Robert Eccles & Daniel Crowley: Rescuing ESG from the Culture Wars

Aniket Shah, Global Head of Environmental, Social, and Governance (ESG) and Sustainability Research at Jefferies, recently joined Robert Eccles and Daniel Crowley in a conversation about the political complexities and misconceptions surrounding ESG.

They offer insight into ESG’s unfortunate entanglement in political and cultural battles, addressing common misunderstandings held by both the left and the right. They discuss efforts to bridge political divides, acknowledging the often-overlooked overlap between ESG disclosure and conservative values. The group also expressed optimism for the future of the ESG movement, even if it eventually moves away from the ‘ESG’ moniker.

Robert Eccles is among the world’s foremost experts on integrated ESG reporting. He is the Founding Chairman of the Sustainability Accounting Standards Board and a former Professor of Management Practice at Harvard Business School.

Daniel Crowley is a partner in the Washington, DC office of K&L Gates LLP, where he leads the firm’s global financial services policy practice. He previously served as Chief Government Affairs Officer at the Investment Company Institute and Vice President and Managing Director in the Office of Government Relations for NASDAQ.

How are individuals from different political persuasions coming together to advocate for ESG principles?

Crowley: We’re witnessing a power struggle in global politics, and, unfortunately, ESG often gets ensnared in these debates.

On the one hand, you have political factions on the left and right waging assaults on each other’s policy agendas. On the other, you have a concentrated desire within the investor community for increased transparency related to material risks.

That’s where ESG centers – not in the debates between the far right and far left, but in the investor community’s search for quality information. The more we conflate these issues, the more our public understanding of ESG is diminished.

Eccles: Opposition on the Republican side may be louder, but there’s considerable pushback from the left, too. Progressives claim it’s not ‘true sustainability’ – just another tool for value creation.

Loud, unconstructive groups on both extremes pollute our discourse, but if you look past the political theater, there’s more bipartisan alignment around ESG than one might expect. It’s time for both sides to lower their defenses and engage in productive dialogue around material factors.

Political repercussions – real or imagined – have a significant impact on our clients’ decision making. Can you offer some insight into our heated politics’ effect on the private sector?

Eccles: We meet with a lot of company leaders and asset managers, and despite the political rhetoric, they are continuing to discuss ESG with investors, albeit more quietly.

Some concerns around ESG are self-inflicted, with firms making grandiose claims about saving the world from climate change and inequality. When our conversations are disciplined, they breed consensus. ESG is about distinguishing between material risk factors and positive and negative externalities.

Politically, there’s an important debate to be had about the roles of the public and private sector in our society. On the issue of ESG, though, there remains broad engagement from both sides of the aisle.

Crowley: Today, many House Republicans equate ESG with the Green New Deal. They think it’s the product of an AOC-led ideological movement and view it as a potential threat to our democracy.

It’s important to remember that ESG conversations date back 20 years, at least. We need to take a step back and remember this is a risk issue: when companies aren’t transparent, they get wiped out. We saw this with Enron, WorldCom, and now, Silicon Valley Bank.

Republicans should remember that these are conservative principles. We want free markets to be rooted in an informed assumption of risk. When the right shoots at ESG, they form a circular firing squad, hitting key constituencies in the Republican party: asset managers, brokers, hedge funds.

How is the idea of an ‘ESG fund’ or an ‘ESG stock’ undermining the conversation around ESG?

Eccles: People make the mistake of confounding ESG with impact. ESG integration is about data analysis – it doesn’t inherently make the world a ‘better’ or ‘worse’ place.

An impact fund invests to address societal challenges. These funds could still fall short on ESG practices in their operational strategies! Socially responsible investing is important, but these labels muddle the public discourse around ESG, and we need to distance ourselves from them.

Crowley: Another issue is the narrow interpretation of ESG’s components. In Washington, DC, ‘E’ has become synonymous with climate change, ‘S’ with human capital, and ‘G’ with proxy voting. People don’t appreciate the scope of ESG analysis.

These concepts are much broader than they’re often treated by our elected officials. The current dialogue no longer represents the foundation of ESG, which is managing enterprises for long-term value creation.

If you were to emphasize one or two key points to ESG skeptics on both the right and the left, in a bid to find common ground, what would those be?

Eccles: If I’m talking to someone who claims not to like ‘ESG,’ I’ll tell them I don’t like ESG either!

I like material risk factors. I like addressing externalities. I won’t try to dissuade you from disliking ESG; I’ll just recenter the conversation around managing risk and equipping investors with quality data. Then, we have plenty to discuss.

Crowley: Many on the left call for increasingly detailed disclosures, regardless of their financial materiality. The truth is that disclosure, alone, can’t move the needle on climate change.

