Dear Team Jefferies rocks your socks,

Today we released our collective results for our third quarter and our first nine months of Jefferies’ fiscal 2020. As each of you can see, these results are remarkably outstanding. You all achieved the best performance in our history for a quarter and for the first nine months of any year. Our firmwide Net Revenues increased relative to third quarter and first nine months of 2019 by 78% and 52%, respectively. Our firmwide Net Earnings1 increased relative to those same periods last year by 313% and 159%, respectively. Jefferies Group’s return on tangible equity for the third quarter 2020 was 23%1 and for 2020 YTD 18%1. Wow! As the world is still incredibly volatile and uncertain, it is also worth highlighting that Jefferies risk profile and metrics continue to consistently operate within our historical conservative low ranges of VAR, level three assets and overall leverage. In fact we ended the third quarter with a record liquidity buffer at Jefferies Group of $8.1 Billion and $1.6 Billion of liquidity at our parent holding company.

Across the board, our firm has come together despite incredibly difficult conditions and it is abundantly clear that so many of you have done everything in your power to help our clients best navigate one of the most challenging periods in history. You were there for our clients and they in turn rewarded us with more business overall than ever before in our history. The fact that we have been able to do this almost entirely from our respective homes is a testament to the tenacity, focus, commitment, pride and culture you have created and fostered at Jefferies.

