Mid-Year Review: A Record-Breaking 1H of 2024 for the Secondary Market

In July, Jefferies’ Private Capital Advisory team released its mid-year review of the secondary market, consolidating discussions, surveys, and research from the market’s biggest and most influential limited partners, general partners, and secondary buyers.

This report follows Jefferies’ H2 2023 secondary market review, which predicted near-record secondary volume, higher LP pricing, and a sustained capital overhang for fiscal year 2024. The latest findings show the first half of the year largely met these expectations.

Here, Jefferies Insights shares high-level takeaways from the Private Capital Advisory team.

It’s shaping up to be a banner year for the secondary market.

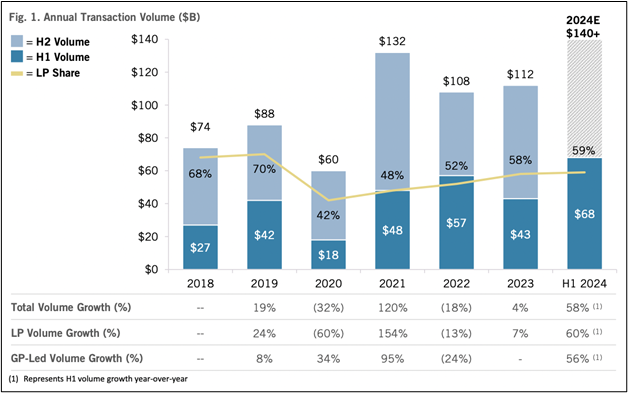

Global secondary volume hit a record $68 billion in H1 2024, driven by near-peak dedicated secondary capital dry powder, a surge in well-capitalized new entrants, increased demand from ’40 Act funds fueled by retail capital inflows, and a supportive macroeconomic and valuation environment over the first half of the year.

Jefferies original (H2 2023) and revised (H1 2024) expectations for the secondary market.

Key First Half Themes

Liquidity Demands Drive Record First-Half Volume

The first half of 2024 saw record-breaking secondary market volume, surpassing the previous record of $57 billion set in the first half of 2022. Activity was robust as limited partners (LPs) sought liquidity across their portfolios, bringing larger and more diversified transactions to market. General partner (GP)-led volume also grew as a function of robust demand for continuation funds by investors and continued adoption of the structure from sponsors desiring to generate liquidity for their LPs and hold attractive companies for longer.

Jefferies expects these trends to continue in H2 2024.

LP Portfolio Pricing Climbs Higher

The average high bid for all strategies was 88% of net asset value (NAV), a 300-basis point increase from the second half of 2023. Pricing for LP portfolios steadily improved throughout the first half of 2024, driven by expectations of near-term interest rate cuts, strong portfolio performance, and a gradually improving exit environment. Both newer vintage funds and older tail-end funds saw price increases as buyers showed strong demand for diversified exposures.

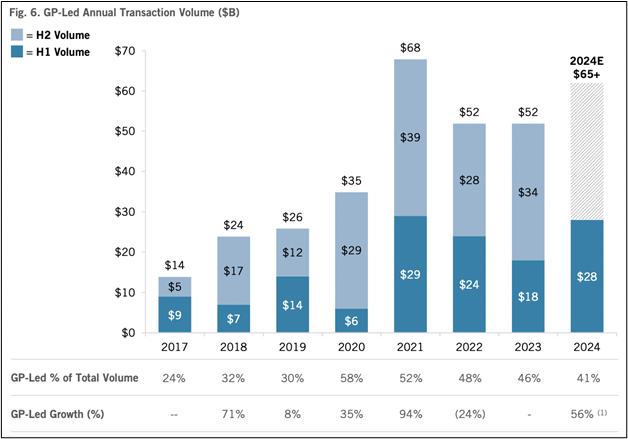

Buyside Demand Catalyzes GP-Led Volume Growth

GP-led activity in the first half of 2024 continued to benefit from the momentum in the second half of 2023. On a last twelve months (LTM) basis, GP-led volume reached $62 billion, marking one of the highest periods of sustained activity since the inception of the GP-led secondary market. Continuation funds comprised 14% of global sponsor-backed exit volume in H1 2024, up from 11% in 2023. As continuation funds have become mainstream in private equity and expanded into other segments of the private markets, well-capitalized secondary investors are eager to partner with a range of sponsors on these deals.

Jefferies expects continued momentum in the GP-led market.

Record Levels of Available Capital

At the end of the first half of 2024, dedicated available capital, including near-term fundraising, was estimated at $253 billion. This was nearly unchanged from 2023. Record fundraising, combined with the emergence of increasingly active and sizeable ’40 Act funds raising capital from retail channels, supports a well-capitalized buyside heading into the second half of 2024.

