The Path Forward: A Healthier Startup Ecosystem Emerges

With Gaurav Kittur, Global Co-Head of Internet Investment Banking

Over the last two years, tech companies, particularly those in the consumer internet sector, have grappled with a range of challenges, from inflated consumer acquisition costs to a scarcity of IPOs. These complexities have forced companies to reevaluate their operational strategies, tighten budgets, and streamline their focus around profitable growth.

In the following discussion, Gaurav Kittur, Global Co-Head of Internet Investment Banking at Jefferies, shares his perspective on this transformative period. Speaking from Jefferies’ Private Internet Conference, Kittur explores the effects of these challenges on the tech ecosystem, the strategic adaptations made by companies, and the emerging opportunities for growth and innovation.

Q: What challenges have tech companies faced over the last two years?

The last 18 to 24 months have been incredibly tough for tech companies, especially those in the consumer internet sector. This period has seen almost no IPOs. On top of that, the cost of acquiring new consumers for these companies has skyrocketed.

As a result, companies with constrained marketing budgets had to pull back spending on user acquisition (UA), which affected their top-line growth and, consequently, their attractiveness to investors. This has led to a real capital crunch for companies in this segment.

Q: How are companies adapting to challenging times?

I think companies have used this time to get really disciplined. As I speak with a lot of CEOs in the space, a lot of them have used the last 18 to 24 months to execute painful but necessary reductions in force (RIF).

These RIFs resulted in a decrease in product development expenses and a shift in focus towards building profitable products. Companies have been launching their products earlier, seeking feedback, and then concentrating their marketing budgets on profitable customers rather than just acquiring all kinds of customers.

Despite the harsh capital environment, I believe the tech ecosystem is in a healthier state overall. Things feel incredibly painful right now, but we may look back at this moment and realize it benefited the tech ecosystem. Many companies may find, two or three years from now, that they have healthier unit economics thanks to this challenging period.

Q: What’s next for the tech ecosystem?

We’re reaching a point where a lot of the hard work is behind us, in terms of stripping costs and refocusing on profitable growth. Now, companies are growth businesses, operating in massive addressable markets.

As a result, you have companies ready to go back out to raise capital, and this capital will drive profitable growth. It may also drive transformative M&A. I think companies won’t just try to grow organically, but also consolidate others around them.

Q: How has companies’ approach to growth and financing evolved?

Over the last 18 months, all we’ve talked about was structured financing rounds. This was primarily because company valuations dropped so quickly that many businesses weren’t ready to face this new reality.

Today, everyone is open to new priced equity rounds, recognizing the realities of today’s valuation environment. Companies are talking about IPOs again. I’ve heard from a number of companies who are ready to go public earlier in their life cycle than they traditionally would have.

Part of this shift is driven by a desire to instill discipline, as public companies are inherently more disciplined than private ones. The other factor is alignment. By going public early, everyone holds common equity. This means that employees, investors, and all other stakeholders are aligned moving forward.

Finally, I should mention that companies are thinking big. They’re looking at their competitors, looking at adjacencies, and thinking: is there something we can do to fundamentally change the course of our business?

Whether these be cash transactions or stock deals, these inter-company dialogues have been incredibly active. This combination sets us up for significantly more activity over the next 6-12 months.

Navigating the Decarbonization Landscape: A Strategic Guide for Investors

The global transition towards net-zero emissions is gaining momentum, accelerated by policy incentives, the war in Ukraine, and a new wave of digital innovation. Despite geopolitical and macroeconomic headwinds, climate-related capital continues to flow into both public and private markets. Amid this dynamic landscape, investors grapple with a critical question: how to optimally allocate time and capital to emerging clean technologies.

At Jefferies, we aim to provide investors with a strategic framework to navigate this complex landscape. Our approach goes beyond merely identifying winners and losers, focusing on how to select a technology for analysis and how this selection process may evolve over time.

