tracks an index of US companies with high ESG factor scores, as calculated by MSCI.

- SP50 includes 500 leading companies in leading industries of the US economy.

- 984000 measures the performance of the large- and mid-cap segments of the US market.

Findings: During the Trump Administration, SUSA saw the strongest performance and S&P 500 the weakest, with a delta in total return of 6.7 percent. Under Biden, performance flipped: the S&P 500 saw the strongest performance and SUSA the weakest, with a delta of 9.1 percent.

—

Again, these findings do not establish causality, as the factors impacting ESG performance during any given period are multifarious. That said, today’s political parties diverge significantly in their approach to the energy transition and related policies. With so many elections slated for this November, there is no question that 2024 will be a critical year for ESG.

For the full report, and more coverage of ESG performance, follow Jefferies’ Sustainability and Transition team.

The Climate Tech Investment Landscape — A Deep Dive

With over 7,000 companies – of which 100 are valued at over $1 billion – climate tech has emerged as a pillar of ESG and sustainability investing. As the energy transition unfolds, these technologies are only poised to capture more market share.

The novelty of many climate tech solutions makes it difficult for investors to assess their progress, market penetration, and impact on existing players – especially since most operate in private markets.

Jefferies’ Sustainability & Transition team set out to examine the landscape of climate tech investing; analyzing its current state, trajectory over the next year; key developments and innovations; and more.

First, it’s crucial to understand the evolution of climate tech since 2020. This period marked a significant leap forward for the sector, with over 2,500 companies raising around $150 billion through more than 4,000 deals. Acquisitions have been the primary exit strategy, accounting for 65 percent of exits since 2020. Despite macro challenges, the sector maintained its momentum in 2023, with the average deal size growing by 28 percent and investments increasing at an annual rate of 23 percent.

In 2024, as macro conditions improve, climate tech investors have dry powder. Once the domain of VC funds, the sector’s cap table now includes private equity, governments, corporates, and infrastructure funds, all ready to invest substantial capital.

Here are some of the key questions for climate investors in 2024.

What’s in store for the sector’s investment landscape?

Corporate involvement in the climate tech space is expected to grow in 2024. Established corporates are likely to integrate innovative companies with limited capabilities and balance sheets, aiming to expand their market share or adjust their existing business lines.

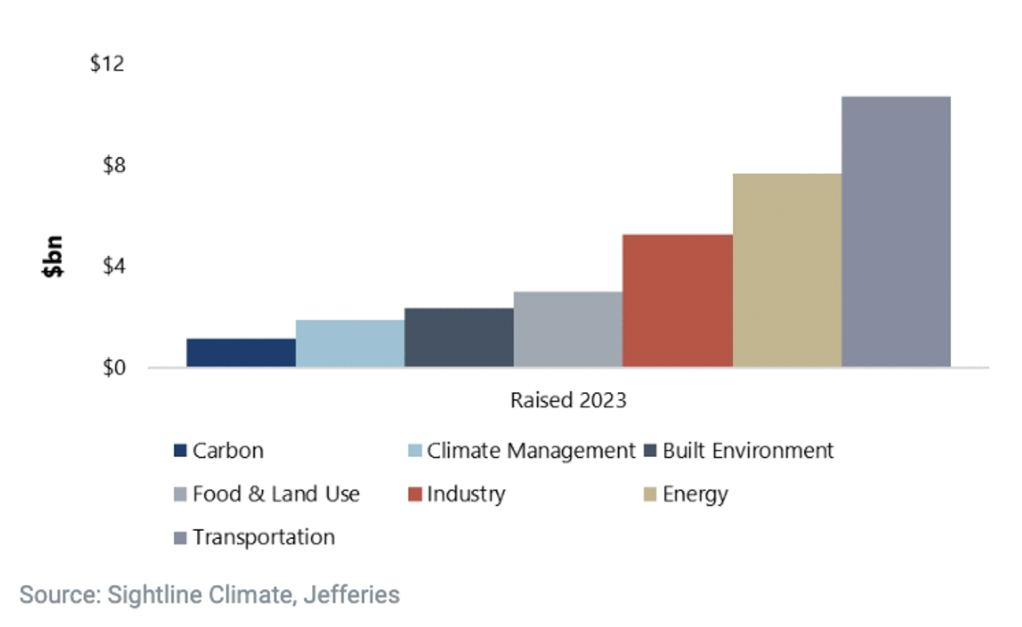

The sector is set to mature even further, continuing the trend from 2023, with the bulk of funding flowing towards established players that offer proven solutions in specific sectors. Data indicate that Energy and Industry will be the main areas of focus for investors in 2024.

What are the size and scale of key players in the climate tech ecosystem?

Climate tech has undergone significant evolution in recent years, shifting from primarily funding innovative and immature technologies to also embracing infrastructure, growth, and bankable projects. Several factors need to be considered as investors evaluate the sector’s key opportunities in 2024:

Funding Levels: Where is capital flowing?

- In 2023, late-stage and growth funding experienced continued declines (around 30 percent), whereas seed-stage funding showed resilience, increasing by 12 percent year over year.