What To Expect in H2 2024

Looking ahead to the second half of 2024, Jefferies forecasts record annual transaction volume exceeding $140 billion by year-end. Growth will be driven by increasing transaction supply, robust secondary pricing, and anticipated interest rate cuts that could boost further growth and equity returns.

Jefferies expects sustained LP-led transaction volume near $40 billion, with GP-led transactions rising to over $35 billion. LP portfolio pricing is anticipated to continue climbing, potentially exceeding 90% of NAV in the second half of 2024 — levels not seen since 2021 — barring any sustained period of public markets volatility.

Additionally, the continued emergence of ’40 Act funds and other alternative capital pools is expected to further drive demand for secondary transactions and maintain dedicated available capital despite significant deployment from traditional secondary funds.

For Jefferies’ full H1 2024 review of the global secondary market, click here.

How Does Sunlight Deflection Fit Into Climate Change Mitigation?

The scientific community is exploring every avenue to expand and accelerate efforts around climate change. One area of research and investment is solar radiation modification (SRM), which reflects sunlight away from Earth’s atmosphere and into space.

Although much remains uncertain about SRM’s impacts — such as the effect of aerosols on clouds and climate — research in this area is expanding rapidly. Over the last few years, the US government has allocated more than $47 million to increase understanding of cloud aerosol effects and SRM.

Jefferies’ Sustainability and Transition Team hosted three experts to discuss the trajectory of solar radiation modification and its role in decarbonization.

What is Solar Radiation Modification?

Solar radiation modification (SRM), also known as solar geoengineering or solar radiation management, refers to large-scale methods to increase the amount of sunlight reflected into space, thereby reducing global mean temperatures. The goal is to reduce Earth’s absorption of solar radiation, which gets trapped in the atmosphere as infrared radiation and causes planetary warming.

Once seen as taboo, these methods are gaining traction in the climate science community. The UN Environment Programme and the US Office of Science and Technology Policy have both released reports recommending further research.

Several SRM methods exist, with the most promising involving the release of aerosol particles to reflect sunlight from the stratosphere or making low-lying marine clouds more reflective.

Many researchers view SRM as a temporary solution to limit global warming until emissions reduction and carbon removal technologies can be scaled sufficiently to stabilize temperatures.

SRM: The Two Leading Techniques

The two leading techniques within SRM are (1) Marine Cloud Brightening (MCB) and (2) Stratospheric Aerosol Injection (SAI).

- Marine Cloud Brightening

Counterintuitively, pollution particulates, including aerosols, may offset between 0.3 and 1.1 degrees of greenhouse gas warming. This occurs because aerosol pollution reduces the size of water droplets in clouds, making them more reflective of sunlight.

Reducing aerosol pollution, therefore, might inadvertently accelerate global warming.

One leading SRM technique, Marine Cloud Brightening, aims to replicate this effect using sea-salt spray from ships. This would involve thousands of ships spraying particulates into targeted marine cloud regions, potentially cooling the Earth by 1-2 degrees Celsius.

The impacts of this technique, including its effect on precipitation in the targeted regions, remain uncertain.

- Stratospheric Aerosol Injection

When large volcanoes erupt, such as Mount Pinatubo in 1991, they emit particulates into the atmosphere that linger for some time. These eruptions historically trigger a cooling effect of more than 0.5 degrees Celsius for up to two years, with observed recoveries in Arctic ice during these periods.

To emulate this effect, scientists theorize that continuously populating the lower stratosphere with a steady level of aerosols could reflect warming solar radiation.

Practically, this would involve hundreds of aircraft dispersing aerosols, such as sulfur dioxide, from optimized altitudes and locations. The resulting global cooling effect could last 1-2 years.

This method, like Marine Cloud Brightening, carries risks. Potential side effects include impacts on the ozone layer, weakening of the hydrological cycle, increased acid rain, and other environmental consequences.

Areas of Controversy and Pushback

Solar radiation modification is attracting significant interest — but it’s also drawing considerable controversy.

In January 2022, there was a call for an “International Non-Use Agreement on Solar Geoengineering,” urging “immediate political action from governments, the United Nations, and other actors to prevent the normalization of solar geoengineering as a climate policy option.” To date, over 500 academics from more than 60 countries have supported this agreement.

In March 2024, at the United Nations Environment Assembly (UNEA), governments failed to reach a consensus on how to regulate solar radiation management. Switzerland proposed establishing a UN expert group to research SRM, but this was met with significant opposition from a group of African countries and the Center for International Environmental Law (CIEL).

The United States: The Global Leader in Climate Intervention Research

The US is currently the only country deploying aircraft into the stratosphere for climate research. SRM projects have bipartisan support in Congress, though budgets remain in the single-digit-million-dollar range.