Climate solutions exist across a spectrum, from mature technologies to nascent innovations. Investors face a tough choice in deciding where to focus their attention. To ease this process, we have studied seven analytical frameworks for the investment community. These include (1) the scientific approach, (2) a policy-focused approach, (3) the IEA’s Energy Transitions Pathways Clean Tech Guide, (4) adoption curves and technology penetration rates, (5) the five grand challenges and green premiums, (6) the view from corporates (i.e., industry pain points), and (7) demand-side measures.

The Scientific Approach

The scientific approach is grounded in data and research from the scientific community. It particularly centers on research from the UN’s Intergovernmental Panel on Climate Change (IPCC), which ranks technologies based on their emissions mitigation potential and cost. This approach provides a data-driven frame of analysis for investors, allowing them to prioritize technologies with great emissions potential and cost efficiency.

A Policy-Based Approach

A policy-based approach leverages national roadmaps published by governments, which outline key areas of focus that will receive some form of policy support. These documents can be utilized by investors in deciding which technologies to focus on. For example, the recent UK mandate that 53% of all national emission reductions come from domestic transport is accelerating EV development and commercialization – an attractive, policy-driven opportunity for investors.

Leveraging the UK Carbon Budget

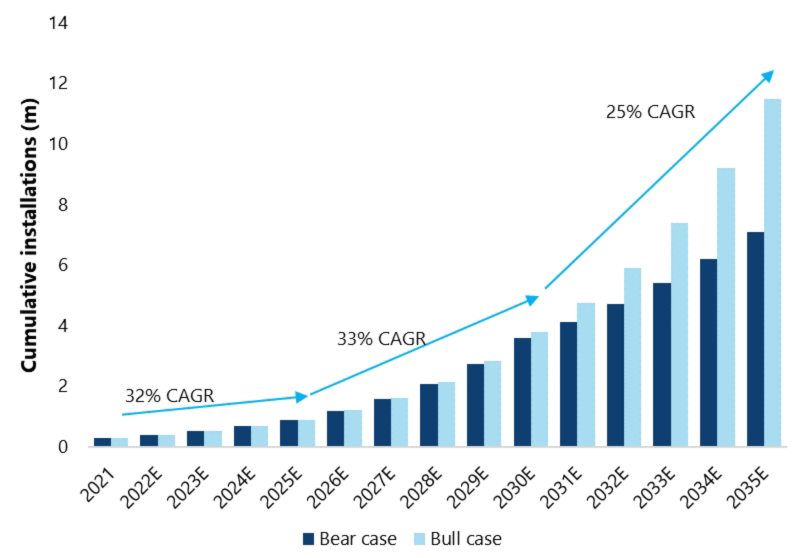

The UK’s Carbon Budget can be used to map out potential expected market sizing. Here, investors used the government’s framework to create a total addressable market for heat pump penetration (2021 – 2035).

Source: UK Carbon Budget Delivery Plan

The IEA’s Energy Transitions Pathways Clean Tech Guide

The IEA’s Energy Transitions Pathways Clean Tech Guide is an interactive framework with information on more than 500 individual technologies across the energy system, all of which would contribute to achieving net-zero. The guide provides information on the level of its maturity alongside development and deployment plans for commercial scale to be achieved. Investors can leverage this framework to gain insight into the main players in a given solution, and their anticipated trajectory of progress over time.

Adoption Curves & Technology Penetration Rates

Understanding where a technology is on its adoption curve and what the adoption rates could be moving forward is a strong basis for an investment strategy. Identifying solutions moving through the early adopters to late majority phase is a proven method for asset managers.

There are a range of factors that impact adoption speed, including the type of innovation, purchase intention data, relative advantage, strength of incumbent technologies, and the complexity of the technology. Investors should use all these indicators in assessing the adoption trajectory of a target innovation.