If we hope to tackle climate change, we need to leverage macroeconomic forces. Concentrate on implementing measures like a carbon tax. As these policies take effect, they’ll enhance the relevance of ESG materiality, allowing the goals of ESG proponents and climate activists to advance in unison.

Digital Health: Below the Surface

Digital health is the latest healthcare theme capturing investors’ attention. Data breakthroughs in life sciences have been around for decades (Think: CRISPR DNA editing), but our healthcare systems are going through a complete digital transformation in the wake of Covid-19. Digital Health: Below the Surface, unpacks the digital health universe, the institutional investor landscape, and how this area differs from other sub-sectors in life sciences.

Normalcy Returns Faster Than You’d Think After Financial Crises

APRIL 2023

Dear Clients, Jefferies Employee-Partners, and Friends,

With the end of the first calendar quarter of 2023 complete, once again the financial world feels “on fire.” Interest rates are still rising, inflation remains unchecked, two top 20 U.S. banks were put into receivership and auctioned off, and we just witnessed an emergency “shotgun wedding” to protect the world from the imminent demise of a systemically critical global bank. The financial news is dominated by discussions about asset/liability mismatches due to rapidly rising interest rates and the resulting mark to market losses, protecting consumer deposits above the federally mandated $250,000, and which large bank could be next to stumble. It is almost enough to make one forget that there is a European war going on “real time.” Though we can NEVER FORGET the Ukrainian war because the unprovoked attack on innocent people makes the financial calamity pale in comparison, but you get our point.

So how do all of us put this new financial crisis into perspective as we focus on our day-to-day responsibilities as we manage our businesses, investment portfolios, co-workers, families and friends? It is very easy to get sucked into the abyss and focus on the day-to-day minutiae of putting out fires caused by the second and third level effects that emanate from the serious financial issues we have just mentioned. In times like these, nothing enables us to see the big picture better than stepping back from the immediate fires (yes, we still need to put them out hourly) and taking a look at the very big picture over a widely extended time horizon.

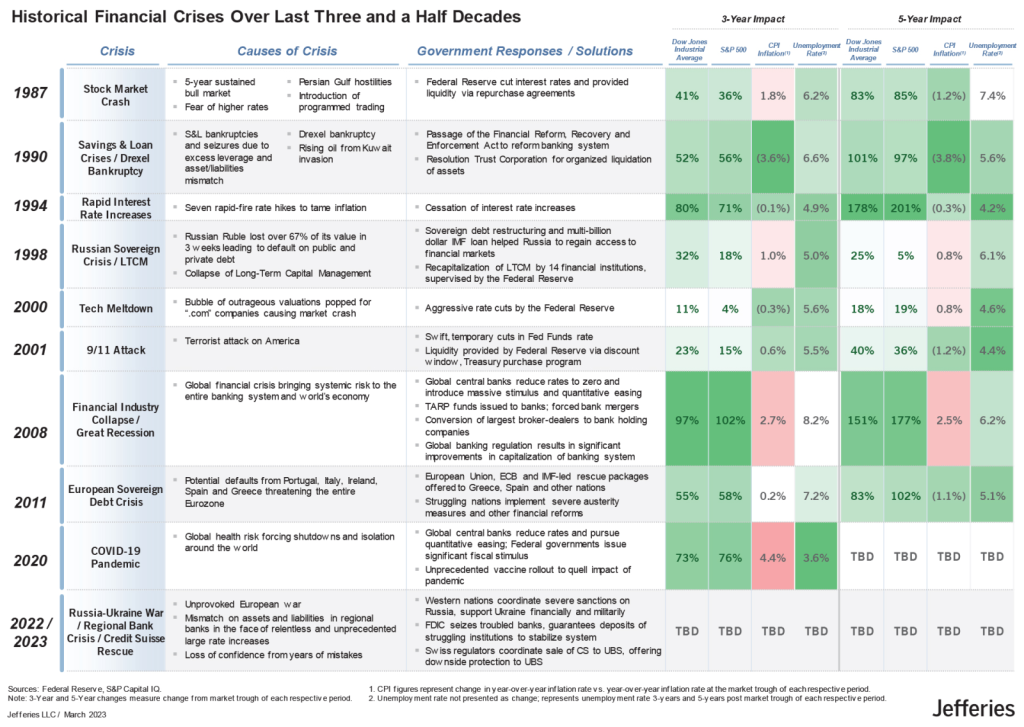

For that reason, we prepared the slide below that shows the periods of economic and market challenge the two of us have experienced these past three plus decades:

Some observations from this smorgasbord of turmoil:

- Our world always finds a way forward. In fact, things are usually pretty darn good in a surprisingly short period of time after we avoid often anticipated the “end of the world.”

- Government intervention, while never ideal or desired, can help solve very complicated and broad problems. The goal, though, should be to make much-needed changes in regulation, incentives and culture throughout our system during periods of relative calm to avoid/minimize future problems and reactive intervention.