In 2020, the National Oceanic and Atmospheric Administration (NOAA) established the Earth’s Radiation Budget (ERB), a comprehensive research effort to study the scientific foundations and impacts of SRM approaches. Although its budget is modest, it has more than doubled since its inception.

Other countries and bodies, including China, the United Kingdom, the European Commission, and Australia, are also conducting experiments to explore the potential of SRM techniques.

–

Solar Radiation Modification remains a novel and underexplored field of decarbonization research, and it is not without some risks and controversies. Still, amid the push to expand and accelerate decarbonization efforts, SRM remains a crucial area for scientists, governments, and investors to actively monitor.

The Jefferies Sustainability and Transition Team will continue tracking the sector’s developments as it attracts more resources and attention.

Great Hill’s Michael Kumin Sees a “Return to Basics” in the Era of Artificial Intelligence

Before Michael Kumin invests in a company, he needs to feel comfortable holding it for as long as a decade.

As a managing director at the growth-focused private equity firm Great Hill Partners, Kumin is now assessing how AI will shape its existing portfolio and future investments at a moment when global venture investment is rebounding.

We recently met with Kumin at the Jefferies Private Internet Conference in Los Angeles, where we explored his vision for AI’s future and its impact on growth investing within private equity.

How is AI changing your approach to investing?

MK: The question we are facing right now is not just how we can incrementally influence our businesses to improve them next year and the year after, but what the fundamental influences we can bring to bear over the next decade are. That’s a pretty challenging question.

If you ask what these companies will look like in 2034, you must challenge yourself to reimagine the consumer journey. Take search for an example. Will people be typing into a search box or talking to a voice-assisted agent sitting on their shoulders? You must be thoughtful and creative and consider every investment’s risks and opportunities.

Does the growth of AI mean you need an added level of diligence?

MK: We now have an AI-specific conversation on every investment we make. Certainly, in anything truly digital, you must be a prudent investor and include that in your calculus. So, we have dedicated slides on AI in every investment deck and every presentation, and the topic comes up in just about every discussion.

Do most of your investments focus on companies starting to leverage AI?

MK: We are trying to find good, solid, high-growth businesses. We are trying to identify where we can accelerate their go-to-market or product development and where there may be risk in the durability of their business model. So, we are balancing the pros and cons at every step.

Do you see more competition now? Do you see a narrowing of the bid-ask spread?

MK: Yes, that has started to narrow. I think you are just seeing a compression – the ask is coming down a bit, and the bids are coming up. Some of that is based on the cost of capital perception of where rates are going, and some of it is due to the sense that the economy is settling out.

You have several great companies in your portfolio. As bids increase, how are you approaching liquidity?

MK: That’s been the question in digital commerce and consumer-facing assets. I think you saw companies return to basics, focus on unit economics, and focus on operating leverage. So, within our portfolio, that’s been the focus for the last couple of years. Almost to a company, we expect to have the highest EBITDA performance in each company’s history. As performance continues to show, I think the buyers will come in and start to get back to normalized multiples.

Which parts of the internet spaces is Great Hill most focused on?

MK: As AI becomes more of a disruptor, the question is, what impact does it have on company valuations? Is it an accelerant where companies are worth more because AI drives down their cost structure and the company becomes more profitable? Or is there the potential that AI causes more risk in business models?

There’s a question of whether what is old is new. By that, I mean that companies that sell physical products will be hard to displace. There is a renaissance of some of the older school products and business models based on a change in valuations, and those businesses might actually have some appeal because AI disrupts them less.

Prime Services C-Suite Newsletter – July 2024

Jack-of-all-Reads: A newsletter for multi-hat-wearing C-suite leaders and their key constituents.

Making a Splash – Trends Across Cyber Security, AI, and the Regulatory Environment

Industry Insights:

Our newsletter, Jack-of-all-Reads, shares the latest and greatest insights in a brief read on a monthly basis. Please let us know of any comments or questions – we welcome and appreciate your continued partnership.

Industry Insights:

- Top of Mind: Increased Scrutiny Around Hedge Funds’ Use of AI. The United States’ Senate Committee on Homeland Security & Governmental Affairs released a report on hedge funds’ implementation of artificial intelligence, “AI,” into their trading processes. They concluded that the current rules do not provide adequate disclosures to clients around how this could potentially increase risks to market stability.

- Classification. Led by chairman Gary Peters, the report found that the existing regulations fail to classify AI technologies based on their associated risk levels. They argue that regulators have not sufficiently clarified how the existing regulatory framework applies to hedge funds’ use of AI. It also acknowledges that the inherent intricacy and opaqueness of these technologies make it difficult for managers to provide adequate disclosures to clients, especially regarding trading decisions.

