In The Age of AI: Tech Leaders on How Gen AI Is Changing Everything

“The consumer experience fundamentally changed with the web browser in the ‘90s. It changed again in the 2000s with the smartphone. Generative AI is another step function in the consumer experience.”

Cameron Lester, Global Co-Head of Technology, Media and Telecom Investment Banking at Jefferies

Just two months after its release, ChatGPT became the fastest-growing consumer application in history, reaching an estimated 100 million monthly users. Instagram took more than two years to reach that mark. Facebook took nearly five.

Today, more than a year later, ChatGPT and the wave of gen AI platforms that followed have transformed not just the consumer experience but the global economy.

Venture capital is flooding into the AI sector, even as it cools elsewhere. Companies everywhere are racing to integrate AI into their operations and business models. And whispers of a potential IPO from early leaders like OpenAI have everyone paying attention.

Despite the hype, questions remain.

Can these technologies meaningfully impact businesses, given their unclear enterprise applications?

Will young companies like Perplexity and Anthropic emerge as winners, or will they be overtaken by large tech incumbents with their robust user bases and distribution advantages?

How will the race for AI infrastructure and the resulting surge in power demand disrupt industries like raw materials and oil and gas?

In April, at Jefferies’ 2024 Private Internet Conference, “In The Age of AI,” tech leaders, investors, and bankers gathered from around the world to discuss these questions and more. In this video, you’ll hear key insights from the conference’s organizers and participants on how AI is reshaping everything from human productivity to B2B ecommerce.

Can Subprime Consumers Hold Up?

The U.S. economy is the fastest growing of any developed country. Monthly unemployment just clocked in at 4.1%, the first time it has risen above 4% since November 2021, while total household wealth reached a record $156 trillion last year.

However, challenges are mounting for subprime consumers, who could be hit unusually hard if the economy turns south. This could lead to significant strategic changes for the Specialty Finance and Lending Technology sector that serves them.

By the end of last year, the gap between the household wealth of America’s richest 1% and poorest 50% had grown to almost $41 trillion, a record driven primarily by the gap in home and equity ownership.

While some nine in 10 households in the top 20 percent by income own their homes, fewer than half of the bottom 20 percent do. Almost 93% of total U.S. stock market wealth is now held by just 10% of the population, also a record.

Although wages are finally outpacing inflation, consumer prices are still 19% higher than before the pandemic. America’s personal savings rate – which spiked in 2020 and 2021 amid record government stimulus – is back to 3.9%.

Add it all up, and it is no surprise that a recent Federal Reserve survey found almost four in ten Americans saying they wouldn’t use cash to cover an unexpected $400 expense, relying instead on family, selling assets, credit, or a loan.

Strapped consumers are increasingly turning to specialty finance and tech-enabled lending companies to sustain their spending, especially as more fall behind on existing payments. Nearly 9% of credit card balances and 8% of auto loans have now transitioned to delinquency on an annualized basis.

The positive momentum across the Specialty Finance and Lending Technology sector reflects its growing role in filling an essential consumer need. Fintech banks continue to increase deposits and new customers. On average, lending technology companies have seen double-digit growth in revenue, adjusted EBITDA, and earnings per share. Cash advance providers have a growing customer base and are originating more loans and cash advances.

Although delinquency rates and charge-offs in the Specialty Finance and Lending Technology sector remain above pre-pandemic levels, they are decelerating, and charge-off rates are expected to decline in fiscal year 2025 for nearly all issuers. This should provide a tailwind for equity prices across the industry, as there has historically been a strong correlation between changes in delinquency rates and total returns.

However, companies across the sector should be mindful of the risk that an economic downturn could hit subprime consumers unusually hard. Subprime consumers typically behave similarly in recessionary and expansionary periods because they are, by definition, always in some form of financial stress. But if the U.S. were to drop into a recession in the months ahead, these consumers, already living so close to the brink, may face insurmountable difficulties paying back their debts. It could create new risks for the specialty finance and tech-enabled lending companies serving them.

One way for companies in the sector to mitigate the risk would be to consider moving up market, as there are now legions of formerly prime consumers who are having difficulty accessing credit. In recent months, banks have tightened lending standards for nearly all categories of residential mortgages, while credit card application rejections are on the rise. This could create a growing group of customers seeking alternative financing solutions.

Despite recent declines in consumer sentiment, the U.S. economy and consumer are still strong. But the Specialty Finance and Lending Technology sector should start preparing now for the day when that’s no longer the case.