- The transportation and energy verticals remained highly attractive to investors.

- Industry was the only subsector to gain positive momentum amid a challenging macroeconomic environment.

Transportation and Energy remained in favor in 2023.

IPOs, SPACs, Acquisitions: What’s the state of dealmaking?

- Overall, IPOs, SPACs, and M&A transactions decreased by 50 percent in 2023. SPACs, in particular, saw an 89 percent downturn, signaling a potential collapse in that market for climate tech companies.

- Transportation and Energy saw the largest number of companies go public or get acquired, representing 64 percent of the sector’s total exits in 2023.

- More than 80 percent of M&A deals in the climate tech space were for undisclosed amounts.

- On average, the median exit time for companies is just north of 8 years.

Corporates & Climate Tech: How has their role evolved?

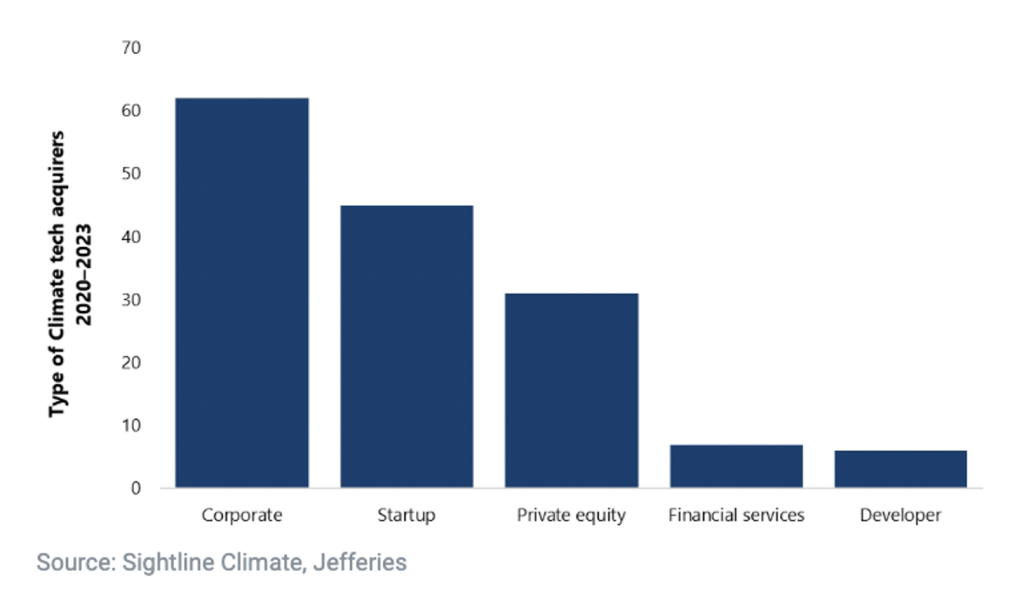

- Since 2020, corporates have emerged as the most active acquirers of companies, responsible for 41 percent of all acquisitions.

- Notably, BP, Shell, and Schneider Electric have been particularly significant players.

- Corporate venture capital has been distributed relatively evenly across Series A and growth-stage funding rounds.

Corporates have been the most active acquirers of climate tech companies over the last 3 years.

How can investors identify winners and losers in emerging climate tech sectors?

Identifying potential success stories in climate tech involves considering returns relative to the level of risk, a familiar approach for investors. Three key risks need to be assessed:

- Technology Risk: Assessing technology risk is often the single biggest issue investors face. Technology risk exists at each step through from concept to early and late prototypes, all the way to first-of-a-kind and commercial operation stages. Earlier-stage innovations naturally command higher risk premiums.

- Execution or Project Risk: With a database of over 16,000 projects globally, Bent Flyvbjerg estimates that over 90 percent of projects (construction) aren’t completed on time, overrunning by an average of 60 percent. Assessing execution risk for first-of-a-kind and one-of-a-kind projects will be a key determinant of success at both the sector level and the company level.

- Geographic Risk: The success of specific solutions will greatly depend on the local context. Some innovations may be more applicable or relevant in certain geographies than in others.

It is now widely accepted that the energy transition is a technological revolution which will play out over the next two decades — and potentially longer. It will harness the power of many new technologies, many of which are not the incumbent options in their respective sectors.

Adoption of new technologies will be both uncertain and nonlinear. Investors who are able to develop an understanding of how innovations play out at various stages will be able to develop strategies to capitalize on new markets.

For a more detailed analysis of the state of climate tech in 2024, see Jefferies’ Sustainability and Transition team’s full report on the state of the market.

Leucadia Asset Management Announces Strategic Relationship with GREYKITE

Cato Networks’ Head of Strategy on Product Differentiation and the IPO Roadmap

In September 2023, Jefferies hosted its seventh annual Tech Trek, Israel’s largest institutional investor conference. The three-day event connects leading global investors with the Israeli tech ecosystem through a series of panels, presentations, and meetings.