- Next Steps. The committee recommended several provisions for regulators, such as the SEC and CFTC, to implement. These recommendations aim to make regulations more uniform across the industry.

- Managers are encouraged to reach out to their legal providers and make sure they classify when and where artificial intelligence is used in their processes.

- CrowdStrike Outage: Bringing Vendor Assessment to Light. Given the events from earlier this July, many managers are on high alert of potential phishing attacks and placing an emphasis on the vendor relationships that they, as well as their service providers, are engaging in.

- Risk Mitigation. Top of mind items for creating a safer technology ecosystem for fund managers include:

- Implementing two factor authentication on all devices.

- Reviewing the information security and business continuity plans of each vendor, while also inquiring on any past breaches.

- Understanding internal risk management practices.

- Researching the vendor with initial and ongoing due diligence.

- Focus on Vendor Management. If a key vendor experiences a data breach, their client data is likely to be at risk as well. Many funds are now looking at their lineup of vendors and understanding which data they have access to and how to monitor this. Some managers are engaging with experts who can independently perform annual due diligence outreach on vendors’ cyber security processes.

- SEC Action. The SEC seems to be extending their cyber focus to vendors as well, especially given recent cyber-attacks on these groups. The committee is aiming to show the importance of data integrity, confidentiality, and designing effective ways to report disclosures. The changes to the regulation SP also requires data breach notifications.

- Risk Mitigation. Top of mind items for creating a safer technology ecosystem for fund managers include:

- Regulatory Updates. Approaching this election year, regulators were eager to propose rulings across different functions of a firms’ lifecycle from employment, investor transparency, and operational considerations. Updates below:

- Non-Compete Ruling. After the proposed rule was voted in by the FCA, many groups had challenged the ruling. It was granted a preliminary injunction earlier this July, meaning the final ruling should be decided this August. Although the outcome is unknown, many firms are continuing to operate as normal, whereas others are taking precautionary steps to be ready for the potential update of employment agreements.

- Outsourcing Rule. The vendor management rules highlight the importance of requiring registered persons to maintain oversight of their vendors. The expectation of this ruling is that documents will need to be kept that outline both the due diligence process taken and practices around the supervisory framework.

- Private Funds Rule. The rule was vacated by the Fifth Circuit Court of Appeals on June 5th. Although many were using the wait and see approach here, others used this time to reevaluate some of their processes associated with investor transparency.

- FCA’s Sustainability Disclosure Requirements (SDR). The FCA’s Sustainability Disclosure Requirements came into effect in the United Kingdom this May. These “anti-greenwashing rules” aim to ensure that all sustainability related claims are “clear, fair, and not misleading,” and applies to all FCA-regulated firms, including alternative fund managers. Upcoming in the second half of 2024, there are some key dates that managers should be aware of.

- July 31, 2024, firms will be allowed to use the FCA’s four sustainable investment product labels on their funds, with the appropriate disclosures to investors. Firms must notify the FCA if they choose to label their products. ESG labeling will go live as well.

- December 2, 2024, firms must ensure the names and marketing materials for their sustainability labeled products are accurate and do not mislead investors.

- Next Steps. Managers should review their marketing materials and update accordingly to ensure they are in compliance with the FCA’s SDR naming and marketing provisions. They should also prepare to meet the FCA’s disclosure requirements, which require managers to make available transparent information on their fund’s sustainability.

Please reach out to your Jefferies contact for more information on any of the topics above.

Client Corner:

Virtual Data Rooms. Our team has been fielding an increase in questions around virtual data rooms. While these initially gained popularity during the pandemic, they are now coming back into focus a reliable means of keeping data secured. We are seeing a mix of clients utilizing systems they are already users of, for example their CRMs, however many are also looking at stand alone and custom built offerings.

Spotlight on Content and Events:

How Data Centers Are Shaping the Future of Energy Consumption

The Jefferies research team has released a recent piece exploring the explosive growth in data centers, which, coupled with infrastructure and power constraints, presents both challenges and opportunities for a myriad of sectors, including utilities, energy, capital goods, and more. Click here to read more.