Technology Types & Market Performance

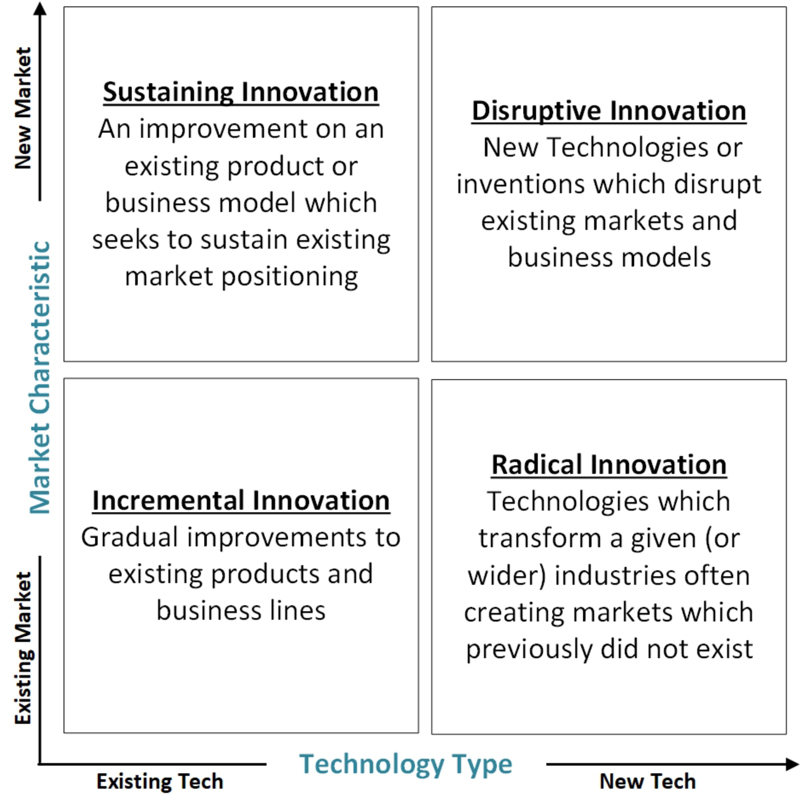

There are four main categories of innovation, and adoption and penetration rates vary widely between them.

Source: Satell – HBS, Jefferies Research

Five Grand Challenges & The Green Premium

The five grand challenges, popularized by Bill Gates in his work on How to Avoid a Climate Disaster, provide investors with a reference point with which to commit time and capital to. If addressed, these five grand challenges would reduce global GHG emissions by at least 75% through 2030, according to Climate Watch & WRI. Identifying solutions that go towards addressing these challenges is a viable starting point for investors.

The View From Corporates (Industry Pain Points)

The view from corporates, or industry pain points, is another approach for investors interested in decarbonization. Across various industries, companies face myriad challenges in decarbonizing their operations. Surveying companies and executives across sectors to understand the biggest challenges they face in reaching net-zero would lead to a subset of issues to be addressed by sector.

Demand-Side Measures

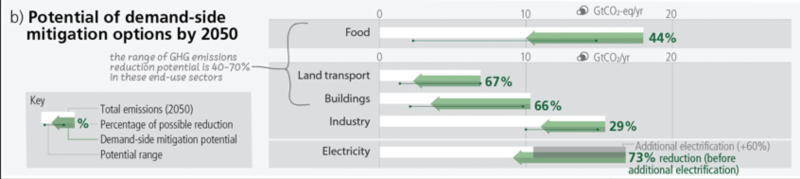

Demand-side measures, which relate to individual choices, consumer behavior, and lifestyle changes around consumption, offer another avenue for investment. The IPCC’s WG III report made clear that certain demand-focused measures would reduce emissions substantially. In many cases, business solutions can facilitate changes in consumer behavior. These may include product sharing services, alternative proteins, energy efficiency measures, and high-speed railways. Investments in innovations designed to address consumer demand can have the greatest mitigation potential.

Demand-Side Mitigation in Electrification

Demand side changes in electricity and buildings could materially reduce emissions through 2030.

Source: IPCC WGIII

—

The decarbonization landscape offers myriad of opportunities for investors, but navigating this landscape requires a nuanced understanding of the various technologies, policies, and market dynamics at play. By leveraging the seven frameworks outlined here, investors can make more informed decisions about where to allocate their time and capital. This will not only help them identify potential winners and losers in the clean technology space but also enable them to contribute to the global transition towards a net-zero future.