At the conference, Jefferies spoke with Yishay Yovel, Chief Strategy Officer at Cato Networks. Cato, an Israeli-based SASE platform company with converged networking, security, and mobility capabilities, is one of the tech ecosystem’s most anticipated IPOs. In September 2023, Cato announced a $238 million equity investment, valuing the company at over $3 billion.

Yovel shared insights on Cato’s strategy for building a differentiated product in an already developed sector; Cato’s “rip-and-replace” approach; achieving resilience in turbulent markets; and the company’s path to going public.

Note: The following interview preceded the events of October 7th and does not take into account the effects of the ongoing conflict.

Achieving Growth in Mature Markets: Cato’s Strategy

Founded in 2015, Cato Networks reached $100 million in annual recurring revenue (ARR) in 2022, growing its ARR from $1 million to $100 million in just five years. Serial entrepreneur Shlomo Kramer, founder and CEO of Cato, previously led cybersecurity startups Check Point and Imperva to multi-billion-dollar IPOs. Cato’s cloud-native architecture combines enterprise networking and network security within a secure access service edge (SASE) framework. Today, more than 2,100 enterprises across 150 countries have adopted the Cato SASE Cloud.

Yovel spoke to the company’s unprecedented growth in the network security sector, which, at the time of Cato’s founding, was already dense with cloud solutions from major providers.

“Most companies grow by building a point solution for a point problem. Our approach was different,” Yovel explained. “Enterprises have a difficult time managing multiple products with separate capabilities. We took a step back and asked, ‘Why is there so much complexity in networking and security infrastructure, and can we simplify it with a single-product architecture?’”

That became the vision for Cato: a turnkey networking and security infrastructure that is scalable and addresses multiple needs.

This “rip-and-replace” strategy became the backbone of Cato’s growth. It involves not just substituting one legacy solution with a cloud alternative, but migrating multiple point products, appliances and cloud services, into a single, cloud-native software stack. Cato’s framework has gained significant traction in the industry, with leaders like Gartner and Forrester now recommending a SASE solution for their network security clients.

Developing Durable Products in Uncertain Markets

Cato’s growth overlapped a challenging period for global markets; in the wake of the COVID-19 pandemic, cost reduction became a priority for many businesses. Though enterprise security is typically viewed as a resilient operating expense, cost centers like the SASE Cloud remained vulnerable to budget cuts. Yovel, addressing this challenge, explained Cato’s approach to building resilient products by prioritizing total cost of ownership (TCO) from the start.

Yovel detailed Cato’s unique sales approach, sharing that “Cato’s projects are essentially funded by existing budgets. We approach companies with separate allocations for firewalls, remote access, and networking infrastructure, and we demonstrate how these budgets can be consolidated into Cato’s solution. Even in challenging economic times, our value proposition is resilient, because we help businesses invest less and get more.”

The Path to Going Public: What’s Next for Cato?

Discussing Cato’s future, Yovel addressed the question on many investors’ minds: when is the company planning to go public?

Shlomo Kramer is on track to be the first founder to lead three cybersecurity companies from seed stage to multi-billion-dollar IPOs. He has discussed a potential IPO in the fourth quarter of 2024, depending on market conditions.

“We want to go public, if market conditions allow it, in the next 12 to 18 months,” Yovel stated. “We have the growth rate and numbers to support this. We just need to find the right opportunity in public markets.”

While predicting the exact timing and specifics of a potential IPO is difficult, the company’s trajectory, product resilience, and focus on growth position it for longtime leadership in network security.

Shifting Tides in the Sleep Apnea Treatment Market: From Philips’ Re-Entry to Ozempic

The sleep apnea treatment landscape experienced a major reshuffling in 2021, as Philips Respironics, a longtime market leader, recalled several CPAP and BiPAP devices due to potential health risks. Now, three years later, Philips is preparing to re-enter the market. What does this mean for companies like ResMed, who stepped in to fill the gap Philips left behind?

This is just the tip of the iceberg in what’s expected to be a critical year for the sleep apnea sector. The advent of GLP-1 drugs brings further uncertainty. These novel treatments have the potential to alleviate sleep apnea symptoms, but their impact on the market is yet to be seen.

In a recent survey of 50 US-based sleep doctors and durable medical equipment (DME) providers, Jefferies’ Global Research and Strategy Team explored these developments and more. Respondents shed light on the current and future market for sleep therapies, from the resilience of established methods like CPAP (Continuous Positive Airway Pressure) to the emerging potential of GLP-1 Agonists.

Here, we unpack the latest trends in pricing, product quality, and novel therapeutic approaches that are shaping an eventful 2024 for the sleep apnea treatment market.

The Competitive Landscape: How Will Philips’ Re-Entry Impact the SDB Treatment Market?