Interesting Service Provider Reads: Highlighting Topical Content from Industry Leaders

Abacus – Understanding the SEC’s Amendments to Regulation S-P and The Aftermath of the CrowdStrike Outage: Essential Insights and Safety Measures

Akin Gump – Fund Managers Must Assess Whether Microsoft/CrowdStrike Outage Has Triggered Additional Regulatory Filings

Kleinberg Kaplan – Business as Usual for Now—A Reprieve from the FTC’s Nationwide Noncompete Ban

Seward & Kissel – CrowdStrike Outage and its Form PF Implications

SS&C – Cybersecurity and Rapid Response – Updates to SEC Regulation S-P

Jefferies Prime Services Contacts:

Mark Aldoroty

Head of Jefferies Prime Services

[email protected]

Barsam Lakani

Head of Sales for Prime Services

[email protected]

Ariel Deljanin

Business Consulting Services

[email protected]

Leor Shapiro

Head of Capital Intelligence

[email protected]

Paul Covello

Global Head of Outsourced Trading

[email protected]

Eileen Cooney

Capital Introductions

[email protected]

DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2024 Jefferies LLC

Clients First-Always SM Jefferies.com

Early Investor in Pinterest, Ro, and DraftKings Offers Take on Changing Face of Venture Capital

In the two decades since Rick Heitzmann co-founded his seed and Series A venture capital firm, FirstMark Capital, he has seen the venture capital industry in New York City transformed.

What was once a community of small, informally-run operations blossomed into an industry of formidable institutions providing entire platforms of support services to the companies they invest in.

During those decades, Heitzmann made a series of iconic investments in companies like Pinterest, DraftKings, and Ro, which earned him a reputation as one of the nation’s most successful venture capitalists. He’s been named to Forbes’ Midas List of the world’s top VC investors every year since 2020.

Speaking at the Jefferies Private Internet Conference in Los Angeles in April, Heitzmann says FirstMark has never changed its philosophy on where to invest.

“Great people make a great company, and having great founders who are incredibly thoughtful about the product and go-to-market strategy is necessary,” Heitzmann said. “But you also pick people who are slightly contrarian, who are thinking of the world differently. They see the megatrends that are coming.”

“We tend to get in early and help form the cultures,” he said. “So, we are really true partners with entrepreneurs.”

Heitzmann is applying that investing philosophy now to a landscape where AI is progressing exponentially, healthcare is being digitalized, and investments in consumer tech start-ups are fewer and farther between.

Here are a few other key insights he shared at the conference.

Q: Are the sky-high valuations of the AI-related companies you see justified?

RH: If you think that these are the fundamental companies, that these are the kings that will be made for the next generation of innovation, then they are justified. Some of these companies are overvalued. They are not all going to be winners. But if you have a great team and a great market poised for explosion, you will see some very valuable companies built.

Q: You were early investors in Ro, which offers GLP-1 medications as part of a comprehensive weight loss program. This space also has a massive adoption curve. Talk to us about that.

RH: The other megatrend you are seeing is the digitalization of healthcare. Ro is very much a part of that. One of the things that is really accelerating is the adoption of GLPs, which is really affecting body and weight loss. You are seeing new things about those drugs pop up every day. Something just came up about it benefiting Alzheimer’s patients. You are even seeing the benefits of helping people drink less alcohol.

RO has been an early leader in this space. It has become the poster child for how these medications get adopted and adherent. We’ve not only said, “Hey, we can provide access to these drugs,” but we’re also going to put you in a program to make it as safe and secure as possible.

Q: We’ve gone through two to three years where consumer tech investments have been out of favor in both public and private markets. Some other VCs have abandoned the category. What gives you the confidence to keep investing in that segment?

RH: If nothing else, because other VCs are leaving. We try to zig when other people zag. Besides that, we also believe in the consumer and the consumer economy. We’re still seeing very interesting companies across the consumer landscape. So, as much as other people are leaving it, we’re wide open for business.

Q: This conference was full of discussions about the opening of public markets. What are you telling your portfolio companies about the timing?

RH: We are telling people to get ready. There have been some green shoots. You know, these things happen slowly. We have over a half-dozen companies that are IPO ready, have the size and scale, and have the teams in place. We believe we will have an IPO or two in the next twelve months, and then we think 2025 will be as close to normal as we have seen in years.

Inside the Mega Deals: What’s Driving Oil and Gas Consolidation?

It was a transformative 2023 for oil and gas, as a flurry of year-end mega deals drove the sector’s most merger and acquisition spending in over a decade. Major moves like Chevron’s acquisition of Hess and ExxonMobil’s purchase of Pioneer Natural Resources signaled a return to consolidation, after years of price volatility and waning investor interest.

This momentum has carried into 2024, most notably with Diamondback Energy’s $26 billion acquisition of Endeavor Energy Partners. Jefferies served as lead financial advisor on the deal.

Jefferies Insights caught up with Greg Chitty and Conrad Gibbins, two of the deal’s architects and Co-Heads of Upstream Americas, to discuss the current dealmaking and capital markets environment in oil and gas; what the Diamondback deal means for the sector’s future; and more.