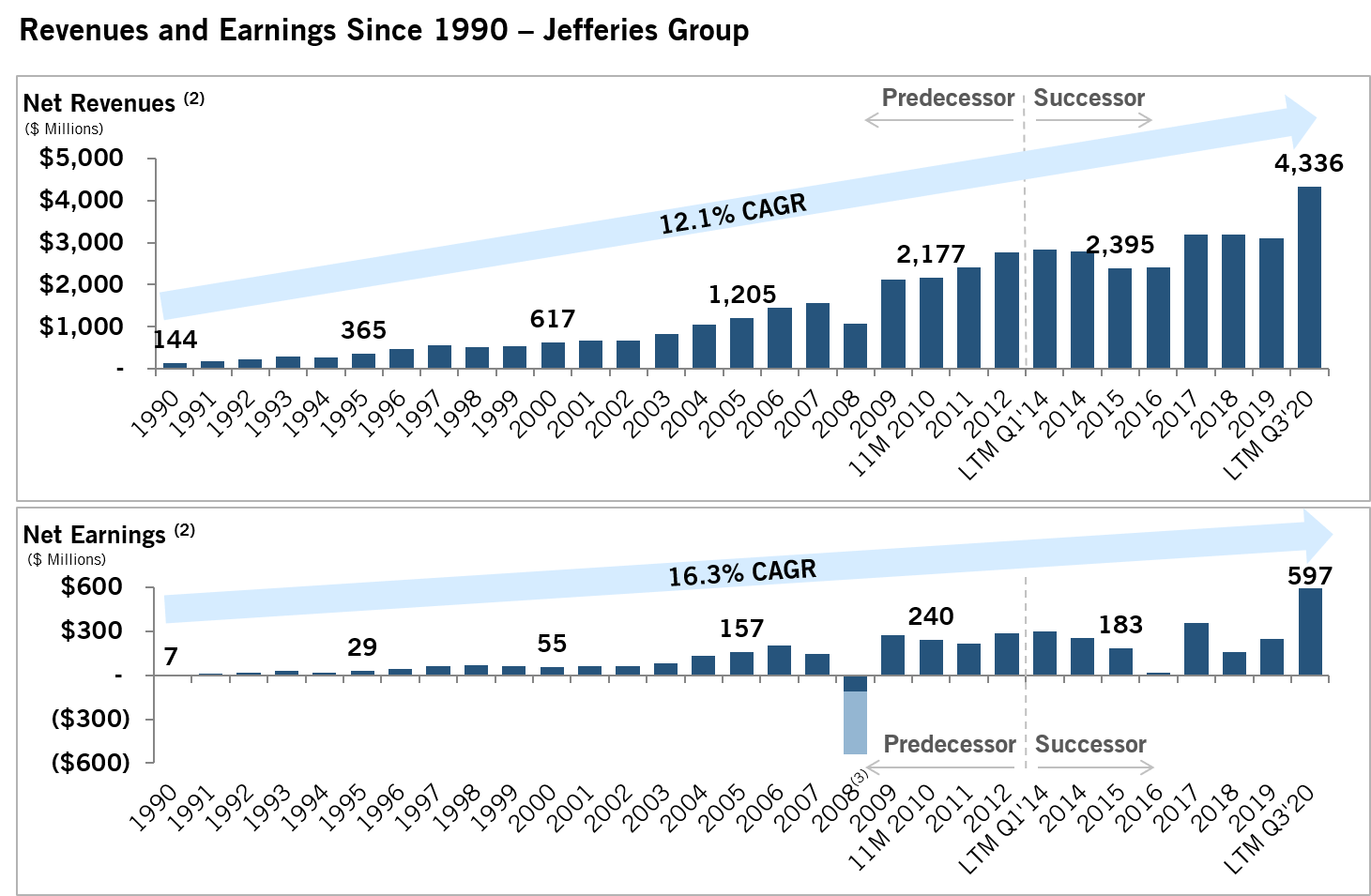

We would like you to take a moment to reflect on the simple graphs below that demonstrate the long term time horizon and commitment to excellence that we all prioritize at Jefferies. It shows the significant ups and occasional downs that reflect all of the hard work and reality of building a world class Wall Street firm the right way — from the ground up, over decades, without taking shortcuts and while navigating through volatile cycles. Nothing is simple and we can all get entangled in the real day-to-day challenges which can cause us to easily miss what we are accomplishing together. Please take a moment to look at and appreciate the firm we are building together:

Bar charts are interesting and they highlight the trends, but they don’t do a good job explaining the substance behind the bars. When the two of us look at this graph, every spec on these bars shows us the team around us:

- Raising capital for an important client so they can expand, hire and/or invest in research and development.

- Advising a client at a critical juncture to acquire another company or maximize value by selling their company to benefit their stakeholders.

- Helping to restructure a company that has hit hard times, so they can re-invent themselves and go back to contributing to society.

- Assisting investors (ultimately the money of individuals, pension funds, endowments) to help manage their life savings through quality research, market color and access to liquidity.

- Directly investing on the behalf of individuals, pension funds and endowments to help them achieve their long term goals through their life savings.

- Supporting our entire organization in a manner that allows us to function regardless of volatility, growth, increased complexity, geographic expansion, market cycles, political uncertainty and health crises.

Also in this chart, we see many of you:

- Making countless personal sacrifices to help a client or co-worker because you believe it is the right thing for you to do.

- Helping improve our culture in every way possible, including mentoring juniors, helping build diversity, minimizing politics and bureaucracy, being transparent, prioritizing clients and having a true sense of urgency.

- Helping to recruit the best and brightest to join us and making sure we do everything possible to retain all of our partners.

- Acting as a long term partner in Jefferies, as opposed to just being an employee.

- Working and living with integrity and respecting the fact that each or our reputations are dependent on one another’s decisions.

- Appreciating the pride that comes with knowing we are building something important and special together.

It is important to recognize that despite the success Jefferies is experiencing during this extremely challenging year, we all must be fully aware of the pain that permeates our world because of COVID-19, racial injustice and the disproportionate negative economic impact being felt by those most disadvantaged. The world is in pain and, while individuals at Jefferies are also having personal challenges in 2020, we still must count our blessings. Our collective success this year must serve as a growing reminder of our good fortune and reinforce our obligation and privilege to do our fair share in helping those in need, promoting fairness and equality, and doing our best both individually and as a firm to help society heal in this moment of extreme challenge.

We have slightly more than two months left in fiscal 2020. These next few months also may be volatile, challenging and highly unpredictable. Our clients will need us more than ever. We will need each other more than ever. We are also not going to walk to the finish line. At Jefferies, we sprint all the way through the tape, while staying humble and watching our risk every step of the way. Let’s please have zero arrogance based on our success to date, because we all recognize how fragile everything truly is and how quickly even an ounce of hubris is capable of ending our mission. We will continue to prioritize your personal safety. Our offices are open for those who want to use them (with our specific safety and social-distancing procedures that must be followed), but we remain steadfast that everybody at Jefferies will make their own decisions regarding where to work, without any direct or indirect pressure. The weather will get colder in most places we operate and force more people inside, and none of us know what the future pattern of this disease will hold. Vaccines and therapeutics will eventually arrive, but we are not going to take any unnecessary chances with any of you, our partners. Choose what is right for you and your family to remain safe and comfortable.