Aniket Shah is Managing Director & Global Head of Environmental, Social and Governance (ESG) and Sustainable Finance Strategy at Jefferies Group LLC. In this role, Aniket leads the integration of ESG and sustainability analysis within the global investment research department and engages with clients on this dynamic area of corporate and financial services.

He is an Assistant Adjunct Professor at Columbia University’s School of International and Public Affairs. Aniket is a graduate of Yale College and the University of Oxford, where he completed his PhD on the financing of sustainable development.

Embracing Neurodiversity: An Untapped Source of Innovation & Growth

Neurodiversity – or the natural variances of the human brain leading to distinct ways of thinking, learning, and socializing – is often overlooked in discussions of corporate culture and inclusion. Today, few workplaces embody a culture of neurodiversity, as many HR departments overlook it in their recruitment and hiring. As new data demonstrates the significant benefits of neuro-inclusive workplaces, there is growing pressure on business leaders to enhance neurodiversity at every level of their organization.

Jefferies’ ESG team recently invited Joseph Riddle, Director at Neurodiversity in the Workplace, to share his research into neuro-inclusive HR practices and their impact on the workforce.

Understanding the Gap

Despite rising awareness, neurodivergent representation in the workplace remains inadequate. Today, fewer than one in six autistic adults are employed full-time. Adults with Tourette’s syndrome also experience high unemployment, and adults with ADHD are 60% more likely to lose their jobs.

This isn’t just an employment issue, but a cultural one. Bias often begins in the hiring process, as many interviewers rely on social nuances, natural rapport, and ‘culture fit’. Such practices exclude neurodivergent individuals, many of whom bring unique perspectives and potential to the table.

The Benefits of Neurodiversity

Studies show that workplaces championing neurodiversity often outperform their non-diverse counterparts on profitability and value creation. A recent study by Accenture found that businesses with strong neurodiversity programs outperform competitors on profitability and value creation, with 28% higher revenue, twice the net income, and a 30% higher economic profit margin. On average, neurodiverse companies total shareholder returns outperform industry peers by 53%.

Promoting Flexibility & Accommodations

Creating a neurodiverse-friendly culture requires flexibility. Conventional expectations around personality and work style can pose barriers to neurodivergent individuals. Forward-thinking companies are exploring strategies such as revamping interview practices, providing real-time employee feedback, and creating dedicated employee resource groups to address these challenges.

Practical workplace accommodations are also essential to supporting neurodivergent individuals. These include offering quiet, secluded workspaces and prioritizing clear, concrete communication. The use of assistive technology and neuro-inclusive meeting formats is also beneficial. Events and meetings can be more neuro-inclusive by communicating agendas and formats beforehand, having people choose their own seating and level of participation, and reiterating important action steps and takeaways.

Finally, employers must recognize that atypical social communication does not imply a skills deficit. This recognition, alone, goes a long way toward empowering neurodivergent employees.

—

As we move forward, businesses need to question and challenge the norms that limit neurodiversity in the workplace. This starts by scrutinizing existing initiatives for neurodiversity inclusion and ensuring that accommodations are in place for an inclusive work environment.

In a world where 72% of HR departments overlook neurodiversity, businesses are closing the door on the unique talents and perspectives of neurodivergent individuals. It’s time to shift the narrative, invest in accommodations, and unlock the power of neurodiversity for a stronger, more inclusive future.

Aniket Shah is Managing Director & Global Head of Environmental, Social and Governance (ESG) and Sustainable Finance Strategy at Jefferies Group LLC. In this role, Aniket leads the integration of ESG and sustainability analysis within the global investment research department and engages with clients on this dynamic area of corporate and financial services.

He is an Assistant Adjunct Professor at Columbia University’s School of International and Public Affairs. Aniket is a graduate of Yale College and the University of Oxford, where he completed his PhD on the financing of sustainable development.

Trend Watch: Partnerships Between Corporations and Private Equity

Recently, several transactions were announced in which corporations and private equity firms partnered to acquire companies jointly. The targets for these transactions are often, but not exclusively, carveouts from other large corporations. In a dramatically subdued transaction environment, these sorts of opportunities offer many unique attributes, not the least of which is the potential to affect a transaction on a bilateral basis. While these transactions are highly structured, one relatively consistent theme is the private equity firm taking a majority position allowing the corporation to avoid consolidating the target in its financial reporting.