Their conversation took place just before news that ConocoPhillips has agreed to acquire Marathon Oil for $22.5 billion, the latest mega-merger in the oil and gas industry.

Oil and Gas Bucked Market Trends. Can They Continue to Overperform?

Oil and gas bucked broader market trends in 2023, a year when high interest rates and recession fears dampened dealmaking. M&A volumes and values declined by 6% and 25%, respectively, and hopes for a rebound in 2024 have yet to materialize.

So, what accounts for oil and gas’s overperformance, and can we expect more dealmaking despite a sluggish M&A market?

“It’s a convergence of different factors,” Gibbins explained. “First, post-Ukraine, we’ve seen renewed appreciation for energy security, and capital has returned to the market. Second, oil and gas companies have impressed, demonstrating capital restraint, discipline, and returning capital to shareholders. Third, we’ve had price stability. When there’s minimal volatility in our business, we can always get deals done.”

The top five Western oil and gas firms — BP, Chevron, ExxonMobil, Shell, and TotalEnergies — returned over $111 billion to shareholders through dividends and share repurchases in 2023. In the late 2010s, concerns about the sector’s long-term viability and price volatility caused a decline in investor interest. Today, as the industry’s leaders return more money than ever, institutional investors are being lured back.

“The market is rewarding consolidation. Just look at the Diamondback deal: the stock was up over 20% after the announcement,” Chitty added. “With investors supporting deals, we should see more activity in public markets, but also across the board.”

Chitty elaborated on the downstream effects of large-cap M&A for the sector. As consolidation continues, smaller private companies will need to take steps to become more attractive to larger public firms, creating a ripple effect throughout the industry. Both he and Gibbins predicted a steady stream of deals of all shapes and sizes. This proved true recently, as Jefferies served as exclusive financial advisor in two deals announced in July:

- Point Energy Partners in their sale of assets to Vital Energy and Nothern Oil and Gas Inc., in an all-cash transaction for $1.1 billion.

- Total Operations and Production Services (TOPS) in their sale to Archrock (NYSE: AROC) in a transaction valued at $983 million.

What Goes Into Executing High-Profile M&A?

The timing and synergies between high-profile M&A can often seem opaque, but Chitty and Gibbins shed light on why the conditions were ideal for the Diamondback and Endeavor deal, which will undoubtedly be one of the year’s defining transactions.

“One of the unique factors in this deal was the narrow market,” Chitty shared. “You’d normally have four or five large-caps eyeing a company like Endeavor, but two of them, Exxon and Chevron, were sidelined by the FTC. Some thought Conoco was in pole position, but we were able to offer the most attractive option to the selling party.”

Gibbins expanded on some of the specific synergies that made Diamondback’s offer attractive: “both companies are Midland-based. That was very important to the seller, because it meant the employee base could be retained. The businesses also have similar cultures – very nimble and entrepreneurial. Altogether, there were strong industrial, administrative, cultural, and financial synergies to the transaction.”

Future Predictions: Consolidation Dominates

As major geopolitical events, including the Russo-Ukrainian and Israel-Hamas wars, continue to strain global oil supply, many investors expect American companies — upstream, midstream, and downstream — to continue to perform. The conversation concluded with Chitty and Gibbins’ predictions for the future, and they doubled down on one clear trend: consolidation, consolidation, consolidation.

“Today’s oil and gas companies can’t double and triple through organic growth,” Chitty said. “If they want to keep attracting investor interest, they have to get bigger and bigger. The way to do that is consolidation.”

Gibbins shared similar insights, emphasizing “investor relevance” as a driving force.

“Think about tech: there’s a handful of names that capture investor attention. Oil and gas is the same,” he explained. “A few large-cap companies appear on every index. For the other 47 or so companies that aren’t included, consolidation is how they achieve the scale needed to attract investors.”

For more insights from Jefferies, the leading advisor on M&A transactions in the energy sector for the last decade, visit Jefferies Insights.

How the UK’s Listed Real Estate Market Is Adapting to New Realities

In July, Jefferies and European Public Real Estate Association (EPRA) hosted a forum to showcase the UK’s listed real estate sector. Six CEOs, representing about a third of the sector’s market cap, discussed key issues like hybrid work, housing shortages, an aging population, the boom in e-commerce, and the urgent need for student accommodation and primary care facilities.

The UK real estate sector is dynamic and offers significant opportunities for long-term investors.

Market fundamentals are strong. The nation is entering a period of relative political stability, the impact of COVID-19 has receded, and interest rates are expected to decline, potentially in September. Brexit has become a “known known,” ameliorated by hopes that the new Labour government may foster a more constructive relationship with the EU. There are signs of substantial market momentum, with either accelerating or stabilizing rent growth and higher occupancy levels across the UK.

