In January, Jefferies’ Sustainability and Transition Team posedten key questions for the energy transition in 2025 — a year many investors expect to be more uncertain than any since the pandemic. Among those questions: How will the carbon removal industry evolve?

Jefferies has long been confident in carbon removal, given its fundamental role in reducing atmospheric CO₂ and strong backing from major governments and tech companies. But the industry is entering a period of transition, driven by concentrated demand, high costs, and wavering government support in a shifting political climate.

To better understand today’s challenges and opportunities, Jefferies hosted CEOs from fourteen leading carbon removal companies. Their perspectives offer a candid look at the sector’s key risks — and how winners could emerge from this moment of uncertainty.

This article previews CEOs in Carbon Removal: A Playbook Amidst Grave Uncertainty, a new report from Jefferies. For full insights from the Carbon Removal Event, consult the complete report.

How Do Executives Address the Key Uncertainties in Carbon Removal?

Jefferies sees three main sources of uncertainty in the carbon removal industry: (1) Concentrated Demand, (2) High Costs, and (3) Volatile Government Support.

The team raised these topics with carbon removal executives. Here’s how they responded:

- Concentration of Demand: Microsoft Now Accounts for 77 Percent of Total Carbon Removal Tons Purchased

The companies argue that demand remains strong, not just from tech, but also from sectors like financials, consumer goods, industrials, and airlines. They note that Chinese tech companies are beginning to show interest in carbon dioxide removal as well. Executives expect demand to grow further as both voluntary carbon and compliance markets open up. They also point out that companies purchasing carbon removal credits early will be “first in line” when costs drop and supply tightens. Finally, they report that since Trump’s victory, they have not seen any slowdown in demand for carbon removal credits.

Still, sector leaders are mindful that Microsoft now accounts for 77 percent of total durable carbon removal purchased to date, with 93 percent of their portfolio focused on BECCS (bioenergy with carbon capture and storage). This concentration raises concerns about the industry’s early dependence on a single corporate buyer.

- High Costs: Carbon Removal Credits Are Exorbitantly Expensive

Most carbon removal companies face specific cost bottlenecks. For direct air capture (DAC), energy costs are a major hurdle. For soil carbon, enhanced rock weathering (ERW), and other approaches, the bigger challenge often lies in MRV — measurement, reporting, and verification. MRV accounts for more than half the costs for ERW companies. At Charm Industrial, which uses bio-oil injection, lab testing for MRV costs about $200 per ton, but because their data is stable, the CEO expects they can cut 90% of those costs by moving to less frequent testing.

Alternative revenue streams can also help offset costs. Equatic’s green hydrogen sales, priced around $3 per kilogram, help bring their net carbon removal cost to well below $100 per ton. Capture6 creates multiple revenue streams by managing brine, producing fresh water, and capturing carbon through their DAC solution — all of which use the same units of energy.

- Volatile Government Support: Will the Trump Administration Kill the Industry?

Government support has been critical for carbon removal companies, with U.S. leadership playing an especially important role. Mote Hydrogen, for example, received a substantial grant from a U.S. Hydrogen Hub, and Climeworks was selected for up to $625 million in funding from the Department of Energy. Climeworks cited the U.S. as a leader in carbon removal but also pointed to Canada’s investment tax credit, a memorandum of understanding with Saudi Arabia, and early moves by several Asian governments. Equatic has received ARPA-E funding and a Department of Energy award, along with a partnership from the Singapore government.

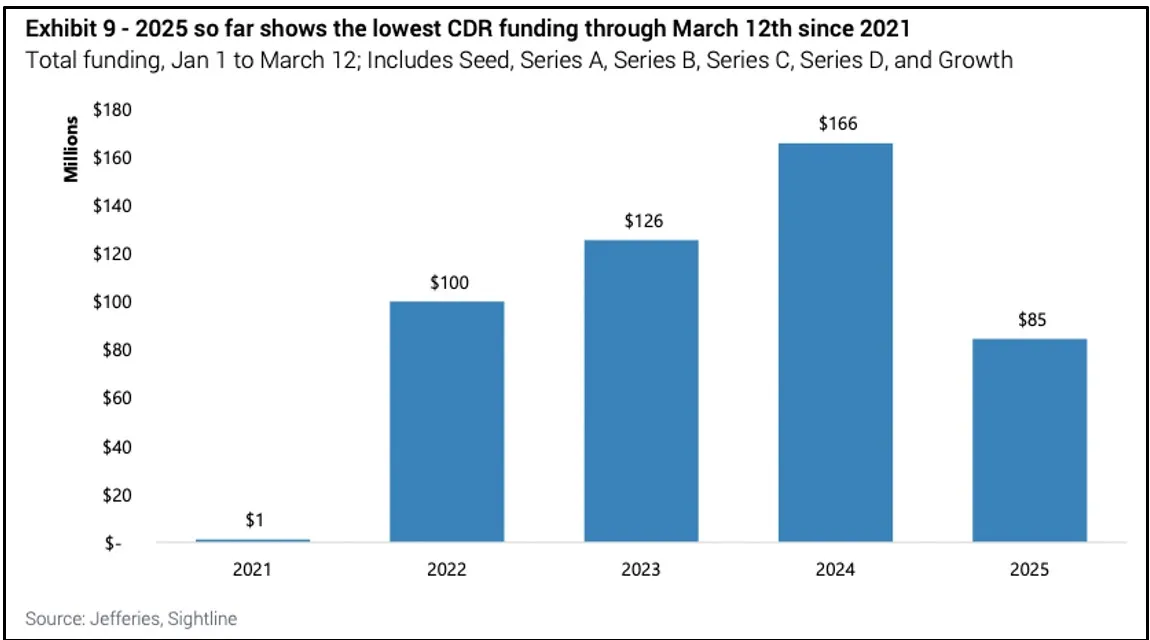

Recently, the Trump Administration has paused federal funding and laid off federal employees who worked on carbon removal. The CEO of Charm Industrial noted that permitting remains a bigger obstacle than economics for carbon removal companies, and suggested that if permitting reform advances under Trump, a pullback in incentives may not be as significant a headwind as some expect. CEOs also noted that venture capital investors are taking a “wait and see” approach, a trend that has continued since the event.

Jefferies continues to view carbon removal as a bipartisan priority, with ongoing support through programs like the 45Q tax credit and DAC hubs.

A Shakeout That Could Strengthen the Industry

Jefferies’ Sustainability & Transition Team wrapped up the event with a definitive message: don’t give up on carbon dioxide removal.

The team projects that a slower energy transition could drive even greater demand for carbon dioxide removal — and that Trump’s presidency may not be as negative for the industry as many expect.

There are also now more than ten proven carbon removal technologies, each with different characteristics, costs, and co-benefits; it’s not just about direct air capture. And there are practical ways to reduce costs, including through economies of scale, alternative revenue streams, and streamlining MRV processes.

Many industry executives believe a shakeout among carbon removal companies will ultimately sharpen the industry’s focus on quality, credibility, and scalability at a reasonable cost. Buyers are taking a portfolio approach and avoiding heavy bets on any single technology. Investors in carbon removal are doing the same — diversifying across technologies, scale, geography, and registries to manage risk.

For deeper insights, consult the full Carbon Removal Event report and Jefferies’ 10-part expert series on the science behind leading carbon removal technologies, published in 2022.