—-

Andrea Lee is Global Co-Head of Investment Banking, Global Joint Head of Financial Institutions, and Global Head of Specialty Finance and Lending Technology at Jefferies LLC. The Specialty Finance and Lending Technology sector includes the full spectrum of consumer and commercial finance, marketplace lenders and technology enabled credit solutions providers.

How Do Presidential Transitions Impact Sustainability Outcomes?

On November 5, 2024, millions of Americans will head to the ballots, casting votes for the presidency, 468 congressional seats, and 11 governorships. Energy and environmental policy are at the forefront of the election cycle, with climate change being a key issue for both voters and candidates.

President Biden and former President Trump bring sharply different views on environmental regulation, American energy policy, and the global energy transition. Still, the potential impact of either administration’s policies on the sustainability landscape remains uncertain.

Jefferies’ Sustainability and Transition Team recently traveled to Washington, DC to discuss the 2024 election cycle with policymakers, sustainability leaders, and investors. Though uncertainty abounds in Washington — both about the outcome of the elections and their influence on the energy transition — a look at recent presidential transitions may offer clues into how these shifts influence issues like climate, energy transition, and human capital.

This summary distills our findings from the Obama/Trump and Trump/Biden presidential transitions in 2016 and 2020, respectively. For a more detailed analysis, including the impact of recent presidential transitions on trade and immigration policy, read the team’s full report.

Obama to Trump: Energy and Environmental Policy

During his first term, President Trump reversed over 100 EPA rules covering air pollution and emissions, drilling and extraction, clean infrastructure, and toxic substances and safety standards. While not inherently against renewable energy, his policies favored fossil fuel production.

Key policies included:

- Replacing Obama’s Clean Power Plan with the Affordable Clean Energy Plan to ease restrictions on greenhouse gas emissions from fossil fuel sources.

- Rescinding the 2015 Interior Department rule that lowered the risk of water contamination from oil and gas drilling.

- Easing EPA restrictions on toxic air pollution from oil refineries.

The real impact of these policies included:

- CO2 emissions per person were lower than those during the Obama administration on average (15.4t vs 17.2t).

- Annual clean energy capacity grew slower than the pace seen during the Obama administration on average (13% vs 19%).

- Oil production was higher than during the Obama administration (11 million vs. 7 million barrels per day), but oil/gas earnings were lower on average (0.7% vs. 1% of GDP).

- New onshore oil and gas leases were decreasing during the Obama administration but increased during the Trump administration until 2019.

- EPA budgets increased more during the Trump administration than the Obama administration, although there were some workforce cuts.

- Fossil fuel subsidies are lower compared to the Obama administration on average (0.05% vs. 0.07% of GDP).

Trump to Biden: Energy and Environmental Policy

Biden has shifted the direction of environmental policy, passing two infrastructure bills that invest hundreds of billions into developing clean energy until 2032. His administration overturned some of Trump’s executive orders on deregulation and created more regulations, including Multi-Pollutant Emissions Standards. For oil and gas policies, the administration raised royalty rates for the first time in 100 years to end bargain-basement fees and increased the amount of bonds for drilling by tenfold.

The real impact of these policies includes:

- CO2 emissions per person were lower compared to the Trump administration on average (15.4t vs 14.9t).

- Annual clean energy capacity grew at a similar rate compared to the Trump administration on average (13% for both).

- Oil production and oil and gas industry revenue were higher than the Trump administration, reaching their highest levels since the beginning of the Trump administration.

- New onshore oil and gas leases fell below the levels seen during both the Obama and Trump administration.

- EPA funding and workforce continued to increase from levels seen during the Trump administration.

- Fossil fuel subsidies are slightly higher compared to the Trump administration on average (0.053% vs. 0.05% of GDP).

The impact of the 2024 presidential election remains uncertain. If former President Trump wins the election, and we experience another transition, his ability to pass significant energy and climate policies will heavily depend on the outcomes of the Senate and House races. Recent presidents have been more successful in passing major legislation during periods of unified government rather than divided government.

Jefferies’ Sustainability and Transition Team will continue to closely track political and legislative developments influencing the global energy transition. Follow our team for regular insights on the presidential election and more.

Charged Up: Six Reasons Why Storage Will Power the Transition

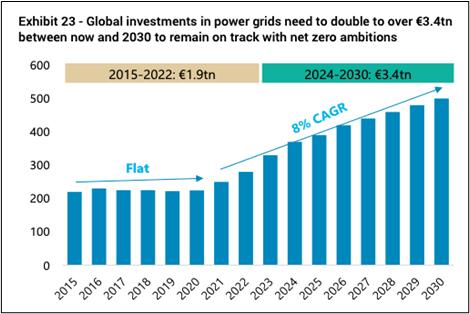

The fragility of current grid infrastructure is now the biggest obstacle to a net-zero power system. Today’s grids, already strained by rising demand and extreme weather, are unprepared for projected electricity load growth over the next decade.