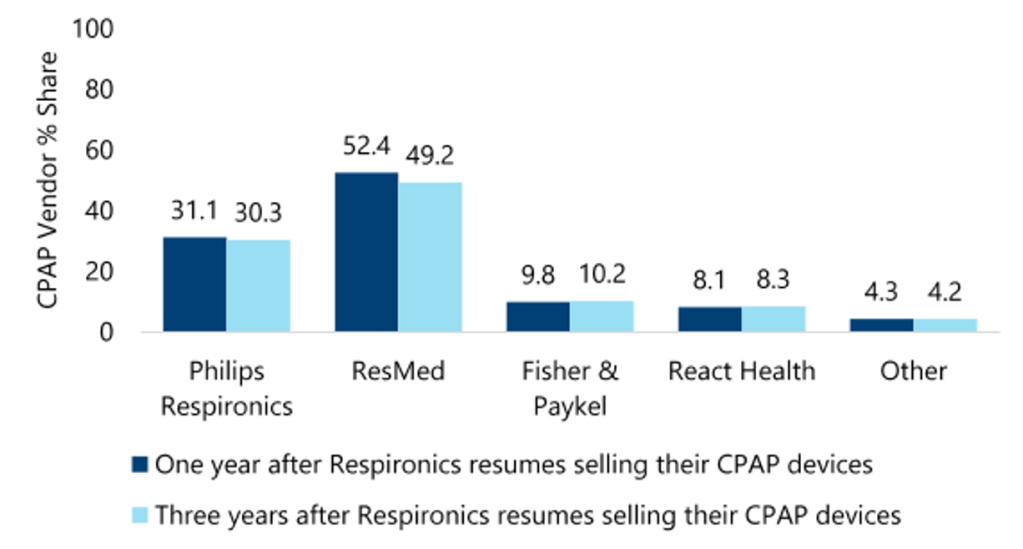

ResMed, the market leader, scored highest in providers’ CPAP and mask rankings. RMD currently holds 62 percent market share, a position strengthened by Philips Respironics’ exit from the market in 2021. This shift came after issues were discovered in Philips’ CPAP and BiPAP devices, leading to a market gap that RMD effectively filled. Despite its strong position, respondents expect RMD’s market share to decrease with Philips’ re-entry, potentially falling to between 49 and 52 percent in the next 1-3 years.

Exhibit 1 – What percentage of your CPAPS do you expect to write scripts for or recommend patients use from the following providers?

Source: Jefferies 4Q23 Sleep Survey

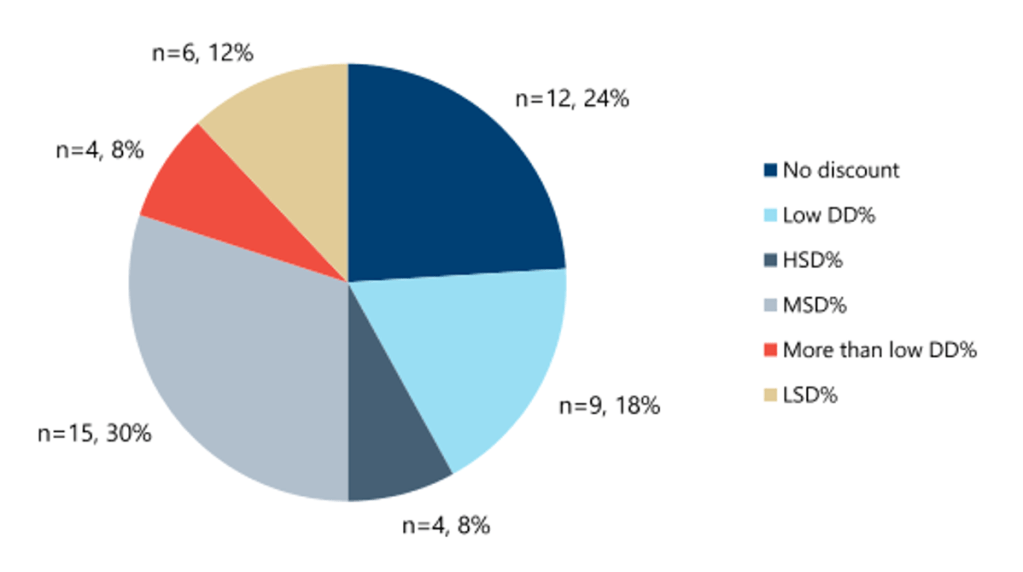

The exact timing of Philips’ return to market is still pending, dependent on the outcome of a consent decree. However, respondents expect PHIA’s re-entry to include competitive pricing strategies, with moderate discounts aimed at RMD. While PHIA is expected to regain market share, the process is likely to be gradual, buffeted by the company’s reputational challenges and an increasingly tough competitive landscape.

Exhibit 2 – Assuming Respironics can prove the safety of their machines, what level of pricing discount would you insist on from Respironics (expressed as average % discount vs ResMed)?

Source: Jefferies 4Q23 Sleep Survey

Looking ahead, respondents also expect scripts for Fisher & Paykel and React Health to increase in the coming years, by 4.1 and 3.0 percent, respectively. Both companies benefited from the initial PHIA recall, with their market share rising by several percentage points.

The Birth of GLP-1s: Do Weight-Loss Therapies Threaten the Industry’s Gold Standard?