- People or institutions that do not have a strong foundation, constitution or character can easily be wiped out at the bottom of the cycle. This has broad implications why the right culture, capital structure, temperament and ego during good times (which always precede bad times) is so important.

- People or institutions that panic, freeze or flee when times are at their darkest deprive themselves of participating when the sun comes out once again.

- People or institutions that buckle up, put out the fires, remain calm, encourage their partners to do the same, and stay the course even when it feels like there is no reason or reward to keep marching on, are often the ones who get magnified positive results when the storm passes.

- The smart, well-fortified, pre-prepared, and forward-looking people or institutions that have the luxury and nerve to play offense during these especially turbulent times can find themselves at another higher level (in almost every aspect) when the sun shines again, if they play their cards properly.

- The reason why people or institutions who focus on the long term versus the short term always win is because this roller coaster never ends. The twists and turns and ups and downs may always look and feel completely different, but when you step back and look from a distance, there are enough patterns and similarities that will help thoughtful minds make sense of it all.

When we look back at these past three and a half decades at Jefferies, we marvel at our corporate and investing clients who have best navigated the storms along the way. We have seen (and hopefully helped) corporate and private equity clients build amazing world class companies, consolidate industries and create enormous economic and social value. We have seen (and hopefully helped) our investing clients generate exceptional long-term, alpha-based returns for their shareholders and even build large, multi-faceted asset management platforms. Both groups of clients have driven change and created positive economic and social benefits for our society.

That said, having lived through so many financial crises, we are acutely aware of the pain and serious ramifications each one has caused, particularly the hardship of losing a job, a beloved firm you’ve given a large part of your life to, and the often gut-wrenching personal and societal economic impact that follows. Today is one of those times. But while extremely unsettling and painful (especially to those directly affected), we do not believe the current financial situation compares in systemic magnitude to the other crises we’ve witnessed and are included in our chart.

To us, the salient takeaway is when we look back at this chart and combine it with our intimate knowledge of our vibrant and impressive client base, it is apparent which characteristics the most successful individuals and companies share. They are all consistent year in and year out. They have a strong foundation both in capital and culture. They share the gift of zero arrogance and while they keenly embrace their current reality, they also have the gift of being able to anticipate change. They strike the right balance of patience and aggressiveness while remaining calm regardless of circumstances. None of them ever give up, and while they all share a keen sense of urgency, they all prioritize the long term.

We at Jefferies always strive to do the same, and we humbly admit that it is not always easy to do so. We clearly make a lot of mistakes, but on balance our partnership with each of you allows us to minimize them, and stick to what we most enjoy:

Working to build value with all of you by focusing on the long term, regardless of the current climate, crisis or calamity.

Once again in the bunker with each of you, but enjoying every moment as we persevere and continue to build together, and knowing that we will all come out together on the other side, sooner than we might expect,

Rich and Brian

RICH HANDLER

CEO, Jefferies Financial Group

1.212.284.2555

[email protected]

@handlerrich Twitter | Instagram

Pronouns: he, him, his

BRIAN FRIEDMAN

President, Jefferies Financial Group

1.212.284.1701

[email protected]

Prime Services C-Suite Newsletter – April 2023

Springing into SEC Proposals, Travel, Digital Health, and Talent

Our monthly newsletter for multi-hat-wearing C-suite leaders covers the latest and greatest insights across the hedge fund industry.

Uncertainty & the Value Proposition of Hedge Funds

In 2022, hedge funds had their best year of outperformance in over a decade. Investors are curious how hedge funds will navigate further volatility, uncertainty, and unexpected market events. The Value Proposition for Allocations to Hedge Funds investigates how managers have outperformed during market turbulence and what role they may play in allocators’ portfolios in the year ahead.

Leucadia Asset Management Announces Strategic Relationship with Catenary Alternatives Asset Management

Prime Services C-Suite Newsletter – March 2023

Spotlight on Operational Due Diligence – Insights from the ODD Community

Our monthly newsletter for multi-hat-wearing C-suite leaders covers the latest and greatest insights across the hedge fund industry.

Capital Raising in a Transition

The Road to 2025

Allocators are looking for the right partner for the next decade, with billions at stake. While PMs and risk managers remain laser focused on adapting portfolios to navigate rate rises, unpredictable markets and currency risk, marketing and IR decision makers are developing new strategies to build more enduring asset bases and LP pipelines. Capital Raising in a Transition addresses the people, policies and processes that are developing next generation asset growth and retention strategies.

Prime Services C-Suite Newsletter – February 2023

Preparedness: Insurance, SEC Updates, and Commentary on iConnections & the State of Our Union

Our monthly newsletter for multi-hat-wearing C-suite leaders covers the latest and greatest insights across the hedge fund industry.