UK Office Market Accelerates in Flight to Quality Amid the Rise of Hybrid Working

After years of COVID-related disruptions and interest rate volatility, office specialists Land Securities and Derwent London have focused on areas of competitive advantage and maintaining robust balance sheets.

As a result of eight years of limited supply, demand is concentrated at the high-quality end of the market. Mark Allan, CEO of Land Securities, believes “the outlook for returns from the development and ownership of best-in-class properties is the strongest in 15 years.”

The shift towards hybrid and remote work has altered market dynamics, but the importance of office space remains clear. Commercial tenants now prioritize sustainability, location (proximity to transport nodes), and amenities to attract and retain their workforce. Additionally, tenants are demanding more space per employee, changing the density of office occupation.

While London remains a unique global city, Paul Williams, CEO of Derwent London, is less optimistic about areas outside the city and remains focused on Central London. He emphasizes the importance of prime locations, ‘If we can’t walk to a building, we’re not interested.'”

The anticipated disruption of demand for flexible office space has diminished. While demand exists, it is now seen as a complement to their other offerings rather than a market disruptor.

Lower Vacancy Rates Leave Room for Rents to Grow

With lower vacancy rates and higher demand, the largest property Real Estate Investment Trusts (REITs) in the UK now see an opportunity to drive rental growth.

In retail, Mr. Allan observes a similar flight to prime locations, accelerated by the rise of online shopping. This trend has forced retailers to rethink their use of physical locations to support an omnichannel approach. They need fewer stores, but those stores must be larger and better equipped — essentially showrooms that draw people in and offer a wide variety of products.

Retail vacancy rates have dropped from 9% during COVID-19 to 4.5%, driven by strong retailers and European entrants. With rents falling to 35% below pre-COVID peaks, Mr. Allan believes we’ve reached an inflection point: “We’re now renewing with existing occupiers ahead of previous passing rents.”

Today, the UK is the largest online retail adopter in the world. Colin Godfrey, CEO of Tritax Big Box, the largest investor and developer in UK Logistics, believes “We won’t see the demise of the high street, but we are going to see an increase of online demand.”

Amid de-globalization, shortening supply chains, and rising manufacturing costs in emerging economies, the UK domestic manufacturing and logistics market is becoming more compelling. A diverse range of occupiers supports the market, in addition to major players like Amazon. Tritax views current hesitancy in uptake as pent-up demand. As demand increases, vacancy rates will decrease, driving rental growth to 4-5%. Significant investments in leasehold improvements also make occupiers sticky and high-quality customers.

Rental growth aspirations are buoyed by the decreasing cost of rent as a proportion of commercial tenants’ total operating expenses. In logistics, property costs are 2-5% of total operational costs, while in the office sector, rent makes up 8% of clients’ cost structure, down from the high teens. With vacancy rates at 3.4%, Mr. Williams expects over 5% annual rental growth for offices over the next five years and Mr. Allan projects rents could grow 30% over the same period.

As a mid-market rental operator, Grainger’s performance is closely tied to wage and general inflation, with rents changing weekly. Grainger’s tenants spend 28% of their income on rent, below the charity sector’s expectation of one-third. The core demographic for build-to-rent is young professionals. Although Grainger could increase rents, they take a conservative approach. Renting remains cheaper than owning, with only 5% of tenants leaving to buy homes and 63% renewing leases. Wage inflation is currently 5%, and as it decreases, rental growth will slow but stay above inflation.

A New Labour Government Spurs Cautious Optimism in Residential, Student Accommodation, and Healthcare

Helen Gordon, CEO of Grainger, the UK’s largest listed residential landlord, expects the incoming Labour government to focus on improving the planning system over implementing rent control, which negatively impacted Scotland’s rental supply when introduced in 2022. “Not only will they not introduce rent control, but they won’t allow the devolved mayors to introduce rent control either, for fear of repeating what happened in Scotland.”

Grainger supports Labour’s intention to implement higher quality terms for renters.

There are housing shortages in most UK university cities due to increasing student numbers and a continued influx of international students. Michael Burt, CFO of Unite Group PLC, reports occupancy rates over 99%, highlighting strong and ongoing demand amid no new supply of purpose-built student housing and a shrinking private market. “All of our conversations with Labour are about how we can accelerate housing supply and make it more affordable. Positively for us, they are very open to innovative housing policy and ways to provide more affordable beds.”

Mr. Burt also believes the new government appreciates the important role that international students play in supporting funding models for UK universities.

Harry Hyman, Founder and Chair of Primary Healthcare Properties, welcomes Wes Streeting as the new health secretary. “He clearly understands that we need to deliver more healthcare outside of hospitals, which will lower costs, increase accessibility, and help tackle the incredible NHS waiting lists. However, we still need to focus on rental growth from the government.”