Though respondents expect continued growth in the CPAP market, this growth faces potential slowing due to the rise of GLP-1 treatments. GLP-1 Agonists, primarily used for obesity management and diabetes, show promise in reducing sleep apnea symptoms by promoting weight loss, a known factor in improving sleep apnea severity.

Survey participants predict a 12 percent increase in CPAP volume for 2024, with GLP-1 treatments having a limited impact initially. However, over the next five years, they expect the CPAP market could shrink by approximately 15 percent as a result of these treatments. To date, there hasn’t been a noticeable decline in adherence to or sales of traditional sleep apnea treatments among patients using GLP-1 treatments, but changes are expected as the market adjusts to these new therapies. Leading CPAP providers like RMD are yet to feel a significant impact but are preparing for future shifts in the market influenced by these novel therapeutic options.

Jefferies’ Sleep Survey offers important insight into shifts in the sleep apnea treatment landscape, as key players like ResMed and Philips navigate periods of transition. The coming years may see changes in market share, competitive pricing dynamics, and the integration of novel therapies like GLP-1 agonists, presenting unique opportunities and challenges for investors, healthcare providers, and patients. Jefferies Global Research and Strategy team will monitor these developments closely; the full summary of the sleep doctor and DME provider summary is available here.

No Transition Without Transmission: The Path Forward for Grid Bottlenecks

The challenge of upgrading and expanding grid infrastructure is now widely acknowledged as the biggest obstacle to a net-zero future.

Despite a surge in clean energy investments, grid development has lagged. Existing infrastructure, unprepared for projected load growth over the next decade, is now the Achilles’ heel of the global transition.

Investors and governments are beginning to recognize the problems facing electricity grids, and significant expansions and investments may be on the horizon. This article explores avenues for progress and the investment opportunities they present, with a focus on short-term solutions to boost grid capacity and flexibility.

The Grid’s Vital Role and Its Biggest Challenges

As electricity becomes a larger part of global energy consumption, the importance of the grid grows. Global electricity demand is projected to rise by 25-30% by 2030 and more than 50% by 2050. The share of renewables in the energy mix is soaring, with around 3,000 GW of renewable projects waiting for grid connections. About half of these are in advanced stages, representing a threefold increase over the solar and wind capacity added in 2023.

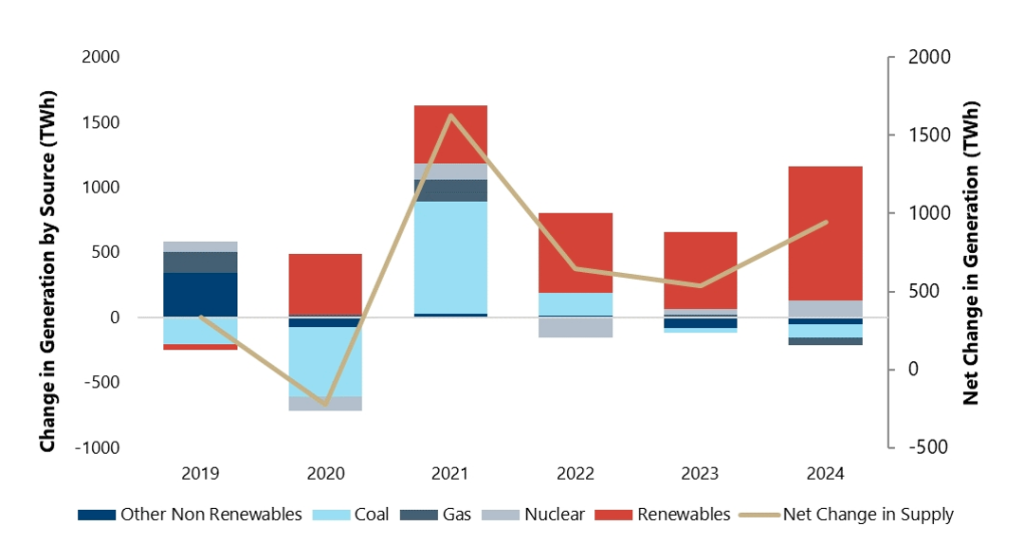

Exhibit 1: As the generation mix changes and renewables’ penetration increases, grid infrastructure will need to evolve.

Our grid infrastructure is not equipped for the coming surge in overall electricity demand and an increase in clean energy sources. The main bottlenecks in today’s grids fall into three categories:

- Physical Infrastructure

- Grid Mechanics

- Services

Below, we break down potential solutions in each category, including the technologies, policies, and procedures that may attract investment.

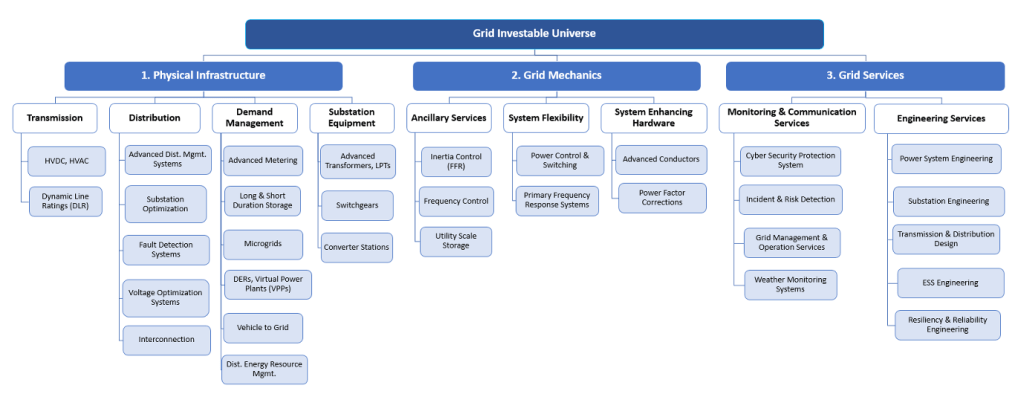

Exhibit 2: We segment the investable opportunity set across three categories of bottlenecks.

Physical Infrastructure

This is, far and away, the biggest hurdle for grids.

The energy transition and associated load growth will require substantial expansion and modernization of the physical grid infrastructure. This comes at a time when many existing assets, already aging, need upgrades or replacements. The construction of new infrastructure and the enhancement of existing ones — such as transmission and distribution (T&D) lines, transformers, and substation equipment — are critical steps.

Many of the required changes will require policy reform. Key areas include streamlining permitting processes, enhancing planning procedures and cost allocation, and mitigating supply chain disruptions.

Although advancements in this domain are largely dependent on policy changes and tend to have longer development times, companies specializing in transmission, distribution, and substation equipment offer promising opportunities for investors.

For an in-depth analysis of companies and solutions in this area, refer to the complete Jefferies report on grid bottlenecks.

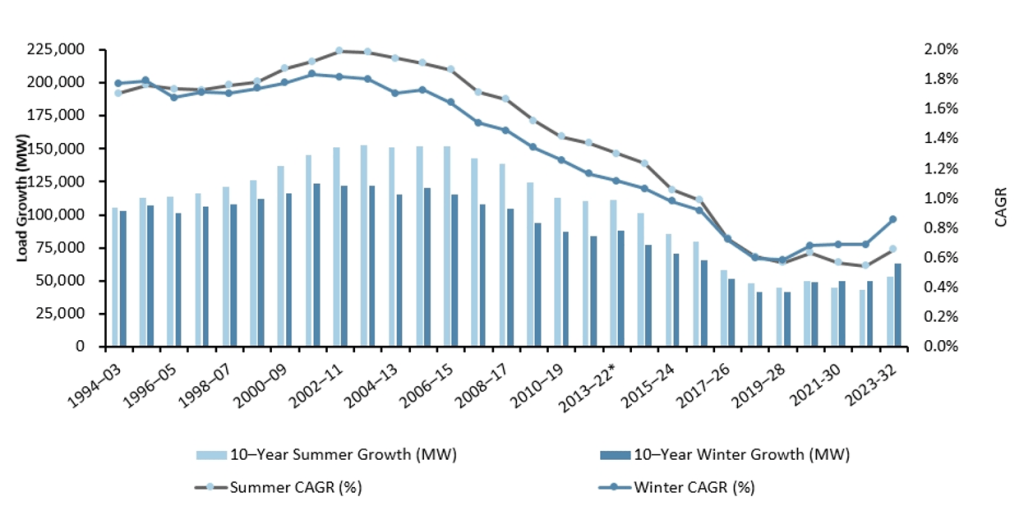

Exhibit 3: The US 10-year load growth forecast trend is set to 2x, increasing for the first time in a generation.

Grid Mechanics

The shift toward renewable energy sources impacts the fundamental mechanics of grid operation. Today, balancing services, flexibility, and the alignment of supply with demand are critical for electricity markets. Going forward, two challenges stand out:

Supply Variability: Traditionally, variability in electricity markets has been on the demand side. As we transition to new generation sources – intermittent renewables – we introduce a significant amount of supply variability.

Ancillary Services: The reliability and efficient functioning of modern grids heavily depend on ancillary services, many of which were historically provided as by-products of fossil fuel generation (for example; inertia, reactive power, and voltage control).

In response, new technologies and methods are being developed to replace these services, such as electronic devices designed to stabilize grid voltage and frequency, thereby enhancing system flexibility. Technologies and processes focused on improving system flexibility and fostering regional interconnection will take center stage in the coming months and years.

Services

Grid services include a wide range of systems crucial for reliability, flexibility, and resilience. These include both the engineering efforts needed to expand and enhance the existing grid infrastructure, and the strategic focus and investment that can address many current challenges in grid deployment.

Monitoring & Communication Services: There is a variety of software and data management platforms available that can enhance grid flexibility by improving real-time monitoring and communication capabilities.

Engineering Services: To support expansion efforts, a significant boost in engineering services is necessary. The current engineering supply chain may struggle to meet the heightened demand for power system engineers, project managers, and substation engineering specialists, among others.

