Dear Clients, Jefferies Teammates, and Friends,

There is little doubt we began calendar 2025 with exceptionally high expectations regarding strength in the financial markets. After several years of below the mean activity for capital formation and strategic mergers and acquisitions (primarily due to the rapid re-adjustment to normal interest rates), the prevailing sentiment was that both the issuers and investors of capital were eager to get back to work. Market levels were solid, IPO backlogs were rebuilding to healthy levels, and the syndicated and direct lending debt markets were hungry for ideas and yield. Corporations, in part thanks to a healthy economy and consumer, were on their front foot again, looking for smart strategic initiatives like mergers and acquisitions. Private equity firms were eager to please their LPs who were in need of their cash returned from their too-large allocation of illiquid assets. And these same private equity firms were still flush with plenty of dry powder to deploy on new investments. Perhaps the expected cherry on top was the broad anticipation of a pro-business Administration with emphasis on deregulation, tax reform, reduced government spending, and a clear mandate for growth by the American people. This was six months ago, to the day.

For those of us who have been navigating our respective businesses and investments over the course of the first half of this year, our reality has clearly not mirrored the perception most of us had been expecting. To be clear, for two people who have been through countless severe financial crises, a pandemic, and just about every other severe business dislocation imaginable, these past six months, while certainly not fun, were not even remotely comparable to the periodic financial calamities so many of us have lived through in our careers. To describe this period, we would use words like: frustrating, confusing, unpredictable, derailing, slow, surprising, and downright crappy. The themes or concepts that drove much of this period were tariffs, potential supply chain confusion, DOGE, inflation uncertainty, interest rate confusion, deficit concern, market volatility, potential tax policy changes, a lingering and heartbreaking Russian-Ukraine crisis, and war in the Middle East with broad implications for everything from world order to oil prices. If there is one thing many of us can agree upon, it is that the financial markets and economic outlook for the first half of 2025, in hindsight, are far different from what we all were looking forward to on last December’s New Years Eve.

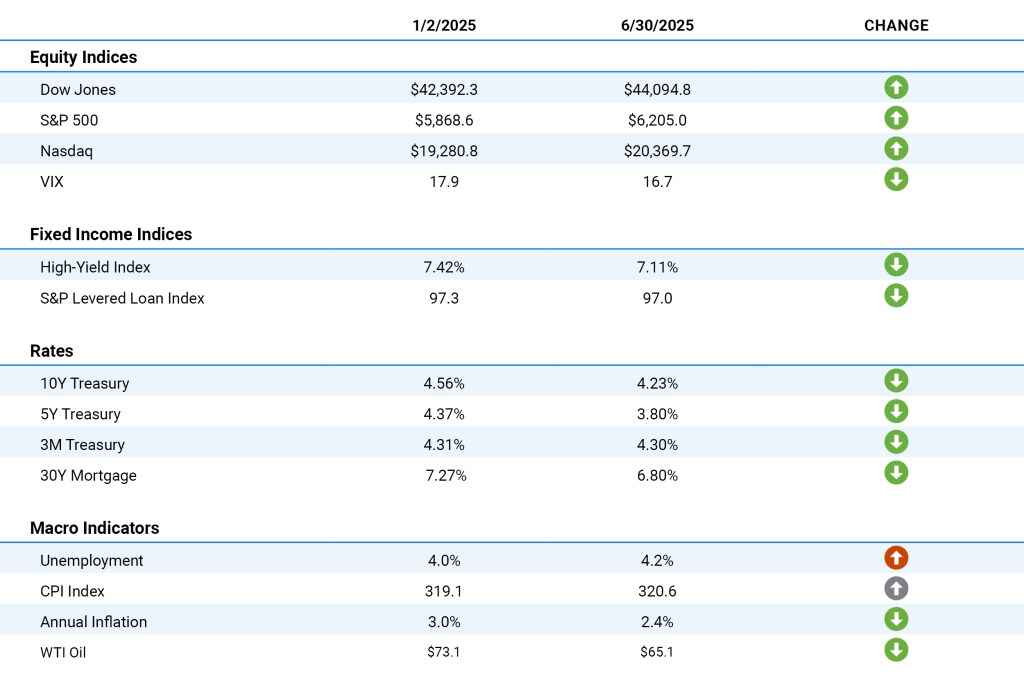

We all know the angst and confusion that we had in anticipation of the day that would be called “Liberation Day” and the period following it. All that said, if you actually step back and take a look at many of the relevant financial market indicators from the beginning of 2025 through today’s yearly midpoint, you see the following:

When you step back and take a non-emotional deep breath and look at the reality of where we are today versus six months ago, it is pretty clear that the financial world today is just fine. In fact, if you just took an “off-the-grid” delightful six-month sabbatical and just looked at the beginning and mid-year financial snapshots of 2025, one could easily come to the conclusion that they missed very little and, if anything, the excitement of the New Year’s positive outlook is not only intact but actually validated.

There are many observations, lessons, and perspectives arising from the observational exercise we just went through. Here are a few of ours:

- It is easy to let emotions, particularly when it comes to politics and policy, roil the markets in the short term, but eventually common sense and reality win out. There does seem to be an “invisible hand” that pushes our system away from the extremes, even when all momentum appears to be on one side. The most difficult part might be maintaining calmness and perspective in moments when it feels like the roller coaster is getting worse or never ending.

- It is virtually impossible to be a short-term investor, trader, or builder of a company. There is just too much noise, and the swings are too extreme. One needs a strong capital foundation that provides ample security and duration, a team and culture that prioritizes long-term success while always maintaining the proper sense of urgency, and a consistent long-term strategy that will not only outlive short-term shocks but will result in creating a durable, important, profitable, and purposeful long-term outcome.

- The US economy is incredibly resilient, and while the rest of the world is fairly solid as well, we are still all connected and rely on each other for mutual long-term success. This recent experience may have had the unintended (but welcomed) effect of having many of our important allies realize they need to be independently strong, and while they can rely on the US to be a good partner, overreliance on this concept can be detrimental to all.

- If you need to raise capital or achieve important strategic initiatives, you should have your plans crystallized and always be prepared to act. The windows of opportunity open and close quickly. Waiting for the perfect split second is as hard as managing exclusively for short-term success. It is probably better to always be prepared to act, and then do so when “most” of the stars align than try to be a perfectionist, believing you can time when all of them align. Very few winners are determined by top ticking or low ticking the sale or buy. Most are determined by executing smart decisions when the window is available. For the record, just about every window is open and available right now.

If you have been in the daily trenches like all of us at Jefferies, it has been a very nerve-racking first six months of 2025. If you are just coming back from your six-month “sabbatical:” Congratulations, you missed nothing. Regardless, the two of us and all of Jefferies are fully engaged and ready to help all of you optimize your opportunities for the balance of the calendar year. The opportunities are abundant, the markets are cooperating, and Jefferies is never on sabbatical.

Thank you and we look forward to an active and prosperous second half of 2025 for all,

Rich and Brian

RICH HANDLER

CEO

Jefferies Financial Group

BRIAN FRIEDMAN

President

Jefferies Financial Group