One key to addressing this challenge is better use of grid-scale storage — technologies that store energy and supply it back to the grid.

These technologies are crucial for scaling clean energy solutions like solar and wind, which, despite their effectiveness, aren’t always available. Solar power fades by evening, just as electricity demand peaks, and wind patterns are even less predictable. Energy storage fills these gaps, ensuring clean energy is available whenever needed.

Investments in storage technology are surging. U.S. battery storage capacity is expected to nearly double in 2024. California already has enough battery energy storage systems online to power 6.6 million homes during disruptions, and other states are following suit.

In this piece, we highlight six key reasons why energy storage will be at the center of the global transition, beyond the obvious intermittent issues of wind and solar.

- Underpinning Renewables: As intermittent power sources like wind and solar increase, energy storage becomes crucial. It shifts power from times of excess generation, like during high winds or abundant sunshine, to times when generation is low. This ensures a consistent power supply, making it possible to integrate a higher share of renewables into the grid.

- Peaking Capacity: Energy storage systems shine during high-demand periods. There are times when electricity demand spikes, such as evenings between 5-9 PM or during the AC-heavy summer months. Energy storage can provide the extra power needed to keep up with these spikes, ensuring a stable and reliable supply.

- Ancillary Services: A fundamental rule of grids is that electricity supply and demand must match at all times. Storage systems play a crucial role in stabilizing grids by balancing power supply and demand, often referred to as ancillary services and operating reserves. These can be divided into four main categories:

- Frequency Response: Storage can respond to very fast, short-lived, and unpredictable changes in grid frequency levels, helping to maintain stability.

- Ramping/Load Following: When demand spikes unexpectedly, storage can respond to these sudden increases, known as load following, ensuring that supply meets demand.

- Peak Shaving: Storage can reduce the need for peaking power plants (often gas or coal) during periods of high demand, thereby helping to lower overall emissions.

- Voltage Support: Storage systems can help regulate grid voltage levels by providing reactive power in areas where it is low.

- Grid Reliability: Energy storage systems boost grid reliability by providing backup power during blackouts or grid failures. In events like natural disasters or equipment failures, storage ensures uninterrupted power, which is especially crucial for hospitals, schools, and data centers.

- Black Starts: Large fossil fuel generators often need external power to start up. Traditionally, this power came from other generators on the grid. During a blackout, however, it must come from an external source. While diesel generators have been used for this, on-site storage systems are increasingly taking over, providing a cleaner, more reliable solution.

- Industrial Applications: Certain storage options are essential for decarbonizing and reducing costs in various industrial settings. Thermal storage, for instance, can be used in industries requiring high-temperature heat by storing energy when electricity costs are low. Sectors like cement, glass manufacturing, and chemicals can greatly benefit from innovative storage solutions such as thermal storage.

For more information on grid-scale storage technology, read Jefferies’ full report. For more from Jefferies on the opportunities to improve grid transmission and the investment opportunities they present, read more content from our Sustainability and Transition Team.

Predictions for the AI Era: Startups, Incumbents, and the Future of Work

The AI era has arrived, but investors, company leaders and technologists are still learning to navigate it. One challenge is the tension between startups and incumbents. Companies small and large are battling over AI’s application layer: how to deliver viable AI products to end users and turn them into revenue-generating machines.

Startups typically lead the way with groundbreaking technologies, but it is often the incumbents, with their limitless capital and distribution networks, that scale these innovations and win the market.

Both startups and incumbents bring unique strengths to the race for AI dominance. The key question for investors and industry watchers is: Who will be the first to commercialize these capabilities and build a sustainable business model?

At the Jefferies Private Internet Conference, “In the Age of AI,” Sarah Tavel, General Partner at Benchmark, shared predictions on the struggle between incumbents and startups, AI’s impact on the labor force and more.

Startups vs. Incumbents: Who Will Commercialize AI?

The clash between young companies and established companies is playing out across the market.

Take Perplexity, a year-old startup whose AI-powered search engine aims to challenge Google’s dominance. Its innovative product aggregates information into a single, cohesive answer rather than just providing links.

In May 2024, Google launched “AI Overviews,” a feature that offers AI-generated summaries at the top of search results. Sound familiar?

“There’s an assumption that startups will struggle to make headway in AI … for big companies like Adobe, innovation is just an API integration away,” Tavel explained. “But for this new generation of startups, AI is native to their business, and that makes a difference. They have a real chance to disrupt the incumbents.”

Tavel refers to the first wave of tech startups as the “skeuomorphic era”—a time when software mimicked and supplemented human work. In this era, it was easy for incumbents to “wrap” software over their business. With AI, where new technologies are genuinely transformative, the playing field might be more level.

How AI Unlocks Opportunity in Underexplored Industries

A key distinction between the Internet era and the AI era is their relationship to human labor. During the Internet era, incumbents used software to boost human productivity, aiming to help people work better and faster. Now, Tavel says, AI delivers a self-contained work product.

“This new wave of companies is selling the work itself,” she shared. “They’re opening up markets historically unexplored by incumbents—pricing their technology not as a productivity tool but as a work product.”

Tavel cited voice acting as an example. This industry rarely attracted incumbents, as there are few opportunities for software to streamline human work. Now, startups have the chance to revolutionize this underinvested sector with AI, which can generate high-quality voice-overs.

According to Tavel, these opportunities are often the most lucrative.

AI Is Only Getting Better. Where Does That Leave Humans?

Tavel wrapped up by discussing AI’s impact on the labor market. Specifically, she addressed fears that AI might trigger a labor crisis by replacing human jobs.

“There are many examples of technology replacing human work, but it’s never permanent. Those workers are reskilled, and ultimately, we all move up Maslow’s hierarchy,” Tavel explained. “AI automating some human labor means we all move up the chain toward more creative endeavors.”

–

As Tavel highlights, AI will bring unprecedented change, and the speed and scale of these transformations remain uncertain. However, there are clear opportunities for startups to lead and win. For investors, executives and workers, these technologies could usher in a more efficient, productive and creative future for all.

The Automotive Aftermarket Industry Is Highly Attractive for Private Equity Investors

Drive down any main street in America and you will see something that is increasingly catching the eyes of private equity investors: blocks of automotive service locations, including collision repair shops, tire stores, general repair centers, car washes, quick lubes and various other automotive parts and service businesses that make up the nation’s $390 billion automotive aftermarket industry.

Keeping cars running is mission critical for all households and businesses, as transporting people and goods is paramount no matter where we are in an economic cycle. This makes automotive aftermarket industry revenues and profits far more inelastic than other services-focused industries—a trait that private equity investors value. As demonstrated by publicly traded automotive aftermarket companies, the aftermarket has a long record of robust and steady cash flows, and the industry’s resilient nature has fostered tremendous investor confidence: From 2007 to 2023, these public companies more than tripled the returns of the S&P 500.

The demand for auto aftermarket services is on the rise thanks to several trends, including:

- More cars on the road: Between 2018 and 2023, the number of vehicles in operation in the United States grew by 2.2% to 285 million.

- Older cars on the road: Average vehicle age increased to 12.5 years in 2023 as consumers are holding on to their vehicles for longer. Supporting this, the number of vehicles aged 4–11—termed the aftermarket “sweet spot” because owners are more likely to use independent (i.e., non-dealership) repair and service providers after vehicles come off warranty—has increased by 20 million since 2018.

- More vehicle miles traveled: Miles traveled, tracked by the Department of Transportation, is a crucial measure of vehicle wear and tear. It has steadily increased over the past two decades, has rebounded to pre-pandemic levels after a brief lockdown-induced decline and continues to steadily grow at low-single-digit growth rates in 2024.

- High new and used car prices: While car prices are moderating in 2024, they remain well above pre-pandemic levels. This, coupled with higher interest rates on costly car loans, is keeping vehicle owners in their cars for longer and driving repairs to these vehicles versus vehicle replacement.

Beyond demand drivers, the automotive aftermarket sector is uniquely suited for consolidation plays that private equity investors often seek. According to the Auto Care Association, there are over 170,000 service channel outlets in America (excluding gas stations). Despite the sector’s overall size and consistent record of profitability, it is highly fragmented and dominated by individual- or family-owned businesses. In most cases, the largest companies in any given subsector have a small single-digit percentage share of that overall market. This creates an exceptionally compelling opportunity for private equity investors looking for long runways to grow platform businesses.

Private equity–backed automotive aftermarket platforms benefit greatly as they scale. Benefits include improved key performance indicator monitoring, labor management and operational execution through tech-enablement of systems; discounted purchasing on parts, tires and supplies; and professionalized management of regional and corporate support functions. This all results in a better experience for consumers as they receive vehicle service.

From 2020 to 2023, Jefferies estimated that there were nearly 240 M&A transactions where the buyer was a financial buyer such as a private equity investor. The high-water mark was nearly 80 financial buyer transactions in 2021.

Jefferies expects the momentum to continue in the back half of 2024 and into 2025 as ownership groups look to monetize on healthy levels of private equity interest. 2024 is already off to a strong start, with Summit Partners acquiring CollisionRight, TPG acquiring Classic Collision and KKR investing $850 million into Quick Quack Car Wash.

Private equity firms looking to build automotive aftermarket platforms are typically seeking companies with differentiated attributes, including:

- Attractive geographies with high densities of vehicles in operation and growing population trends

- Strong operating metrics

- Technology-enabled solutions for operations management and consumer-facing solutions

- Well-built infrastructures that can support significantly larger scales

- Proven management teams

Jack Walsh is a leader in Jefferies’ Automotive Aftermarket Investment Banking practice. With over ten years of experience, Jack specializes in capital raising and advisory for clients across the automotive aftermarket. Since 2015, the Jefferies Automotive Aftermarket Investment Banking practice has executed over 135 M&A, debt and equity transactions representing more than $105 billion in combined deal value. Jack can be reached at [email protected]

How Data Centers Are Shaping the Future of Energy Consumption

The following article is an overview of “Powering Data Centers,” a report from Jefferies’ Equity Research Team. For the full report, visit this link.

If it feels like GPUs (Graphics Processing Units) are suddenly everywhere, it’s because they are. GPUs drive computation across a wide range of industries and applications, from big data analytics to machine learning.

Soaring GPU demand is rippling across the global economy, but no area has been more affected than data centers. They house the infrastructure to power, cool, and manage GPUs. Over the past two years, data center demand has skyrocketed, surging to over 30% annual growth in some key markets.

The pressing question is: Can supply keep up? Market constraints — including scarce raw materials, limited land, labor shortages, and construction bottlenecks — pose serious challenges. Most critically, power generation and grid capacity are lagging.

With demand outstripping supply, rents for wholesale data centers have jumped over 80% since late 2021, reversing years of decline. Rising build costs further strain the market.

This explosive growth in data centers, coupled with infrastructure and power constraints, presents both challenges and opportunities for a myriad of sectors, including utilities, energy, capital goods, infrastructure/construction, and more.

A new report led by Jefferies Utilities and Clean Energy team, with input from more than 20 Jefferies analysts around the world, explores the implications of this growth, the economic dynamics, and the strategic moves needed to sustain the sector’s expansion.

This article previews the following areas of the report:

- Data Center Power Consumption

- Renewable Energy and Power Purchase Agreements

- Regional Dynamics and Opportunities

Data Center Power Consumption

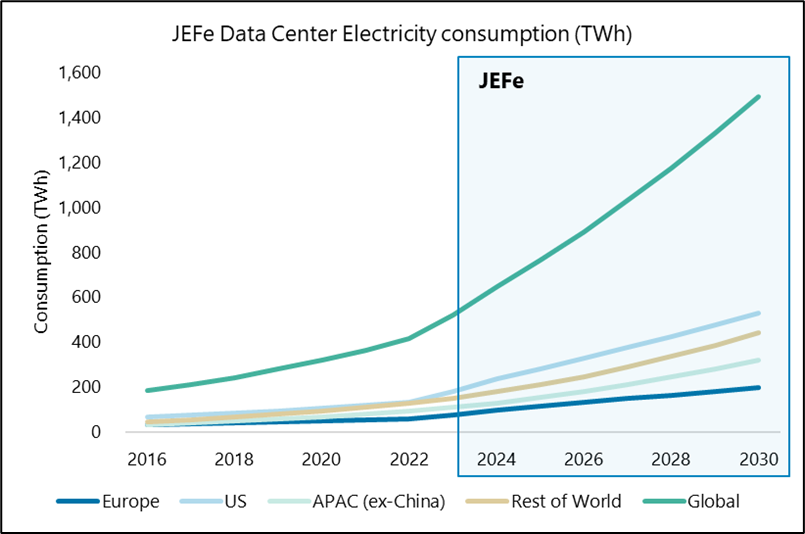

AI Data centers are large, energy intensive operations that often run 24 hours a day. Since 2016, their global power consumption has grown at an estimated 16% compound annual growth rate (CAGR). Jefferies projects this growth will continue through 2030, with US data center electricity consumption outpacing that of Europe and APAC (excluding China).

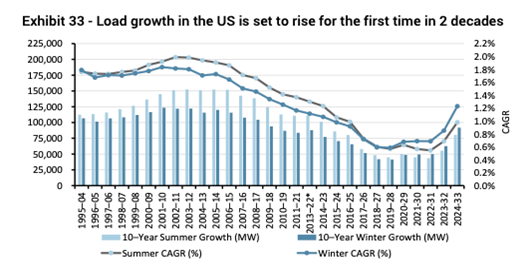

In the US, many regulated utilities, grid planning organizations, and industry consultants are forecasting resurgent energy demand growth over the decade. This growth could strain power generation and grid capacity. Ten years ago, 15% demand growth in the data center market meant about 250 megawatts. Today, the same growth equates to 2 gigawatts — eight times the demand — and growth was double that in 2022 and ‘23.

In Europe, electricity demand has been flat for two decades, remaining at 2000 levels through 2023. It’s now poised for a rebound, expected to grow at 2-3% annually. Data centers will be a major driver, potentially accounting for 20% of this future growth.

Source: Jefferies Estimates, DC Hawk

Renewable Energy and Power Purchase Agreements

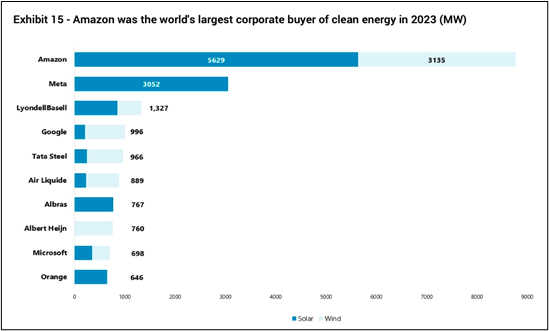

One beneficiary of the data center boom may be the global energy transition.

The growth in data centers is expected to help renewable power developers reduce risk by allowing them to form longer-term contracts at higher prices. Big tech companies are now major buyers of Power Purchase Agreements (PPAs) for renewable energy, with contracts spanning 10-15 years at fixed or variable prices. These firm revenue commitments enable developers to finance new renewable energy projects. As data center demand grows, so will these agreements. In 2023, the corporate PPA market hit a record high for the seventh consecutive year, with an increasing share going toward solar, wind, and other renewable sources.

Source: BNEF, Jefferies Analysis

Regional Dynamics and Opportunities

In the United States, resurgent electricity demand from data centers will require additional transmission and generation infrastructure investments in the US. Companies in these spaces are expected to benefit more than those focused on distribution. Independent power producers and nuclear plants will also profit from increased power demand, with nuclear power particularly valued for its stable, carbon-free electricity. Broadly, US utility capital expenditure can be split into three buckets: (1) Grid Hardening, or investments in grid reliability and resistance against adverse weather conditions; (2) Generation, including solar, nuclear, and peaker gas; and (3) Transmission & Distribution, or enhancing and expanding the system around power delivery.

Source: Long-Term Reliability Assessment 2023, FERC, Jefferies

In Europe, the highest data center capacity growth is expected in Germany, Ireland, Spain, Italy, and Norway, with projections exceeding 15% CAGR over the next decade. Norway and Spain, with their cheap baseload power, are attractive markets for incremental data center demand. Germany, Ireland, the Netherlands, and the UK, with their strong financial services, tech companies, and advanced internet and wiring infrastructure, are also prime candidates for this growth. The challenge is the age of European grid infrastructure: 40% of EU grids are over 40 years old. To address these vulnerabilities, European grid companies are significantly increasing their capital expenditure. This increase is driven by new power plant connections, grid resilience improvements, reinforcements, and maintenance. However, developing the necessary infrastructure could take years due to regulatory and permitting processes.

Source: Rystad Energy, Jefferies Cap Goods Team Estimates

In India, the data center market is rapidly expanding, spurred by the Reserve Bank of India’s directives to localize payment data. The country’s data center capacity is projected to grow at over 50% CAGR. This growth necessitates a significant rise in power generation and T&D investments, expected to increase 2.2 times to $280 billion by 2030. This expansion positions India as a major hub for data centers, driving both economic growth and substantial capital expenditure in the sector.

In China, data center power consumption is projected to reach nearly 8% of total power usage by 2030. AI development – particularly generative AI and large language models – are driving rapid growth. Concurrently, China’s grid infrastructure is set to expand significantly. The country is investing in digitalization and distribution to support renewable energy growth.

As the AI era roars on, GPUs and data centers will remain key drivers of global economies. The demand growth brings significant challenges but also vast opportunities. For a more in-depth look at how data center and electricity demand growth will impact global markets, sectors, and governments, read the full report from Jefferies’ Equity Research Team here.

Why Differentiation Is Defining the U.S. Consumer Sector

Consumer spending—and the psychology behind it—is a perpetual puzzle for investors. Before the Jefferies Consumer Conference, we spoke with Jim Walsh, Vice Chairman and Global Head of Consumer, Retail & REGAL Investment Banking, who has over 30 years of experience in the consumer sector. He shared his thoughts on how U.S. consumers are doing and companies’ opportunities and challenges in the current environment.