—

As global electricity demand continues to grow, and the share of renewable sources in the energy supply increases, upgrading and expanding grid infrastructure is arguably the most critical objective for policymakers and investors in the energy transition. There are many opportunities to enhance the capacity and flexibility of our grid, but they must be pursued strategically and swiftly, or we risk undermining significant global progress towards a net-zero future.

For Jefferies’ Sustainability and Transition Team’s comprehensive perspective on the companies and technologies at the forefront of grid solutions, consult the firm’s full report.

The Power of Partnership: How Investor-Entrepreneur Synergy Catalyzes Global Growth

In September 2023, Jefferies hosted its seventh annual Tech Trek, Israel’s largest institutional investor conference. The three-day event connects leading global investors with the Israeli tech ecosystem through a series of panels, presentations, and meetings.

At the conference, Jefferies spoke with Shay Grinfeld, Managing Partner at Greenfield Partners, an Israel-based investment firm focused on early growth stage technology businesses. Grinfeld shared insights on the dynamic Israeli tech market, the risk-reward balance for growth companies, successful investor-entrepreneur partnerships, and more.

Note: Grinfeld’s comments on Israel were made before the events of Oct. 7. The ongoing conflict may influence the region’s tech ecosystem and investment landscape.

Israel’s Tech Market Evolution

Grinfeld, a seasoned investor in Israeli startups, spoke to the rapid growth of the country’s tech ecosystem. A burgeoning tech hub in the early 2000s, Israel has now emerged as one of the world’s most mature and productive markets. Today, the country is home to more than 90 “unicorns”, privately held businesses valued at over $1 billion.

“Looking back a decade or more, the typical Israeli company would develop a great technology and, upon reaching product-market fit with their initial customers, receive acquisition offers from the US or Europe in the $200 to $300 million range,” Grinfeld recounted. “Now, we regularly see Israeli companies reach $100 million in annual revenue, with many NASDAQ IPOs. Global capital is pouring into the Israeli market.”

He attributed Israel’s tech market growth to two trends: the surge of growth financing and the rise of seasoned entrepreneurs in Israeli ventures. Second- and third-time founders, experienced at scaling businesses, are keen to identify clear paths to profitability and collaborate with the right investors.

“When you think of the global tech scene, San Francisco, New York, and Austin come to mind, but the next city you have to think of is Tel Aviv,” Grinfeld said. “If you want to find great technology, you come to Israel.”

Guiding Startups to Global Readiness

Grinfeld then detailed Greenfield Partners’ investment approach, discussing the balance of risk and reward in growth-stage businesses and investors’ role in guiding companies toward maturity and global market readiness.

“At Greenfield Partners, we help early-stage companies prepare for global markets. What are key metrics, KPIs, benchmarks, and how do we achieve them?” He explained. “We put ourselves in the shoes of entrepreneurs and young CEOs. Their journeys begin with a product, but as they navigate market challenges, new employees, and global growth, they need an adaptable playbook. The experience of long-time investors and advisors is so important.”

Discussing his areas of focus, Grinfeld highlighted IT infrastructure, a sector of enduring interest. He highlighted how a solid tech infrastructure – across data, cybersecurity, IT, and computing, forms the foundation of the new applications and capabilities modern businesses are adopting. Grinfeld also underscored Israel’s global leadership in building top-tier tech infrastructures.

The Power of Collaboration

Finally, Grinfeld spoke to the importance of collaboration and understanding in investment. Events like Tech Trek, he said, are essential for bridging the knowledge, cultural, and experience gaps between global investors and entrepreneurs.

“Creating interactions between founders, CEOs, GPs, LPs on one stage fosters intimacy and collaboration,” Grinfeld shared. “At the end of the day, investors need to understand different stories, people, and cultures to be successful internationally. That’s the magic created by events like Tech Trek.”

Grinfeld’s comments offer a valuable perspective on tech investing, achieving scale as a growth business, and the continued evolution of the global tech ecosystem. As venture capital funds increasingly focus on international markets and entrepreneurs, his insights offer a strong platform for successful investor-entrepreneur partnerships.

ESG and the Energy Transition Are on the Ballot

On November 5, 2024, millions of Americans will head to the ballots, where the presidency, 468 congressional seats (33 in the Senate and all 435 in the House), and 11 governorships will be contested. These outcomes may shape the future of the energy transition, with climate policies front of mind for voters and candidates alike.

Here, Jefferies presents an analysis of six key questions around the 2024 elections’ impact on the US energy landscape. This includes the fate of the Inflation Reduction Act, US-China relations, ESG investing frameworks, and more.

- Inflation Reduction Act: What’s Next?

- 2024’s Impact on Bipartisan Climate Legislation

- The US-China Trade Landscape and Renewable Supply Chains

- The Future of Renewable Energy Permitting

- How Will the Federal Reserve Approach the Transition?

- The Fate of ESG Investing Post-2024

What will happen to the energy and decarbonization aspects of the Inflation Reduction Act (IRA) with a new administration?

This is perhaps the most salient question for investors in the energy transition. The IRA passed in August 2022 without Republican support. If Republicans win majorities in November, it’s unclear if their ideological opposition to the bill will outweigh the support it has from the business community. If Democrats win, they might strengthen the IRA with additional climate policies.