Thank you for showing the entire world what we are capable of achieving. While remarkable, these results merely reflect the beginning of our next stage as a firm. We know we are all capable of even more and we thank you all for starting our next ten year bar chart in such spectacular fashion, despite the challenges that the current environment holds.

Looking forward to driving the next ten year bar chart with each of you,

Rich and Brian

RICH HANDLER

CEO

Jefferies Financial Group

BRIAN FRIEDMAN

President

Jefferies Financial Group

- See the Jefferies Financial Group Additional 2020 GAAP Disclosures at http://ir.jefferies.com/2020GAAPDisclosure for a reconciliation to GAAP measures.

- The financial measures presented herein include adjusted non-GAAP financial measures for 2011-15, which exclude the impact of the results of operations of Bache, a business substantially exited in 2015. See the Jefferies Financial Group Additional 2020 GAAP Disclosures at http://ir.jefferies.com/2020GAAPDisclosure for a reconciliation to GAAP measures. Excludes predecessor first quarter ending 2/28/13. Adjusted Net Revenues and Net Earnings to Common Shareholders for the excluded quarter total $752 million and $88 million, respectively. Net Earnings (Loss) in 1990-2012 are attributable to Common Shareholders. Net Earnings in LTM Q1′ 14-2020 are attributable to Jefferies Group LLC.

- Post-tax loss of $541 million includes expenses of $427 million related to the modification of employee stock awards and restructuring activities. Offset by $434 million equity raise.

For Immediate Release

Jefferies Financial Group Announces Third Quarter 2020 Financial Results

All-Time Record Quarterly Results at Jefferies Group

Quarterly Cash Dividend of $0.15 per Jefferies Common Share Declared

Share Repurchase Authorization Increased to $250 million

New York, New York — September 23, 2020 — Jefferies Financial Group Inc. (NYSE: JEF) today announced its financial results for the three and nine month periods ended August 31, 2020. In addition, the Jefferies Board of Directors declared a quarterly cash dividend equal to $0.15 per Jefferies common share payable on November 25, 2020 to record holders of Jefferies common shares on November 13, 2020. The Jefferies Board of Directors also increased the Company’s stock buyback authorization by $128 million to a total of $250 million. We expect to file our Form 10-Q on or about October 9, 2020.

Highlights for the three months ended August 31, 2020:

- Jefferies Group LLC recorded record quarterly net revenues of $1,383 million, record pre-tax income of $363 million, record net earnings of $268 million and return on tangible equity of 23.2%1

- Record Investment Banking net revenues of $589 million, including record Equity Underwriting net revenues of $305 million, Advisory net revenues of $171 million, and Debt Underwriting net revenues of $139 million

- Combined Capital Markets net revenues of $655 million; record Equities net revenues of $319 million and Fixed Income net revenues of $336 million

- Record Asset Management revenues (before allocated net interest2) of $122 million

- Merchant Banking recorded pre-tax income of $71 million, reflecting record quarterly results from Idaho Timber and mark-to-market increases in the value of several of our investments in public companies, partially offset by a decrease in the fair value of Vitesse’s hedges, as oil prices appreciated during the quarter

- Net income attributable to Jefferies Financial Group common shareholders was $304 million, or $1.07 per diluted share

- We repurchased 7.9 million shares for $128 million, or an average price of $16.26 per share; 259.2 million shares were outstanding and 283.0 million shares were outstanding on a fully diluted basis3 at August 31, 2020; Jefferies book value per share was $36.30 and tangible book value per fully diluted share4 was $26.49 at the end of the third quarter

- Jefferies Financial Group had parent company liquidity of $1.6 billion at August 31, 2020. Jefferies Group had a record liquidity buffer of $8.1 billion of cash and unencumbered liquid collateral at August 31, 2020, which represented 17% of its total balance sheet.

Highlights for the nine months ended August 31, 2020:

- Jefferies Group LLC recorded record nine months net revenues of $3,589 million, record pre-tax income of $772 million, record net earnings of $568 million and return on tangible equity of 17.7%5

- Record nine months Investment Banking net revenues of $1,483 million, including record nine months Advisory net revenues of $697 million, record Equity Underwriting net revenues of $561 million and Debt Underwriting net revenues of $337 million

- Record combined nine months Capital Markets net revenues of $1,879 million, including Equities net revenues of $802 million and Fixed Income net revenues of $1,078 million

- Record Asset Management revenues (before allocated net interest2) of $173 million

- Merchant Banking pre-tax loss of $58 million, reflecting positive contributions from Idaho Timber, Vitesse and FXCM, and a gain of about $60 million from effective short-term hedges against mark-to-market and fair value decreases, more than offset by $145 million in previously reported non-cash charges in the first two quarters of 2020 to write-down our investments in The We Company, JETX and some of the real estate assets of HomeFed

- Net income attributable to Jefferies Financial Group common shareholders of $462 million, or $1.57 per diluted share

- Repurchases of 32.7 million shares for $620 million, or an average price of $18.98 per share

Rich Handler, our CEO, and Brian Friedman, our President, said:

“We are very pleased to report Jefferies Financial Group quarterly net income of $304 million, driven by Jefferies Group record quarterly net revenues and record quarterly net earnings for the second time this year. Jefferies Group’s return on tangible equity of 23.2%1 demonstrates the operating leverage inherent in our business model. Our strong results reflect Jefferies Group becoming an ever increasing portion of our overall business, greater productivity through growing market share with a limited increase in headcount and constant focus on control of operating costs. Our depth of capital markets knowledge and capabilities, combined with the breadth of our investment banking relationships, have positioned Jefferies as a leading firm serving an ever expanding client base across the world.

“Since the beginning of fiscal 2018, our tangible book value per fully diluted share4 has increased 29% to $26.49, while Jefferies issued dividends during this period of $2.90 per share. The tangible book value per fully diluted share increase, combined with the dividends per share during this period, represent a 14% compounded return per share. During this same period, we repurchased an aggregate of 108.6 million shares for an aggregate of $2.3 billion, or $20.90 per share. We remain relentlessly focused on maximizing the value of Jefferies Financial Group by continuing to build Jefferies Group, while managing our legacy Merchant Banking portfolio to a sensible set of final realizations. We will continue to re-purchase shares when prudent from a balance sheet and capital allocation perspective, as we believe there continues to be a significant gap between our intrinsic value and our stock price.

“We continue to make important investments in our people and technology needed to deliver the highest quality of service. With Jefferies Group’s broad product offering, scalable platform, strong capital and liquidity position and the amazing talent of our approximately 3,900 employees, we believe there is tremendous potential to continue to increase our market share across all our businesses.

“Investment Banking’s record net revenues of $589 million were driven by record performance in Equity Underwritings. The unknown future path of the COVID-19 pandemic and uncertainty in timing of a remedy, encouraged companies across the world to raise long-term and permanent capital. Although M&A and advisory activities were a bit muted in the third quarter, our fourth quarter backlog of Investment Banking activity remains robust across all products.

“Capital Markets quarterly net revenues of $655 million was led by record Equity revenues and strong Fixed Income results across virtually every business line, which included material contributions from Europe and Asia. The strong equity markets and more clarity from the Federal Reserve on future rate policy provided a supportive trading environment for investors.

“Jefferies Group experienced record net revenues across Leucadia Asset Management, which were $122 million for the third quarter and $173 million for the first nine months of the year, 44% higher than the first nine months of 2019 (before allocated net interest2) on allocated capital of approximately $1 billion. This included continued positive performance from our investments in multi-manager platforms (Dymon, Schonfeld, Topwater and Weiss) and certain single manager boutiques, particularly ESG, Energy, Event-Driven and Capital Markets-focused. We’ve further enhanced our marketing efforts with the addition of a Head of Asia and a Head of Investor Relations. Despite the slow-down in travel due to the pandemic, fund-raising efforts continue, with strong momentum in several of our strategies.

“Jefferies Group’s balance sheet was $46.7 billion at quarter-end, which was 3% higher than at the end of the second quarter, almost entirely due to an increase in Cash and cash equivalents. Jefferies Group’s balance sheet remains very liquid and our level 3 inventory remains low at $433 million, or approximately 2%, of total inventory. Our liquidity buffer totaled $8.1 billion, which represents an all-time record in liquidity that we believe is prudent considering the volatile environment.”

* * * *

Amounts herein pertaining to August 31, 2020 represent a preliminary estimate as of the date of this earnings release and may be revised upon filing our Quarterly Report on Form 10-Q with the Securities and Exchange Commission (“SEC”). More information on our results of operations for the three and nine month periods ended August 31, 2020 will be provided upon filing our Quarterly Report on Form 10-Q with the SEC.

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements about our future and statements that are not historical facts. These forward-looking statements are usually preceded by the words “should,” “expect,” “intend,” “may,” “will,” or similar expressions. Forward-looking statements may contain expectations regarding revenues, earnings, operations, and other results, and may include statements of future performance, plans, and objectives. Forward-looking statements also include statements pertaining to our strategies for future development of our businesses and products. Forward-looking statements represent only our belief regarding future events, many of which by their nature are inherently uncertain. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Information regarding important factors, including Risk Factors that could cause actual results to differ, perhaps materially, from those in our forward-looking statements is contained in reports we file with the SEC. You should read and interpret any forward-looking statement together with reports we file with the SEC.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable or equal the corresponding indicated performance level(s).

For further information, please contact:

Teresa S. Gendron

Chief Financial Officer

Jefferies Financial Group Inc.

Tel. (212) 460-1932

Matt Larson

Chief Financial Officer

Jefferies Group LLC

Tel. (212) 284-2338

Click here for the full earnings announcement.

- Return on tangible equity (a non-GAAP financial measure) equals our three months ended August 31, 2020 annualized net earnings attributable to Jefferies Group LLC divided by our tangible Jefferies Group LLC member’s equity (a non-GAAP financial measure) of $4,612 million at May 31, 2020. Tangible Jefferies Group LLC member’s equity at May 31, 2020 equals Jefferies Group LLC member’s equity of $6,412 million less goodwill and identifiable intangibles assets of $1,800 million.

- Allocated net interest represents the allocation of a ratable portion of Jefferies Group LLC’s long-term debt interest expense to Jefferies Group LLC’s Asset Management reportable segment, net of interest income on Jefferies Group LLC’s Cash and cash equivalents and other sources of liquidity, which allocation is consistent with Jefferies Group LLC’s policy of allocating such items to all its business lines. Refer to Jefferies Group LLC’s summary of Net Revenues by Source on page 10 and 11.

- Shares outstanding on a fully diluted basis, a non-GAAP measure, is defined as Jefferies Financial Group’s common shares outstanding plus restricted stock units and other shares. Refer to schedule on page 14 for reconciliation to U.S. GAAP amounts.

- Tangible book value per fully diluted share, a non-GAAP measure, is defined as Tangible book value divided by shares outstanding on a fully diluted basis. Tangible book value, a non-GAAP measure, is defined as Jefferies Financial Group shareholders’ equity (book value) less Intangible assets, net and goodwill. Shares outstanding on a fully diluted basis, a non-GAAP measure, is defined as Jefferies Financial Group’s common shares outstanding plus restricted stock units and other shares. Refer to schedule on page 14 for reconciliation to U.S. GAAP amounts.

- Return on tangible equity (a non-GAAP financial measure) equals our first nine months of 2020 annualized net earnings attributable to Jefferies Group LLC divided by our tangible Jefferies Group LLC member’s equity (a non-GAAP financial measure) of $4,311 million at November 30, 2019. Tangible Jefferies Group LLC member’s equity at November 30, 2019 equals Jefferies Group LLC member’s equity of $6,125 million less goodwill and identifiable intangibles assets of $1,814 million.