Q: What is the most important trend in today’s U.S. consumer market?

JW: In the U.S. consumer market, a critical factor that can set a business apart is a truly unique, high-growth, high-volume offering with an attractive value proposition for consumers. If you can effectively communicate this distinctiveness, you will likely attract a diverse range of buyers.

For others, deals will be harder.

Q: A key economic storyline of the last couple of years in the United States has been consumer resilience in the face of inflation. Is that still the case

JW: The consumer probably isn’t feeling as good as you’d think. Marginal consumer spending on luxury items such as restaurants has seen a pullback. Government dollars flowed strongly to the consumer for several years, and now those dollars have been shut off. But where a company has a unique proposition to the consumer—Dutch Bros, Wingstop or Texas Roadhouse, for example—you see a great following across many demographics. For companies with positive traffic within retail and consumer, the valuations are going up dramatically because they’re outpacing the marketplace. So, I would say you have to show consumers something they want to have at a manageable price point. Then they will come in.

Q: If I am a consumer business wanting to fuel my next stage of growth, where should I be looking?

JW: If you are a differentiated consumer business, the public markets are wide open to you now. If you can demonstrate something like 10% unit growth and positive same-store sales primarily driven through traffic, you can definitely get a premium in public markets. Cava’s 2023 IPO, which was one of the most successful of the year, was a great example. These kinds of companies are getting a better premium in public markets because investors can look to the future and have a discounted cash flow analysis that says, “Hey, we could pay for this today, but given these trends, we can look out three or four or five years and see great results.”

If you are a smaller-cap company that is just starting to show significant growth, you might find more willing buyers on the private side, where there is also a fair amount of capital to invest.

Q: If I am the leader of a company that does not meet those desirable growth metrics, what options are available to me to help fund the next stage of my growth?

If you can’t go to public markets and there is a gap in what you can do on the private side, you might want to think about preferred capital. Basically, every private equity program is looking for preferred capital opportunities, even if they don’t focus specifically on the consumer sector. That’s where there is a lot of liquidity.

And then you have a lot of companies that are not firing on all cylinders. Those are the ones that strategics are looking at where they see the ability to cut costs and get scale from synergies and technology. We’re seeing a fair amount of activity in cases like that.

Q: You have been in the consumer banking field for several decades. Aside from technology and the way it is incorporated into everything, what is it that has changed most about the way businesses grow and get capital?

JW: It’s just a far more crowded environment to bring something new and attractive to the consumer. Thirty years ago, there wasn’t as much differentiation available to the consumer, which created a wider opening for an innovator to develop a unique product or business model. That’s harder to do today, and that’s why we haven’t had many companies go public in the last few years. They are just not differentiated enough in the marketplace, and consumers have plenty of options that allow them to be selective in what they shop for or where they go to eat.

Now, there are examples where talented entrepreneurs introduce something totally new, like what Marc Lore has done with the food delivery service Wonder. But, on balance, there is just a higher bar for companies to clear to show that they have an offering that is truly differentiated.

Prime Services C-Suite Newsletter – May 2024

Jack-of-all-Reads: A newsletter for multi-hat-wearing C-suite leaders and their key constituents.

Jumping into Summer Themes – Non Competes, Shadow Trading, T+1, and Operational Due Diligence

Industry Insights:

Our newsletter, Jack-of-all-Reads, shares the latest and greatest insights in a brief read on a monthly basis. Please let us know of any comments or questions – we welcome and appreciate your continued partnership.

Industry Insights:

- FTC’s Non-Compete Ruling. On April 23rd, the Federal Trade Commission (FTC) announced a rule banning non-competes nationwide with an effective date of August 22, 2024. The rule retroactively voids virtually all existing non-compete clauses in employment agreements, with few exceptions. Additionally, it will ban any new non-competes, regardless of the employee’s salary or status, moving forward. While legal challenges regarding this ruling occur between the FTC and various business groups, managers can still take steps to prepare:

- What should fund managers do? The ruling requires employers to provide “clear and conspicuous notice” to their employees impacted. This notice must be received by the effective date.

- Work with counsel to figure out which employees are affected, which are exempt, and how they are going to provide the proper notices required by the ruling.

- Implement alternative protection methods in their employee contracts that do not violate the FTC’s ban.

- What should fund managers do? The ruling requires employers to provide “clear and conspicuous notice” to their employees impacted. This notice must be received by the effective date.