Recent transactions include:

- TPG and AmerisourceBergen jointly acquiring OneOncology from private equity firm General Atlantic. TPG will acquire a majority interest in OneOncology in a transaction valued at $2.1 billion with AmerisourceBergen owning 35%. The transaction carries certain put/call arrangements which, if exercised, would result in AmerisourceBergen owning 100% of OneOncology after an initial investment period of three years. The investment will provide AmerisourceBergen with a window into the provision of oncology services through one of the largest oncology practice management platforms in the U.S.

- Cardinal Health contributing its Outcomes business to Transaction Data Systems (“TDS”), a portfolio company of BlackRock Long Term Private Capital and GTCR. Cardinal will retain a minority stake in the combined entity. The combination will enhance TDS’ digital capabilities in the areas of patient engagement, virtual verification, order grouping, and pill counting, all with the objective of providing an expanded suite of pharmacy workflow software.

- American International Group and Stone Point Capital forming Private Client Select Insurance Services. Under the deal, AIG’s Private Client Group will be moved and rebranded to the new independent platform focusing on high and ultra-high net worth clients.

- Keurig Dr Pepper (“KDP”) and Nutrabolt announcing a strategic partnership in which KDP made a $863 million cash investment and entered a long-term arrangement to sell and distribute Nutrabolt’s C4 Energy beverage. KDP’s investment resulted in an approximate 30% ownership position in Nutrabolt and an overall valuation of $3.0 billion while providing a complete exit for MidOcean Partners.

The rationales for these transactions are varied and numerous with benefits for each party. Common themes include: (i) the provision of partial or complete liquidity to earlier investors while also potentially providing growth capital for add-on acquisitions, (ii) the introduction of a larger strategic partner to provide distribution capabilities or other industrial attributes including, for example, access to an existing customer base or manufacturing capabilities, (iii) partnering with a private equity investor who can provide the “heavy lift” of creating a true stand-alone entity (particularly noteworthy in true corporate carve-out investments), (iv) allowing a corporation to take a meaningful minority investment, enabling it to monitor progress over several years, while providing a defined path to full ownership, and (v) allowing a “selling” corporation to maintain a minority position to allow incremental value creation resulting from the realization of synergies.

These transactions are highly bespoke and, by definition, bilateral, which provides a unique and proprietary opportunity for corporations and private equity investors alike.

Activist Swarms Are On the Rise: A Guide to How Companies Can Navigate Hostile Interests

As activism evolved into a mature asset class over the last two decades, the field inevitably became more crowded. For larger activist funds, the number of public company targets big enough to move the performance needle has also declined. Together, these trends spurred the emergence of the “activist swarm.” Not to be confused with the better-known “wolf pack” phenomenon, where a group of funds informally act together to achieve a common objective, an “activist swarm” results from multiple activists independently identifying and investing in the same target company at the same time.

Earlier this year, three prolific activists separately disclosed a stake in Salesforce, Inc., each with a seemingly different agenda and investment horizon. In January, it was reported that Elliott Management was preparing to nominate a slate of directors at the software company after taking a multi-billion-dollar position earlier in the year. Elliott publicly called for a sustainable leadership plan and increased management accountability by way of enhanced Board oversight. Just a few months earlier, Starboard Value had criticized the company’s subpar growth and profitability relative to its peers. At the same time, ValueAct Capital worked with the company behind the scenes, ultimately extracting a Board seat for the fund’s CIO Mason Morfit as a part of a settlement agreement (perhaps in an attempt to “inoculate” the Board). Elliott ultimately declined to run dissident director candidates at Salesforce’s annual meeting this year.

Similarly, Trian Partners earlier this year launched a public proxy fight for one board seat at The Walt Disney Company shortly after the company had settled with Third Point Management by adding one new independent director to the Board. Third Point has previously disclosed a position in the company and called for an array of strategic changes. After Disney announced a series of operating initiatives, Trian withdrew its nomination.

Activists understandably work hard to hide stake building in a target for as long as possible. Multiple activists showing up on a company’s register at the same time make an already complex and time-consuming process for a Board and management team that much more difficult to navigate. Last year, the number of “activist swarms” nearly doubled relative to prior years. Given the record amount of capital available to be deployed by activist funds, we will likely see more of these “activist swarms.” As always, companies that prepare in advance for the omnipresent risk of activism or hostile strategic interest tend to achieve more optimal outcomes compared to those companies that start the process flat footed.

Using High Yield to Refinance Existing Debt

Issuers and sponsors can utilize the rising demand and liquidity in the High Yield space to refinance near-term loan maturities. Given rate volatility, new CLO creation has been muted for most of the year, creating a technical imbalance in demand. Approaching reinvestment deadlines for CLOs are limiting the ability for CLOs to roll their current investments into new deals.

Meanwhile, new senior secured bonds are proving to have more liquidity and demand. Senior secured bonds also allow for issuers to naturally hedge against rising interest rates. Today, the high yield market diversifies an issuer’s investor base and access to markets, offers fixed rate debt, and is pricing tighter than term loans. Recent secured bonds have priced ~150 bps lower in yield than term loans, and have tightened even further in the secondary market, trading ~184 bps tighter on average.

- The most notable recent deal was the Hub International term loan and bond deal to refinance the company’s existing $6.4 billion of term loans, revolver draws, and to fund near-term M&A. While the term loan priced best-in-class for a B3 loan, the $2.175 billion secured bonds at 7.25% came 250bps lower in yield than the term loan that priced alongside it, reducing the company’s outstanding term loans by $1.7 billion.

Year-to-date, 18 refinancings or extensions collectively entail the repayment of $14.1 billion of institutional loans. At this point in 2022, there were only seven refinancings or extensions that collectively contributed to the repayment of $4 billion in institutional loans. The high yield market will soon emerge to be the most attractive way for issuers to reduce their institutional loan footprint. Inn 2022, there has been $12.1 billion of bond-for-loan takeout volume, accounting for 31% of all repayments unrelated to new issues. Comparable yields required for secured bonds are significantly lower than yields on pari term loans, in some cases 266 bps cheaper.

Acquiring a Stressed Company Trading Below Its Net Cash Balance As an Alternative Source of Financing

The 2020 and 2021 boom in SPAC fundraising – where the market saw a combined 861 SPAC IPOs, and the wave of De-SPAC transactions that followed – resulted in a meaningful number of companies with significant cash balances and little to no debt on their balance sheets.

Those cash balances were intended to finance the growth and development of those businesses. However, economic headwinds in 2022 and 2023 raised questions about the viability of certain business models and led to depressed equity valuations across much of the De-SPAC universe. The Bloomberg De-SPAC index indicates a decline of approximately 80% over the last three years. Yet, many of those same firms still have meaningful cash balances and are trading (on a total market capitalization basis) at 60-90% below their net cash balances.

Public companies with financing needs could consider targeting one of these companies for acquisition as a potential alternative to more traditional financing structures. Through a stock-for-stock acquisition, the acquirer could use its equity currency to boost liquidity and potentially acquire attractive assets in a capital-efficient transaction.

(Sources: S&P and Statista data on SPAC IPOs for 2020/2021 & Bloomberg De-SPAC Index data for 2020 – 2023)

Upside for Rates Likely Capped as Economic Data Softens in the Fall

US Economist Tom Simons slightly raised his terminal rate forecast to 5.375% in the wake of the June FOMC meeting. There were a few key elements of Chairman Powell’s post-meeting comments that gave Tom the impression that one more rate hike is coming, but not two. First, Powell explained that the decision not to raise rates in June was part of a process of moderating the speed of rate hikes. Second, Powell, echoing many others, referenced the idea that moderating the pace of hikes while inflation remains unacceptably high is justified by the uncertainty surrounding policy lags. By the time of the late-July meeting, Tom does not believe there will be enough evidence of slowing growth and inflation to stop the Fed from hiking. Assuming a hike in July, he thinks the Fed will “skip” again in September, which means that the next opportunity to hike would be in October. However, by that point, Tom expects the data to have softened to the point that another rate hike will not be necessary. He anticipates significant declines in headline inflation, the rolling over of labor market data and increased pressure on consumption spurred by the likely September or October resumption of student loan payments.