Republican states stand to gain the most from IRA-related investments. Of the 271 major clean energy projects announced since the IRA’s passage, 48.3 percent are in states with a Republican trifecta. Still, Republicans have attempted 31 times to repeal or reduce funding from the IRA during this period.

In short, investors need to consider how the IRA might change depending on November’s results. Whether Republicans or Democrats win full control, or the outcome is mixed, the impact on the IRA will be significant.

Will the Bipartisan Infrastructure Law and CHIPS and Science Act, both containing climate elements, be affected by the November elections?

Unlike the IRA, both of these legislative packages passed with bipartisan support. The Bipartisan Infrastructure Law, a $1 trillion package, earmarks significant funds for clean energy initiatives, including power delivery systems, energy-efficient retrofits for homes, and workforce development in clean energy sectors.

The CHIPS and Science Act, passed in August 2022, bolsters US manufacturing and supply chains through investments in R&D, science and technology, and energy workforce development. This act aims to position the US at the forefront of emerging industries like nanotechnology, clean energy, and quantum computing.

Given their bipartisan backing, these laws may see less impact from November’s elections than the IRA. However, their critical role in driving investments in the energy transition means they should remain a focus for investors.

Will the next administration see reduced trade tensions with China, especially in the renewable energy supply chain?

Under the Trump administration, the US imposed new tariffs on China due to unfair trade practices in technology and innovation. These tariffs, under the Section 301 framework, continued into the Biden administration. There are select exceptions for businesses, including those dealing with renewable energy materials like solar panel components.

A recent report from Wood Mackenzie forecasts that China, the world’s leading supplier of renewable energy technology, will be a critical supplier for global solar manufacturing over the next decade. The US has tried to reduce its dependence on Chinese products through subsidies, but it still struggles to compete with China on cost. The Inflation Reduction Act’s requirements for domestic manufacturing and assembly could boost U.S. competitiveness in this sector, but these are only starting to take effect.

The future of US-China trade, particularly given their joint interest in improving relations, will greatly influence renewable energy supply chains and America’ capacity to meet its own renewable energy manufacturing goals.

How will the 2024 elections impact the viability of significant permitting reforms needed for renewable energy and grid transmission build out?

Jefferies has repeatedly hosted Neil Chatterjee, a former Commissioner of the Federal Energy Regulatory Committee (FERC), and his perspective on permitting reform is bearish. Permitting remains a key bottleneck for both fossil fuel and renewable energy infrastructure development. The 2023 Fiscal Responsibility Act did include some permitting reform measures, but these changes won’t spur the broad cost reductions and improvements to energy security and reliability needed to achieve net-zero emissions by 2050.

Both political parties recognize the need for permitting reform, but their approaches differ. Republicans aim to relax federal environmental review processes, while Democrats focus on streamlining the construction of new electricity transmission lines. The direction and extent of these reforms may hinge on the November election outcomes.

How will the next Fed Chair approach climate change?

Jay Powell’s term as Fed Chair ends in May 2026, and the next president will nominate his replacement. A key question is how the next Fed Chair will approach climate change. Powell faced criticism for not sufficiently regulating banks’ financing of fossil fuels. In October 2023, Powell stated that the Federal Reserve is not a “climate policymaker,” indicating that such decisions should be left to elected officials. He emphasized the Fed’s role in understanding and managing financial risks related to climate change, but not in directing bank lending.

The Fed began climate scenario analysis in early 2023 with major banks like JPMorgan Chase and Bank of America. This analysis is a data-gathering exercise without immediate supervisory consequences. It follows similar steps by the European Central Bank and the Bank of England.

Despite not being at the forefront of climate-related financial regulations, the Fed has engaged in related activities. It joined the Network for Greening the Financial System in December 2020, contributing to research and discussions on financial risks from climate change. However, given current U.S. resistance to incorporating ESG factors in financial decision-making, the Fed’s future role in climate change, both domestically and globally, remains uncertain.

How will the 2024 elections affect ESG Investing and the SEC’s climate-related disclosures?

These issues are contentious at both the state and federal level. Republican state Attorneys General (AGs) have been actively opposing ESG approaches, mainly by boycotting firms that exclude certain sectors and prohibiting the use of ESG factors in investment decisions.

Post-election, if Republicans gain control of the White House and Congress, we can expect them to follow the lead of Red states in pushing back against ESG. Additionally, once the SEC finalizes its climate-related disclosure rules, it’s likely to face lawsuits from trade groups, Red state AGs, and industries. If the SEC loses these legal battles, it can’t revisit the same rulemaking for five years.

Despite these challenges, some states like California have passed bills that advance ESG principles, potentially having a more lasting impact than federal regulations. These state-level actions could be more resilient to challenges under the “Major Questions Doctrine.”

++

The new year, including the US general elections, will critically influence the direction of the global energy transition. Follow along with the Jefferies Sustainability and Transition Team for continued insights on these six key questions and more.