As with other disruptive economic or technological shift, the rapid growth of AI is starting to draw backlash, including from U.S. political leaders. Scrutiny is on hyperscalers like Microsoft and Amazon Web Services over the potential impact of data center growth on electricity prices and AI more broadly across society

For policymakers and business leaders, it’s a balancing act. AI infrastructure is one of the economy’s brightest spots, but electricity prices have risen by double digits for many U.S. consumers, with a perception that AI is causing this

A new note from Jefferies’ Washington Strategy team looks at how opposition to data center expansion could translate into policy action—and what that might mean for the trajectory of AI infrastructure.

Bipartisan Political Scrutiny Builds Around Data Center Growth

Concern about data center expansion has made unlikely allies of the Trump Administration and Democratic leaders in Congress, including Senators Bernie Sanders and Richard Blumenthal. It comes as the President tries to rein in fast-rising electricity costs in the Northeast—an increasingly sensitive issue for voters across the region.[1]

The Administration has said Americans should not face higher electricity bills as a result of data center growth and has asked hyperscalers to publicly commit to a new compact governing the pace of AI infrastructure expansion.[2] Senator Sanders has gone further, calling for a nationwide pause on new development. Six states have proposed some form of data center moratorium, with several measures extending through late 2029.

In response, Microsoft has launched a “Community-First AI Infrastructure” plan, pledging to fund its own facilities while investing in water conservation, local jobs, tax bases, and AI training. The plan includes a commitment to cover incremental electricity costs for consumers in areas where Microsoft is building data centers.[3]

Microsoft is one of several hyperscalers with major AI infrastructure projects underway, alongside OpenAI, Meta, Amazon Web Services, and others. The key question in the months ahead is which policy levers federal and state leaders may use to manage growing concerns around the scale and pace of this expansion.

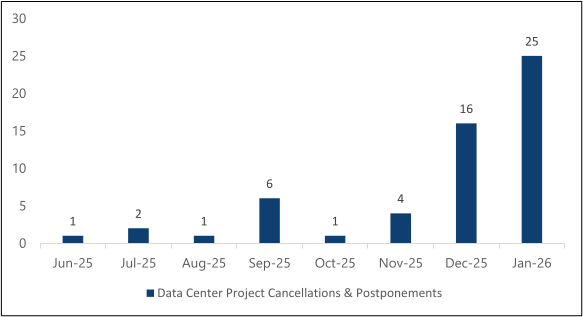

Twenty five data center projects have been cancelled or postponed this month, a 56 percent month-on-month increase.[1]

There are several policy levers available to the Trump Administration, federal lawmakers, and state governments. Some—such as easing Bureau of Land Management permitting standards—are already in effect. Others, including scaling back state tax incentives, remain under discussion and negotiation.

- Federal Permitting and “Energy Dominance” Policy: The Trump Administration and Congressional Republicans are prioritizing lower energy costs by accelerating permits for energy projects and expanding domestic production. The Reconciliation 2.0 blueprint emphasizes easing Bureau of Land Management permitting rules when the federal government owns less than half of the subsurface minerals within a drilling space unit.

- Cost Allocation Requirements for AI Companies: Lawmakers are increasingly weighing policies that would require AI companies and data centers to bear a larger share of grid-related costs. Ohio now requires large power users to cover 85 percent of the capacity costs they create, and federal officials may explore similar approaches.

- State Tax Incentive Reform: States are beginning to reassess data center tax incentives, as today’s high-energy, large-scale facilities no longer align with the assumptions behind earlier programs. Katie Hobbs’s recent call reflects this shift.

- Consumer Energy Support and Price Regulation: States may expand energy assistance programs or formalize electricity price caps to shield consumers from higher costs. Federal efforts to preempt state authority are likely to face resistance, given states’ continued leadership in AI-related regulation.

What to Watch Going Forward

The most telling signal for AI infrastructure amid mounting policy headwinds will be forecast versus actual data center load. Jefferies will closely track how much data center capacity actually comes online over the course of the year relative to current industry projections. In several regions that have introduced more stringent interconnection rules, large-load queues have already begun to shrink.

Credit markets may offer an additional early signal. Widening credit default swap (CDS) spreads could indicate how investors are reassessing hyperscaler AI capital expenditure and its funding profile. Large-load tariffs are another variable to watch. Some states, like Ohio, have begun introducing new tariff structures aimed at discouraging speculative load requests.

Federal agencies are also likely to shape outcomes. The Department of Energy has asked the Federal Energy Regulatory Commission to begin developing rules to help large electricity users connect to the grid more quickly and efficiently—setting the stage for potential tension between federal and state authorities.

Finally, the upcoming Prince William Digital Gateway hearing could prove pivotal. The Virginia Court of Appeals has barred construction pending the resolution of multiple lawsuits, with oral arguments scheduled for the week of February 23–24. The decision keeps one of the largest proposed U.S. data center campuses in limbo.

For continued coverage of AI infrastructure, capital expenditure, and related policy dynamics, see Jefferies Insights.

[1] https://www.politico.com/news/2026/01/16/trump-tame-electricity-prices-00733422

[2] https://www.politico.com/news/2026/02/09/trump-administration-eyes-data-center-agreements-amid-energy-price-spikes-00772024?_bhlid=6e0c30a25b3af1149a99a60bdeabbe0de43dd8ff&utm_campaign=ai-startup-ceo-warns-something-big-is-happening&utm_medium=newsletter&utm_source=capital.news

[3] https://blogs.microsoft.com/on-the-issues/2026/01/13/community-first-ai-infrastructure/

[4] Don Johnson, Chief Economist at MacroEdge Data Stream