Chief Market Strategist David Zervos believes the major takeaway from the FOMC dot plot at the June meeting was that the current economic situation just isn’t that bad. The unemployment rate, which had been forecast to rise to 4.5% by year end, is now expected to be 4.1%. Headline PCE inflation is now projected to come down even faster, to 3.2%. Core inflation was the only negative update in the new projections, and is now seen ending the year at 3.9% instead of 3.6%, which is no doubt the primary reason why 50bps of additional hikes have now been put into the Fed’s SEP. Ultimately, Zervos believes that if core inflation gets back onto a path that looks set to hit 3.6% by year end, then the Fed skip will turn into a full-fledged pause. If, however, core inflation continues to be sticky and trend toward the new forecast of 3.9%, additional hikes are headed our way.

Global Head of Equity Strategy Christopher Wood highlighted several important trends. First, there is growing confidence that AI will provide the next productivity-enhancing growth narrative for the coming decade. He doesn’t believe that necessarily means the Big Tech stocks will be the dominant thematic for the duration, as he believes the picks and shovels theme remains the most compelling for now. Second, the fact that global investors still do not want to invest in Chinese stocks provides an explanation for interest in Japanese stocks. Third, the YTD weakness in oil has been due to a combination of concerns including Russia cheating the global sanctions regime, slowing demand in the West, the lack of a more vigorous recovery in China and further drawdowns of the US SPR. As a result, if OPEC supply remains constrained, the demand outlook is likely to remain the key variable for prices.

Generative AI — 10 Predictions Across All Sectors

Over the past several weeks, Jefferies’ US Research teams have been tasked with thinking about the myriad of ways that the rapid development and adoption of AI will forever change the industries they cover. In this piece we offer a compendium of their top 10 predictions on what the future of generative AI will mean for their individual universes. In addition, we offer the most compelling and consistent expected developments.

Bespoke…everything: Whether B2B or DTC, our analyst teams across a wide range of sectors (e.g., industrials, consumer, financials) expect that instant and personalized offerings will proliferate.

No really, everything: More accurate healthcare diagnostics, personalized drugs, a better understanding of genomes & disease risks, and perhaps even surgeonless surgeries.

The walls have eyes: Inventory management will be a cinch when cameras and weighted shelves eliminate checkouts, reduce shrink, and monitor out-of-stocks.

R&D time travel: Generative AI should accelerate the trend toward molecular modeling, virtual chemistry, searchable molecule libraries, and discovering novel ways to create chemicals and treat diseases.

What’s downtime? Everything from manufacturing to fleet management to ocean-going vessels to consumer autos will be maintained in real time, as AI should be able to predict what parts will be needed and when.

Armchair exploration: Both energy and mining companies will use AI to analyze subsurface/geologic data to better map and determine recoverable volumes and more complex ore bodies to meet growing global demand.

Unrisky business: Most notably for banks, lenders and insurance companies, underwriting, originations, and general risk management should all see substantial improvement. AI should even be able to detect fraud more quickly.

Weather or not: AI should finally be able to lead to better prediction of one of the trickiest and most everyday of issues. This could mean aircraft avoid the compounding effect of weather delays, and climate adaptation efforts dramatically improve.

Slicing through your inbox: Streamlining routine tasks like documentation, communication, verification and reporting should mean big, big, big productivity gains. And never having to lose half a Saturday to clearing to bring that pesky counter back down to single digits again.

BYOPaintbrush: If you thought we were good at imagining now, be warned that creativity is liable to explode. Whether creating multimedia content, designing buildings, coding complex algorithms, or even just planning a vacation, our personal, capable robot assistants will do more than just transfer knowledge — they’ll put every human on the shoulders of giants and redefine the phrase ‘if you can dream it’.