- T+1: Understanding the Expected. The SECs acceleration of the settlement cycle from T+2 to T+1 had an effective date of May 28th in the US and May 27th in Canada, Mexico, and Peru. This rule will enforce completion of allocations, affirmations, and confirmations of trades sent or received within one day of the trade. Service providers have been adjusting their processes to be compliant with the new timeline.

- What is Changing? Most prime brokers are set to begin sending notifications to clients to inform them that the trade will need to be allocated and confirmed within the allotted time frame. The cut off for afterhours trading will be at 8pm EST on the day of the trade. Managers are ensuring there are systems in place to manage this and decrease the likelihood of mishaps.

- Being Prepared. Managers should be checking in with their OMS providers and fund admins to ensure all systems are in place and sent to their counterparties on time. Some groups are utilizing vendors such as NYFIX or CTM to assist in these processes. If unaware, reach out to your counterparties for list of action items including steps such as:

- Make arrangements with your counterparties, prime brokers, and custodians to affirm transactions on trade date.

- Explore electronic industry trade processing solutions.

- Update FX liquidity, trading, and settlement arrangements.

- ODD: Ins and Outs of Current Practices. As we enter new stages of technology and investing, ODD teams are navigating new processes. Through our conversations with ODD professionals as well as the SBAI’s 2024 Operational Due Diligence Survey there are various ways in which the function has evolved.

- New Assets. As investment teams look to diversify, ODD professionals are working on understanding new asset classes. They’re assessing different types of managers and funds for the first time and having to learn unfamiliar parts of the industry.

- More Technology. Firms without robust dedicated teams in house are more likely to rely on data tools as well as be early adopters of software and technology. As the majority of ODD professionals feel that they do not have enough time to perform tasks, the movement towards AI is expected to have great implications towards these groups.

- Counterparties. As managers continue to outsource back office functions, it can provide additional hurdles for those performing ODD to get quality information and full transparency.

- Onsite. According to the SABI survey, the majority of ODD reviews are still done onsite. Most allocators are performing a full ODD review with new manager relationships, however, a small group are taking a risk based approach.

- Insider Trading: Shadow Trading Ruling. The SEC won their first shadow trading case on April 5th after an 8 day long trial. Shadow trading is defined as occurring when an investor invests in one company after hearing material nonpublic information about another company which can affect the performance of the related companies stock.

- Implications for Managers. The ruling confirmed that this type of trading is a considered an insider trading activity encompassed under an expansion of the existing insider trading rules. Given concerns, there is additional focus on having proper compliance controls and technologies in place.

- How to Stay Protected. Many groups are specifically looking into technology to monitor expert network calls and some are even revamping their compliance policies.

Please reach out to your Jefferies contact for more information on any of the topics above.

Client Corner:

Increased Software Interest: Analytics and Data. We’ve recently observed an uptick in clients asking about various software and technological solutions to supplement key aspects of the reporting and data aggregation process. As the technological revolution continues, many are looking for ways to stay ahead, and do more with less resources. There has been an increase in emerging managers leveraging these tools as well. Our team has been doing research around the key players in the space, feel free to reach out to Ariel Deljanin to discuss further.

Spotlight on Content and Events:

Pitching 101: Reviewing Industry Best Practices.

As managers focus their attention on the capital raising process, they must begin to evaluate how they want to present and pitch themselves as well as their business. This piece describes the common outlines, frequently asked questions from inventors, and the do’s and don’ts of presenting.

Contact your Jefferies representative to learn more.

From the Desk of BCS: 2024 H1 Insights. Although many themes from the 2023 Trends Pack are continuing to impact decision makers today, the Jefferies Capital Intelligence team is compiling insights around current key trends impacting the hedge fund industry. Through engaging with clients, the ODD community, and attending conferences, this piece has a focus on combining long-term industry data with current insights to identify emerging trends. Some top of mind topics include managing counterparty and LP relationships, the war on talent, regulatory environment, and capital raising. Stay tuned for the H1 2024 iteration of From the Desk of BCS.

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

Akin Gump – SEC Announces First Off-Channel Communications Enforcement Action Against a Standalone Private Fund Manager and “Round 2” of Marketing Rule Enforcement Actions — Focus on Hypothetical Performance

Lowenstein – ‘Shadow Trading’ is Insider Trading: Jury Establishes Liability in Historic Shadow Trading Case

RQC Group – SEC Issues Risk Alert Providing Initial Observations Regarding Marketing Rule Compliance

Seward & Kissel –2023 New Manager Hedge Fund Study

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Ariel Deljanin

Business Consulting Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

Paul Covello

Global Head of Outsourced Trading

[email protected]

Eileen Cooney

Capital Introductions

[email protected]

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2024 Jefferies LLC