Mr. Hyman sees rental growth as essential for the development, modernization and expansion of facilities, which are crucial for improving NHS efficiency and providing care at a fraction of hospital treatment costs.

———

If you’d like to view any of the conference panels or have any questions regarding the conference content, please contact Mark James ([email protected])

Lightspeed’s Nicole Quinn on Consumer Technology’s Resurgent 2024

It was a painful post-pandemic slump for tech, as fundraising and dealmaking tumbled far from their 2021 heights. By year’s end, however, the market seemed to have found its bottom, and investors eagerly awaited a revival in 2024.

So far, the year looks promising: VCs are armed with record levels of dry powder, and a backlog of high-quality tech companies are eyeing public markets. Tech deal value surged to $125B in Q1 2024, up from $92B in Q1 2023.

In public markets, the recovery was boosted by IPOs from Reddit, Astera Labs, and Ibotta, Inc. Investors are closely watching Stubhub and Stripe, both rumored to be eyeing public markets later this year.

Now, the big question for tech investors and industry watchers is, what can the year’s early activity tell us about the deals to come?

In April at Jefferies’ 2024 Private Internet Conference, “In the Age of AI,” Nicole Quinn, a partner at Lightspeed Ventures focused on consumer technology, discussed opportunities in the sector, how AI is reshaping tech companies, and where consumer brands fit into the equation.

There’s a lot of enthusiasm in the tech sector. Is that translating to enthusiasm around the IPO market? Has Reddit changed everything?

Reddit has definitely changed everything. It showed us that there may be more liquidity than expected this year, through IPOs and M&A.

It’s been a quiet couple of years. Companies sat on their hands – even really high quality companies, with strong growth and revenue. Now, investor appetite is back, and companies are ready to come out and raise money.

You work with a lot of great consumer brands. Do you expect them to access public markets, too?

I certainly expect consumer companies to pursue IPOs at some point. They have predictable and revenue streams from subscription customers, which attracts investors. Many of them are profitable, too.

For now, I think many consumer brands will look to private markets or M&A first to generate liquidity. Ultimately, they are building sustainable businesses, achieving profitability, and when the time is right, public markets will reward that.

How is AI helping companies move towards profitability?

I’ve been bullish on AI for a long time. At Lightspeed, we’ve invested $1.2 billion in AI across 53 companies – and we’ve been making those investments for a decade.

I’m most excited about AI-native companies, but to your point, all businesses can leverage AI to support profitability. In customer service and operations, companies don’t need huge teams. There are countless tools available to make these functions easier and cheaper.

Does it change the CAC (customer acquisition cost) equation? There’s been concern about rising CAC in the consumer internet sector recently.

Companies are thinking outside the box with marketing, and that’s very exciting. You’re absolutely right that for businesses like Facebook and Google, customer acquisition costs rose over the last few years. It is companies that have grown organically and virally through incredible products, ambassadors, and outside-the-box thinking that have performed exceptionally well – and we expect that to continue.

Regarding AI: we’re still in the early innings. As these tools develop, I do expect less paid acquisition, and that’s great for these consumer businesses.

Over the last several years, it has been harder for companies to raise money from venture capital. Business models and financials are more scrutinized. As an investor, how do companies give you the comfort to finally sign a term sheet?

I’m an early-stage internet investor, so I’m an optimist. I’m so pleased with the changes companies have made in recent years. The fundraising environment got tight, and founders said, “we need to be self-sufficient.”

When companies come to market this quarter, they’re more attractive than ever before. They always had plenty of growth, but the margins weren’t there. Now, they’re showing numbers that investors love.

At the same time, we still want an exciting product. We still want companies to be delighting their customers. When you can pair that with a sustainable business – that’s when we’re excited to invest.

Where Does Climate Investing Go From Here?

12 months ago, JEF Sustainability & Transition published an Expanding Overton Window, containing 10 bold predictions for the future of Climate Investing. One year on, we revisit these predictions to see how they are playing out, what lessons the investor community can take and importantly set out perspectives around what the next year could have in store.

Here are six predictions we believe will shape the next phase of climate investing:

- Political swings occur in 2024 — yet only have a marginal effect on the pace of decarbonization.

- Protectionism under the guise of decarbonization will increase.

- First of a kind large scale climate projects will begin to scale — corporate R&D and allocations to the theme will 2x.

- Voluntary Carbon Markets and related infrastructure will regain credibility.

- Attention will turn to agriculture as power and transport decarbonization continues.

- Allocations to the transition will become more tactical — reacting to the evolution of the transition.

You can watch the entire discussion below: